Heartwarming Tips About Interest Payable On Income Statement

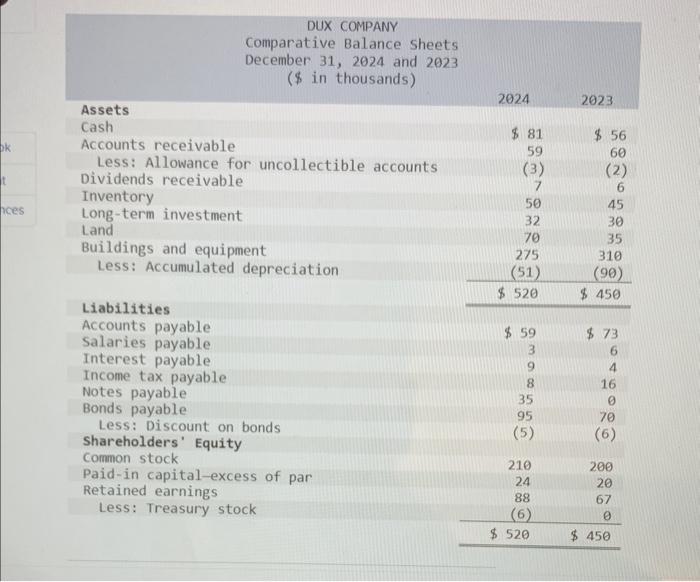

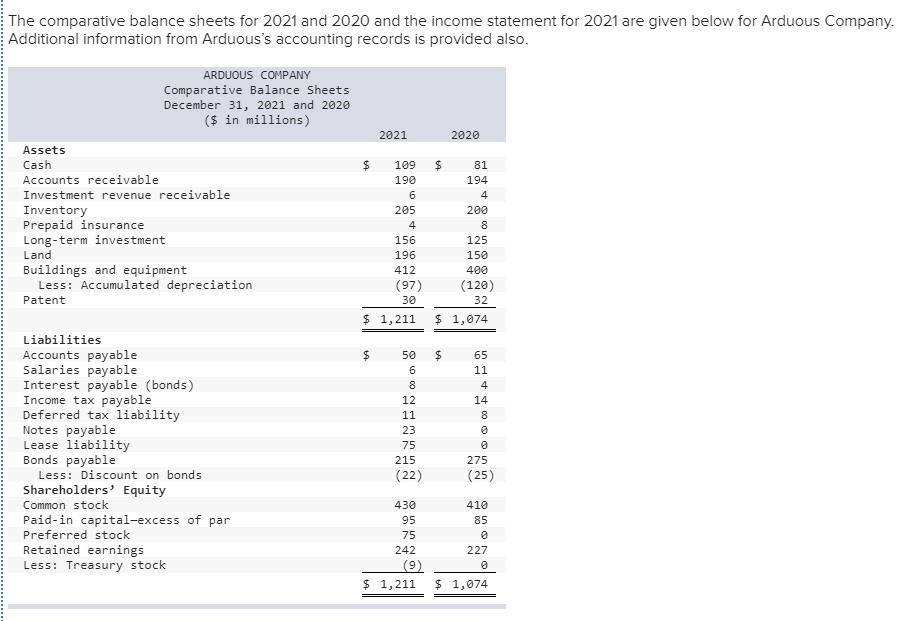

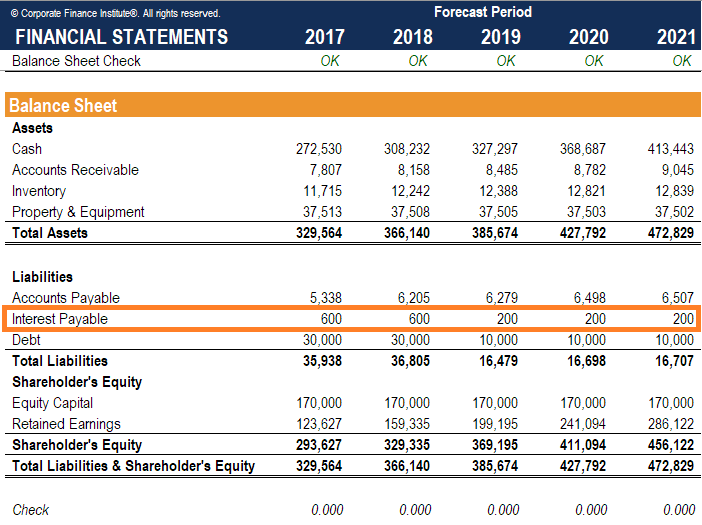

