Peerless Tips About Forecast Balance Sheet

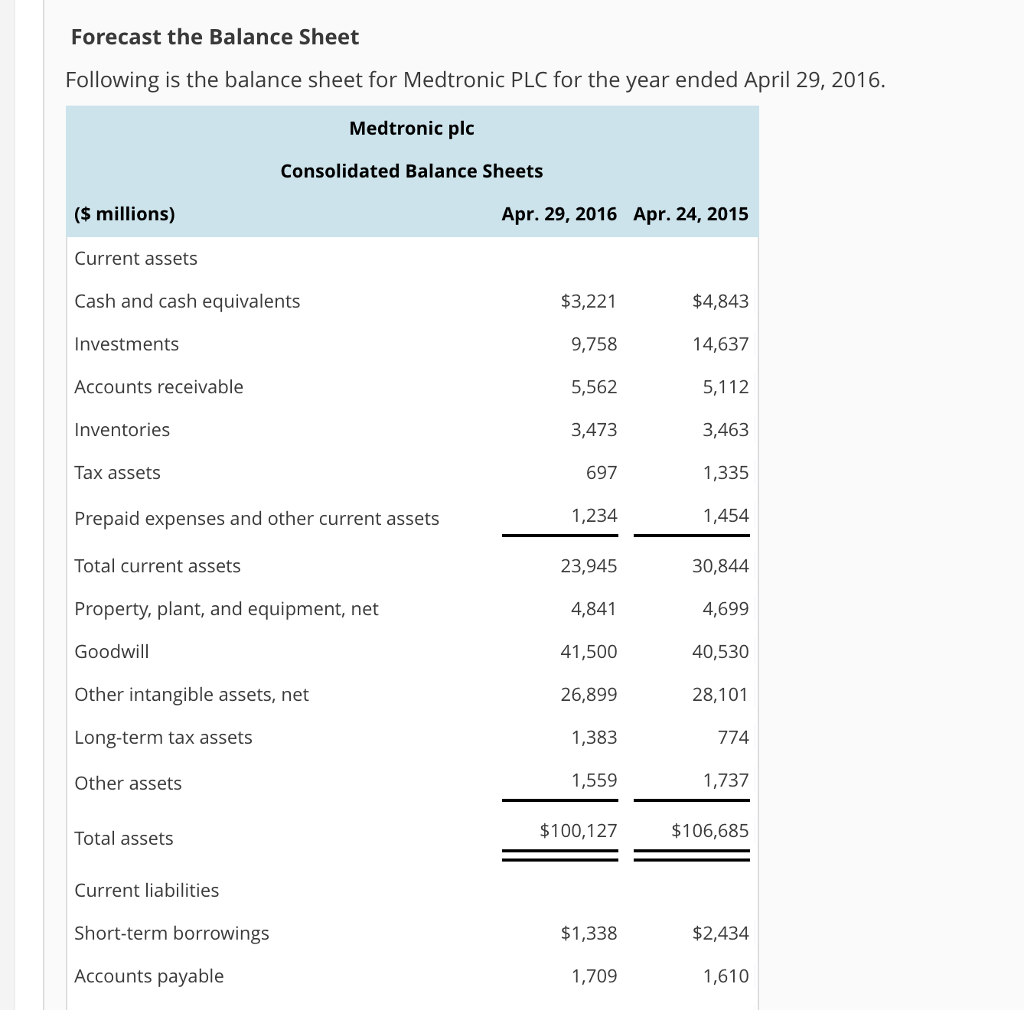

The forecast is used to estimate what assets and liabilities a company will have in the future and thus represents.

