Real Tips About Cost Accounting Reconciliation Statement

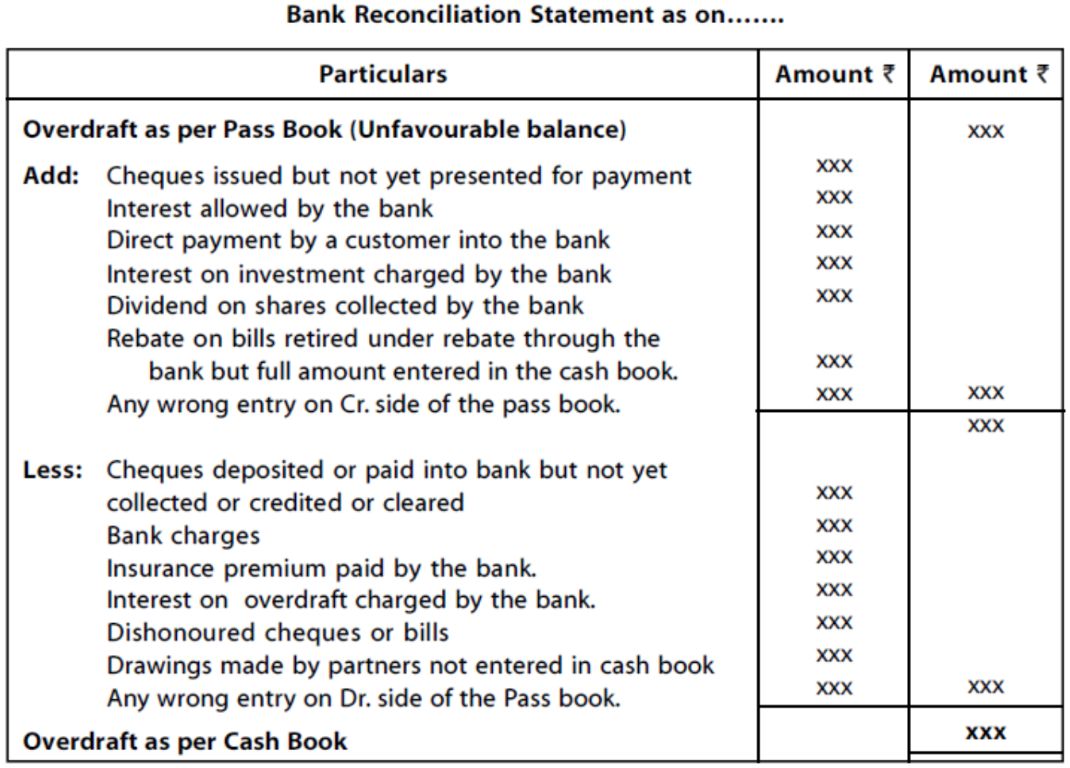

The reconciliation statement provides bases to verify the arithmetical accuracy of the incomes and expenses recorded in the two accounting systems.

