Awesome Info About Tax Liability In Balance Sheet

It is assumed that assets will be realized, and.

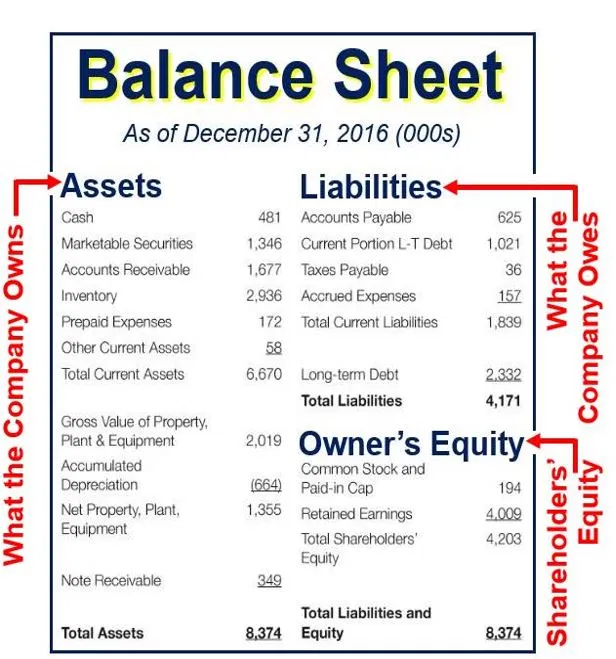

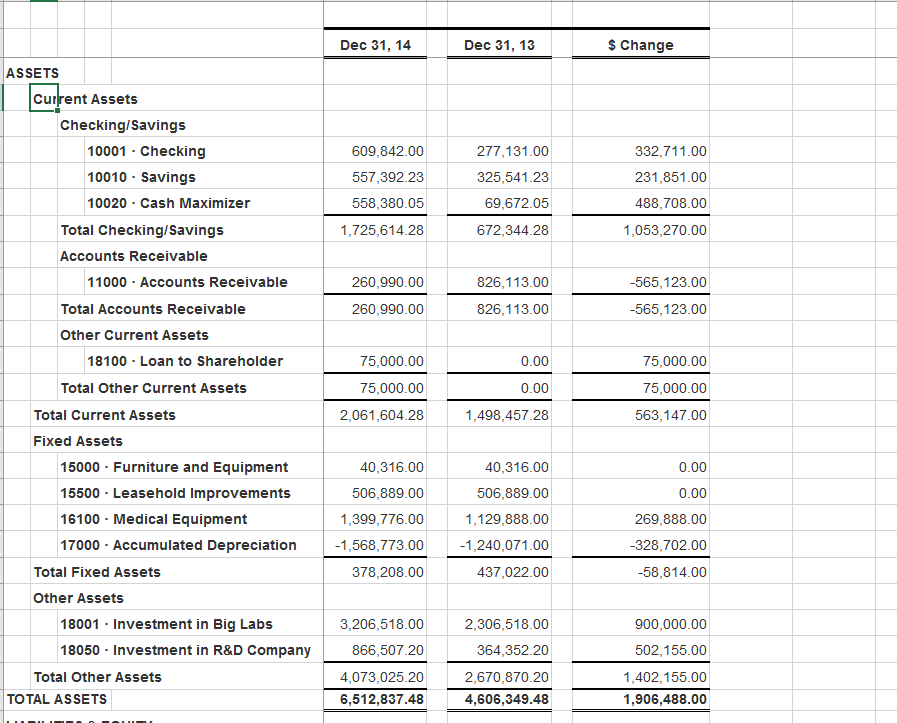

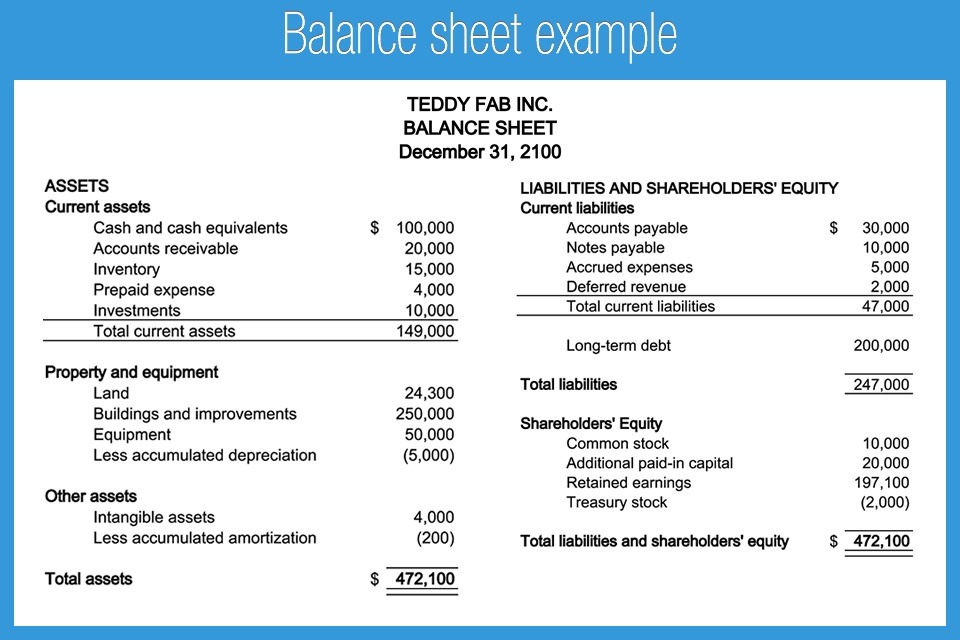

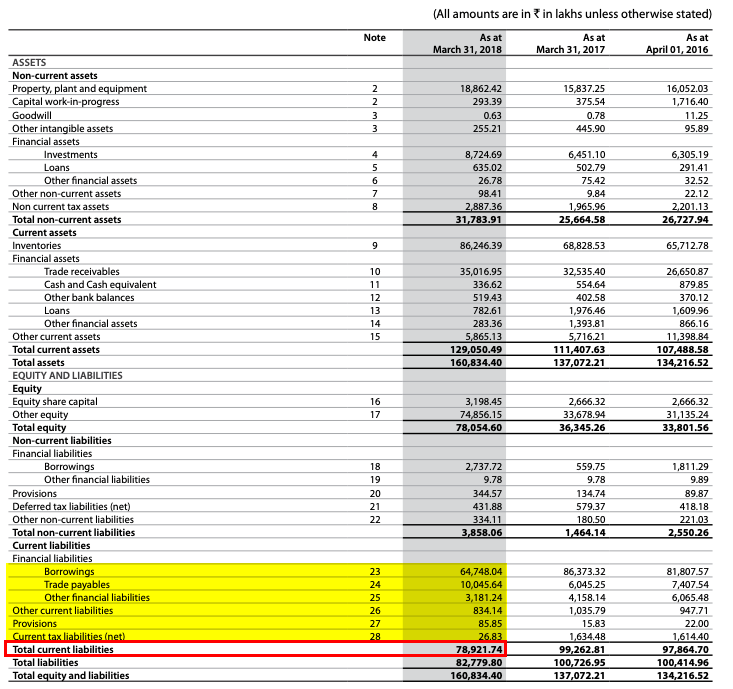

Tax liability in balance sheet. A balance sheet provides a snapshot of a company’s financial performance at a given point in time. It can also be referred to as a statement of net worth. Income taxes payable (a current liability on the balance sheet) for the amount of income taxes owed to the various governments as of the date of the balance sheet if a.

