Fabulous Tips About Accounts In Trial Balance

Example of a trial balance document

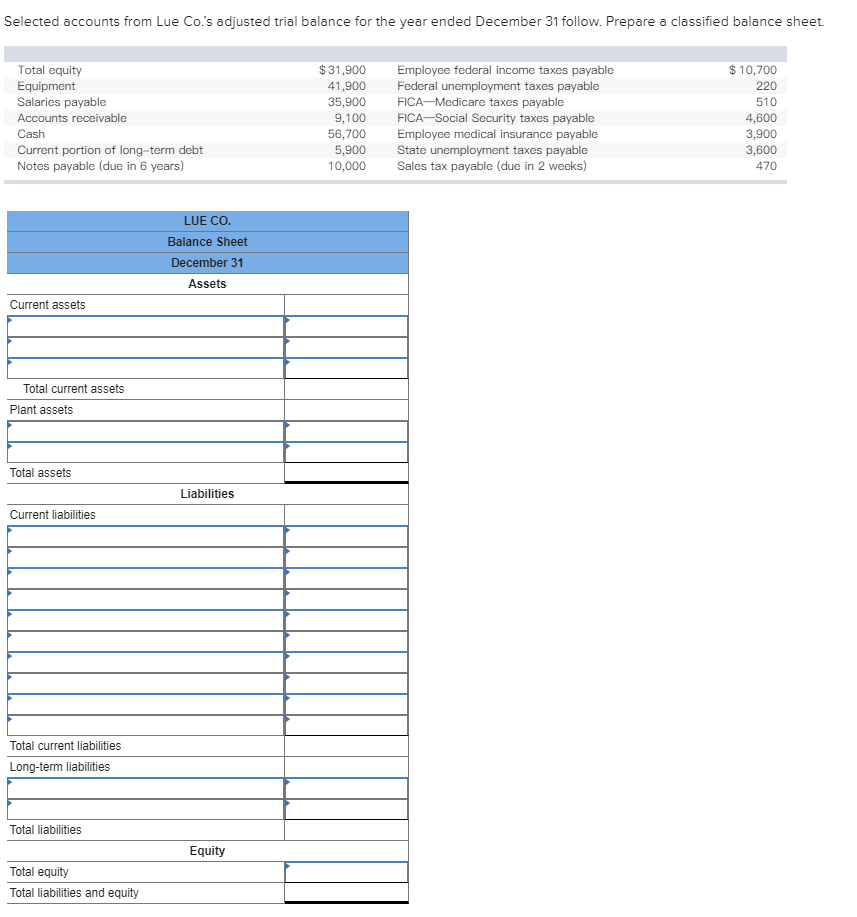

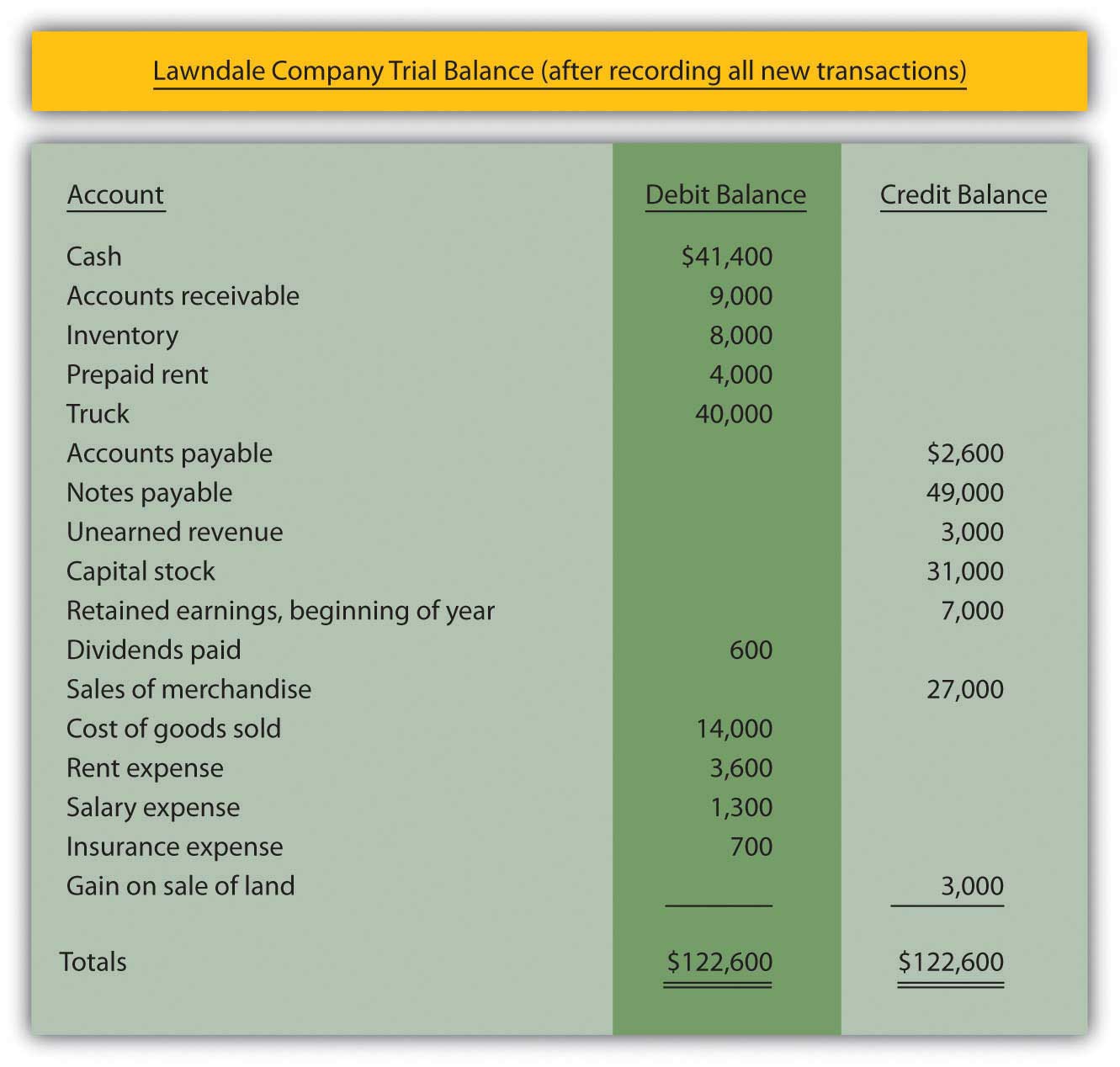

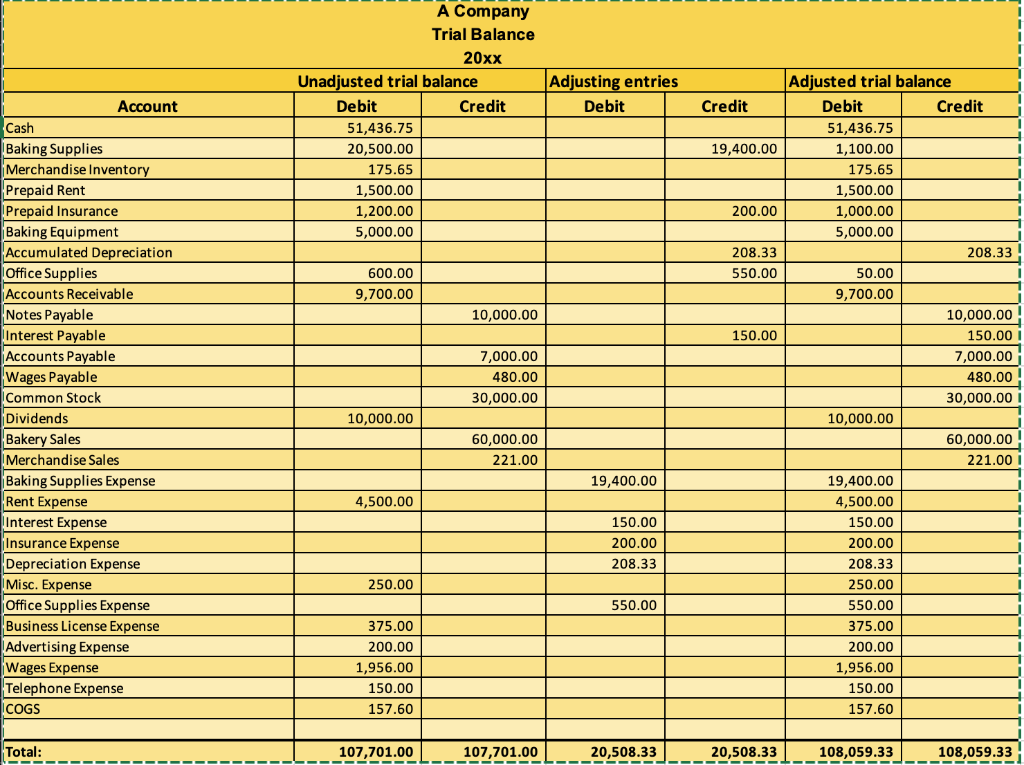

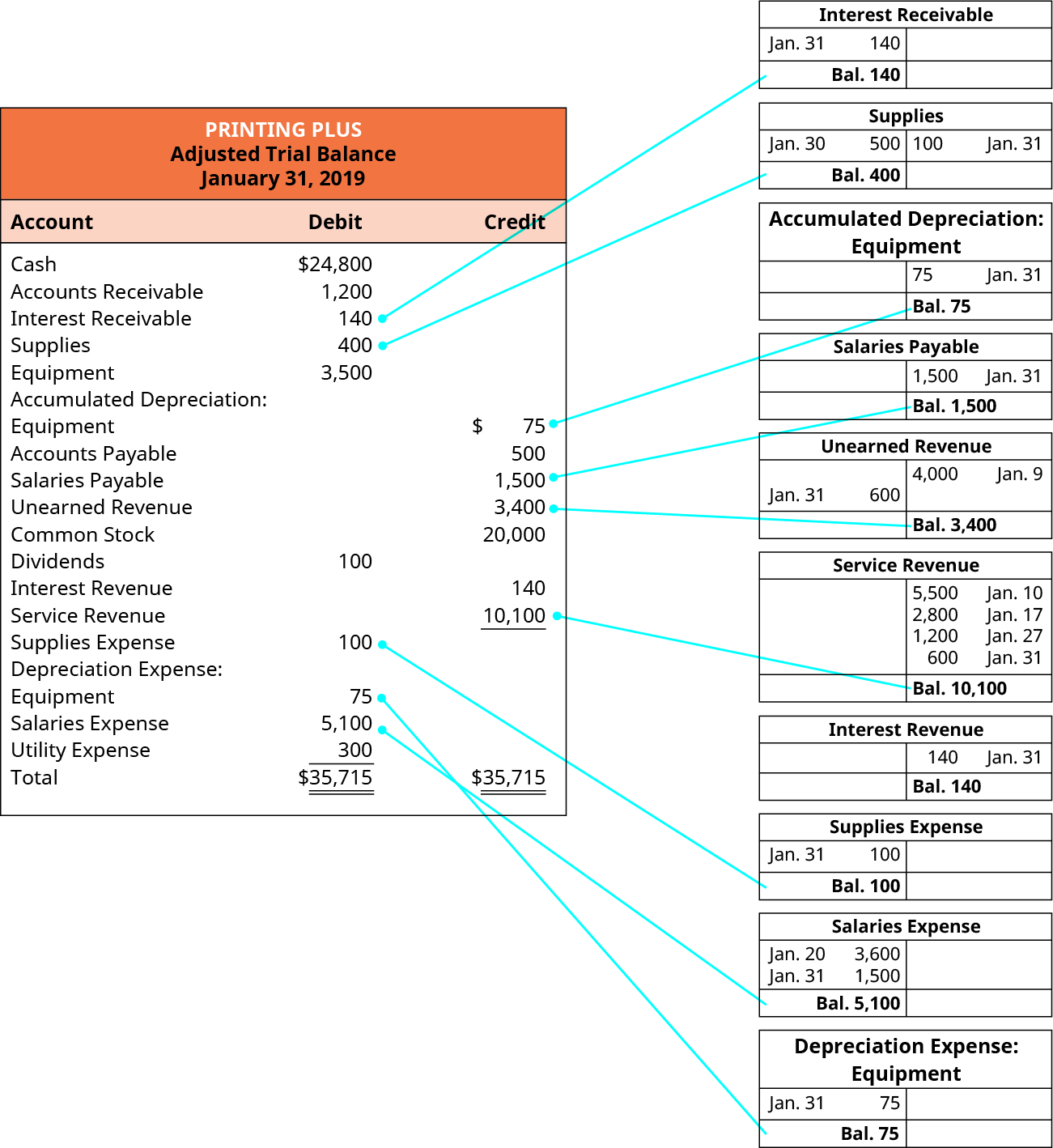

Accounts in trial balance. Read more can be prepared by. Then we produce the trial balance by listing each closing balance from the ledger accounts as either a debit or a credit balance. The trial balance is a list of all the accounts a company uses with the balances in debit and credit columns.

This balancing step in the accounting process helps ensure the accuracy of the financial statements. Trump lost his civil fraud trial on friday, as a judge found him liable for violating state laws and penalized him nearly $355 million plus interest. Former president donald trump unveiled in philadelphia his newly launched sneaker line, “trump sneakers,” a day after he and his companies were ordered by a judge to pay nearly $355 million in.

This statement comprises two columns: The debits and credits include all business. A trial balance is a worksheet that lists all general ledger ending account balances into two columns either a debit or a credit.

It is prepared at the end of a particular period to indicate the correct nature of the balances of various accounts. The total of both should be equal. Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements.

