Formidable Info About Company Cash Flow Statement

The cash flow statement, also called the statement of cash flows, is a financial statement showing how cash flows in and out of a company over a specific period of time.

Company cash flow statement. A cash flow statement, also referred to as a statement of cash flows, shows the flow of funds to and from a business, organization, or individual. The cash flow statement is required for a complete set of financial statements. Cash inflows refer to receipts of cash while cash outflows to payments or disbursements.

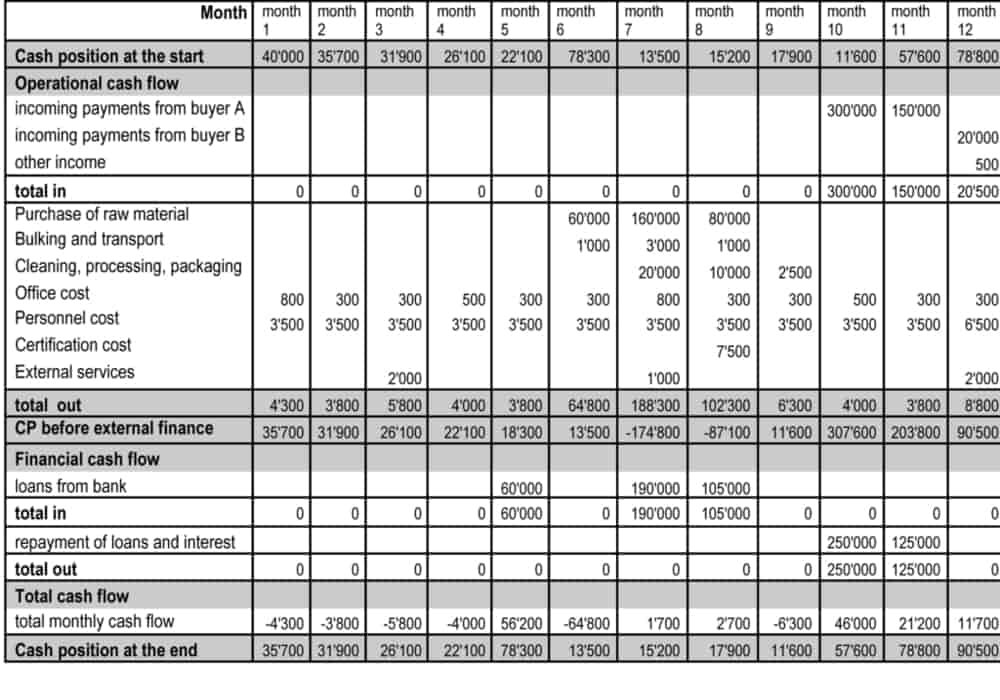

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period. A cash flow statement gives investors insight into how a company manages its cash and where the money goes.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. What is a cash flow statement? The cash flow statement is an essential financial document that gives a detailed picture of how a company handles its cash and ensures liquidity.

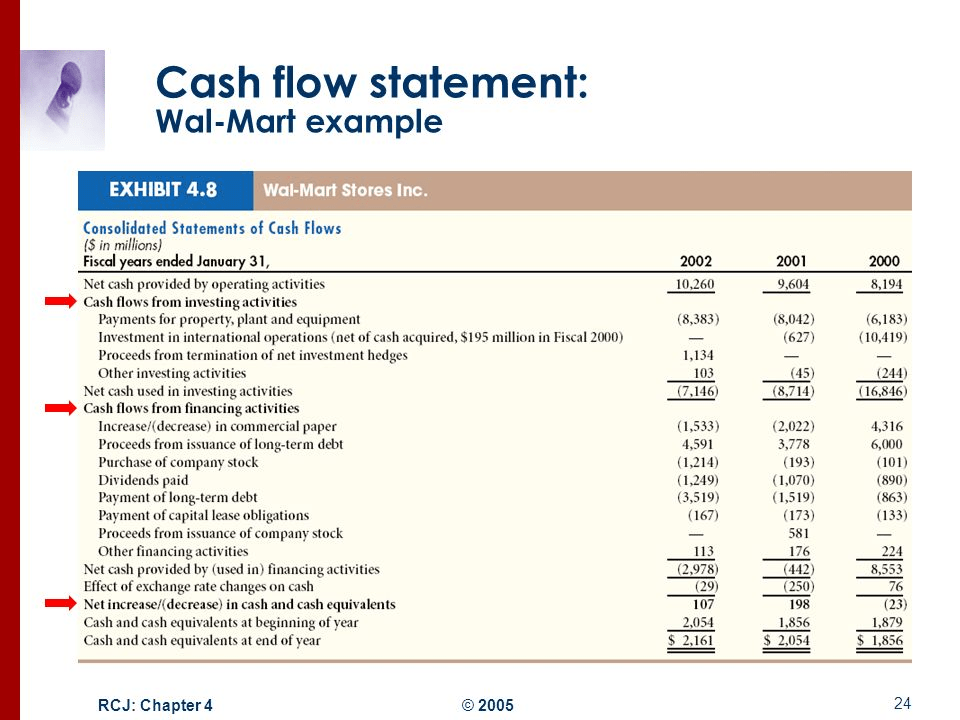

A cash flow statement is one of the three basic financial reports—the other two being the balance sheet and income statement (or profit and loss statement). A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. Operating, investing, and financing activities.

Cash flow from operations was $11.6 billion for the full year, up 5%; Unlike the income statement and balance sheet, it concentrates on tracking the actual cash movements during a specific period, usually a fiscal year. The cfs measures how well a.

A cash flow statement (cfs) is a financial statement that shows the inflow and outflow of cash in a company over a specified period. A cash flow statement (cfs) is a financial statement that captures how much cash is generated and utilized by a company or business in a specific time period. By looking at the cash flow statement, one can see whether the company has sufficient cash flowing in to pay its debts, fund its operations, and return money to shareholders via.

Company provides 2024 financial outlook. A cash flow statement shows if you're earning more money than you're spending. It helps identify the availability of liquid funds with the organization in a particular accounting period.

The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

The cash flow statement is a standardized document that clarifies the state of a company's cash flow at a point in time. What is a cash flow statement? Get a cash flow statement template and more in this guide.

Gain valuable insights into rolcon engineering company annual cash flow. The cash flow statement is a financial statement that reports a company's sources and use of cash over time. How to prepare a cash flow statement

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)