Stunning Tips About Increase In Accounts Receivable Cash Flow

This increase in accounts receivable of $800 indicates that the company did not collect $800 of the revenues that were reported on february's income statement.

Increase in accounts receivable cash flow. You could use a budgeting app that links to your bank account to automatically import and categorize your transactions for you. After all, late payments prove a hassle to even the most successful company; A decrease in accounts receivable means that your customers have paid their invoices, or your collections efforts have been successful.

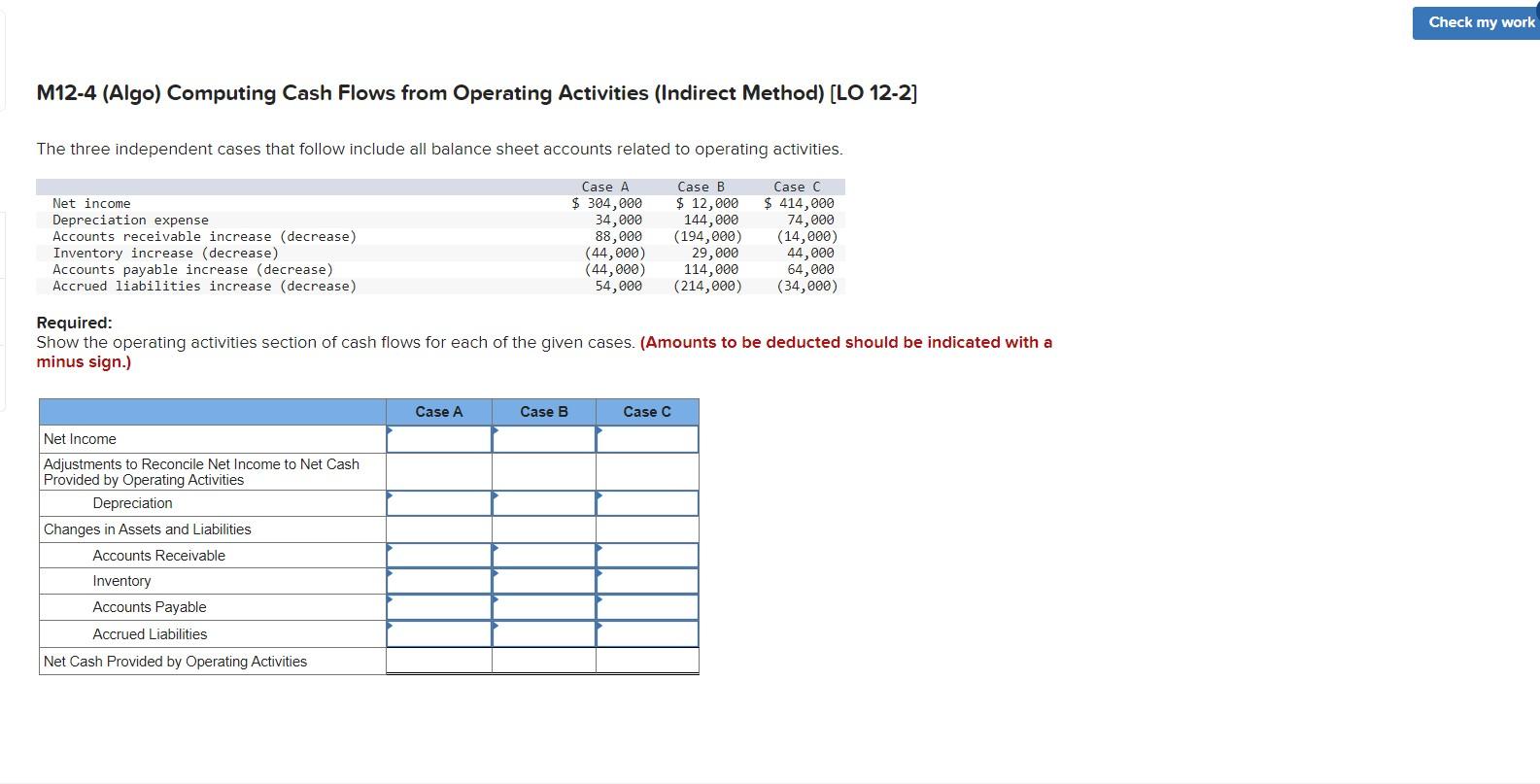

The starting point of the cash flow statement is net profit and it has been increased due to transactions that did not involve cash. Late payments have been linked to a. Upward changes in accounts receivable are deducted from net earnings on the cash flow statement.