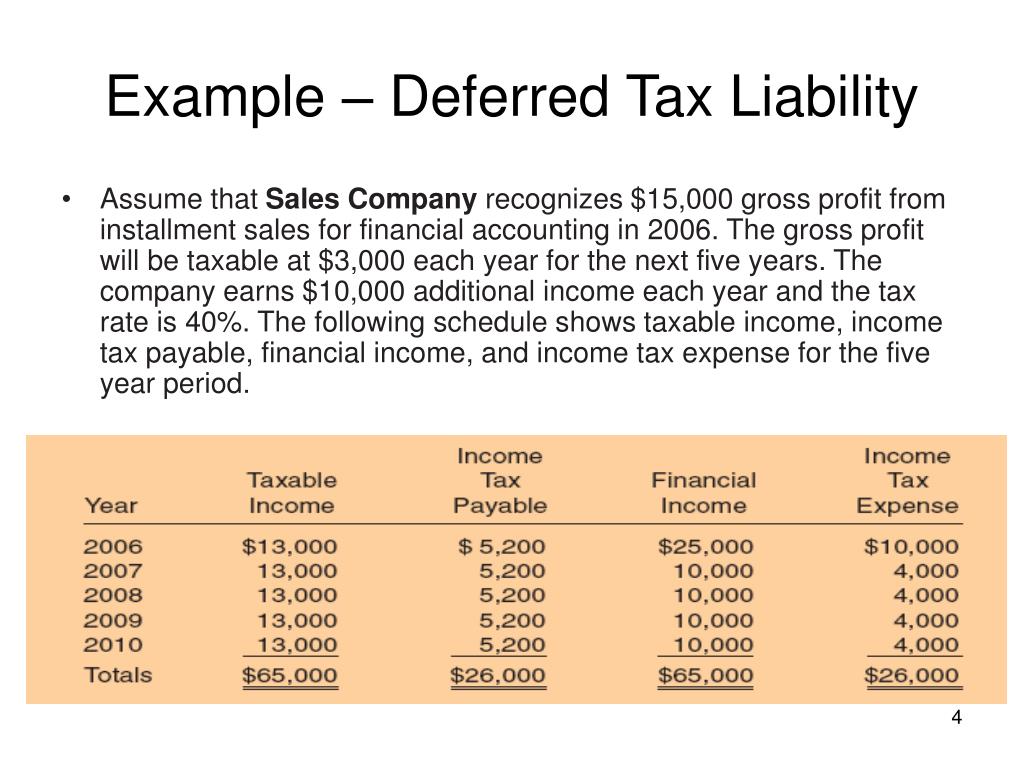

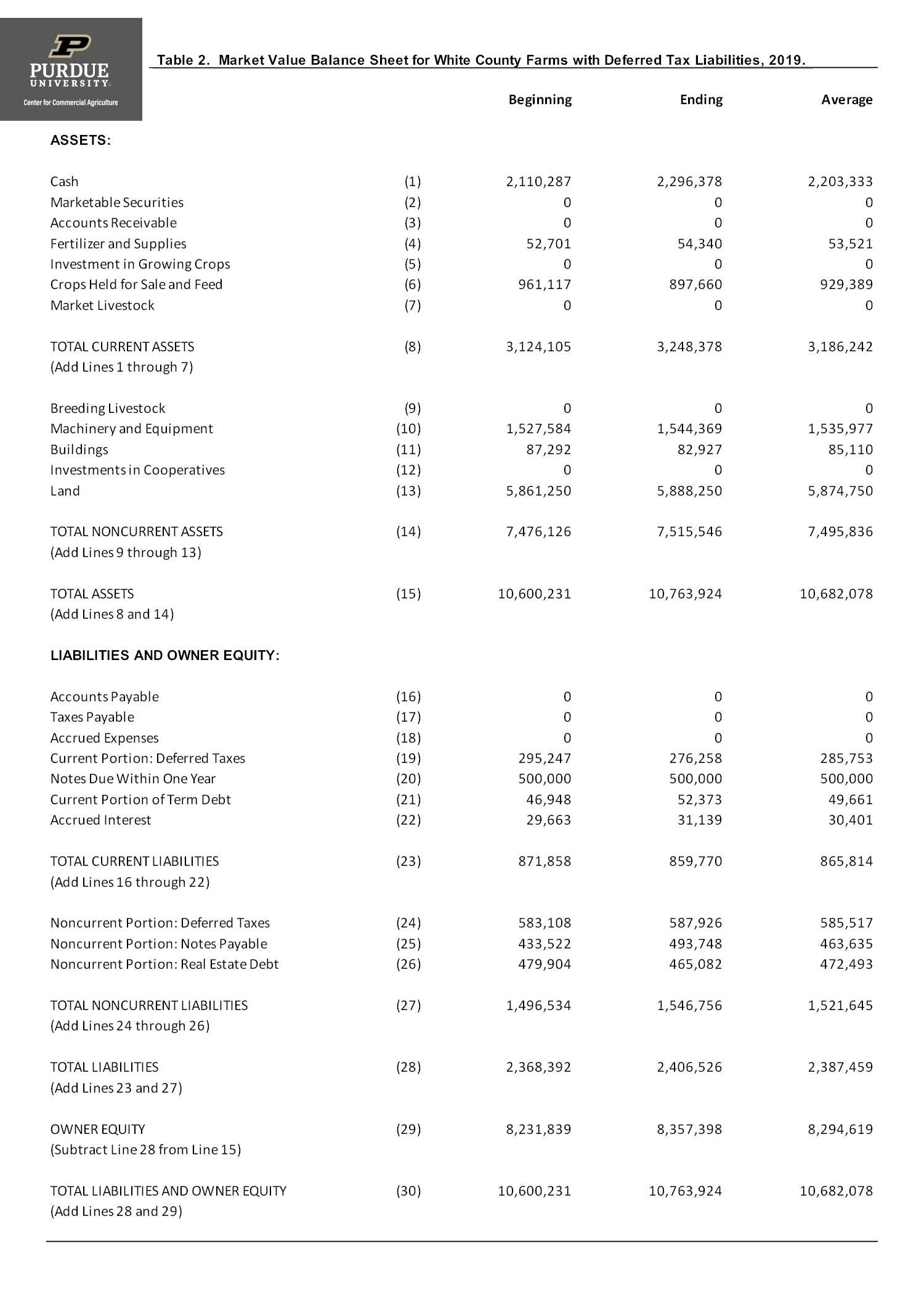

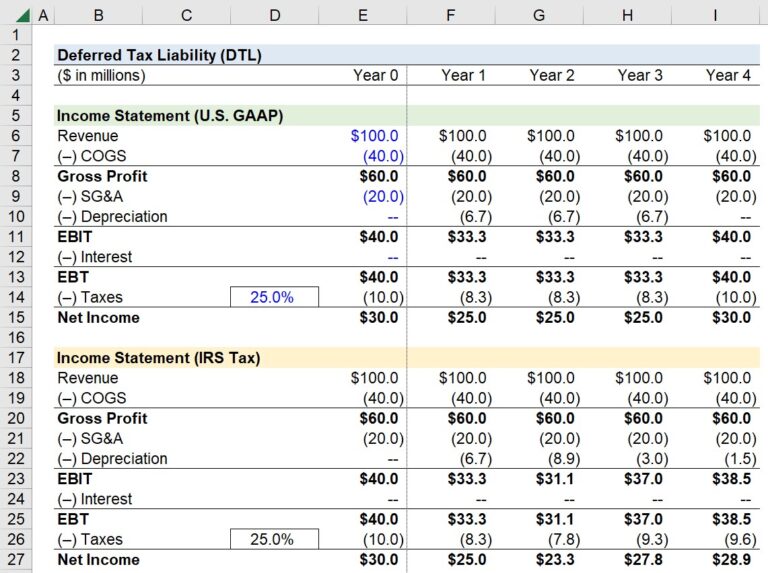

Going off the prior depreciation example, the deferred tax liability (dtl) recorded on the. What is a balance sheet? Accordingly, in a single balance.

