Casual Tips About Trial Balance Explanation

Investment in equity securities $55,000.

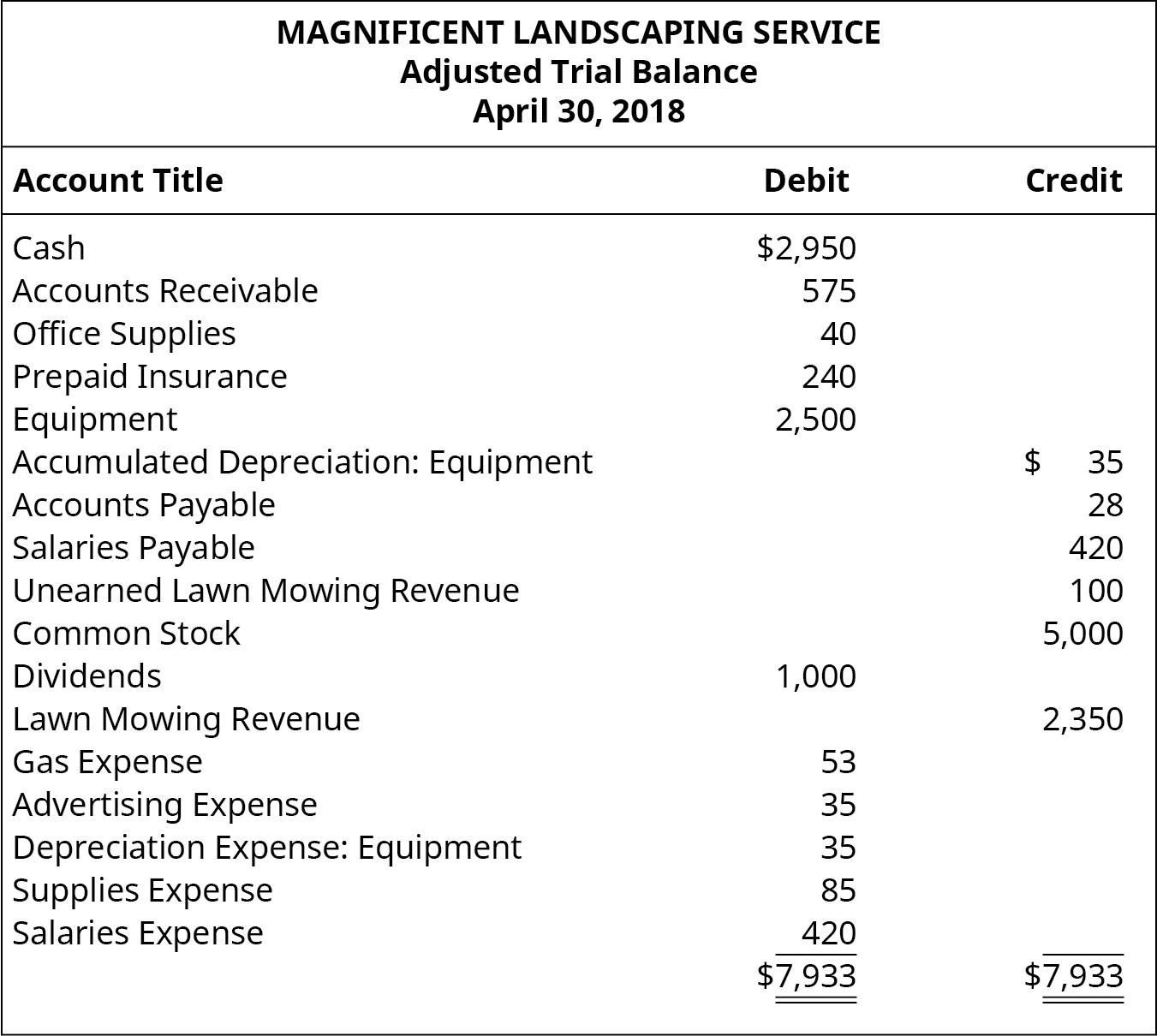

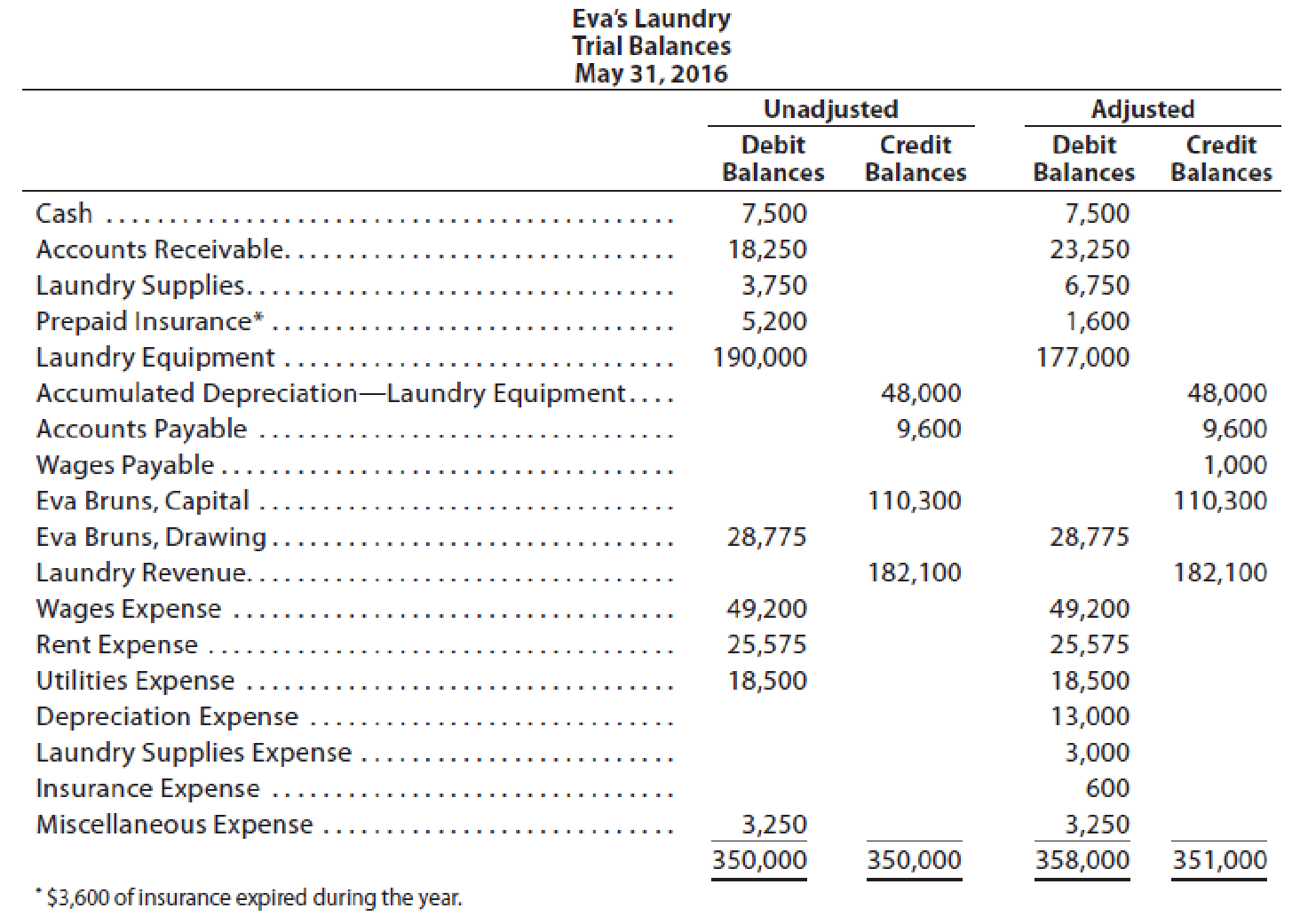

