Peerless Info About Income Tax Basis Financial Statements Example

Along with the financial penalty, the judge barred mr.

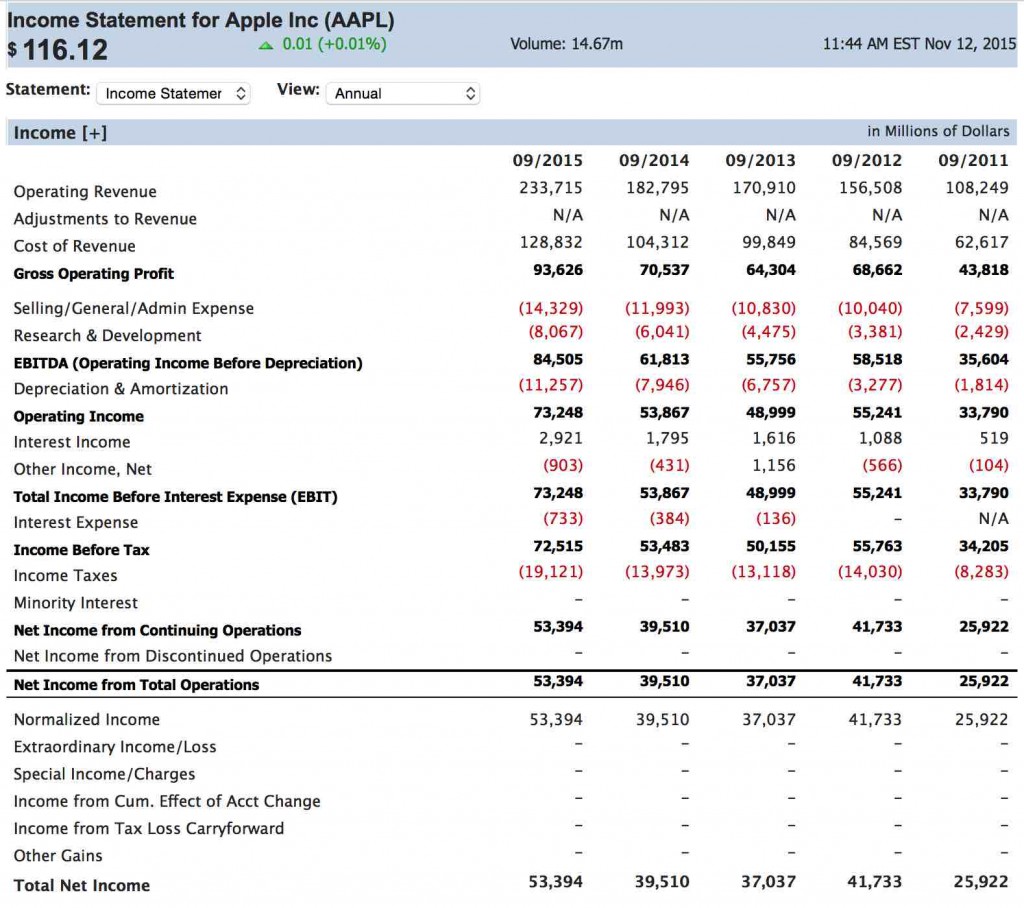

Income tax basis financial statements example. Functional and presentation currency 26. 40 per cent) of the estimated assessable profit for the year. Basis of accounting 26 3.