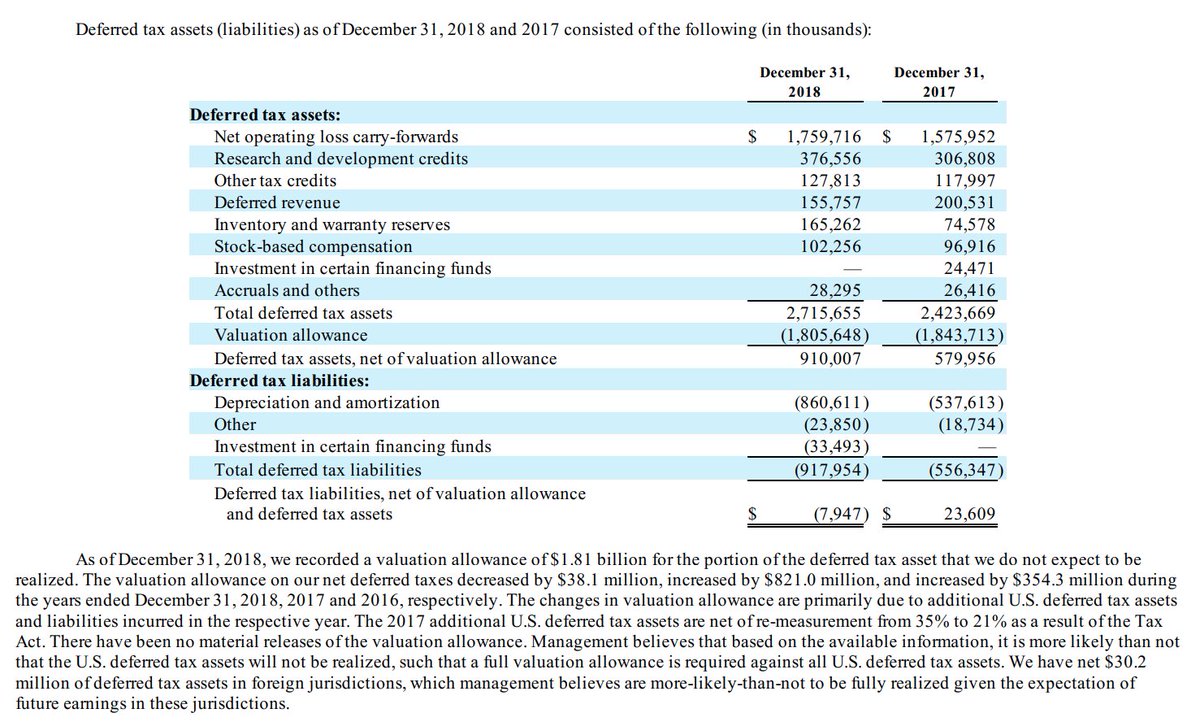

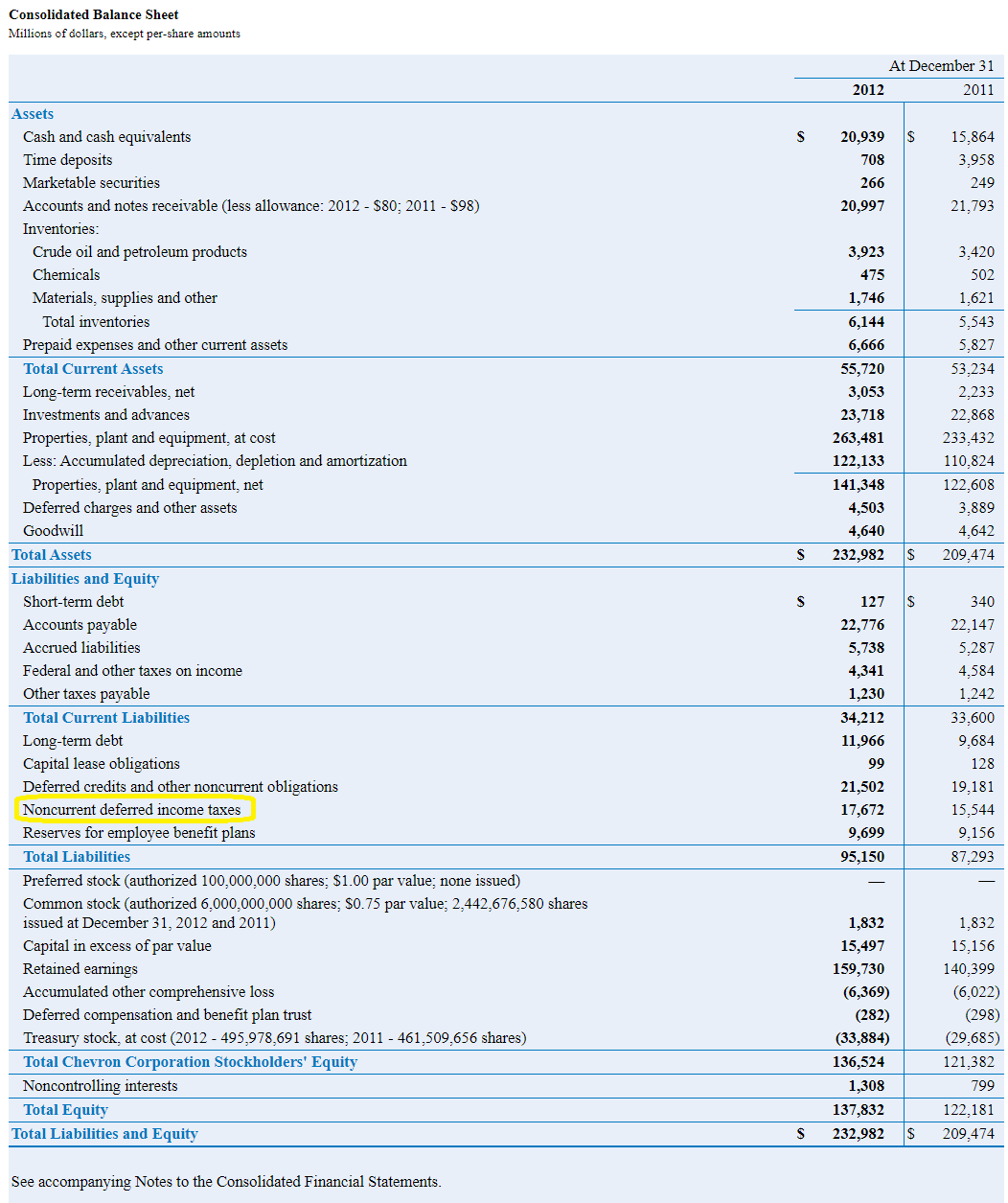

Reporting entities are required to disclose total deferred tax assets and total deferred tax liabilities for each. 16.3.1 tax effect of temporary differences giving rise to dtas/dtls. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

