Fabulous Tips About Cash Flow From Operations Definition

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

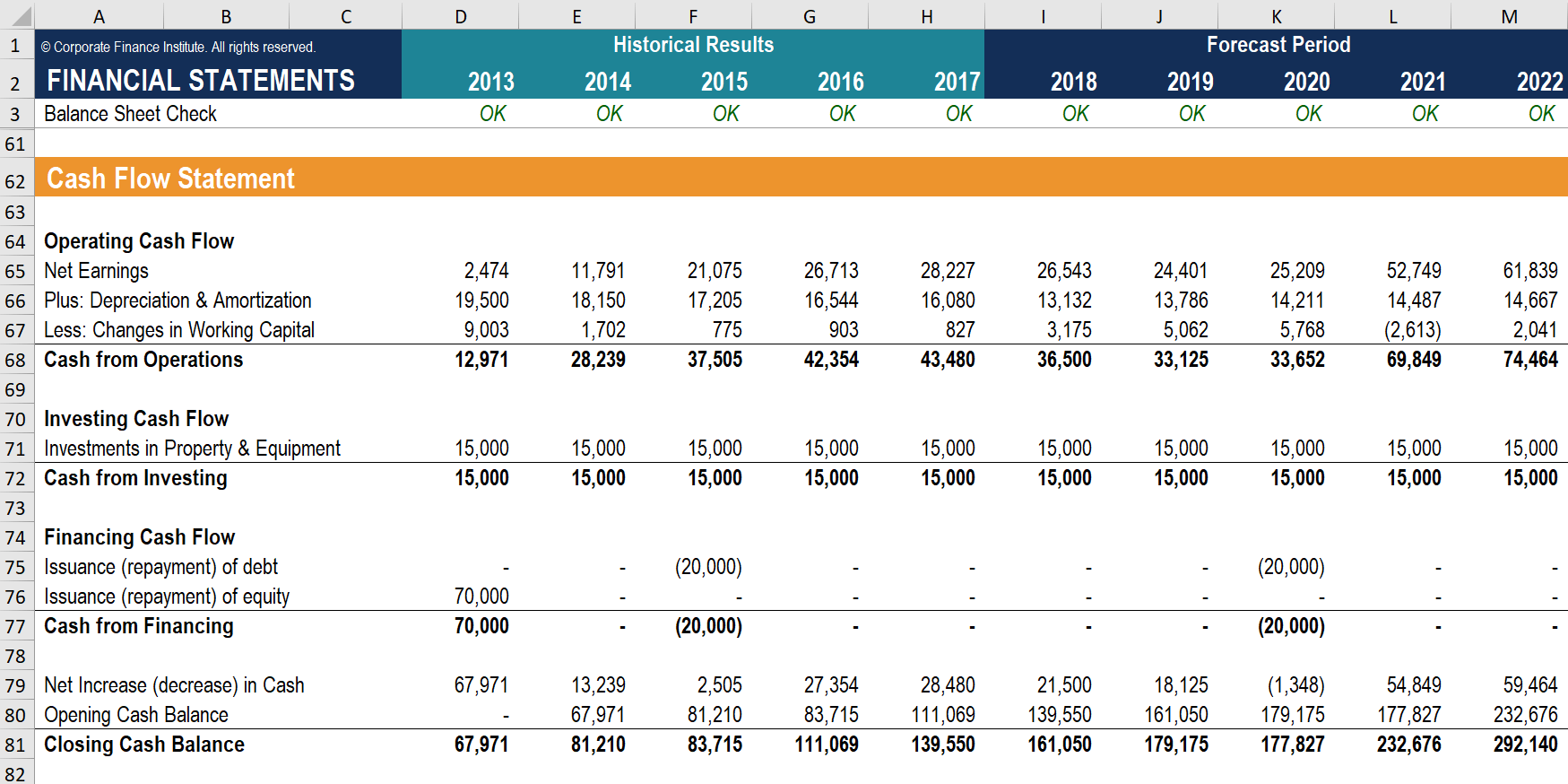

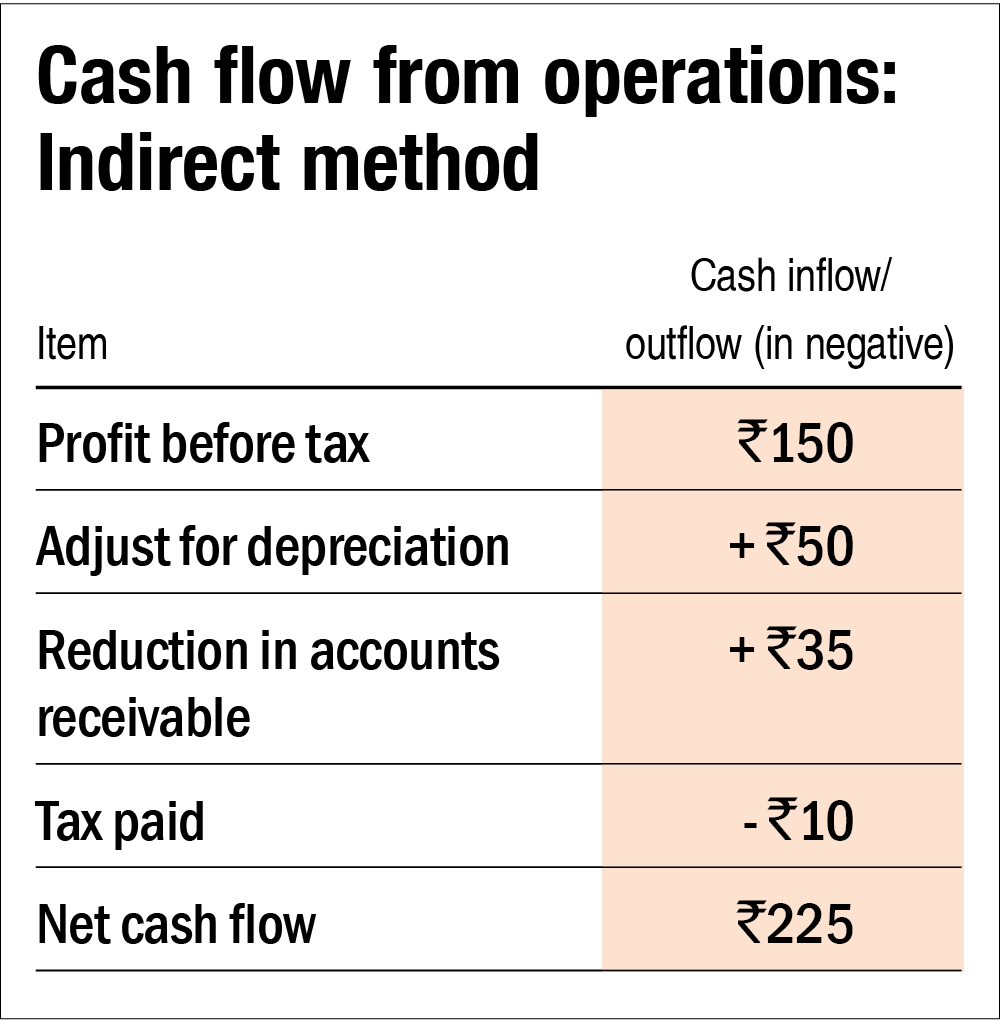

The cash flow from operations can be prepared in two ways:

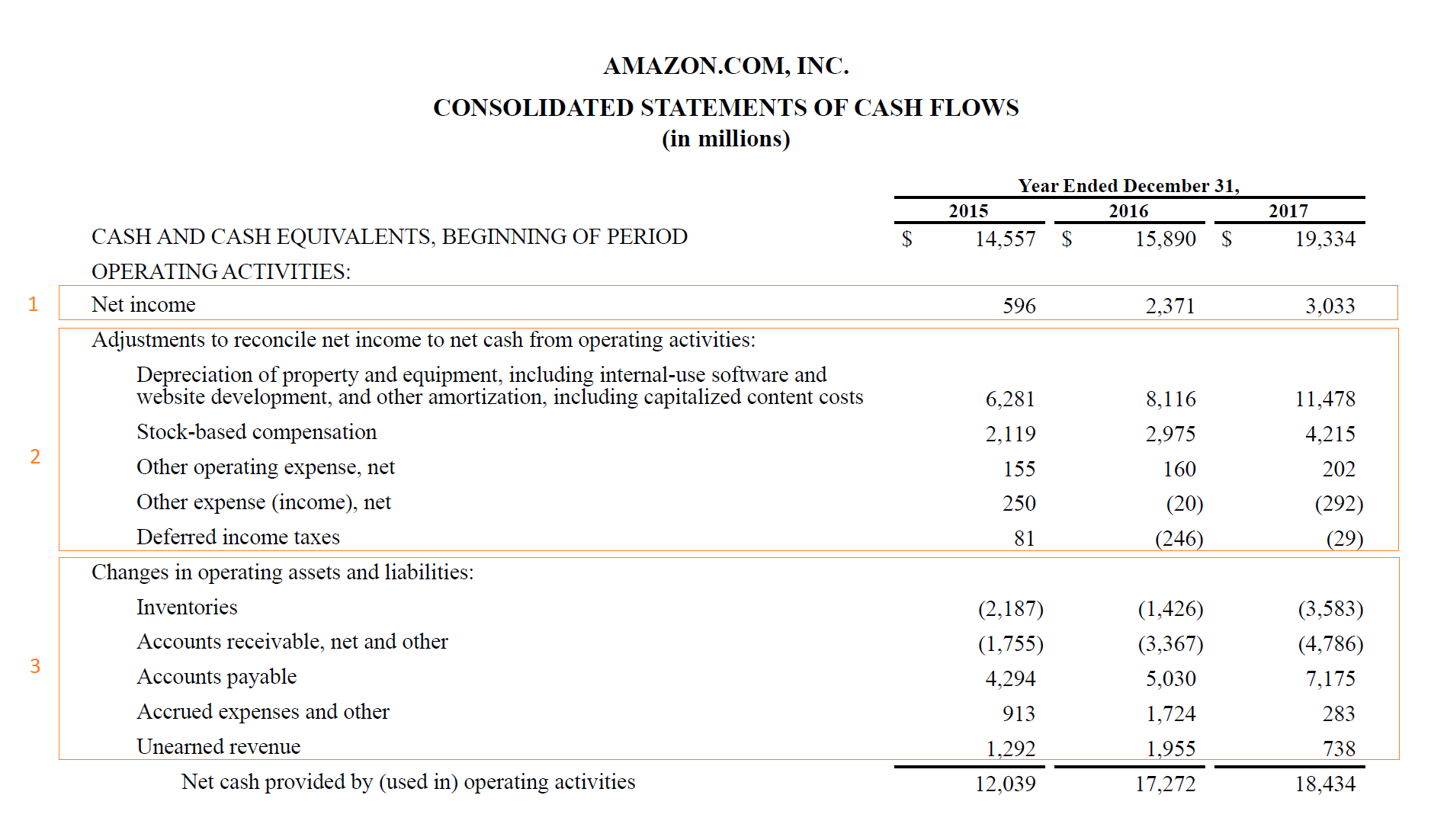

Cash flow from operations definition. The direct method and the indirect method. Cash flow from operating activities may also be referred to as operating cash flow (ocf) or net cash provided from operating activities. We define gross bookings as the total dollar value, including any applicable taxes, tolls, and fees, of:

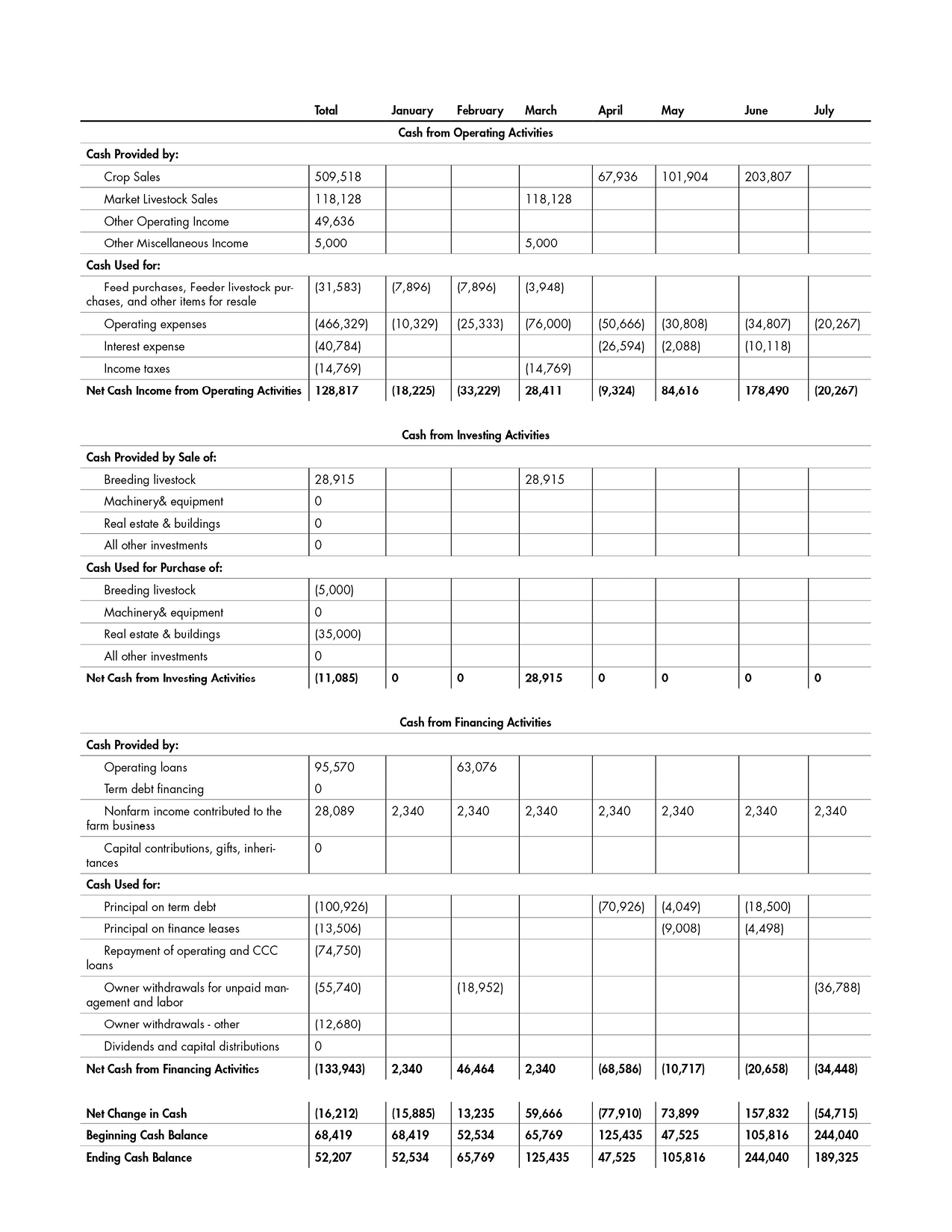

Examples of these cash outflows are payroll, the cost of goods sold, rent, and utilities. Cash flow from operating activities formula the “cash flow from operations” is the first section of the cash flow statement, with net income from the income statement flowing in as the first. This is the cash recorded from the sales of products the company produces and/or the services the company provides.

