Divine Info About Audited Profit And Loss Statement Cpa

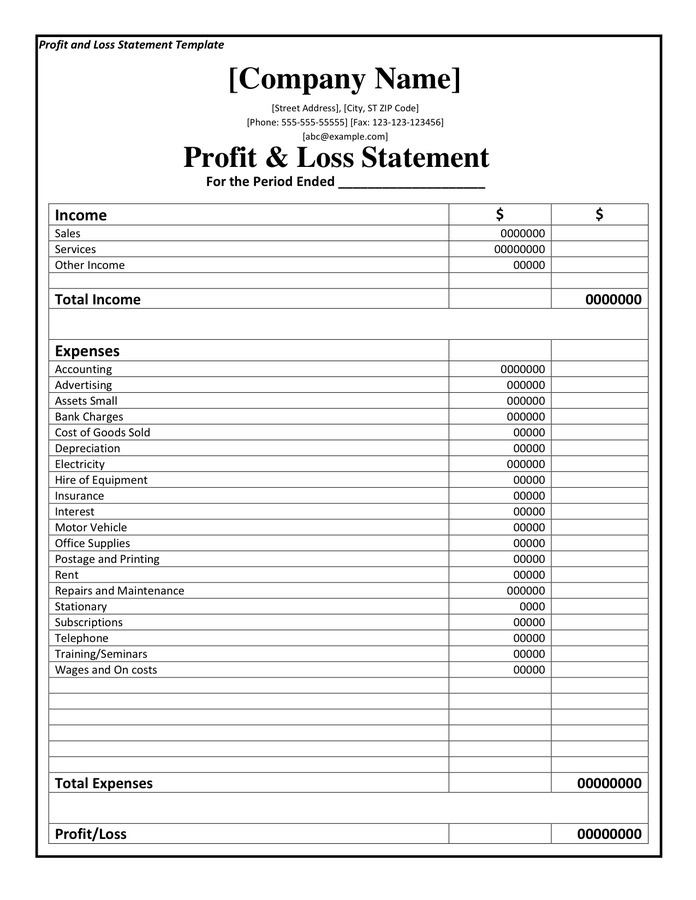

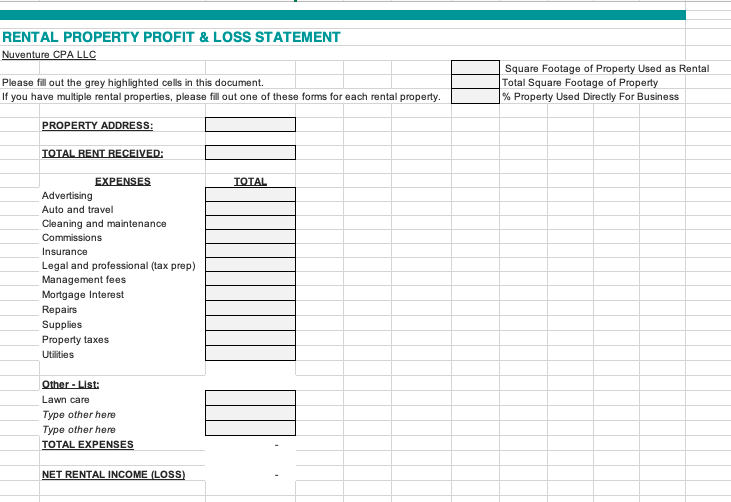

A profit and loss statement of a business entity is a statement of revenues and expenses.

Audited profit and loss statement cpa. The net result of all of these. Introduction scope of this section.01 this section applies when an accountant in public practice is engaged to prepare financial statements or prospective financial information. This means the cpa is not an employed of.

