Outstanding Tips About Income Tax Paid In Profit And Loss Account

July 9, 2023 at 3:14pm this blows my mind.

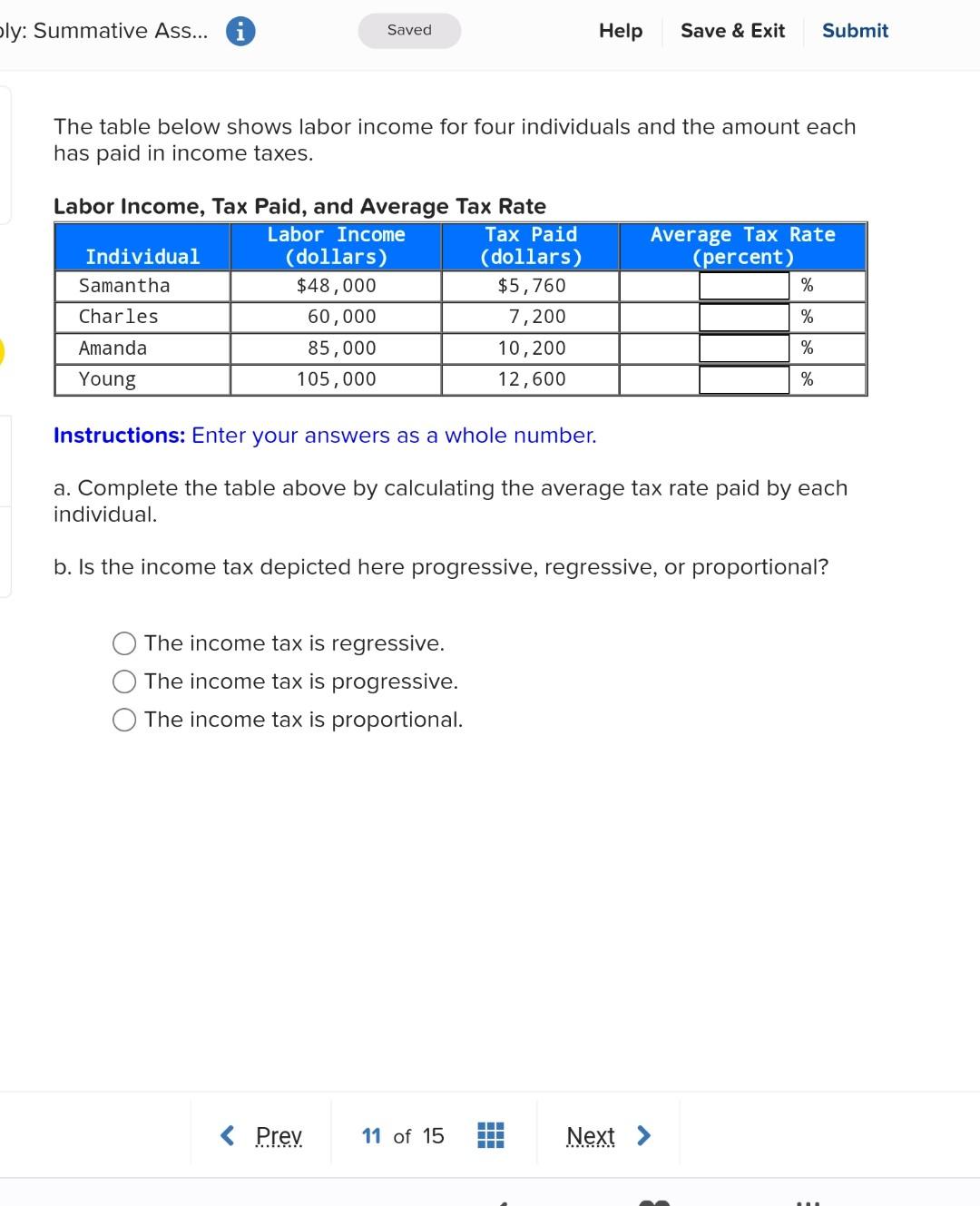

Income tax paid in profit and loss account. Income tax expense doesn't belong as a general expense on the p&l. These can wipe out gross profit and lead to a net loss (or negative net income). As a cpa and registered tax agent i can see this is an error and i've made sure i account for it properly when i lodge a return for a licnet.

The estimated corporation tax payable on the company’s profits or losses during the accounting period. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20. We'll share details about sales taxes inside quickbooks online (qbo).