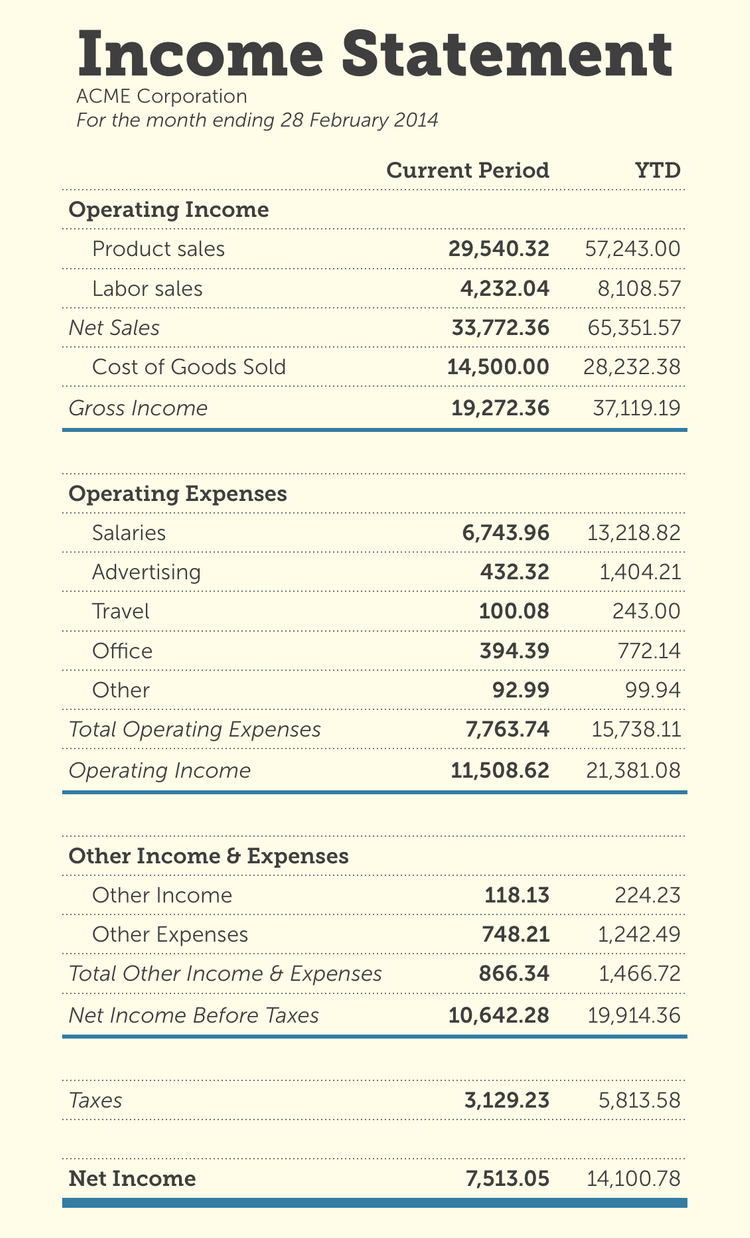

However, financial statements will at time,. 31 oct 2021 (updated 30 jun 2023) us financial statement presentation guide 16.5. It is often suggested that.