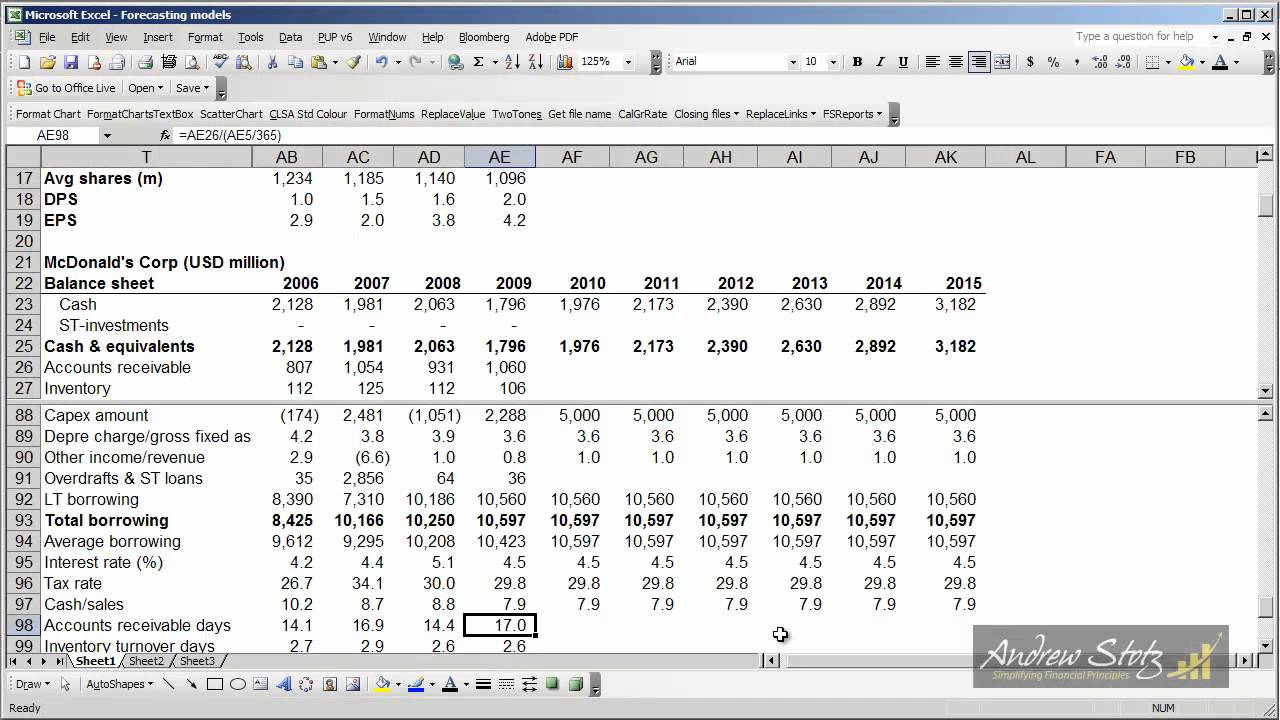

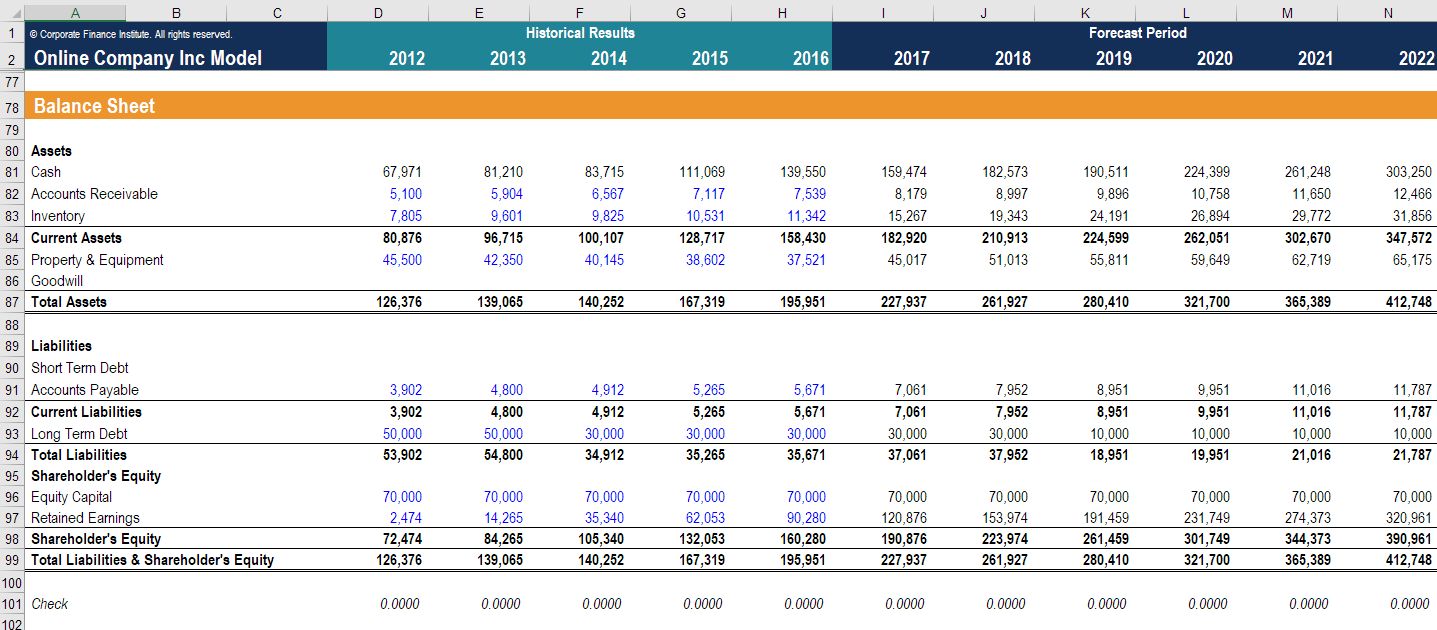

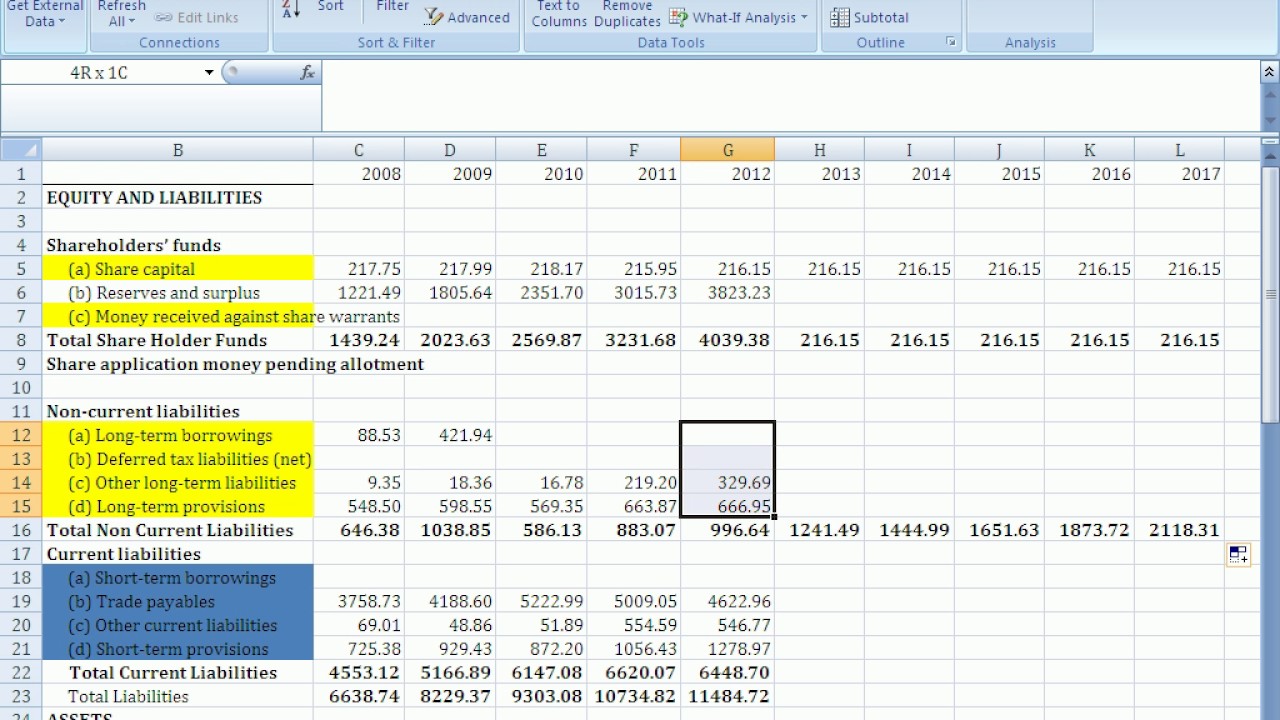

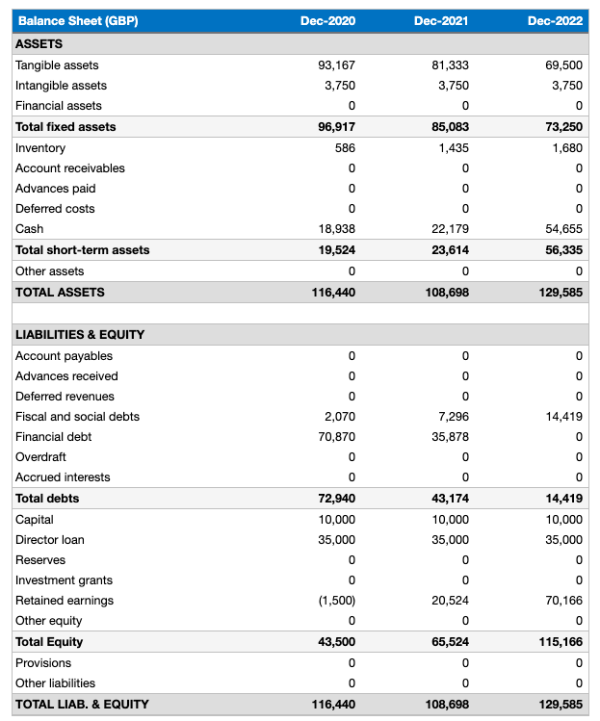

