Nice Tips About Balance Sheet Not

It’s a good idea to ask your bookkeeper or accountant for help before you continue.

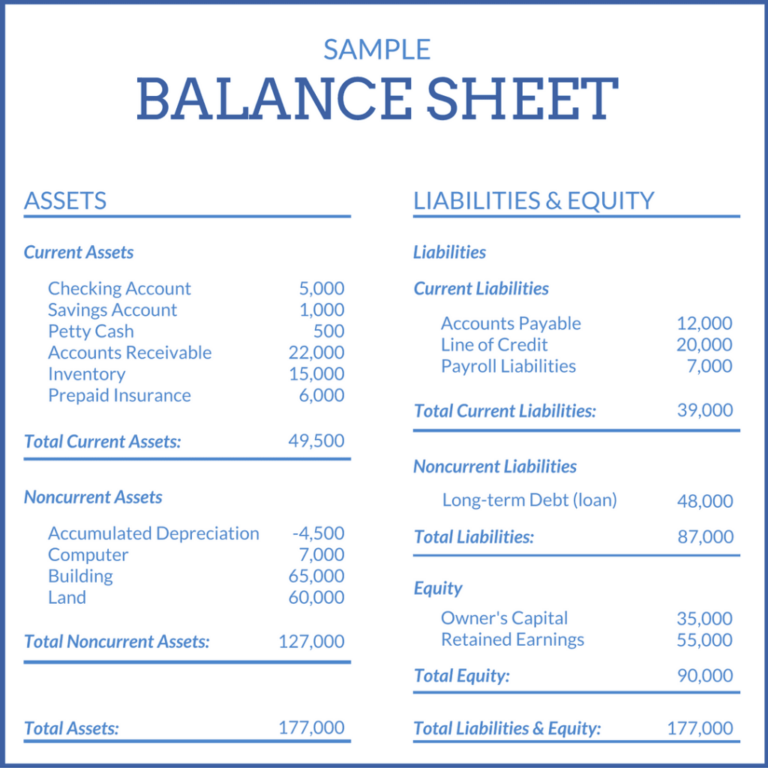

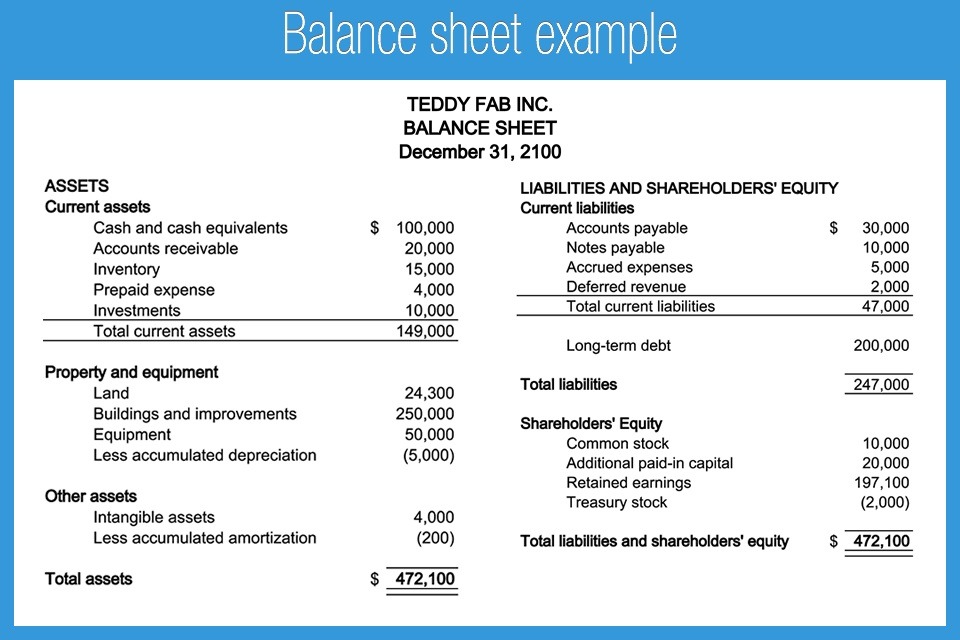

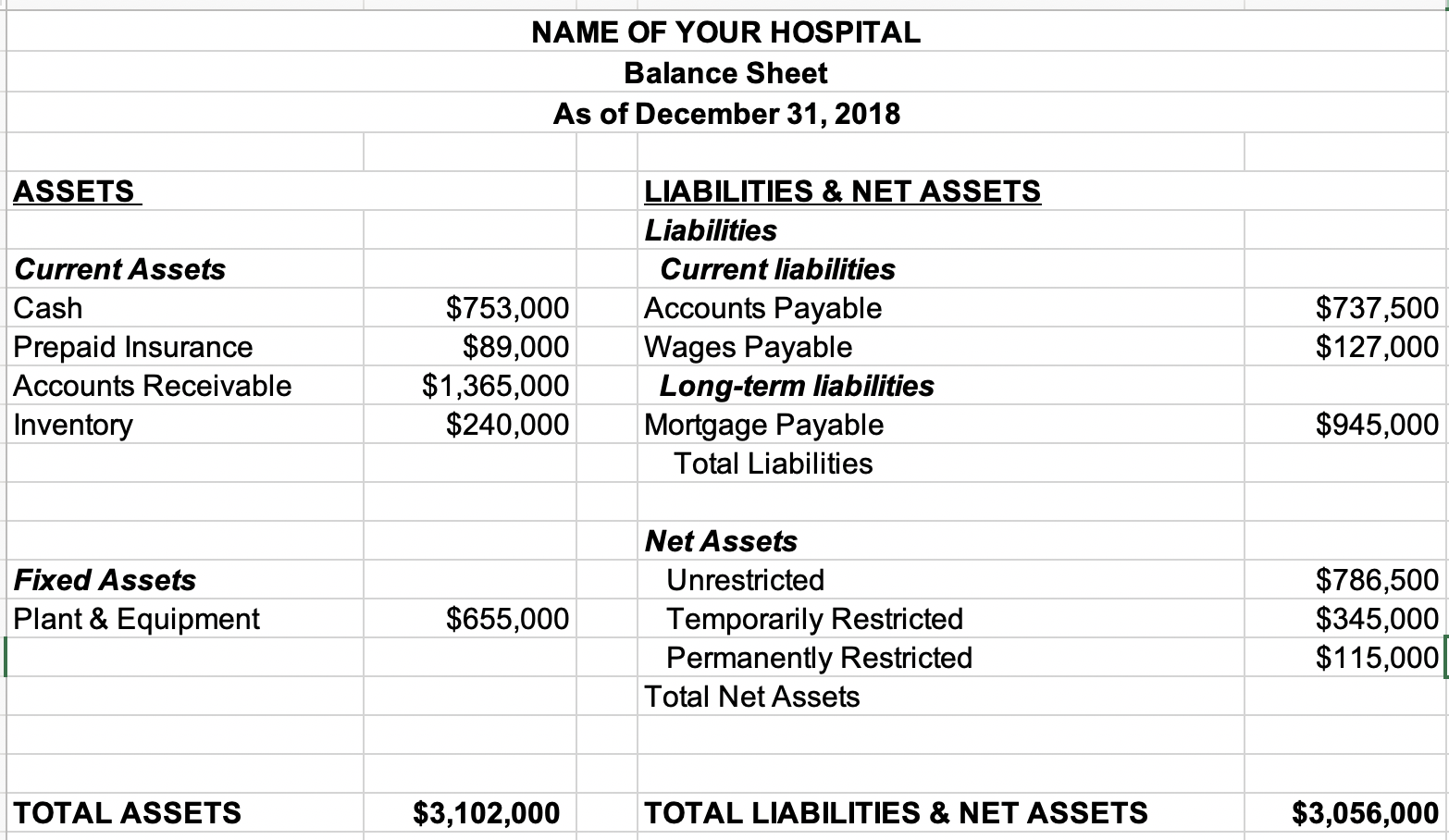

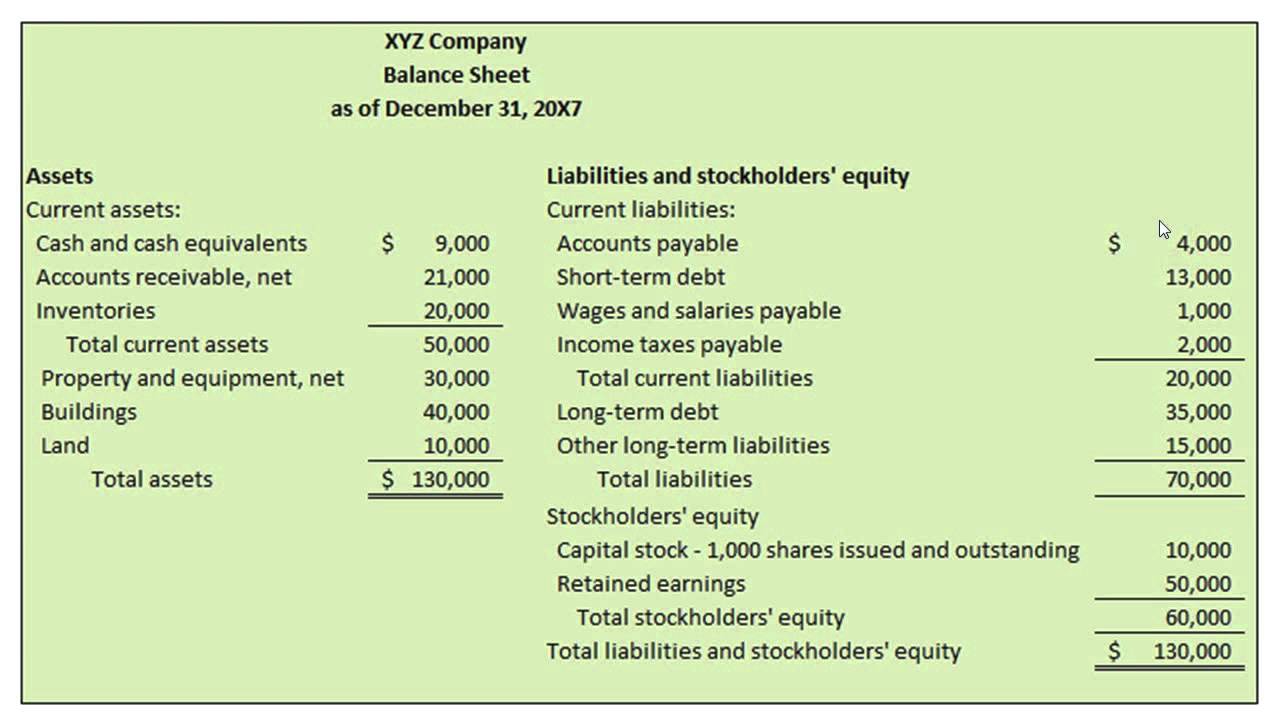

Balance sheet not balance. Succursale française, 28 avenue victor hugo, 75116, paris. Assets go on one side, liabilities plus equity go on the other. At the end of your prediction, there may be fewer active items, such as debt facilities, because we need to pinpoint the part of your balance sheet where it isn’t balancing.

With assets listed on the left side and liabilities and equity detailed on the right. If you don’t have one, we can help you since you might have to edit transactions to fix this problem, you should step 1: Keep this formula in mind for your balance sheet:

Consistent with the equation, the total dollar amount is always the same for each side. The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. As fixed assets age, they begin to lose their value.

Fed minutes suggest officials are seeking smallest balance sheet possible. This means that the balance sheet should always balance, hence the name. This made the older, lower.

A balance sheet is balanced because the total assets of a company equal their liabilities plus owners' equity. Making the correct balance sheet check may seem obvious however, there are a few things we must ensure: The european central bank’s (ecb’s) audited financial statements for 2023 show a loss of €1,266 million (2022:

The name balance sheet is based on the fact that assets will equal. Wire the balance sheet so that it always balances by making retained earnings equal to total assets less total liabilities less all other equity accounts. Balance sheet reports can be tricky.

You pay for your company’s assets by either borrowing money (i.e. Typically, errors are due to incomplete or missing data, incorrectly entered transactions, errors in currency exchange rates or inventory levels, miscalculations of equity, or miscalculated depreciation or amortization. +33 1 44 29 91 38.

But what do they actually mean and include? So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Increasing your liabilities) or getting money from the owners (equity).

You’ve probably heard at least some of these terms before. Based on provisional unaudited data. A balance sheet must always balance;

A balance sheet is out of balance when the sum of your company assets, liabilities and shareholder's equity does not balance to zero. 1) find the net difference of net assets and equity. Assets have declined by about $1.3 trillion since june 2022.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)