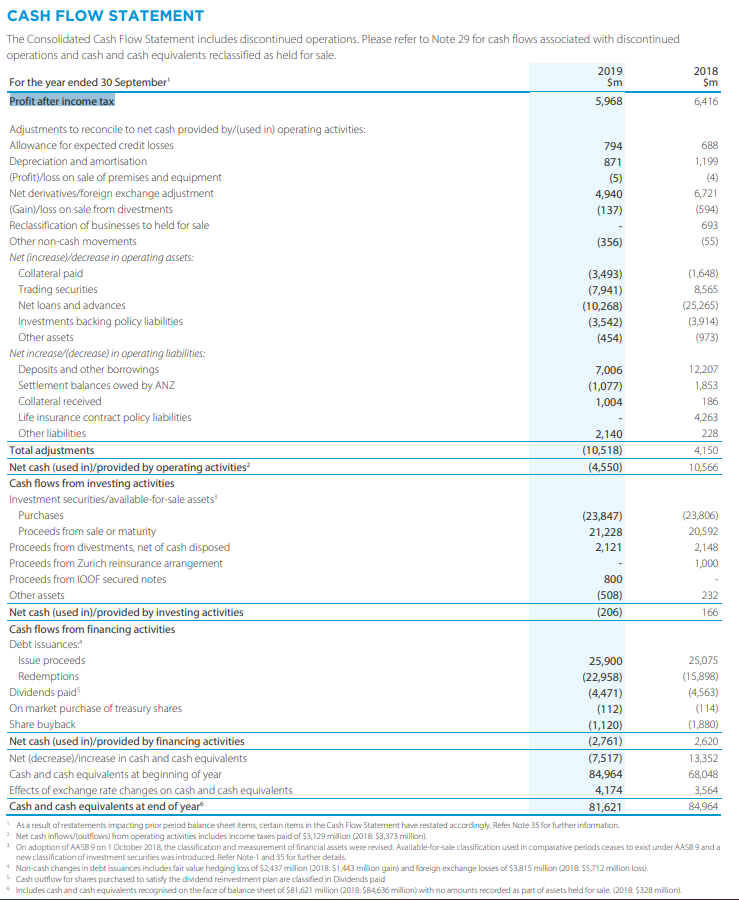

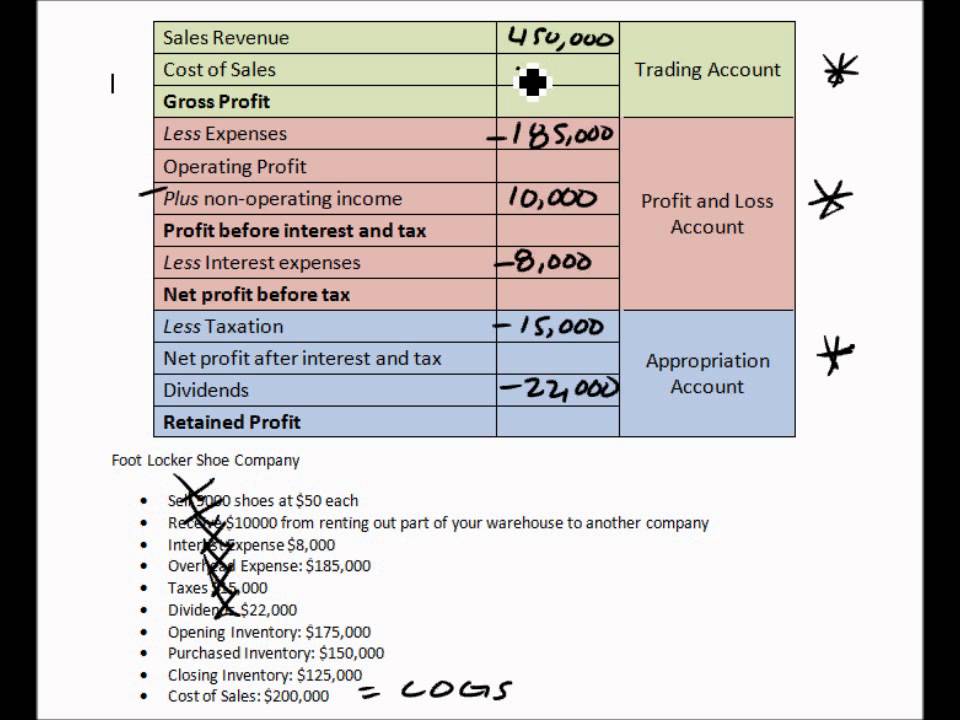

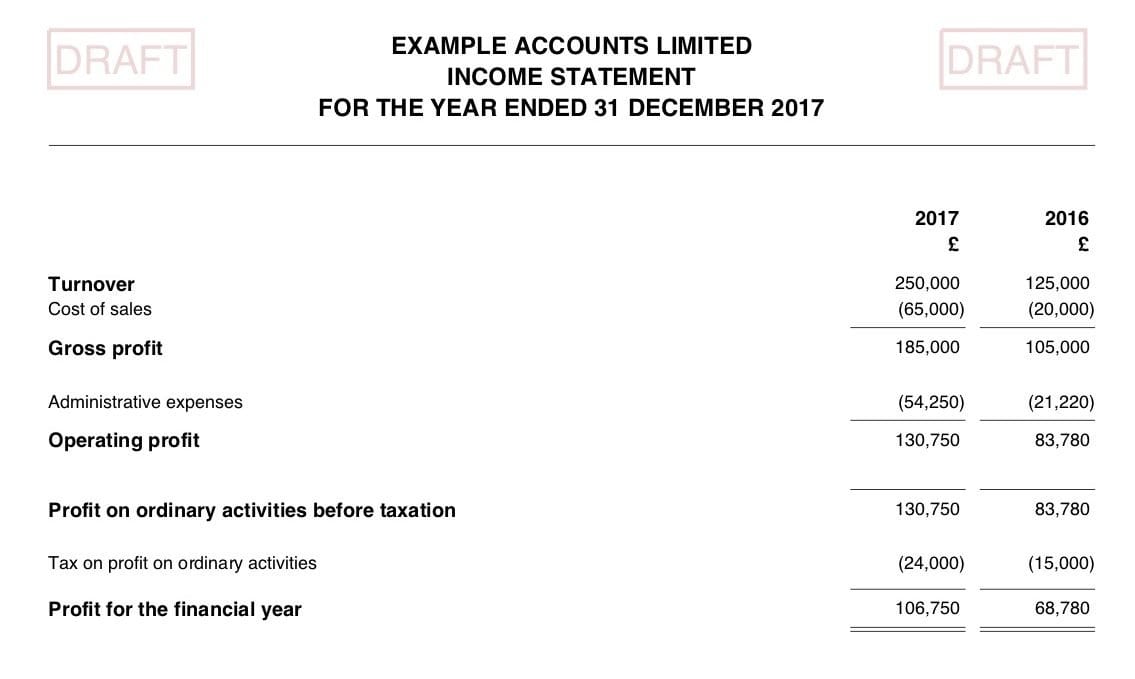

A p&l statement, often referred to as the income statement, is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Net profit or loss for the year

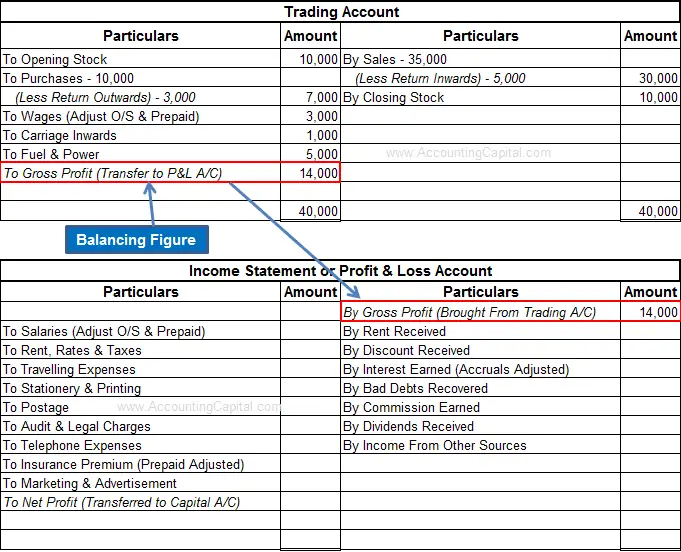

Click the profit and loss by client report under business overview. Depreciation of assets) may not be allowable, or fully allowable, or differently allowable under the income tax act. Your profit and loss account comprises revenue and expenses and makes use of this central formula:

Also, the profit and loss account only shows ‘revenue’ transactions that are connected with the commercial activity of the business. In qbo, know that what you'll see in your profit and loss report is the income and expense total only. The profit and loss report will display all your income, expenses, and net income.

The profit and loss account is compiled to show the income of your business over a given period of time. Hub accounting april 5, 2023 a profit and loss statement is calculated by totaling all of a business’s revenue sources and subtracting from that all the business’s expenses that are related to revenue. (sg&a) expenses, best buy also paid $370 million of income tax.

A profit and loss account is prepared to determine the net income (performance result) of an enterprise for the year/period. Your p&l statement shows your revenue, minus expenses and losses. The profit & loss statement is a crucial financial statement summarising the costs, revenues and expenses incurred by a business during a specific period, usually a quarter.

It shows your revenue, minus expenses and losses. Change the report period, and click the customize button. Any vat charged/ incurred is not included in the profit and loss account.

The outcome is either your final profit or loss. Therefore, debit it to capital a/c. To find out whether you’ve made a profit or a loss, you need to subtract the value of all your debts from all money that has been paid to you over the set period.

Before anything else, please be aware that sales tax is a liability. If the number is positive, you’ve made a profit. Here are the most common terms in the profit and loss account that you need to understand:

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-Loss-Gross-Profit-Net-Operating-Income.jpg)