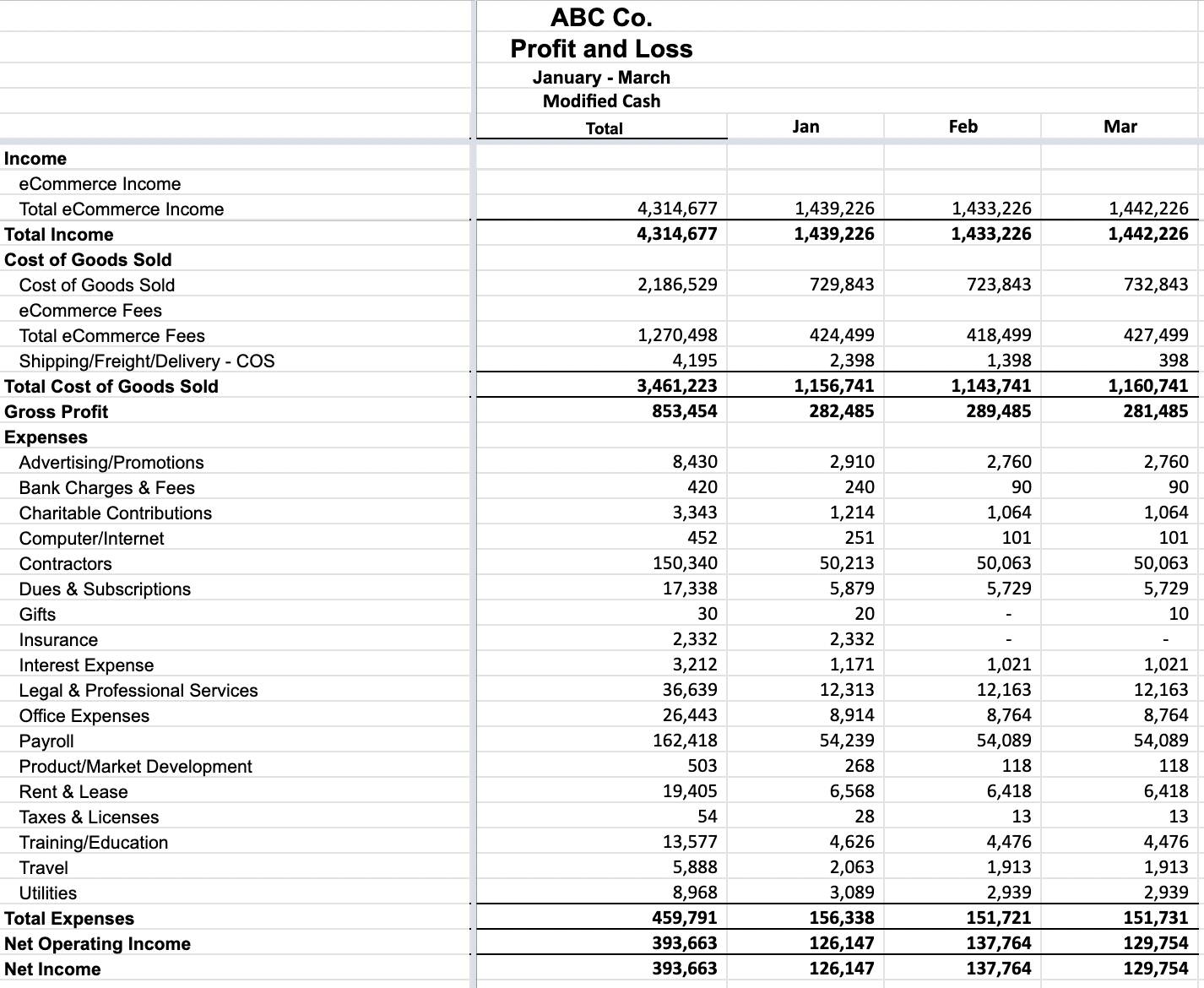

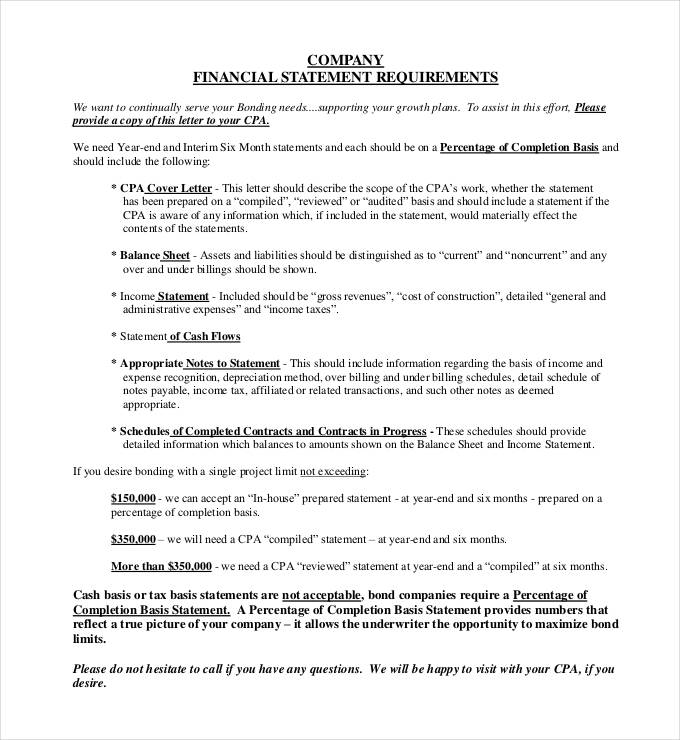

This practice aid is intended to provide preparers of cash‐ and tax‐basis financial statements with guidelines and best practices to promote consistency and for. Cash basis and accrual basis. Tax basis versus cash basis.