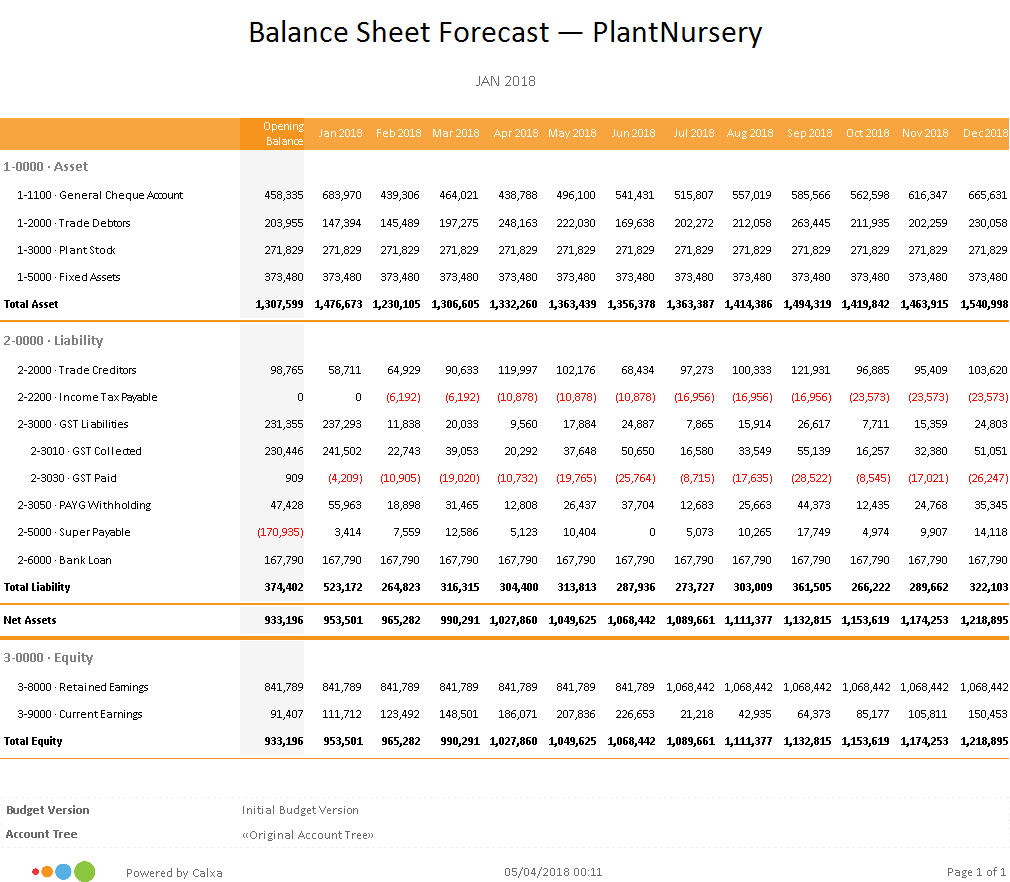

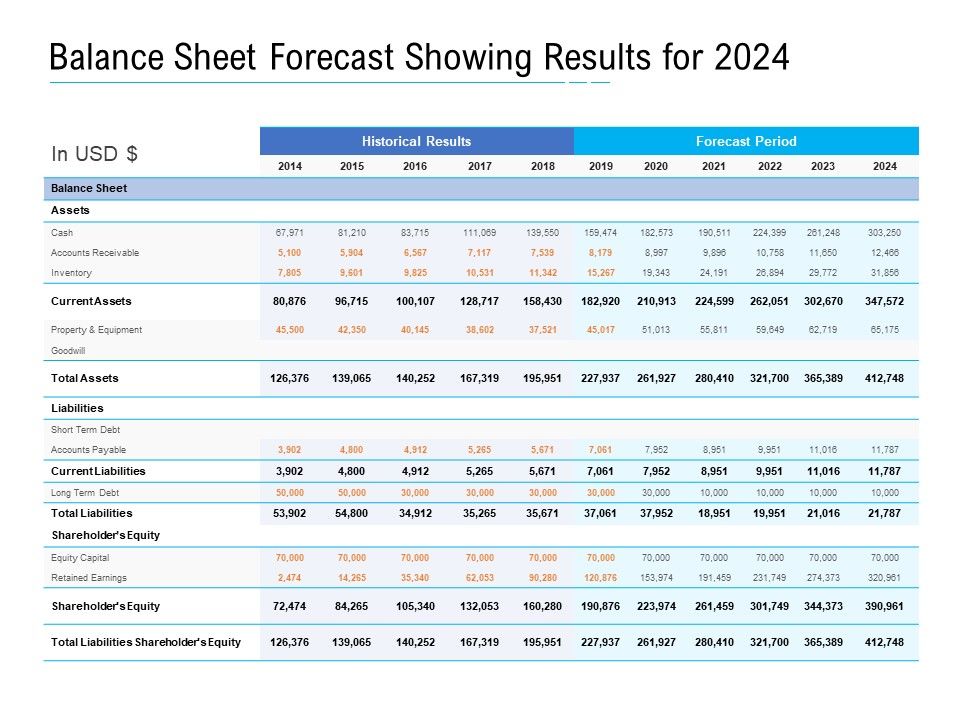

Forecast balance sheet. How to forecast a balance sheet assets. This forecasting process is typically conducted using historical data and financial software to project the future state of the balance sheet. A predicted statement of projection and assumptions for the future of the business is the result of integrating those three phases.

