Divine Tips About Ifrs For Smes

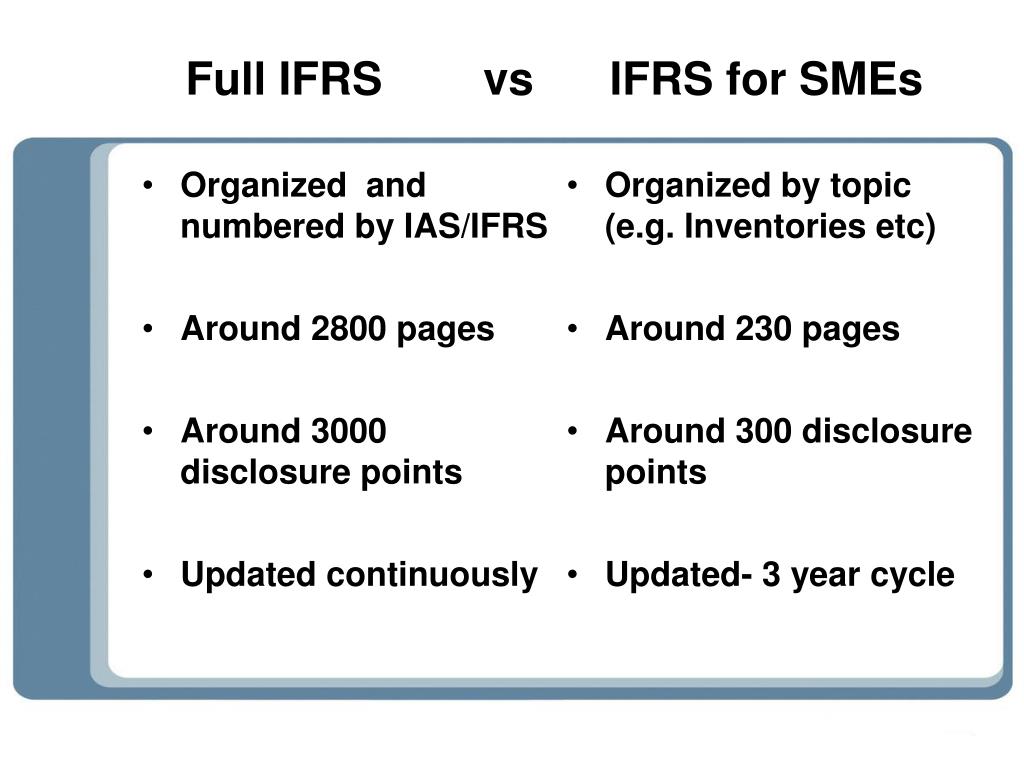

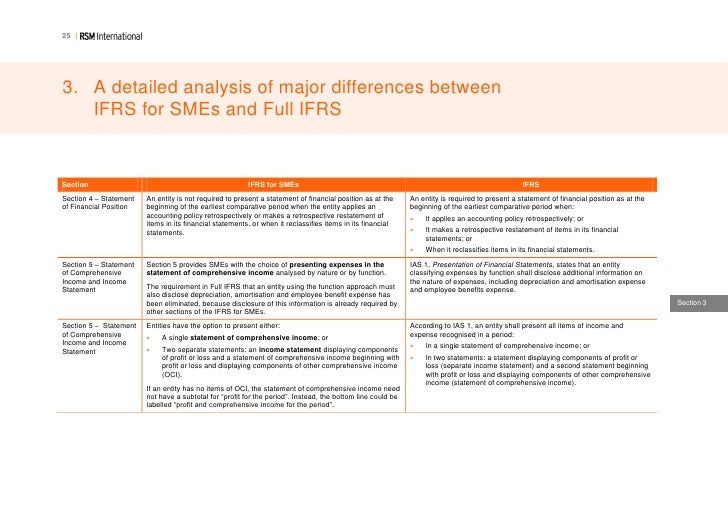

Some topics in full ifrs accounting standards are omitted because they are not relevant to typical smes;

Ifrs for smes. Learn the key accounting principles to be applied to the ifrs for smes standard, that can be applied by eligible entities in place of full ifrs standards. Smes include all entities that are not publicly traded and that are not banks or similar financial institutions. This standard provides an alternative framework that can be applied by eligible entities in place of the full set of international financial reporting standards (ifrs ®).