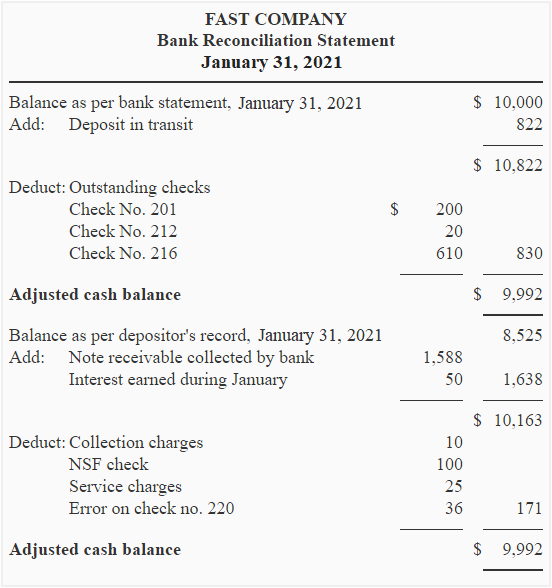

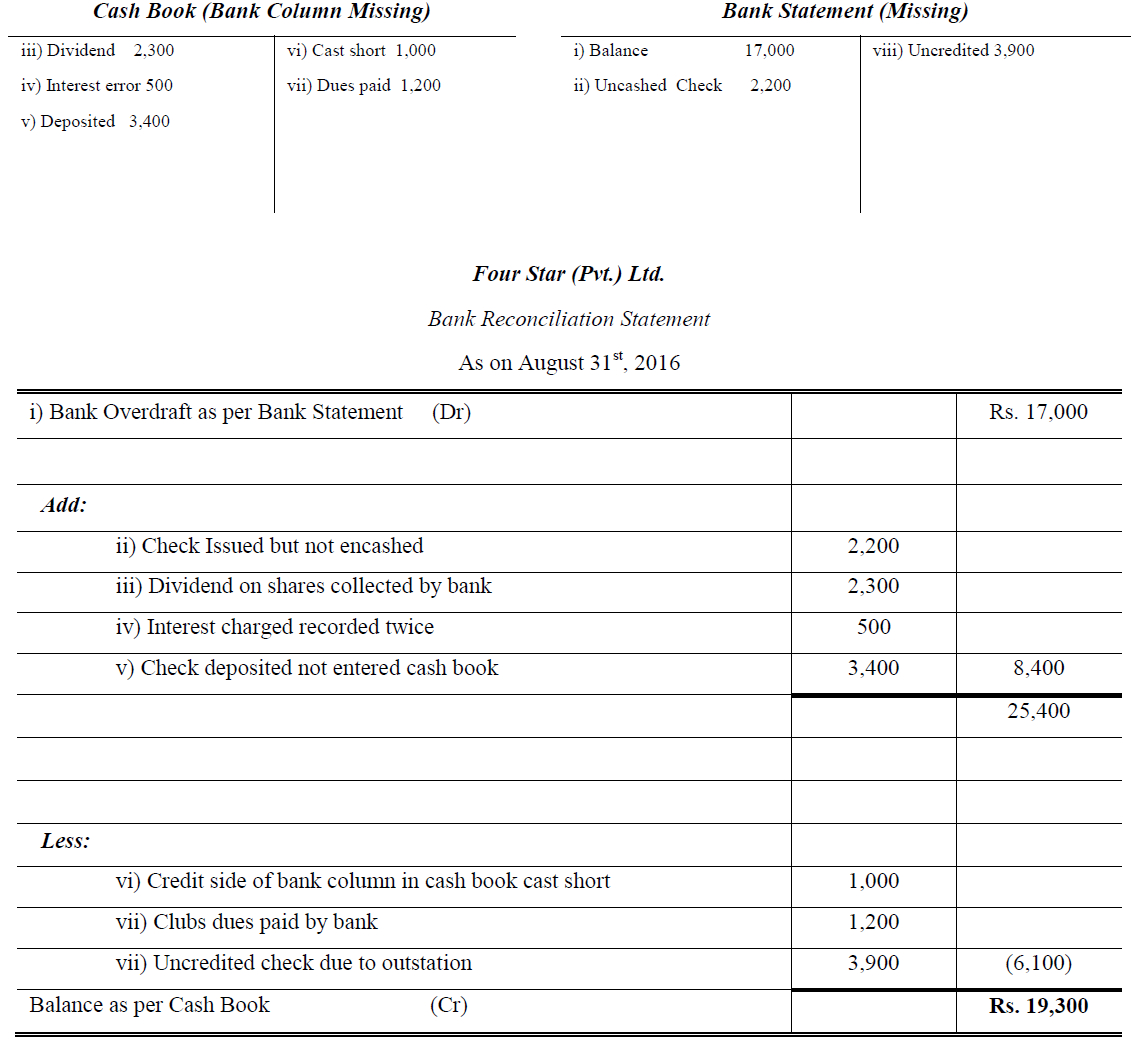

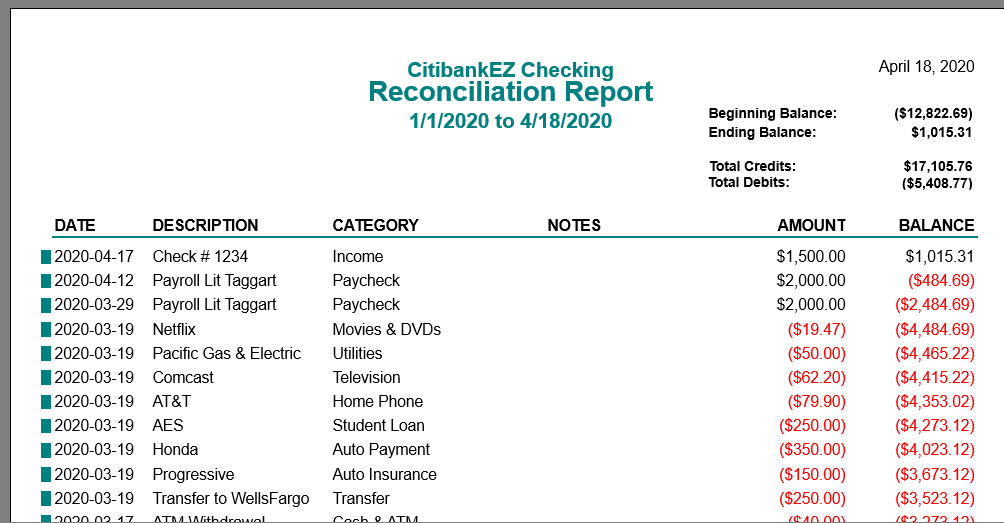

Cost accounting reconciliation statement. Kohler, “reconciliation is the determination of the items necessary to bring the balances of two or more related accounts or statements into an agreement. For this purpose, we make reconciliation statement. It has a balance as per cash book as of 31st march 2019 of $1050.