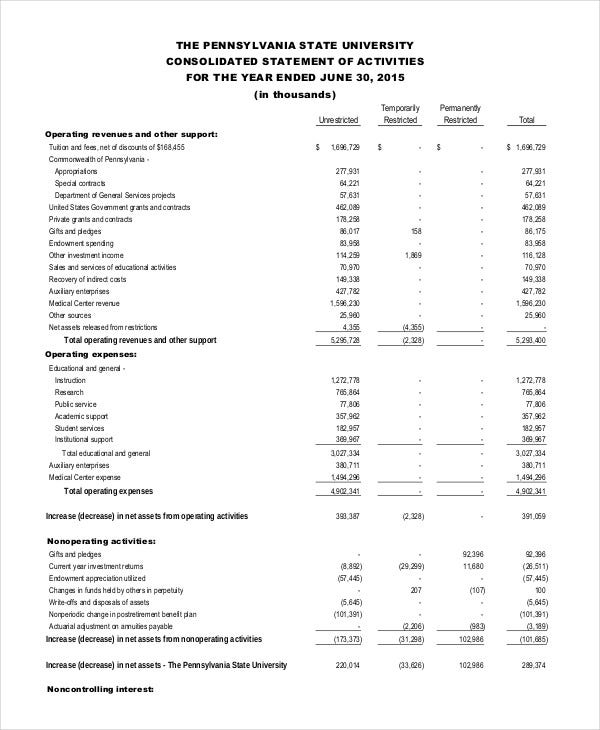

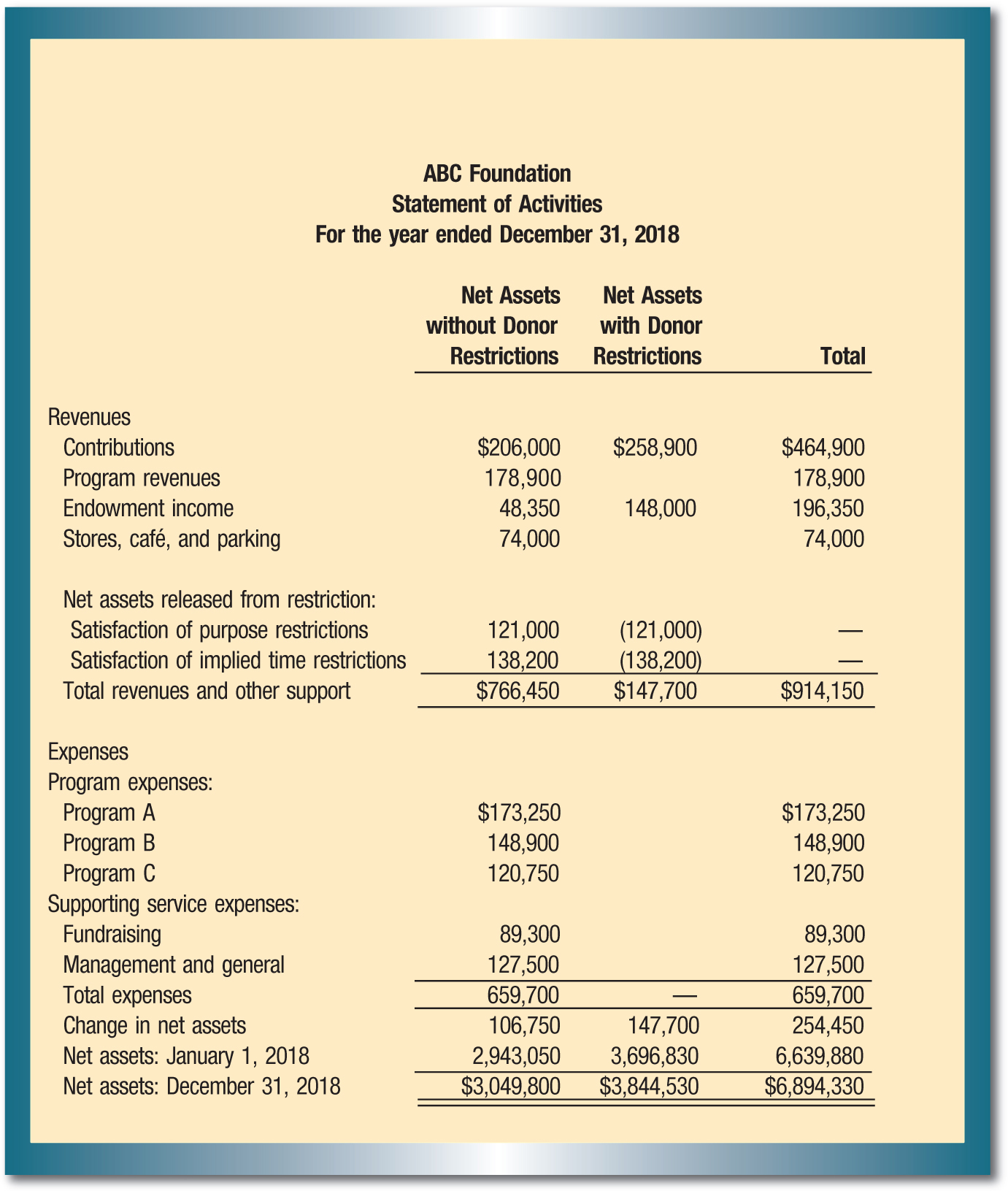

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. The p&l statement shows revenues, expenses, gains, and losses over a specific period of time such as a month, quarter, or year. An audited financial statement is any financial statement that has been audited by a certified public accountant (cpa).

A profit and loss statement is a financial document that summarizes a company’s revenues and expenses over a certain. One of the most basic ways to meet these goals and objectives of lean accounting is through a different way to look at the traditional profit and loss statement. A certified financial statement is a financial document audited and signed off on by a certified, independent auditor and is issued with an audit report, which is the.

A certified public accountant (cpa) will audit the contents of these statements using generally accepted accounting principles (gaap) to ensure the details. A profit and loss statement, or income statement, is the report that shows you an overview of your business's income, expenses, and profits or losses over a period. Certified statements, including balance sheet, profit and loss statement, and cash flow statement, are thoroughly audited by a cpa to ensure their accuracy and.

Financial statement services your cpa can provide 3 financial statement services your cpa can provide basic financial statement. An audited financial statement is a company's document that a registered certified public accountant (cpa) has reviewed and determined is free from error. How to certify a profit and loss statement prepare the income statement.

The income statement is another name for the profit and loss statement. Unaudited profit and loss statement having your p&l statement audited by a licensed cpa helps ensure accuracy. It summarizes all the revenues and expenses of a business entity that relates to a certain.

A cpa will guarantee that a financial statement. An income statement, also known as a profit and loss statement, details your company’s revenue after all expenses and losses.