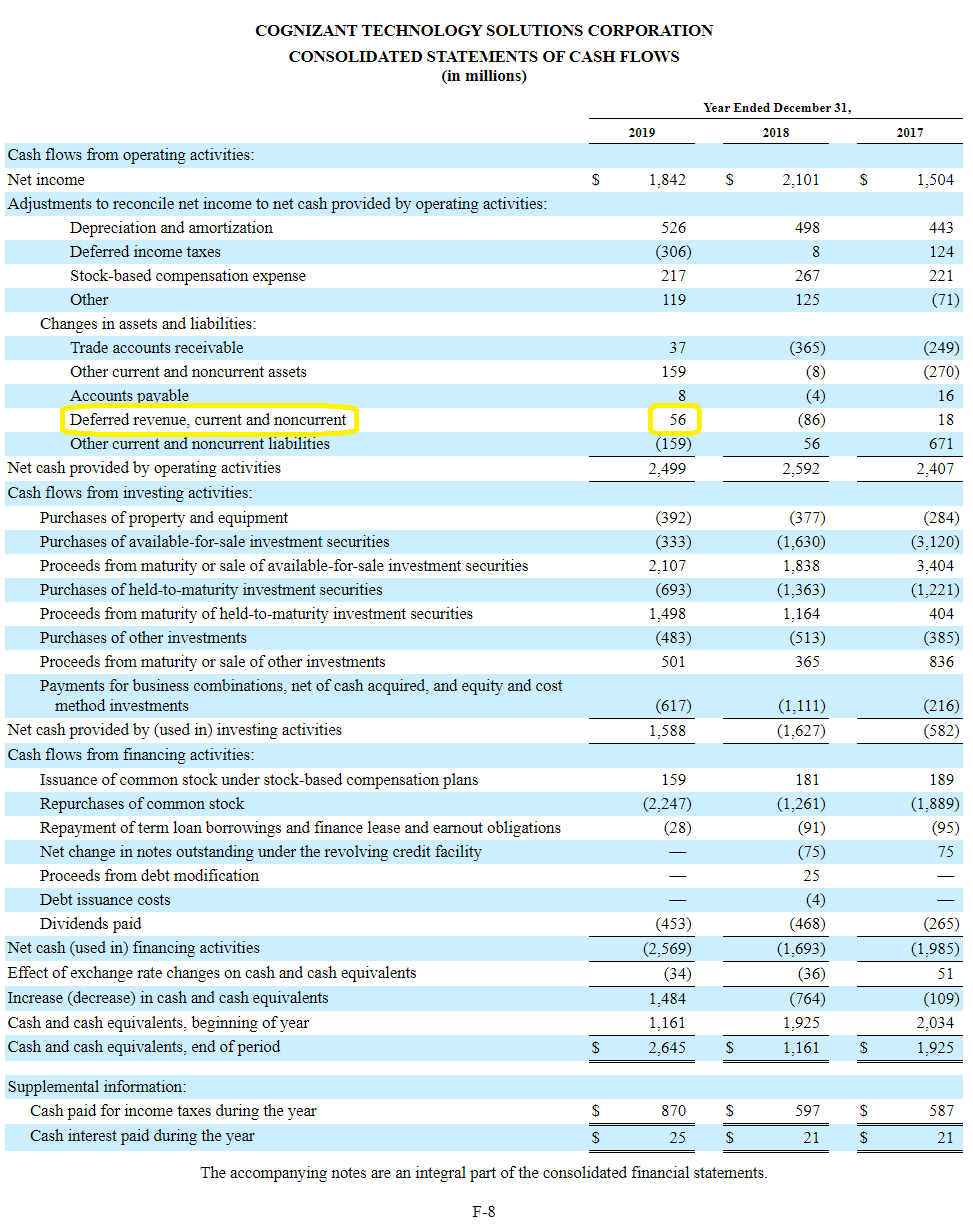

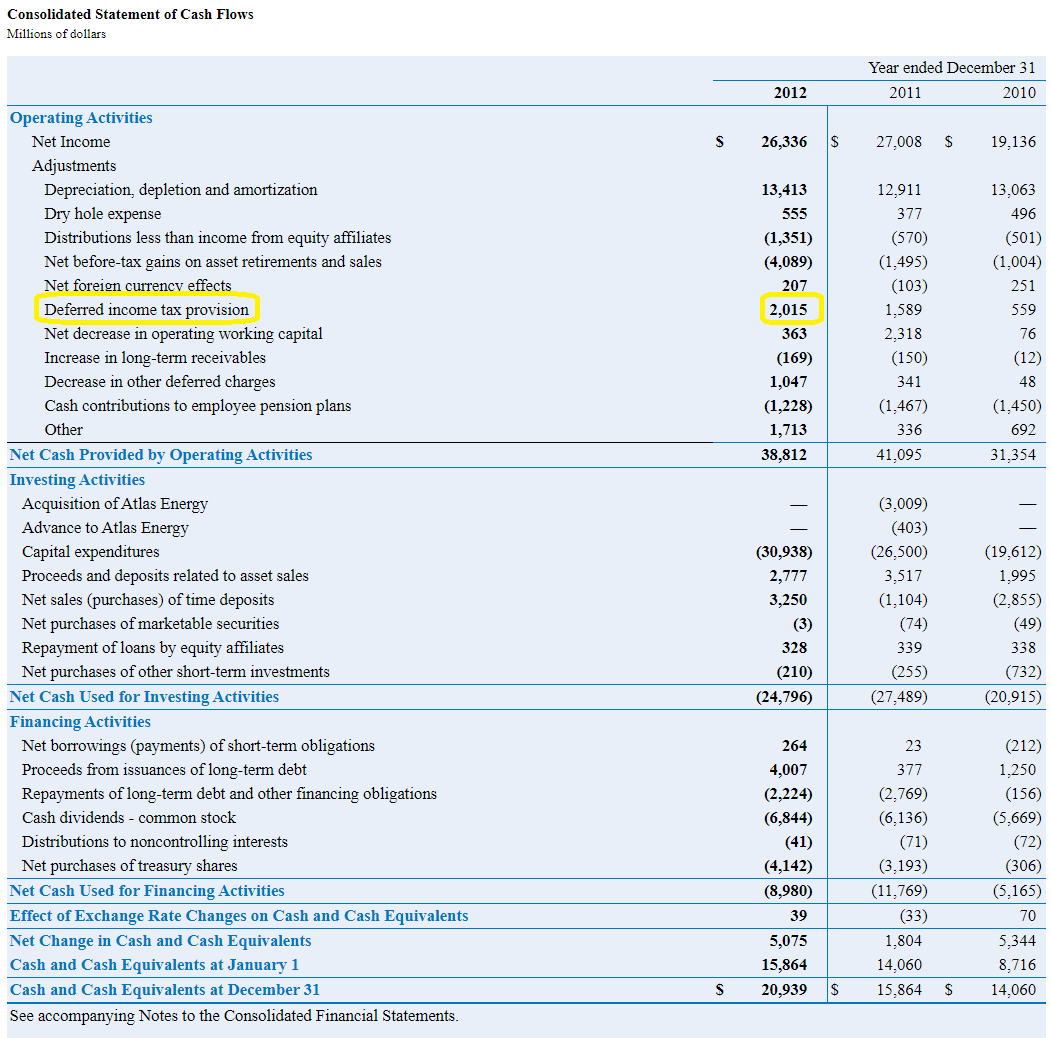

It is the opposite of a deferred tax liability,. The balance sheet, the income statement, and the cash flow. Updated may 27, 2021 reviewed by charlene rhinehart taxes appear in some form in all three of the major financial statements:

How to pass gst receivable journal entry in the books of accounts. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a company. This financial statement is used.

Tax bases the tax base of an item is crucial in determining the amount of any temporary difference, and effectively represents the amount at which the asset or. Liability is an obligation between one party and another not yet completed or paid for in full. A decrease in the tax rate will decrease a firm’s dta and income tax expense.

The watch manufacturer recognises the $120 liability on its balance sheet and an. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. This asset and liability method, required by asc 740, measures the deferred tax liability or asset that is implicit in the balance sheet;

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. As fixed assets age, they begin to lose their value. A deferred tax often represents the mathematical difference between the book carrying value (i.e., an amount recorded in the accounting balance sheet for an asset or liability).

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)