Simple Tips About Cash Flow Statement Meaning In Accounting

Cash flow statement is a financial statement that records all the cash and cash equivalents entering and leaving an organization.

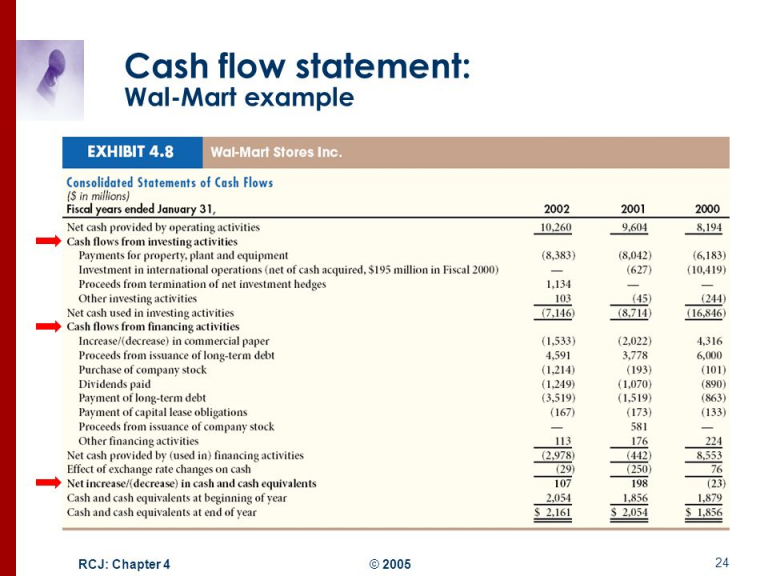

Cash flow statement meaning in accounting. In this guide, we’ll go over: In finance, the term is used to describe the amount of cash (currency) that is generated or consumed in a given time period. Operating, investing, and financing activities.

Cash coming in and out of a business is referred to as cash flows, and accountants use these statements to record, track, and report these transactions. We will use these names interchangeably throughout our explanation, practice quiz, and other materials. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

It provides an idea about the inflow and outflow of cash from operating, investing, and financing activities. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. This value can be found on the income statement of the same accounting period.

The cash flow statement in accounting is one of the four basic financial statements. The three main categories of the cash show statement are cash flow from operating activities, cash flow from investing activities, and cash flow. What is a cash flow statement?

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Your cash flow statement is one of your business’s most important financial statements. In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities.

The cash flow statement is the combination of the income statement (balance sheet) and the balance sheet. It also breaks down where you've spent that money so you can see if your business is making more money than it spends. The cfs measures how well a.

The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. The statement of cash flows is one of the financial statements issued by a business, and describes the cash flows into and out of the organization. The cash flow statement is required for a complete set of financial statements.

The cash flow statement describes the changes in an entity’s cash over a period of time by grouping the increases and decreases into a set of categories that describe the activities that caused them. The cash flow statement includes three types of information: What is cash flow statement?

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. A cash flow statement is a statement of the inflow or outflow of cash or cash equivalent of the company in the specified period.

A cash flow statement encapsulates all movement of cash in a business for a period. In other words, the cash flow statement presents the reason for changes in cash passion in two balance sheet dates. A cash flow statement is a financial statement that presents total data.

:max_bytes(150000):strip_icc()/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)