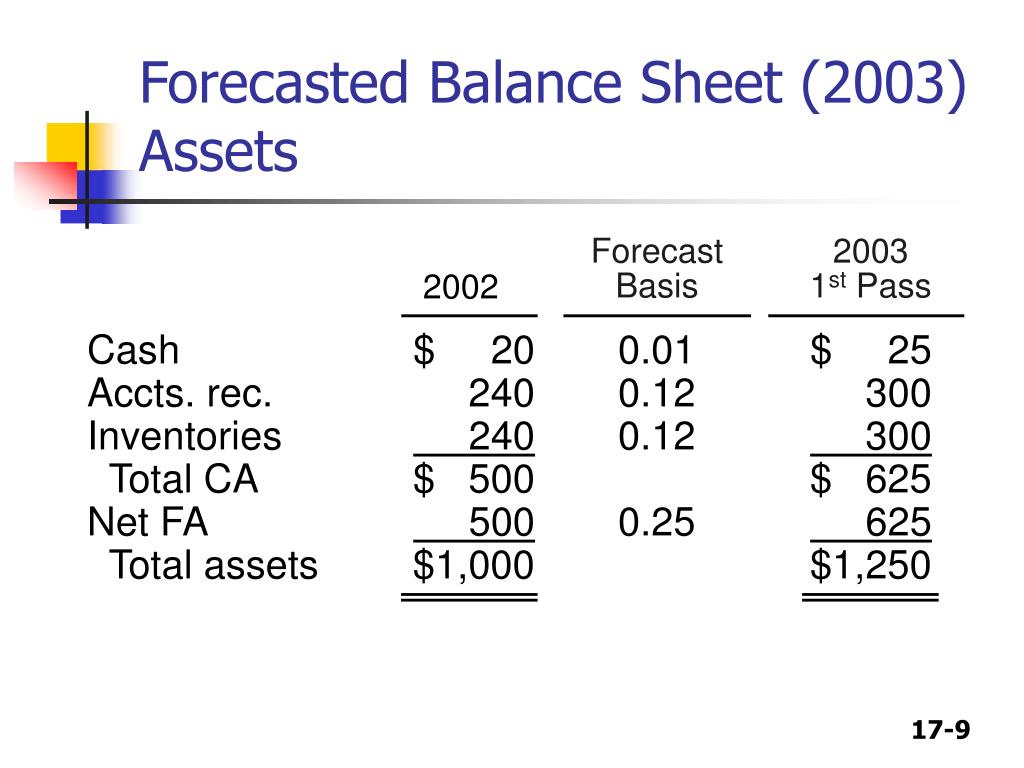

How to project the balance sheet (19:03) in this tutorial, you will learn which income statement line items should be linked to balance sheet accounts such as accounts receivable, prepaid expenses, and deferred revenue. A good modeler, when attempting to forecast the line items of a balance sheet statement, should initially build the first forecast period only (i.e. The small business guide to financial forecasts deskera content team table of contents as a startup owner, it would be a godsend to view glimpses of the future in a crystal ball and draw plans, and to know which direction your finances will sit in the approaching times.