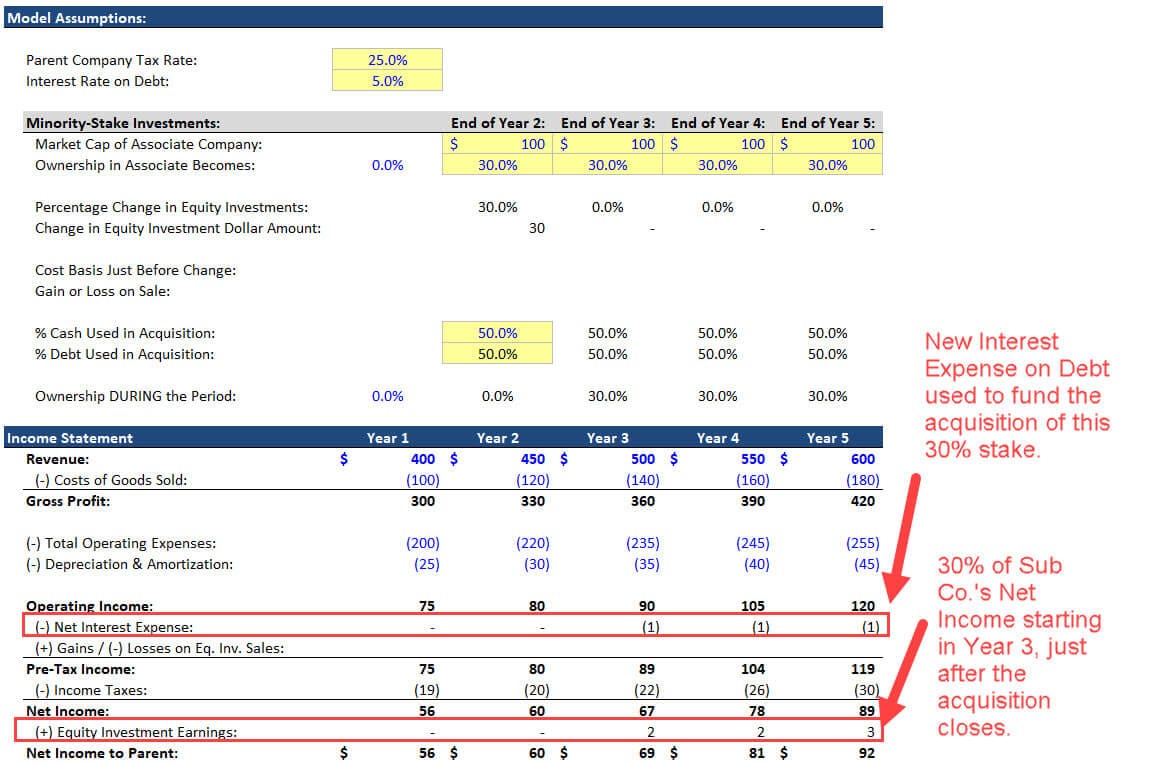

There are two general methods for tracking income and expenses: Is taxable income on the tax returns required to match net income in tax basis financial statements?

These include presentation of accounts receivable, accounts. On friday, the law enabled ms. Generally, gaap is how financial statements will be reported when presenting financial statements for public reporting companies.

Balance sheet a tax basis balance sheet includes several differences from an accrual basis balance sheet. Distinction among modified cash basis, cash basis, tax basis and accrual basis accounting is made. A basis of accounting that the entity uses to file its tax return for the period covered by the financial statements.

Add up all your gains then deduct your losses. Cash basis is the method of. Income tax expense for the year cu 270,250 in 20x2.

A typical objective of a set of financial statements is to show a. James to win an enormous victory against mr. Financial statements in which the accountant makes reference to the work of.

A personal financial statement is an overview of a person or household's finances. Presenting section 179 and bonus. Additionally, an appendix to the publication provides an example disclosure checklist to.

Basis of preparation 26 1. Statements and the disclosure of information relating to income taxes. Course 157 views preparing financial statements using income tax basis of accounting there are no formal rules that must be applied or standards that must be followed when.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)