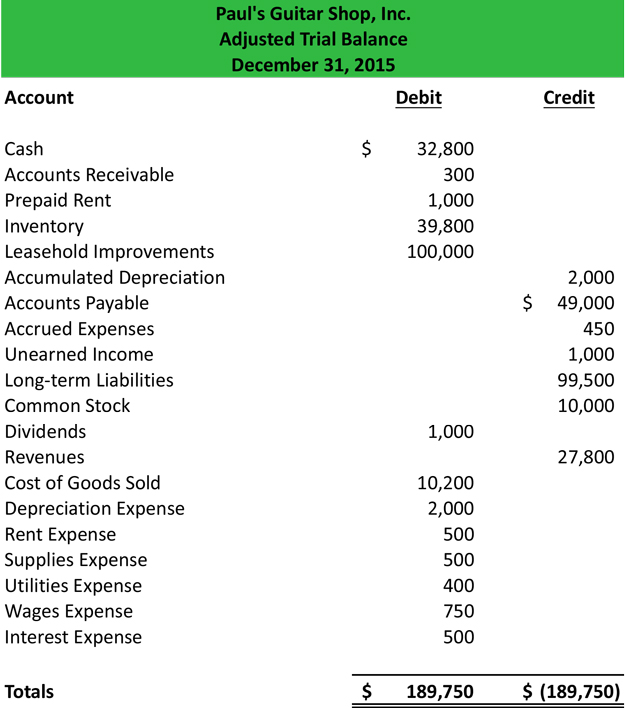

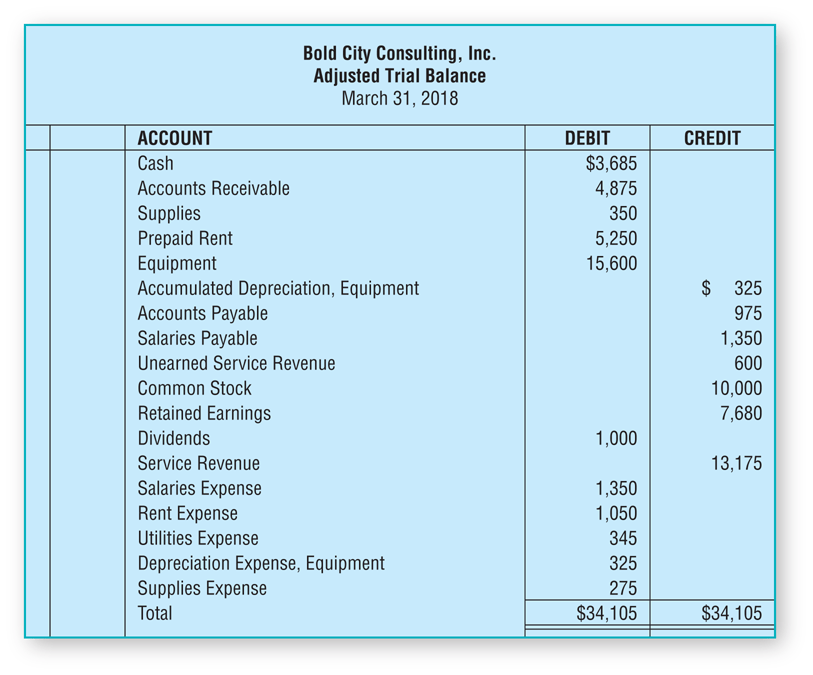

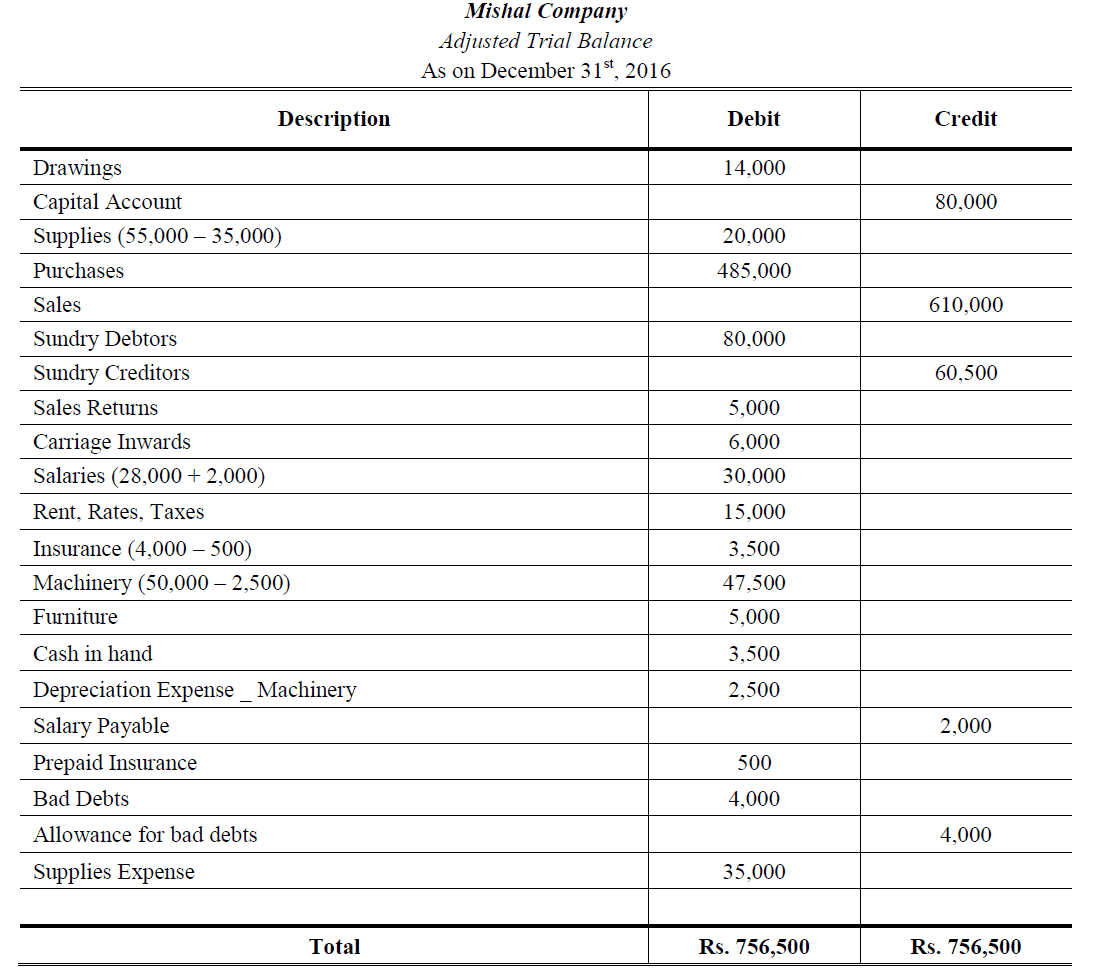

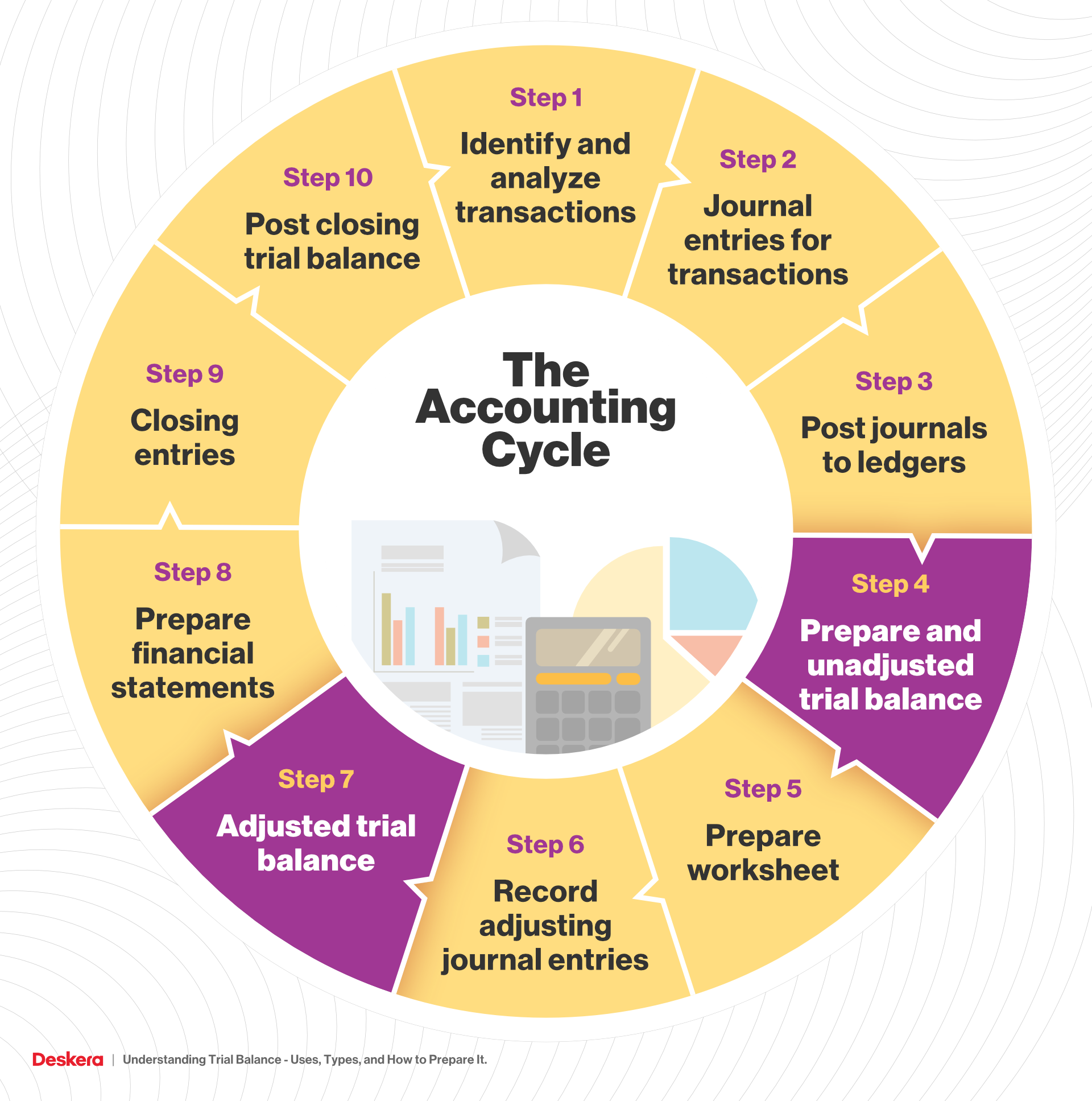

Trial balance explanation. It is the third (and last) trial balance prepared in the accounting cycle. In this lesson, we will discuss what an adjusted trial balance is and illustrate how it works. This statement comprises two columns:

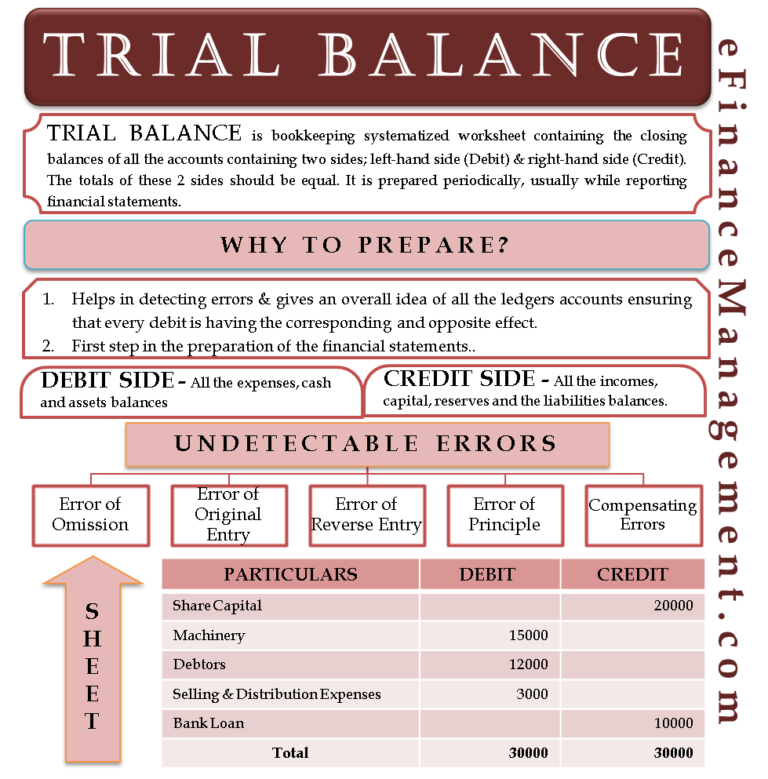

Trial balance has a tabular format that shows details of all ledger balances in one place. As the name suggests, it is an actual “trial” of the debit and credit balances, they should be equal. It’s primarily used to verify that the total of all debits equals the total of all credits, which means the company’s accounts are balanced.