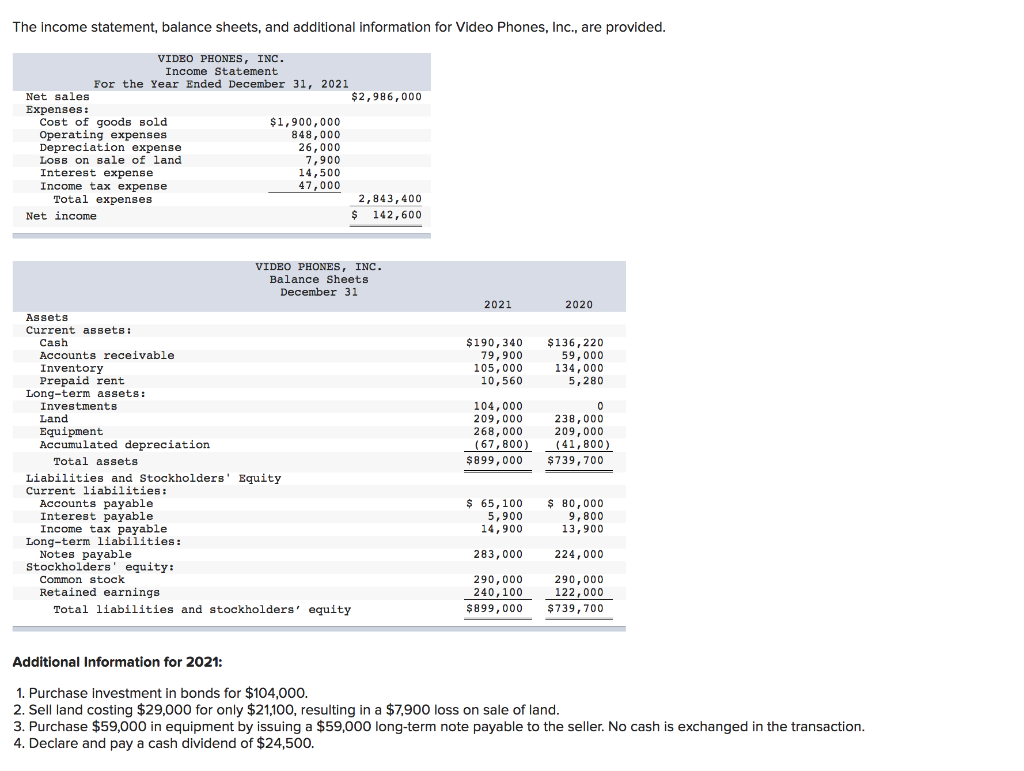

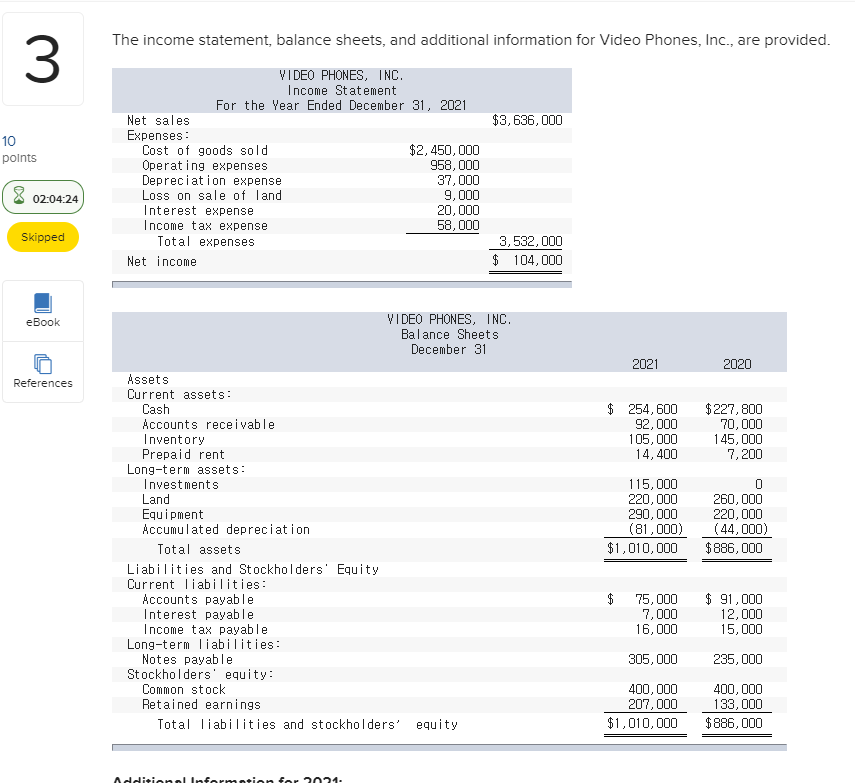

Interest payable is the amount of interest owed to lenders by a corporation as of the balance sheet date.