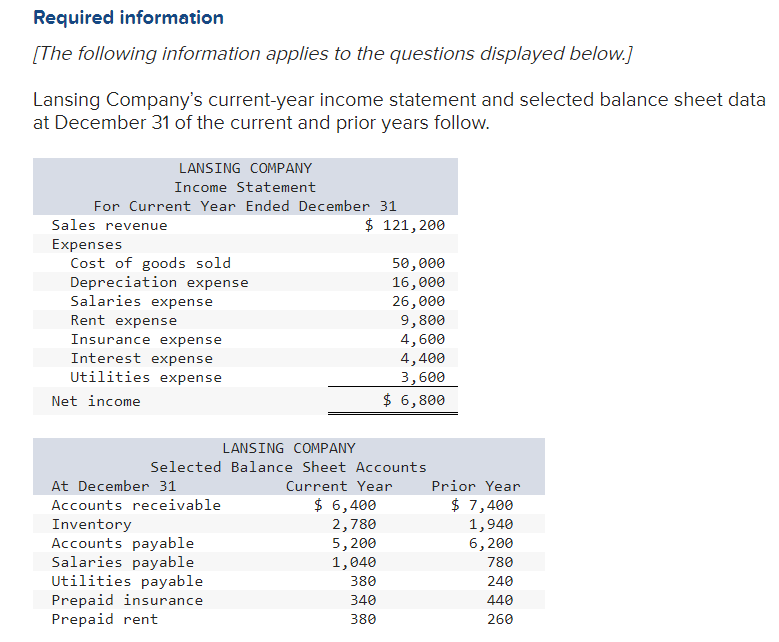

Using the accrual concept of accounting, accounts receivables have increased and sales i.e. Increase in ar: The statement of cash flows is prepared by following these steps:

Then, you can see where you're spending more than you. To reiterate, the relationship between accounts receivable and free cash flow (fcf) is as follows: Decreases to cash.

Decrease in accounts receivable => add the decreased amount to net income. Accounts receivable increased by $4,000. This situation can create a gap in available funds, making it challenging to cover operational costs.

An increase in accounts receivable indicates that sales are paid more with credit than cash. This alarming trend has serious implications for both businesses and the economy as a whole. Paystand integrates with major erp and order management systems to provide robust payment functionality directly within your system of record.

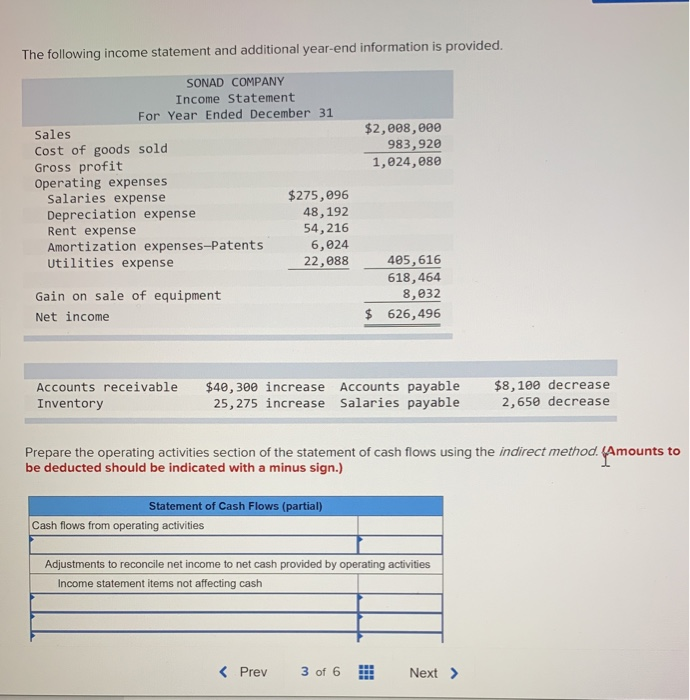

By following these six strategies, you may be able to maximize your accounts receivable and maintain or increase your cash flow. Conversely, a negative number indicates a cash flow increase of the same amount. This article delves into the relationship between accounts receivable and cash flow statements.

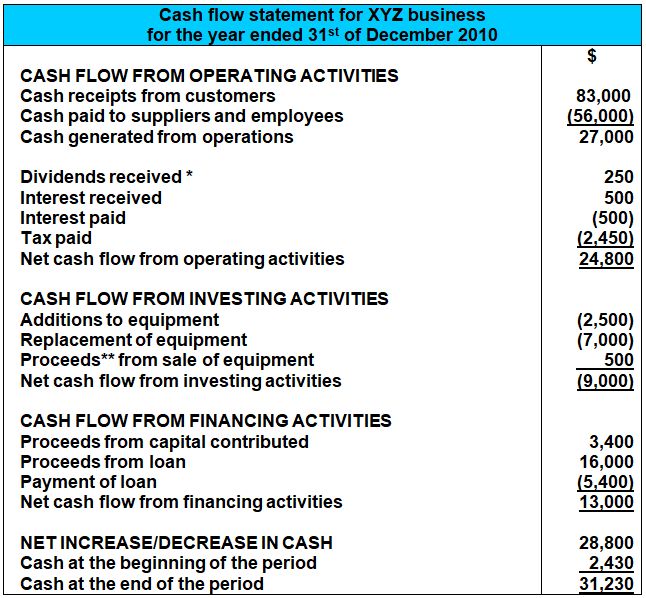

When something is not good for the company's cash balance, the amount is shown in. Cash flow from investing activities Accounts receivables, like cash, are considered a current assets.an asset is something of value that a company owns or controls.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Increase in accounts receivable => deduct the increased amount from net income. Even with an optimal rhythm, some remain.

Decrease in accounts receivable (a/r) → the company has successfully retrieved cash payments. This is how cash flow problems usually start. When ar increases, it gets deducted from net earnings because it is not cash even though they are in revenue.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)