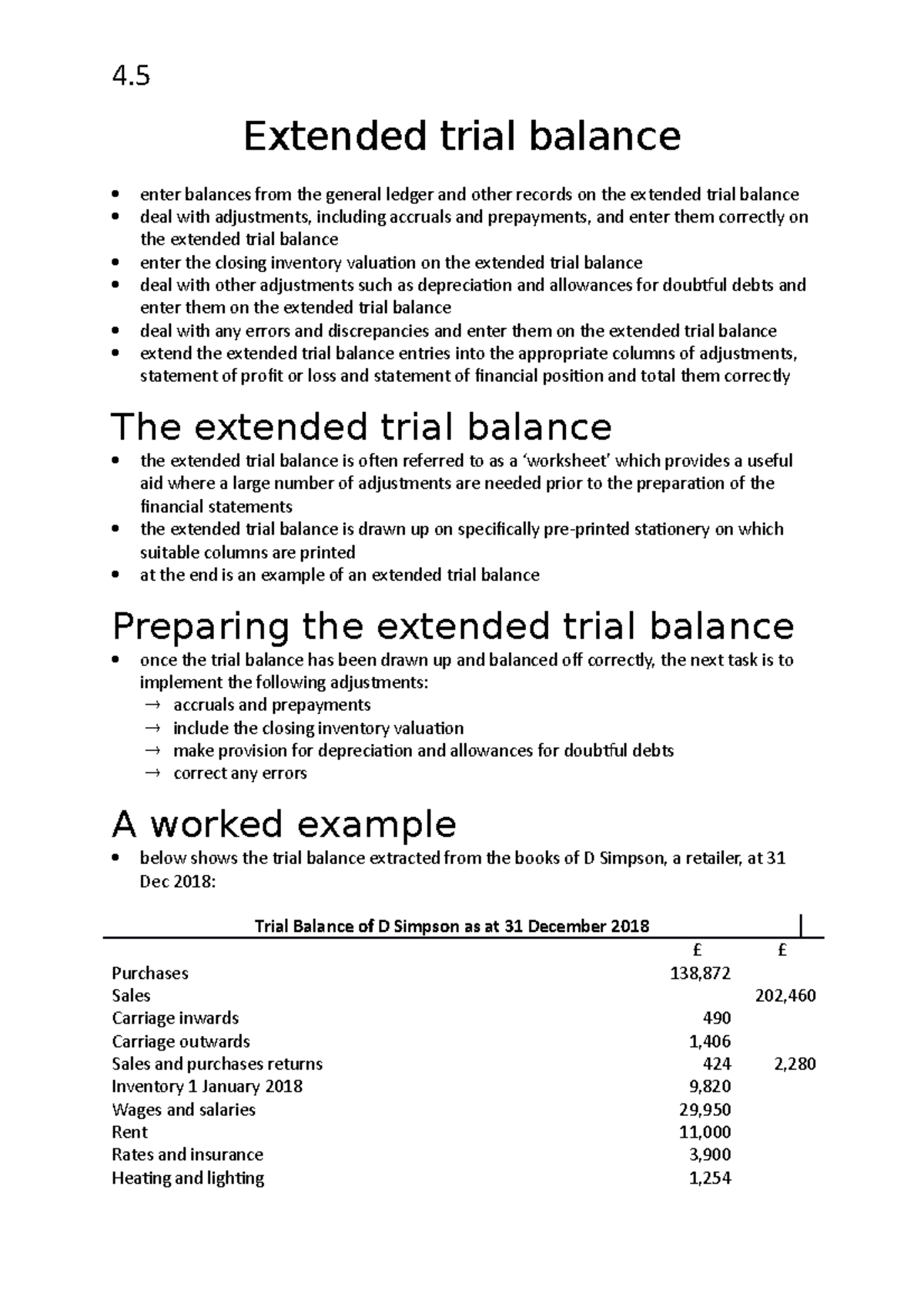

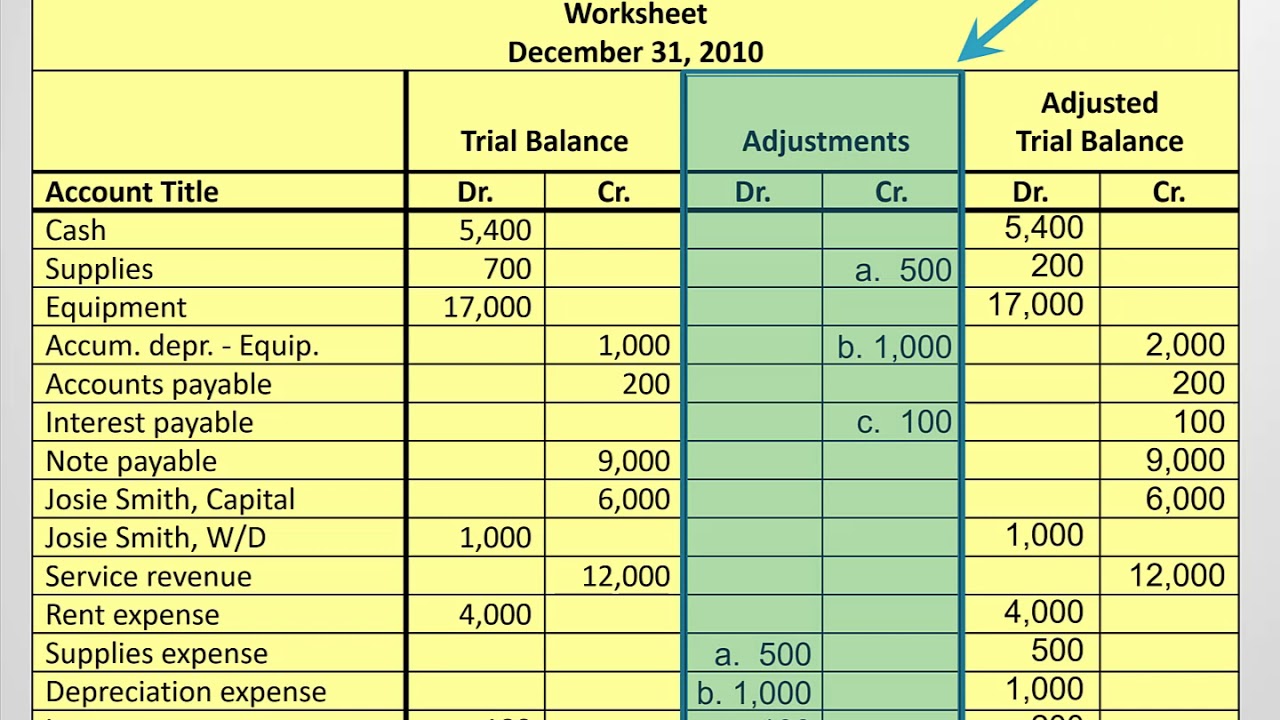

Trial balance may be defined as an informal accounting schedule or statement that lists the ledger account balances at a point in time compares the total of debit balance with the total of credit balance. Preparing an adjusted trial balance is the fifth step in the accounting cycle and is the last step before financial statements can be produced. It includes transactions done during the year and the opening and closing balances of ledgers, as every entity needs to evaluate its financial position over a particular period.

For example, utility expenses during a period include the payments of four different bills amounting to $ 1,000, $ 3,000, $ 2,500, and $ 1,500, so in the trial balance, single utility expenses account will be shown wi. Purpose of a trial balance trial balance acts as the first step in the preparation of financial statements. In a nutshell, a trial balance is an informal accounting statement, prepared with the help of ledger account balances.

Adjusted trial balance. The total balances of all accounts are calculated. Checked for updates, april 2022.

The balances from the ledger were wrongly entered in the trial balance. There are three main types of trial balance: It is a working paper that accountants.

It is a statement of debit and credit balances that are extracted on a specific date. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

If totals are not equal, it means that an error was made in the recording and/or posting process and should be investigated. A trial balance is a bookkeeping tool that consolidates all the ledger accounts of a business into one report, showing the debits and credits made to each account. The name of each account is recorded, along with a serial number.

We will learn the meaning of trial balance, advantages, methods and to understand it in much better ways we will solve one example with all methods of it. You count, measure, or weigh all tangible assets and list all tangible, fixed, current, and intangible assets as well as all debts. The trial balance is used to test the equality between total debits and total credits.

Trial balance ensures that for every debit entry recorded, a corresponding credit entry has been recorded in the books. Debit balances are written in the debit column, and credit balances are written in the credit column of the trial balance. An adjusted trial balance is prepared after adjusting entries are made and posted to the ledger.