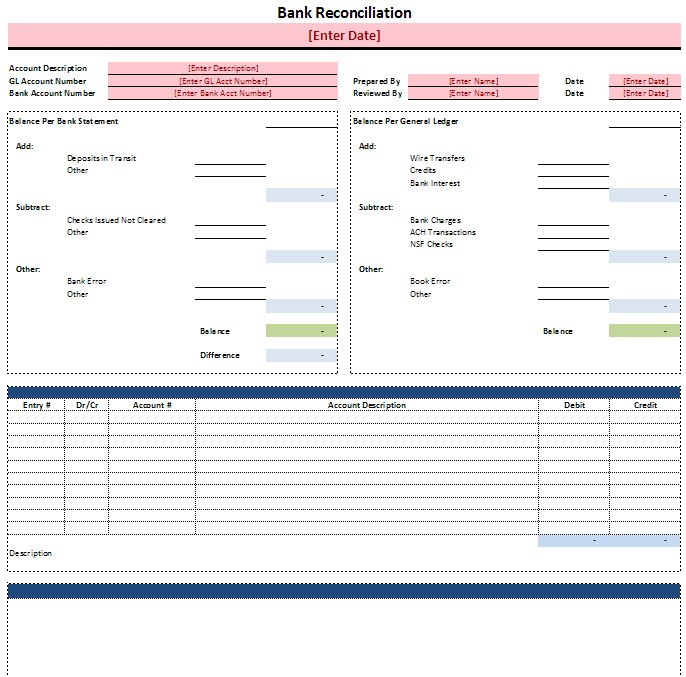

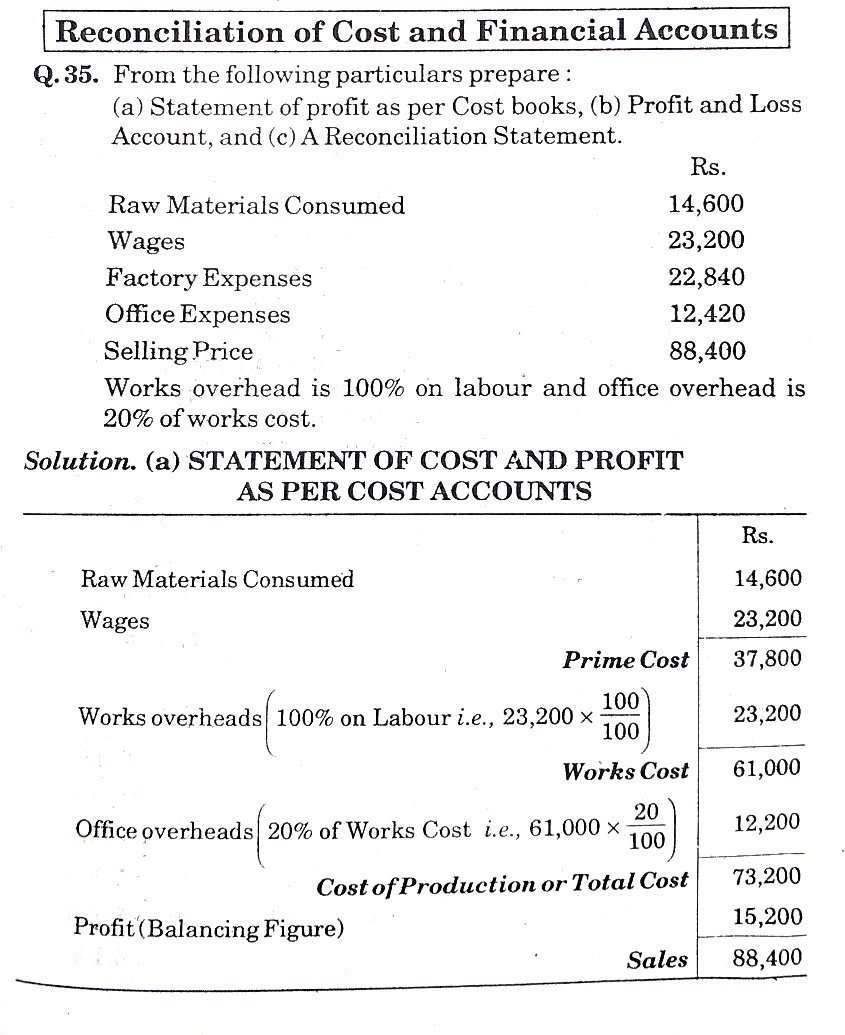

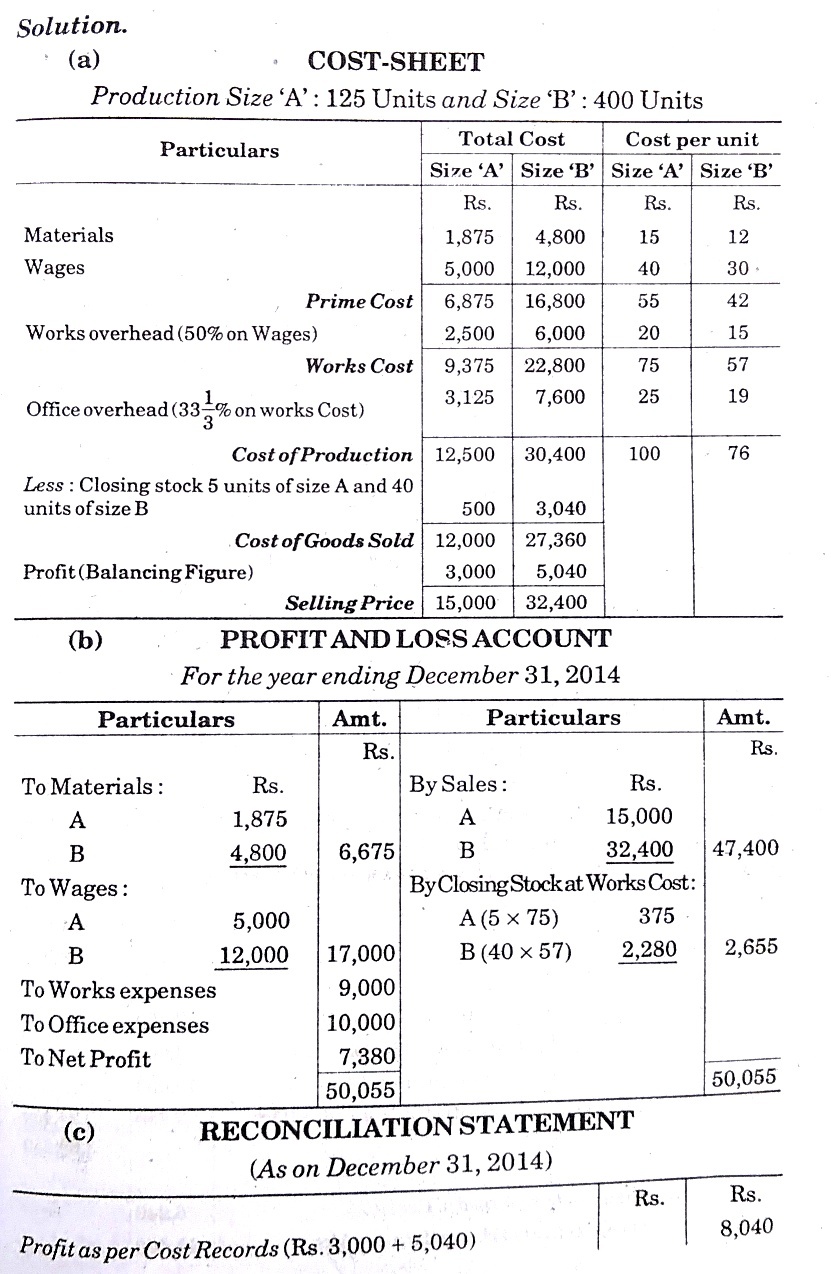

A financial reconciliation statement reconciles the totals of the cost account with those of the financial accounts. So to reconcile the costs using the fifo method: A cost reconciliation statement is prepared to reconcile the differences in net profits shown by cost and financial accounts.

It shows whether there is any divergence between the two sets of books, and if so, how such divergence occurred. The same principles of bank reconciliation will apply here. The cost and financial accounts are reconciled by preparing a reconciliation statement or a memorandum reconciliation account.

Has a balance per pass book of $ 1,000 as of 31st march 2019. Method for preparing reconciliation statement: Reconciliation statement between financial and cost accounting.

A cost reconciliation statement will identify any discrepancies between budgeted and actual costs, resulting in more efficient financial decisions across departments. Reconciliation is the process of identifying the items required to bring the balances of two or more connected accounts or statements into an agreement, according to eric l. The cost and financial accounts are reconciled by preparing a reconciliation statement or a memorandum reconciliation account.

A cost reconciliation statement is a statement reconciling the profits or losses shown by cost accounts and financial accounts. The costs per equivalent unit are used to value the units in the ending inventory and the ones that have been moved to the next process. It is a statement wherein the causes responsible for the difference in net profit or loss between cost and financial accounts are established and suitable adjustments are made to remove them.