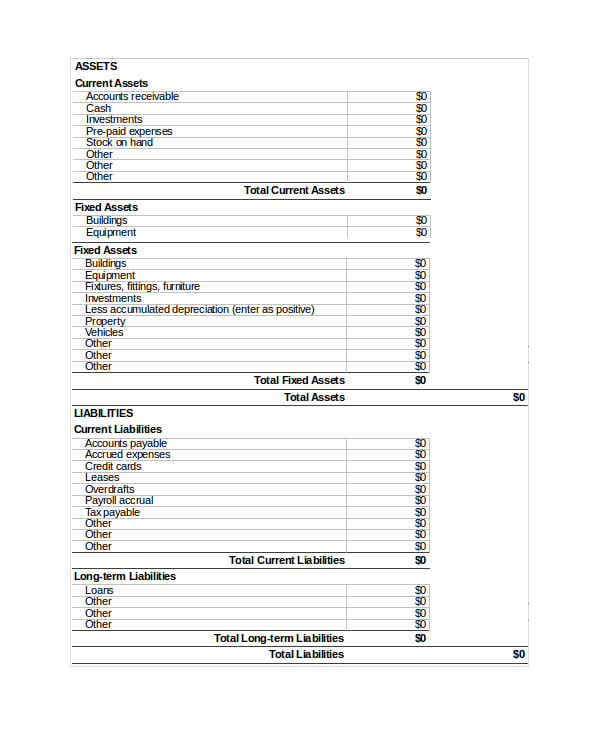

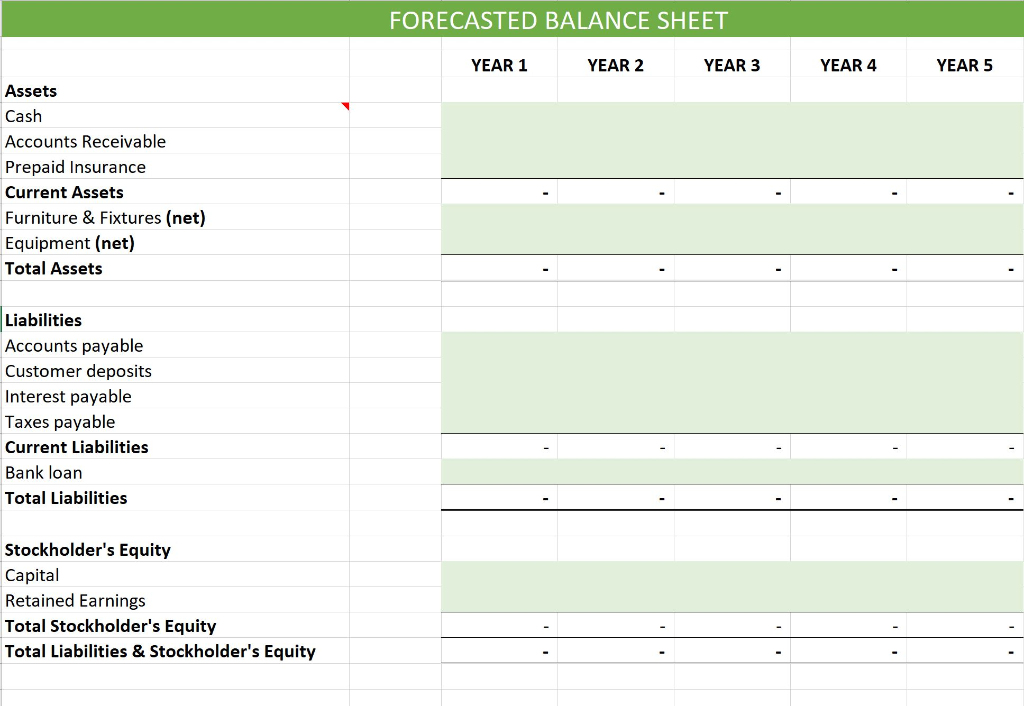

In the financial forecasting model, the balance sheet forecast comes after the income statement and cash flow estimates. To forecast a balance sheet, businesses examine past financial statements and use that historical data to make projections about their future capital, assets, debt and equity. Enter the assets first, enter the cash and cash equivalents and the accounts receivable in the c8 and c9 cells respectively.

You’ll also see an example of how to check your work, how to tell when you’ve linked something. How to forecast balance sheet in excel? The balance sheet forecast is a forecast of the assets, equity and liabilities at a certain point in the future.

Electronic spreadsheets like ms excel are used to analyze and process historical and future data. Finally, this ‘check’ line shows whether the balance. =sum (c8:c9) here, c8 and c9 cells refer to the values of $4,219,625 and $125,000.

December 19, 2023 small businesses perform financial forecasting by analyzing historical data and using it to predict the company’s future financial performance. The £1.06m was less than forecast thanks to an extra £137,031 received from the government as. These are the main line items.

Retained profit is any profit (or loss) the business made up to the end of this month. Introduction forecasting a balance sheet involves predicting the future financial position of a company by estimating its assets, liabilities, and equity. Then it works out three others:

Crawley borough council has had to use more than £1m of reserves to balance its budget for 2024/25. Projecting balance sheet line items involves estimating the values of various assets, liabilities, and equity accounts to forecast the future financial position of the organization. Forecasting a balance sheet by estimating the assets, equity, and liabilities at a specific point in the future, companies can make informed decisions about their capital, debt, and other financial aspects.

A balance sheet forecast is part of a three statement financial model (along with your income statement forecast and cash flow forecast) that projects material changes in your company’s cash balance. A year after bhp singled out nickel as a key growth area for its business, the metal's price has plummeted. Since the balance sheet represents a businesses financial position at a certain point in time, it stands to reason that the balance.

If you retained a profit of £2000 last month and make a profit of £500 this month then your retained profit will be £2500 this month. A balance sheet projection (also called a balance sheet forecast) is a guide to a business’s financial situation in the future. It is used to approximate what a business anticipates on owning in the future and also what it expects to owe.