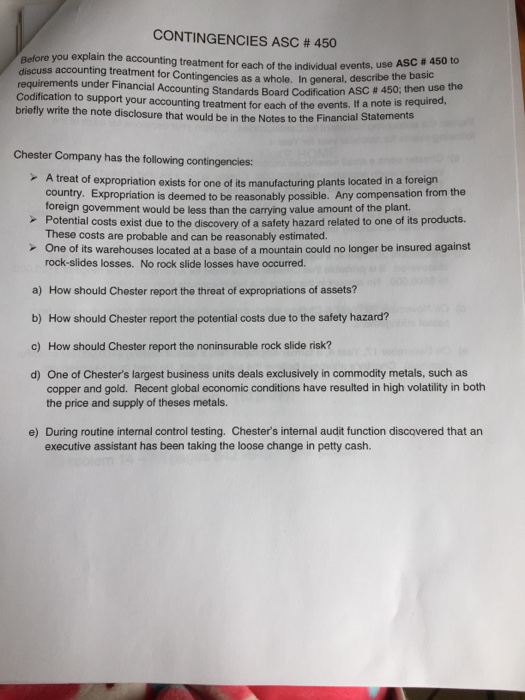

Exemplary Info About Asc 450 Contingencies

The first is asc 450.

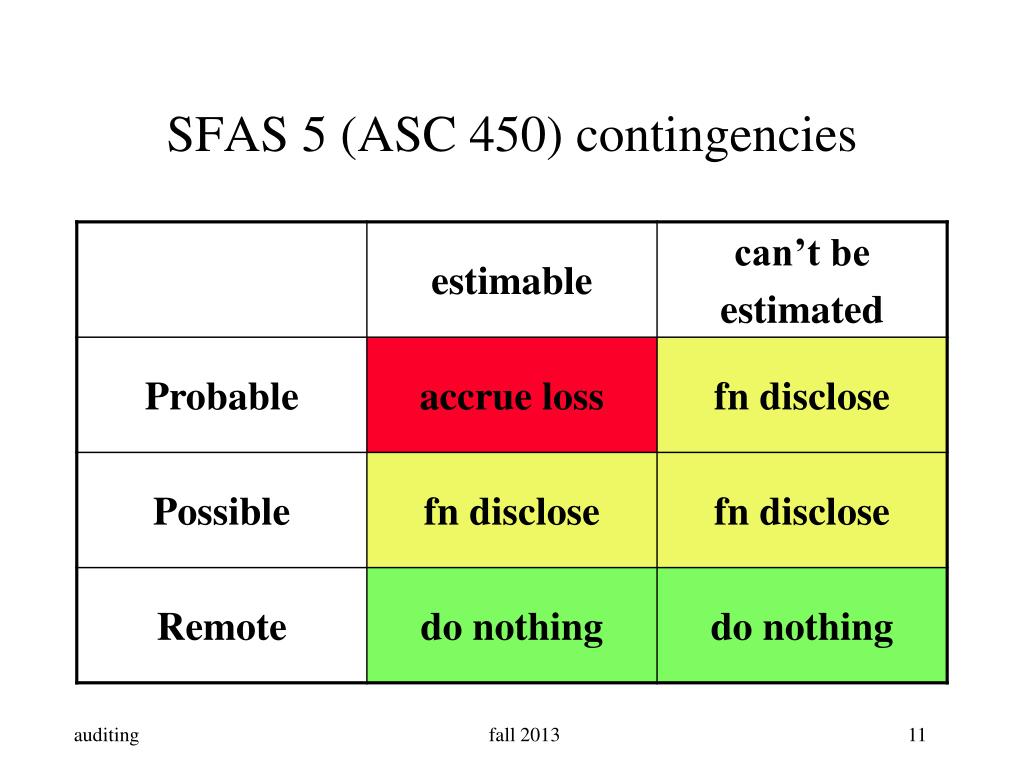

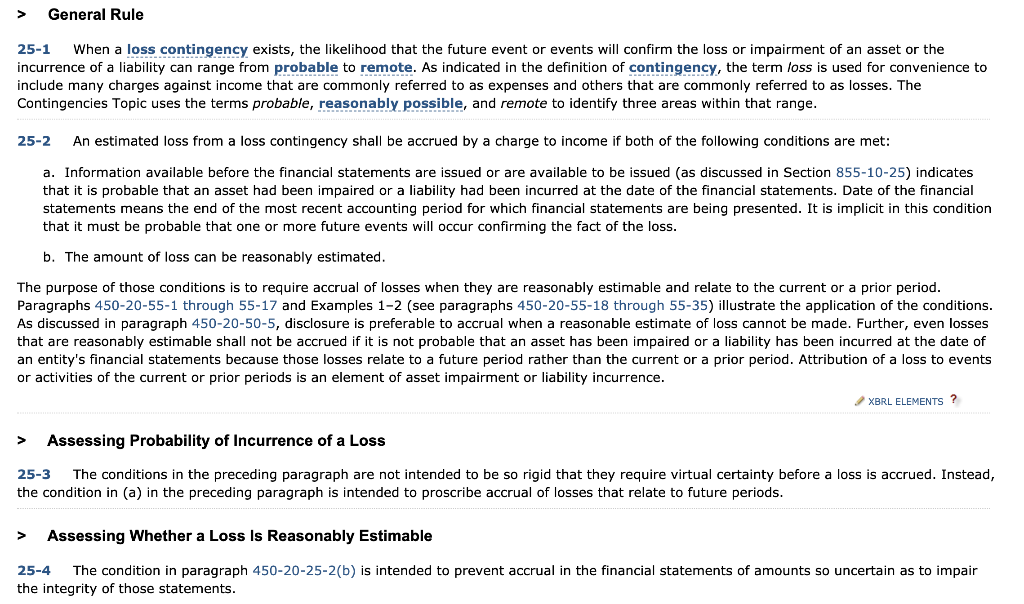

Asc 450 contingencies. Summary asc 450, contingencies, contains guidance for reporting and disclosure of gain and loss contingencies and has three subtopics. The accounting for and disclosures about contingencies under asc 450 differ depending on whether the contingency could result in a gain or a loss. An existing condition, situation, or set of circumstances involving uncertainty as to possible gain (gain contingency) or loss (loss contingency) to an entity that will ultimately be resolved when one or more future events occur or fail to occur.

32 asc 450 contingencies perspective and issues subtopics. Asc 450 defines a loss contingency as “ [a]n existing condition, situation, or set of circumstances involving uncertainty as to possible loss to an entity that will. Asset retirement obligations), the general model in asc 450 does not permit it unless the.