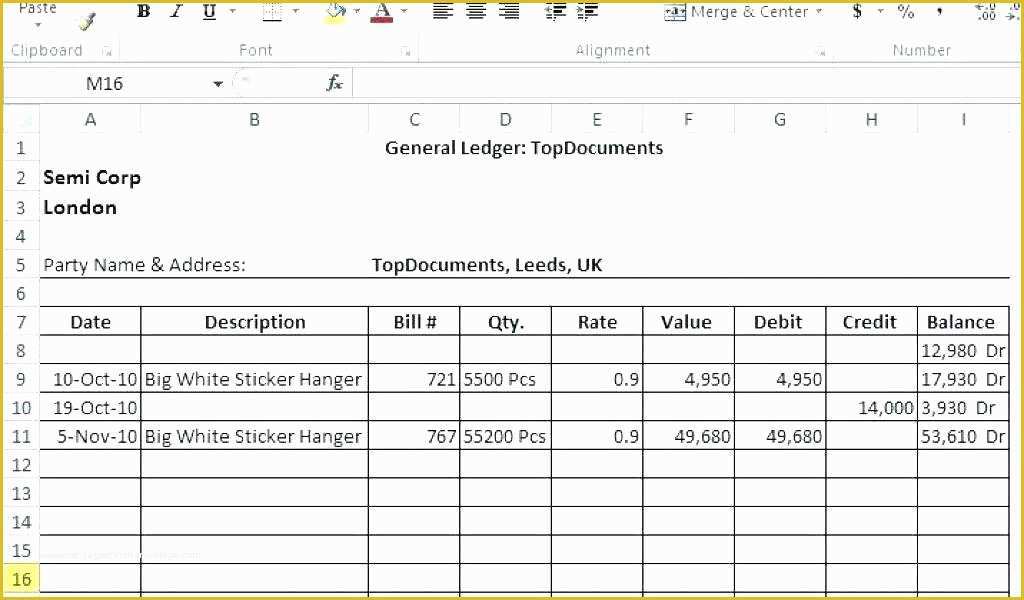

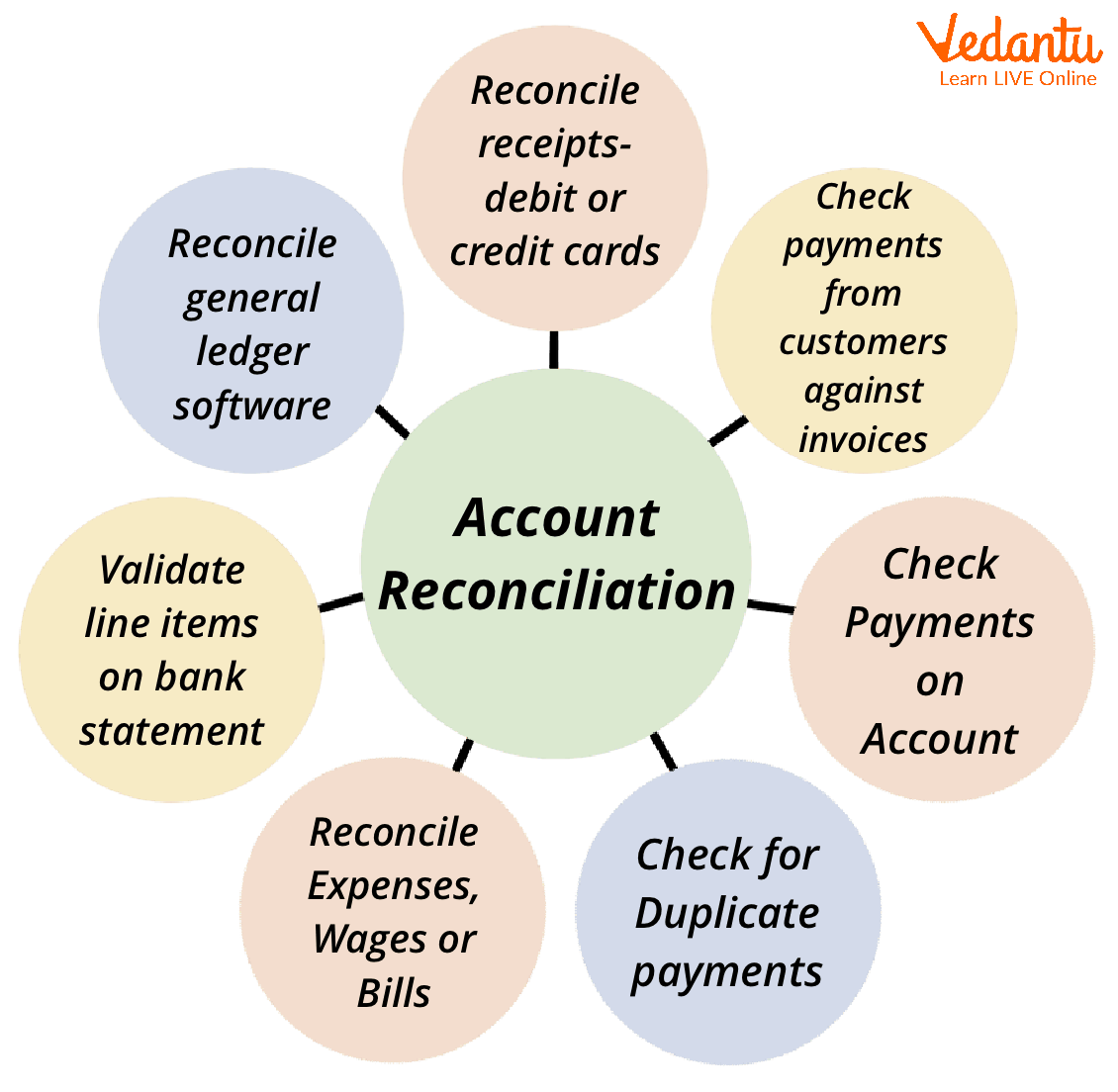

(1) ascertain the reasons of difference between cost accounts and financial accounts. Reconciliation also confirms that accounts in a general. The practice of reconciling the functional outcomes or profits as revealed by cost accounts with those of financial accounts is known as reconciliation.

Over valuation of closing stock in cost account rs 15,000. It is an account not being a part of double entry system of bookkeeping. The reconciliation statement provides bases to verify the arithmetical accuracy of the incomes and expenses recorded in the two accounting systems.

Cost accounting reconciliation report. A cost reconciliation statement is a statement reconciling the profits or losses shown by cost accounts and financial accounts. A reconciliation statement is a statement which is prepared to reconcile the profit as per cost accounts with the profit as per financial accounts by suitably treating the causes for the difference between the cost and financial profit.

The cost accounts and financial accounts are reconciled by preparing any of the following: It helps to check the arithmetical accuracy of both sets of accounts. Net profit as per financial account rs 74,000 of max traders.