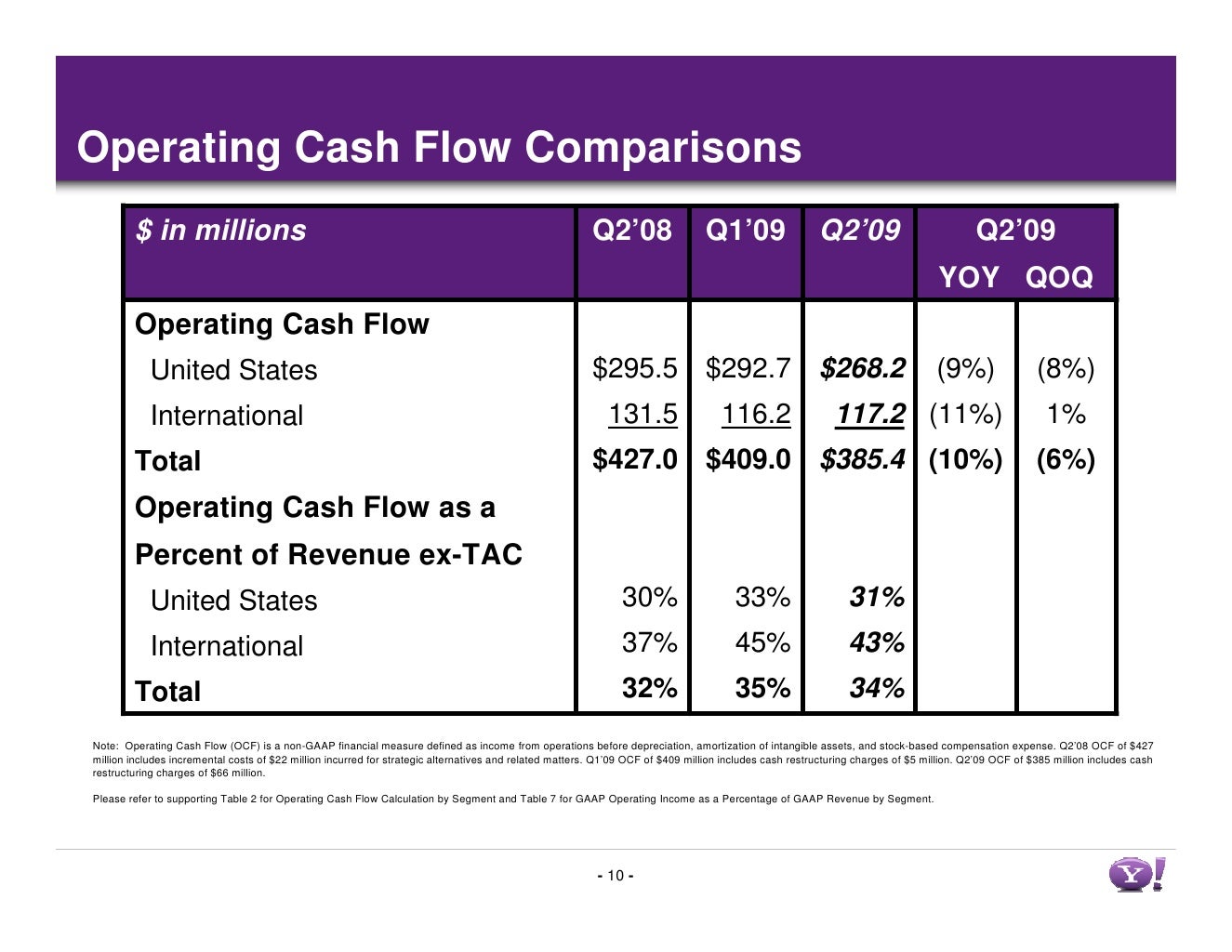

Cash flow from operating activities represents the total amount of cash generated from operating activities throughout a specified period. Cash flow from operations shows the difference, if any, between a company's reported income and. Will reduce spending on us shale operations as it seeks to improve cash flow to repay debt, resulting in largely flat production this year.

Cash outflows can vary substantially when business operations are highly seasonal. Operating cash flow is cash generated from the normal operating processes of a business and can be found in the cash flow statement. Operating cash flow (ocf), sometimes called cash flow from operations, is a measure of the amount of cash generated by a business’s normal business operations.

Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the gdp of all but two. Also called operating cash flow, and listed on the cash flow statement, cash flow from operations is the amount of cash generated from the operating activities of the company. December 12, 2023 what is cash from operating activities?

Operating cash flow shows whether a company generates enough positive. Cash flow from operations, also called operating cash flow, refers to the amount of cash garnered from a business’ core activities. Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting year;

This is typically calculated by taking a company’s net income, factoring in depreciation expenses, then adjusting for any gains or losses on sales and assets. Operating cash flow indicates whether a company can generate sufficient. What is cash flow from operations (operating activities)?

The direct method, arguably the more intuitive way of recording cash flows, simply lists all inflows and outflows that have occurred in a company's operations. The cash flow statement is the least important financial. This information is used to determine the viability of the core operations of a business, since positive cash flow is needed to maintain and grow a firm’s operations.

Key takeaways cash flow is the movement of money in and out of a company. The cash flow from operations formula shows that: London stock exchange | london stock exchange.

It does not include any investing or financing activities. Operating cash flow is the net amount of cash that an organization generates from its operating activities. The ocf calculation will always include the following three components:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)