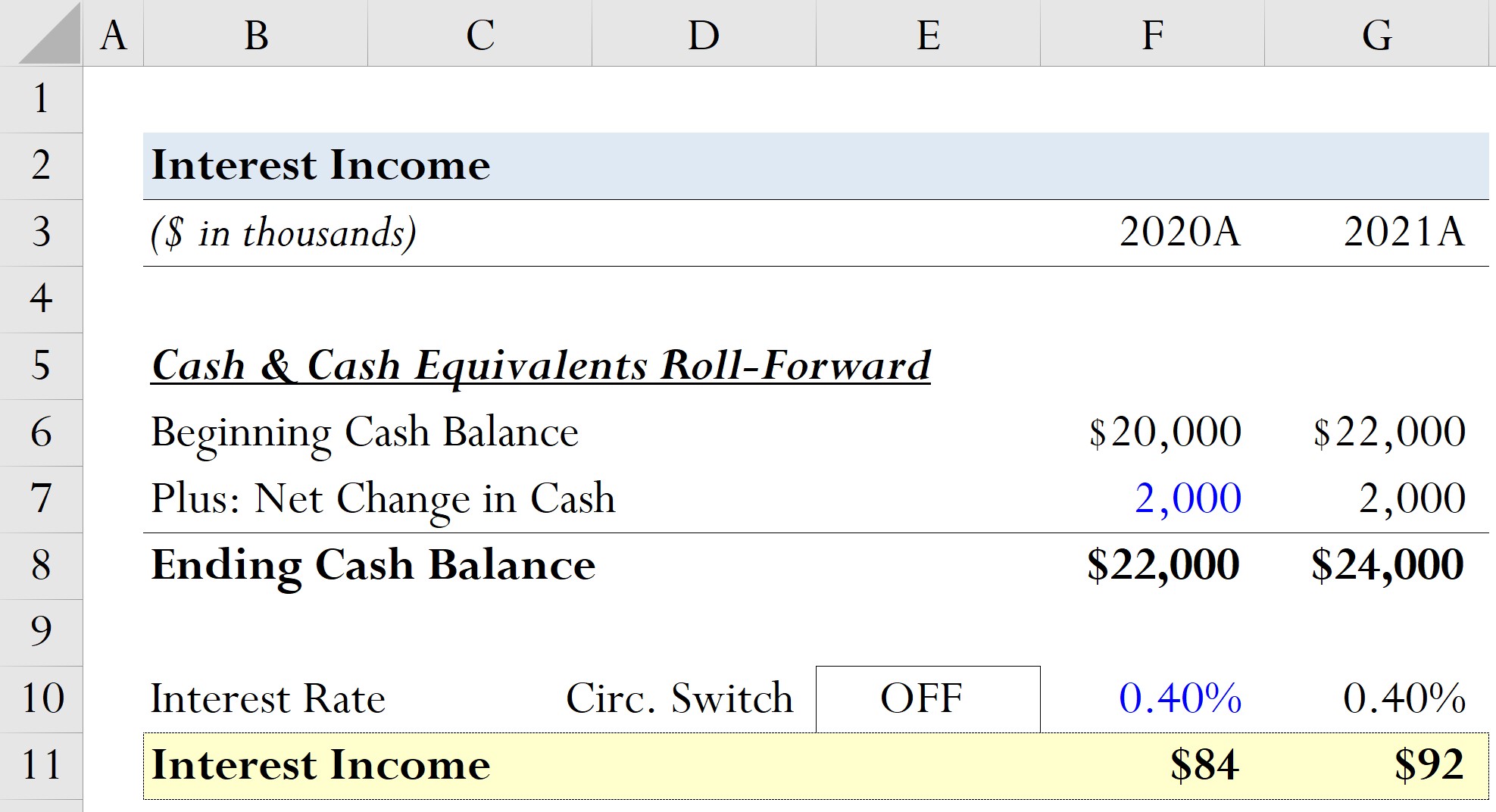

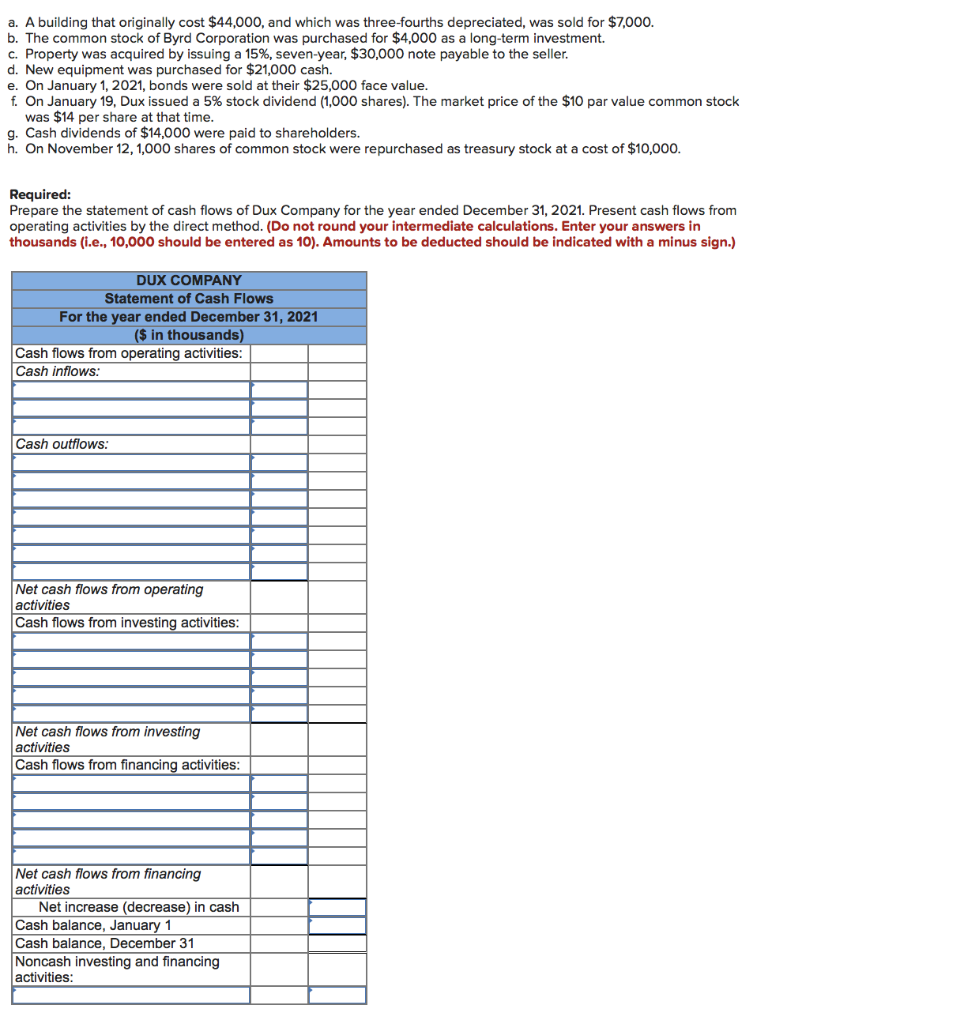

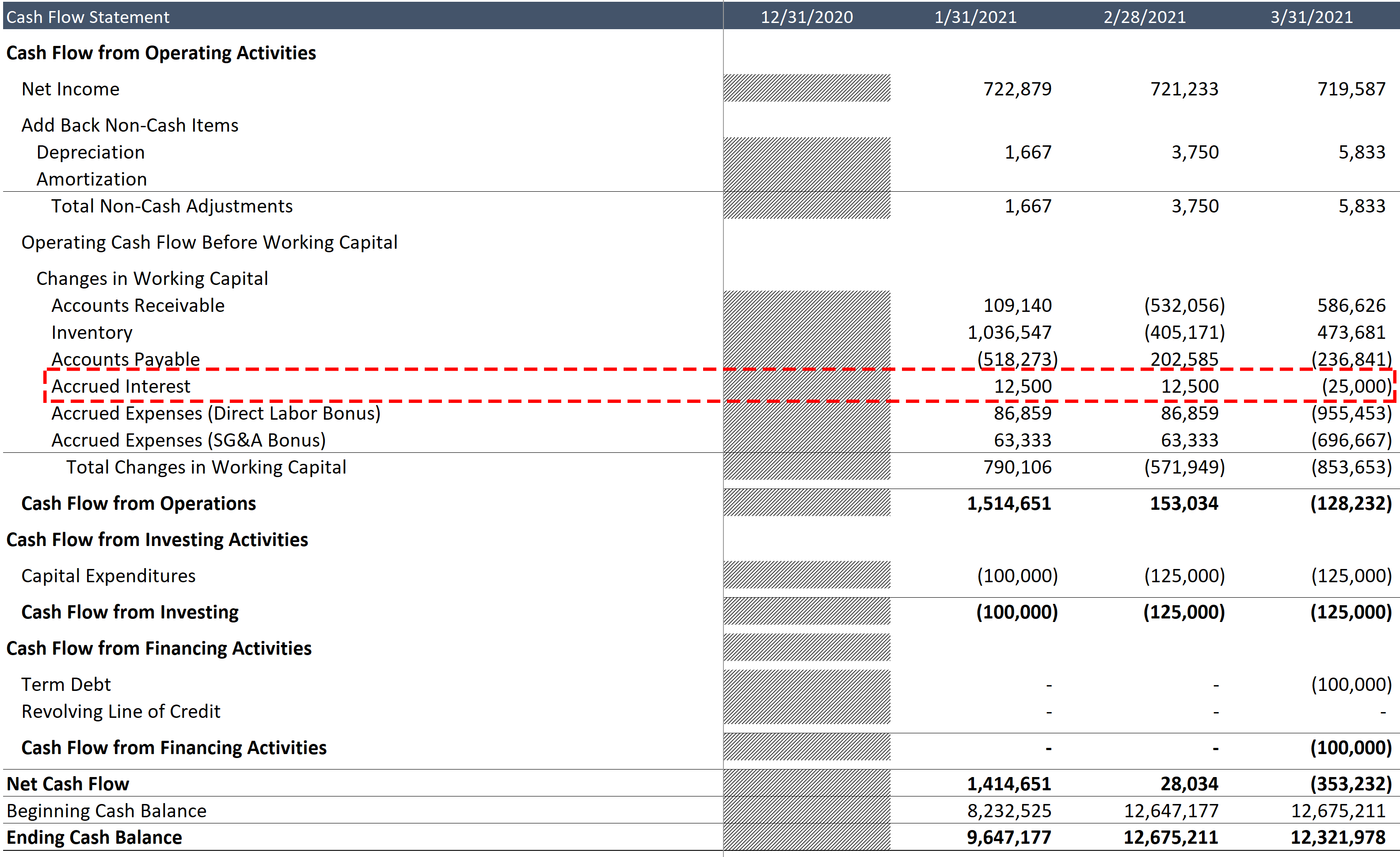

Interest payable on income statement. The interest expense of $12,500 incurred during 2020 must be charged to the income statement for the year 2020. The civil fraud ruling on donald trump, annotated. Use the decimal figure and multiply it by the number of years that the money is.