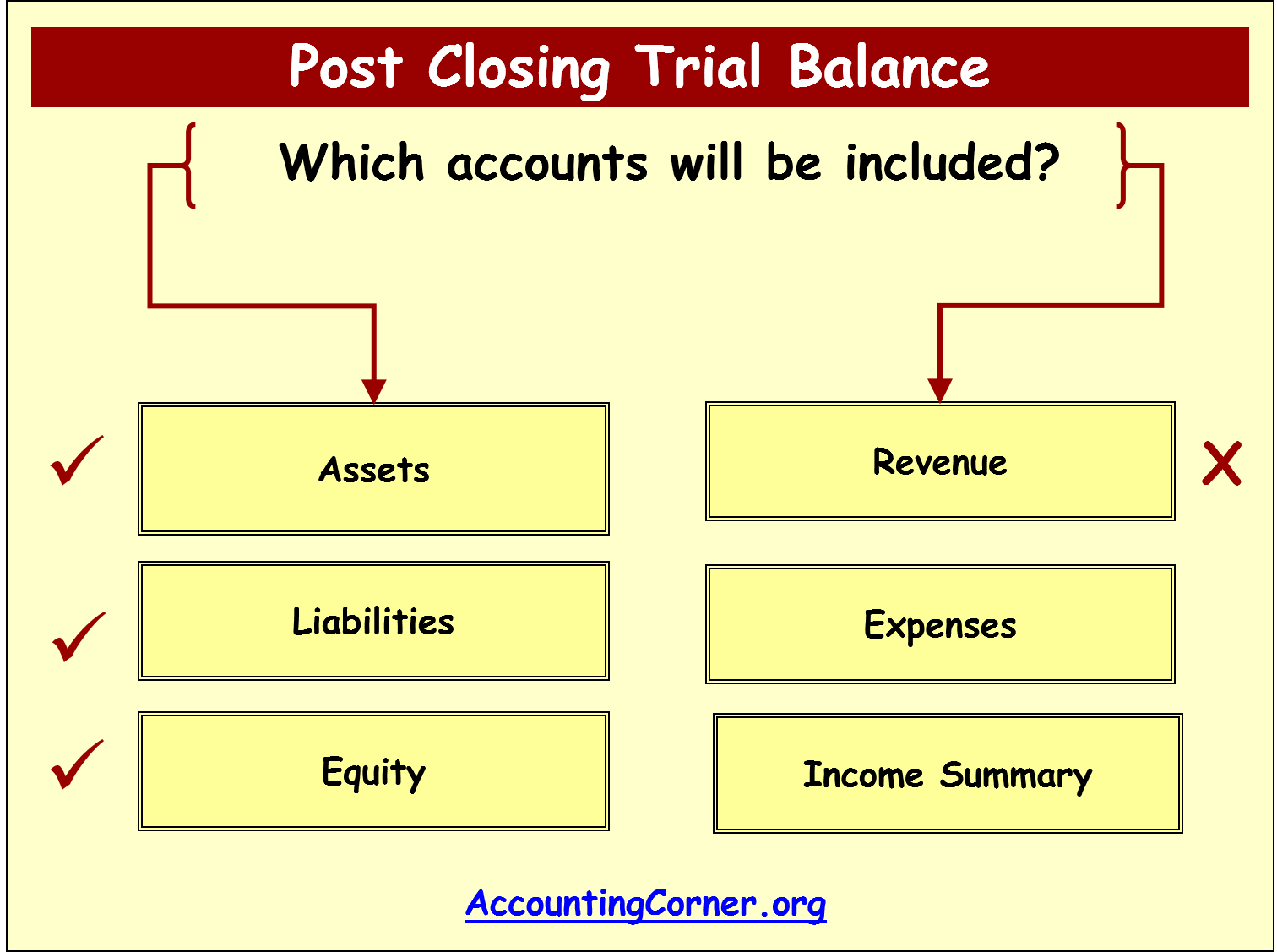

A trial balance is a summary of balances of all accounts recorded in the ledger. The accounts reflected on a trial balance are related to all major accounting items, including assets , liabilities, equity, revenues, expenses ,. In trial balance, all the ledger balances are posted either on the debit side or credit side of the statement.

The trial balance trial balance trial balance is the report of accounting in which ending balances of a different general ledger are presented into the debit/credit column as per their balances where debit amounts are listed on the debit column, and credit amounts are listed on the credit column. This is done to determine that debits equal credits in the recording process the trial balance is the first step toward recording and interesting your financial results. In order to prepare a trial balance, we first need to complete or ‘balance off ’ the ledger accounts.

Moreover, pay attention to account names and codes to ensure consistency. A trial balance is an accounting report used by business accountants during the accounting close process to ensure that all general ledger accounts have equal debit and credit totals, meaning the gl accounts are in balance, as required in. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

The debits and the credits are then totaled to verify their balance. The balances are usually listed to achieve equal. Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available;

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other. A trial balance is a financial accounting document that lists the balances of all the general ledger accounts of a company at a specific point in time. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

Elon musk's private jet on a runway in beijing last year. Trial balance definition. In a matter of weeks, however, mr musk reversed course, banned the account and threatened to sue, claiming that @elonjet resulted in a.