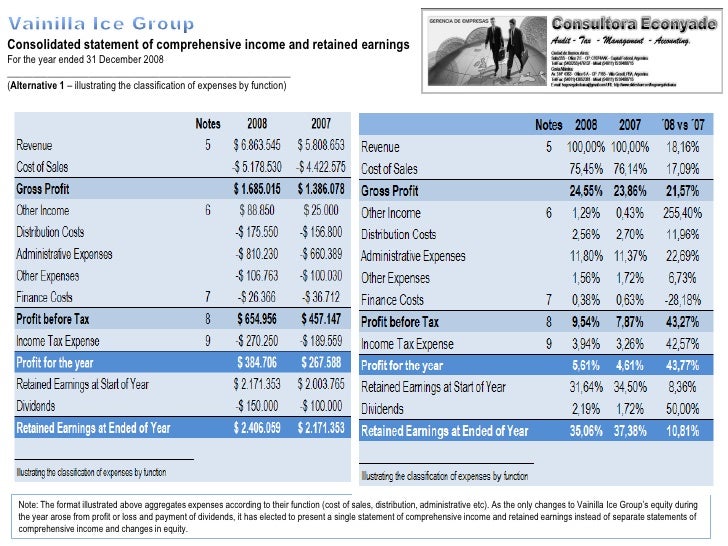

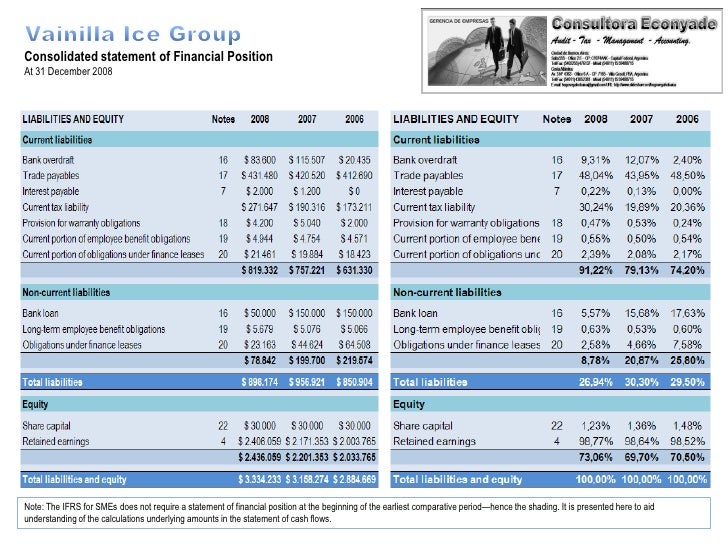

Currently available in albanian, arabic,. The ifrs for smes accounting standard reflects five types of simplifications from full ifrs accounting standards: The ifrs for smes is accompanied by a preface, a derivation table, a basis for conclusions and implementation guidance consisting of illustrative financial statements and a table that collates the presentation and disclosure requirements in the ifrs for smes.

One aim of the ifrs for smes is to provide a standard for entities in countries that have no national gaap. It is a matter for authorities in each territory to decide which entities are permitted or even required to apply ifrs for smes. Ifrs for smes—2015 5 ifrs foundation

The ifrs for smes was published in july 2009. Ifrs sustainability disclosure standards are developed by the international sustainability standards board (issb). Ifrs for smes will provide an

Ifrs for smes® fact sheet.

![Home [www.icab.bb]](https://www.icab.bb/images/Events/IFRS for SMEs Flyer3.jpg)