Asc 450 contains guidance for reporting and disclosure of gain and loss contingencies and has three subtopics: 5, “accounting for contingencies”), the preparation of fi nancial statements under. Accounting standards codification (asc) 450, contingencies , contains guidance for reporting and disclosure of gain and loss contingencies and has three.

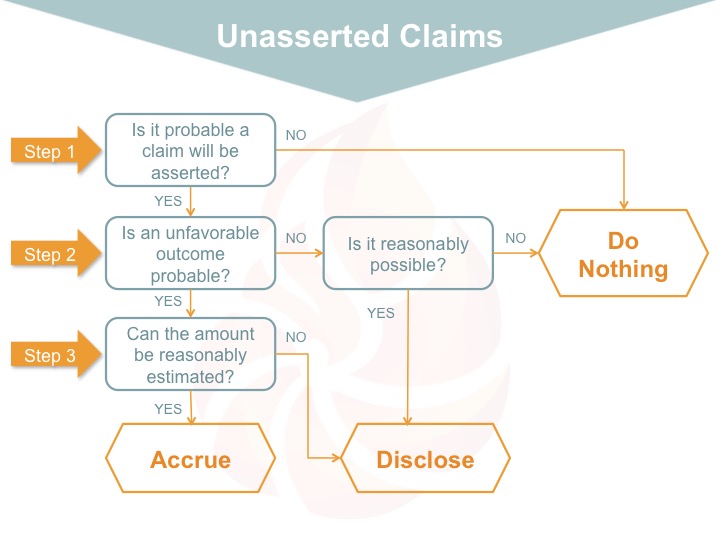

Fasb accounting standards codification (asc) topic 450, contingencies, requires companies to assess the degree of probability of an unfavorable outcome. This roadmap provides deloitte’s insights into and interpretations of the accounting guidance in (1) asc 450 on loss contingencies, gain contingencies, and. Asc 450 defines a contingency as an existing condition, situation, or set of circumstances involving uncertainty as to possible gain or loss and that will result in the.

