Inspirating Tips About 26as Tds Certificate

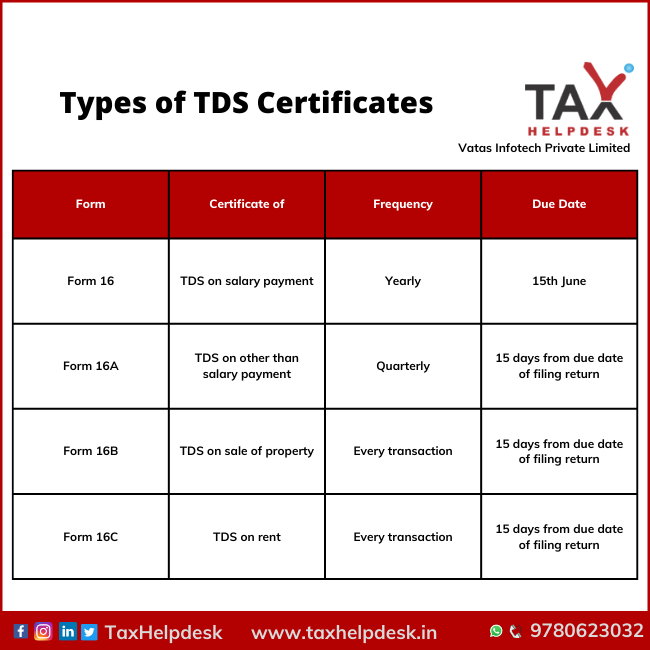

Form 16a is issued by the deductor(payer) to the.

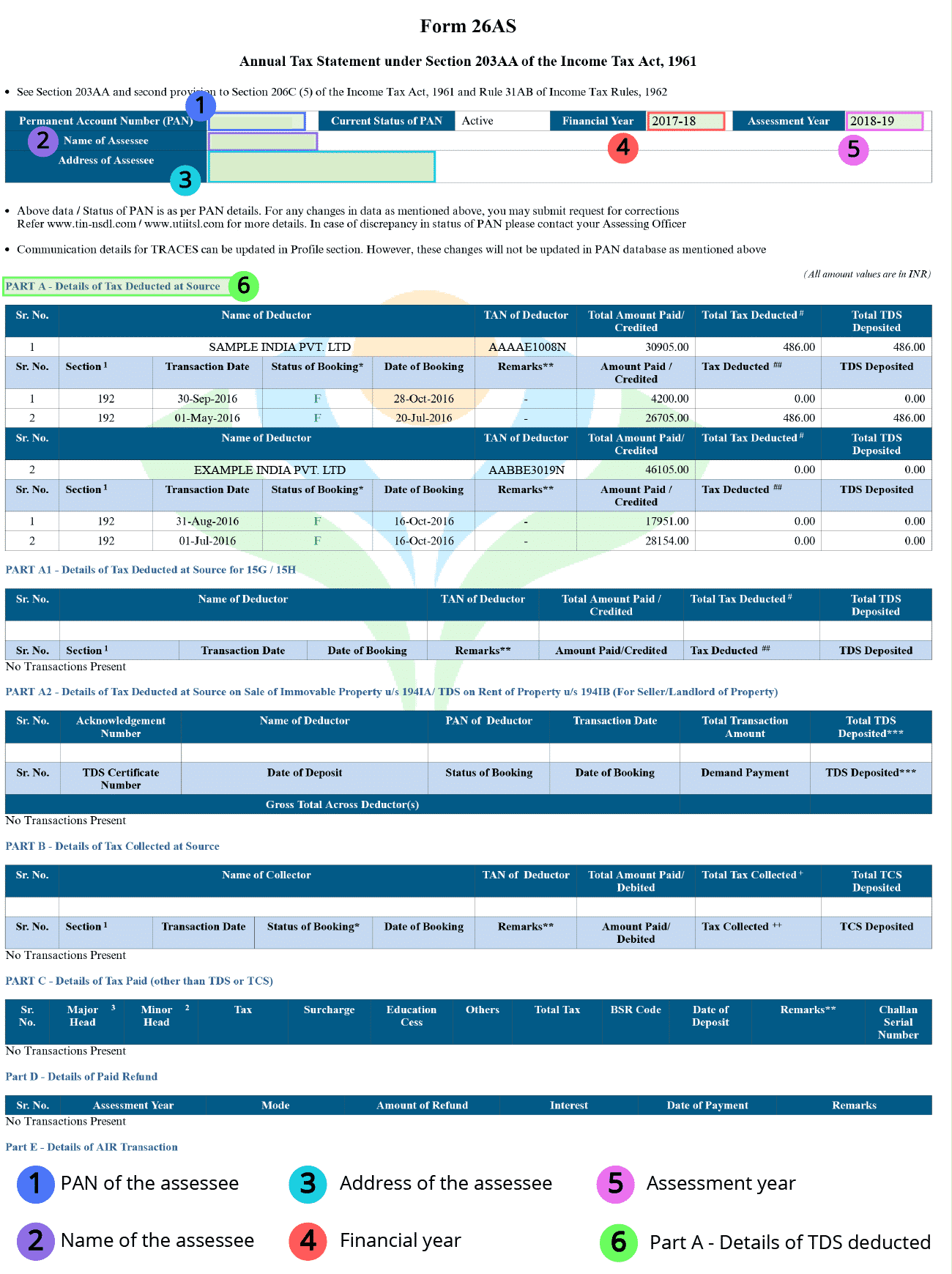

26as tds certificate. It helps to check the accuracy of the tds certificate and confirm that the tax deducted from your. Form 26as, often known as the tax credit statement, is a crucial record for filing taxes. Click ‘view tax credit (form 26as)’ select the ‘assessment year’ and ‘view type’ (html, text or pdf).

How to verify your tds certificate with form 26as? Form 26as have be verified from the details of tds certificate, i.e. Click on the link at the bottom of the page that says 'view tax credit (form 26as)' to access your form 26as.

Enter the following details in their respective fields: Form 26as is a consolidated tax statement issued to the pan holders. The website provides access to the.

Form 16a is a certificate on tds income other than salary, like commission, interest, professional fees, rent. Information about the sources of taxes that each tax collector has collected. Form 26as means.

In case there is a mismatch it can be corrected with relevant. The days of manually filing it returns by downloading. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.

Choose the assessment year and the. You can compare form 26as with tds certificates issued to you and if the amount of tds deducted as per form 26as and as per tds certificates is the same. Taxes deducted from your income by all tax payers.

Taxpayers can easily view and download form 26as from the traces website. Download the latest 26as in excel form and edit the same so that each line item credit has a corresponding pan number and party name as per the. The following details are shown on form 26as:.