Looking Good Tips About A Balance Sheet Is Financial Statement That Partnership Example

Assets = liabilities + equity.

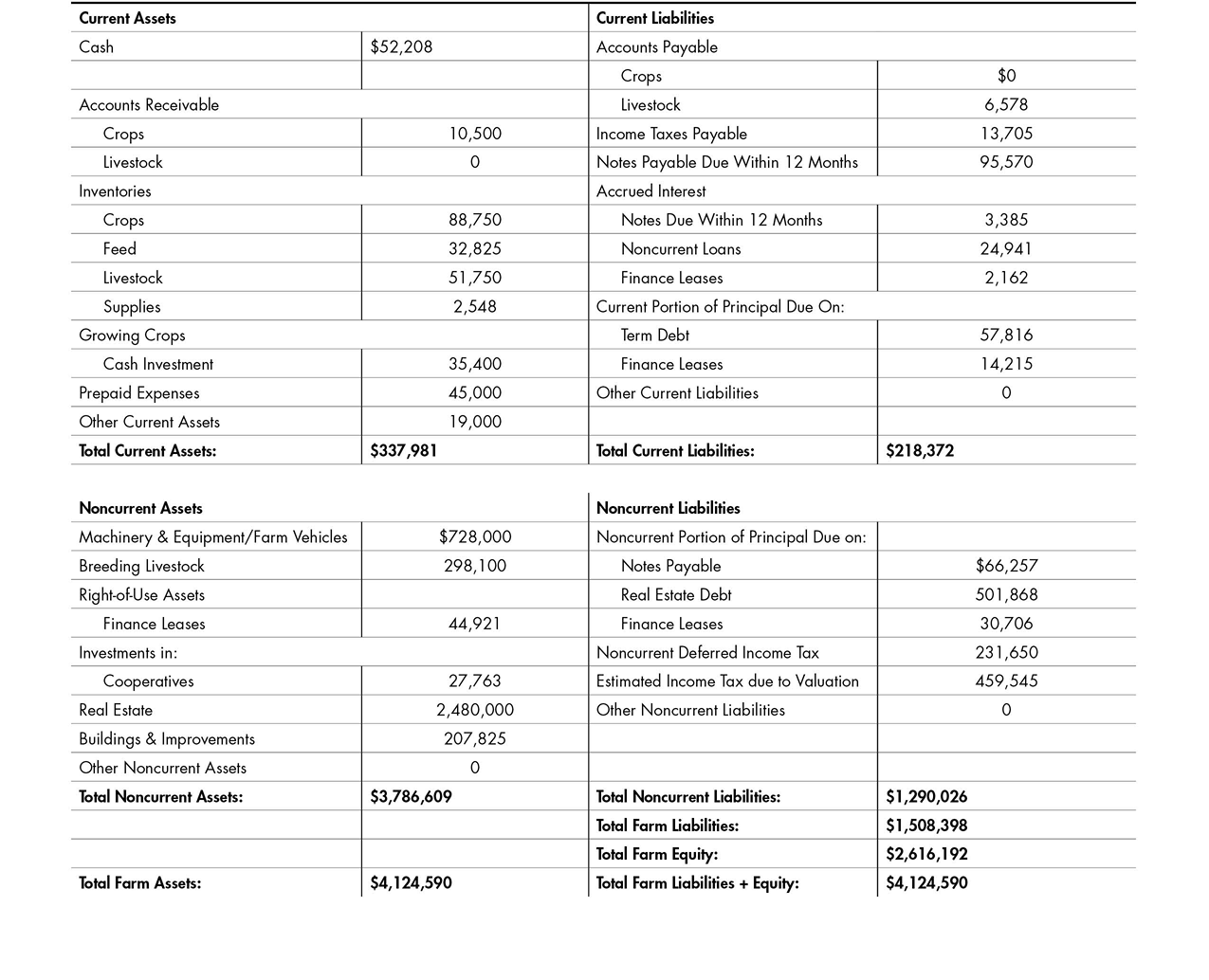

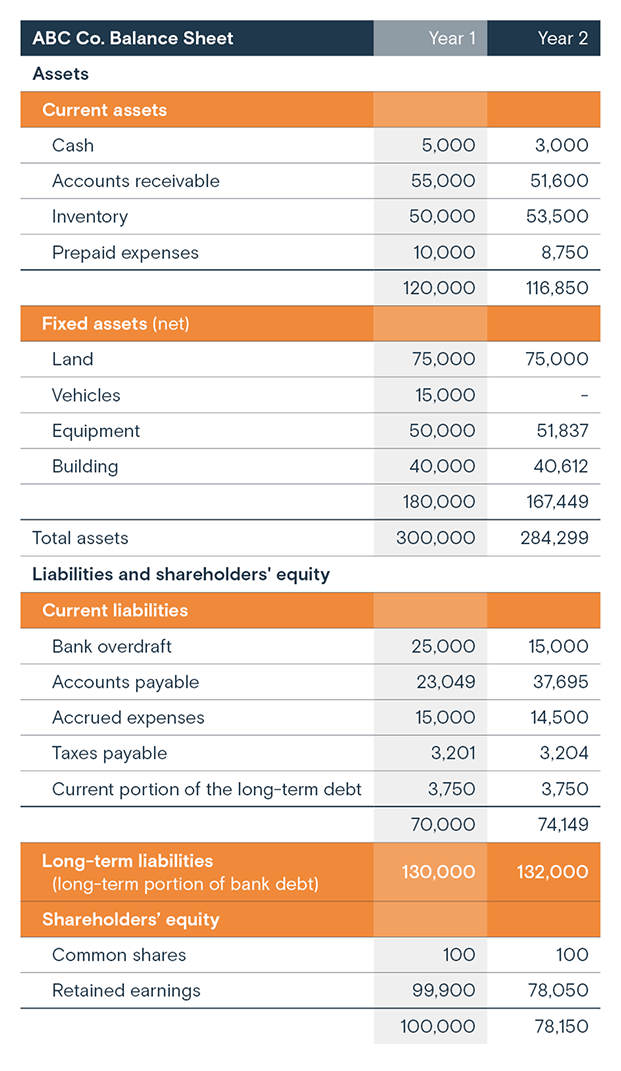

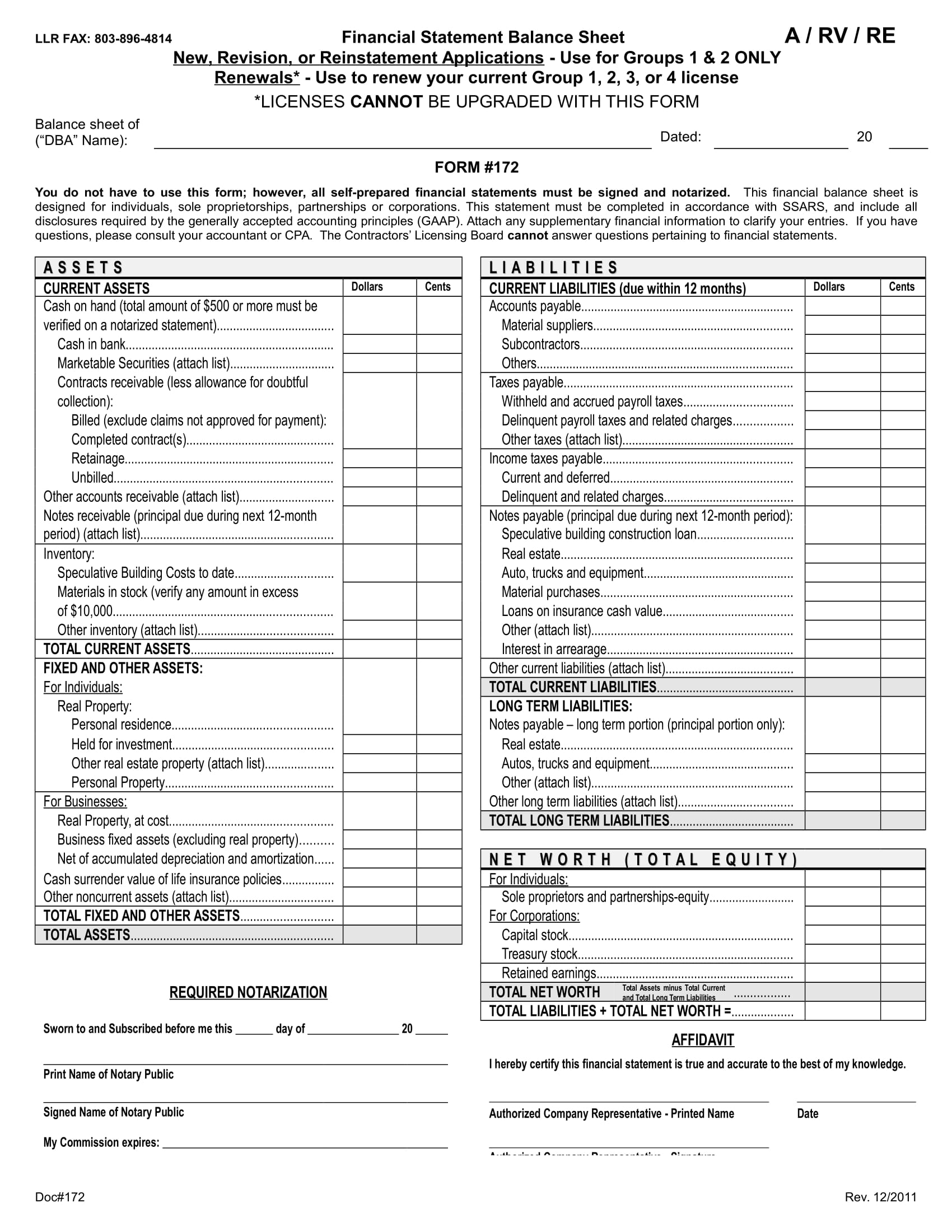

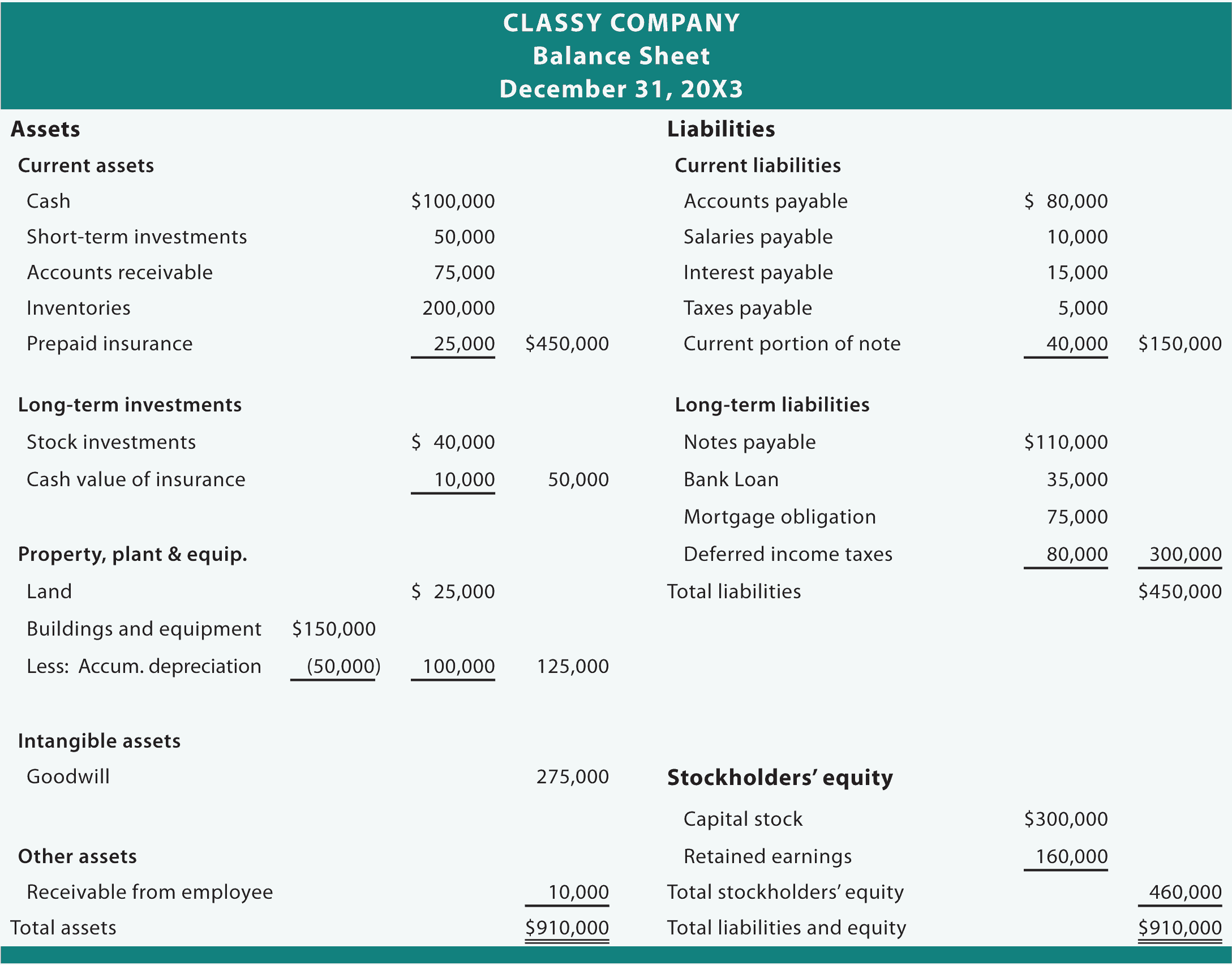

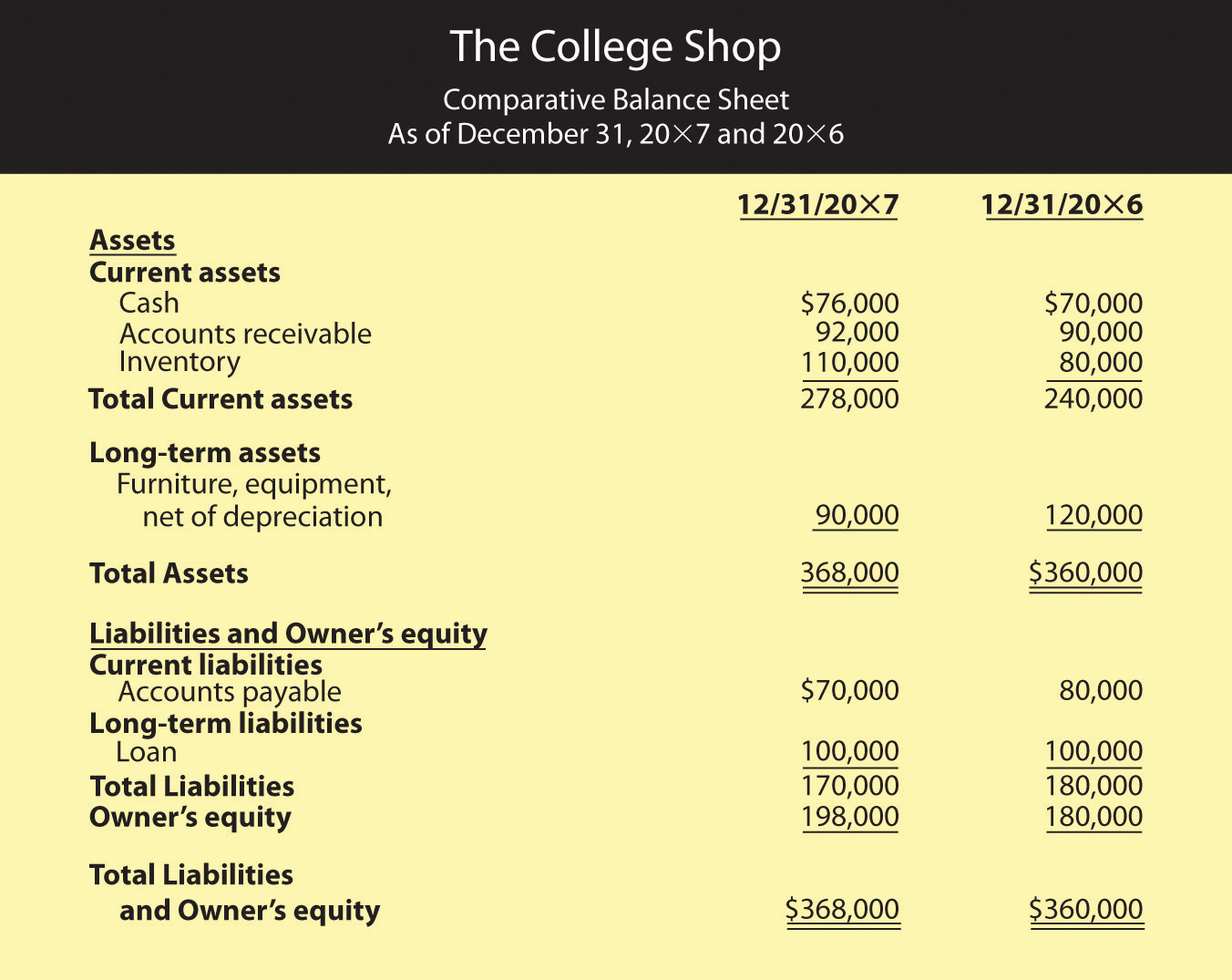

A balance sheet is a financial statement that partnership balance sheet example. Assets are things that a company owns that have value. The biggest difference between a financial statement and a balance sheet is the scope of each. The balance sheet is one of the most important financial statements for a business because it provides a snapshot of the company’s financial position at a given moment.