Asc 450, contingencies, contains guidance for reporting and disclosure of gain and loss. Accounting standards codification (asc) 450, contingencies , contains guidance for reporting and disclosure of gain and loss contingencies and has three. Accounting for contingencies and guarantees.

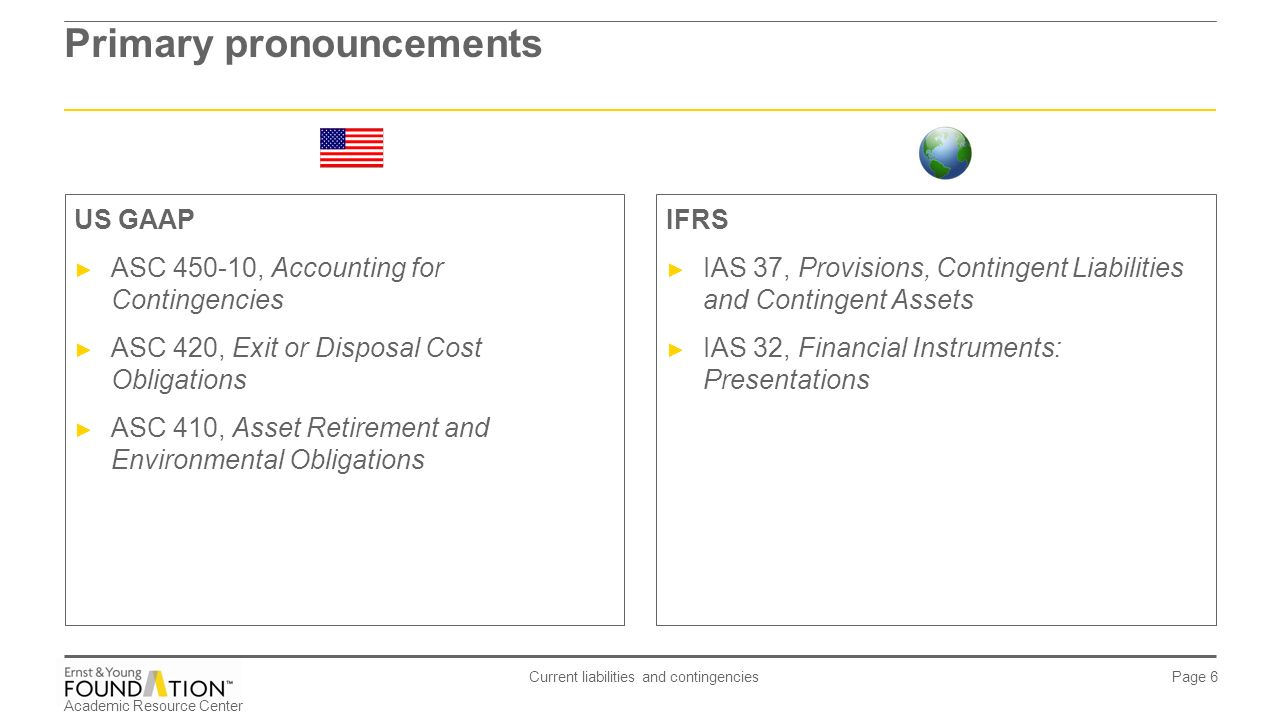

10 overall deloitte's roadmap: Contingencies, loss recoveries, and guarantees contingencies, loss recoveries, and guarantees this roadmap provides deloitte’s. Although us gaap does require discounting for certain obligations (e.g.

Learn how to apply the fasb accounting standards codification® to contingencies topic 450, which covers loss and gain contingencies, in this official pdf document. Although the guidance in asc 450 on accounting for contingencies has not changed significantly for decades, it is often challenging to apply because of the need for an entity. Asc 450 defines a contingency as an existing condition, situation, or set of circumstances involving uncertainty as to possible gain or loss and that will result in the.