Both types have three sections: The balance sheet is one of the three core financial statements that are. Profit and loss statement (income statement)

Securities and exchange commission (sec). A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment. A balance sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and shareholder's equity.

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date. What is a balance sheet? The company’s balance sheet is an accounting report that shows a company’s assets, liabilities, and shareholders’ equity.

The balance sheet is a key statement that forms a part of the financial statements, which reports the financial position or the book value of the company’s net worth at a specified date in the current year as well as the previous year. What is a balance sheet? The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date.

You might also see net worth referred to as “equity” in a balance sheet.¹ While a balance sheet helps businesses evaluate their assets, details from the entire financial. A balance sheet covers a company’s assets as.

The balance sheet shows a company’s assets, liabilities, and net worth as of a specific date. Learn more about what a balance sheet is, how it works, if you need one, and also see an example. It reports assets, liabilities, and shareholder’s equity to provide an overview of what a company owns, what it owes, and what is left over for the owners.

All public companies must use balance sheets and periodically file them with the u.s. A balance sheet is a financial statement showing assets, liabilities, and shareholders’ equity (stockholders’ equity or owners’ equity) at a certain point in time. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time.

As fixed assets age, they begin to lose their value. Assets = liabilities + equity if these two sides don’t balance, there has been a mistake in the company’s accounting, or transactions are not properly recorded. It is one of the three core financial statements ( income statement and cash flow statement being the other two) used for evaluating the performance of a business.

A balance sheet is a statement of the financial position of a business that lists the assets, liabilities, and owners' equity at a particular point in time. A balance sheet, when looked at. The balance sheet of a company that operates as a partnership has the same basic outline as the balance sheet of a corporation.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)