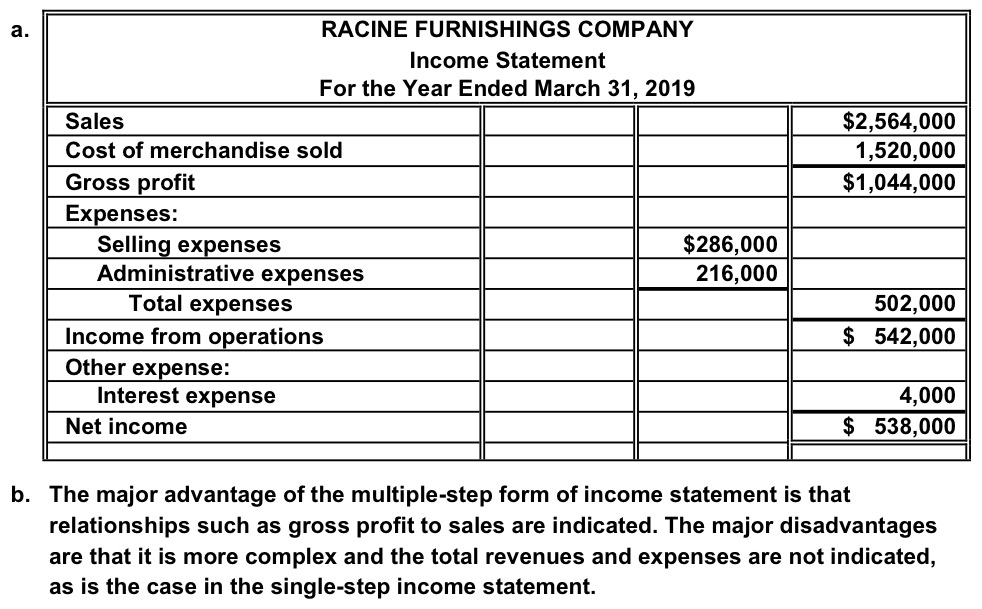

It can display the company's current financial obligations and help improve company leaders' plans for debt repayment. For example, an interest rate of 2% divided by 100 is 0.02. If a company has zero debt and ebt of $1 million (with a tax rate of 30%), their taxes payable will be $300,000.

[interest payable does not include the interest for periods after the date of the balance sheet.] example of interest payable Examples of interest expense and interest payable The interest for the remaining four months (i.e., $25,000 = $500,000 × 15% × 4/12) has not yet been incurred by the company.

This total amount of interest payable can be a key component of the financial statement analysis because if the remaining interest to be paid is an unusually larger amount than the average, it shows that a business. Usually this means the amount incurred (not the amount paid) under the accrual basis of accounting. Interest payable, on the other hand, is a current liability for the part of the loan that is currently due but not yet paid.

Interest payable is the amount of interest expenses that have been incurred at a point but are yet to be paid. Trump was penalized $355 million plus interest and banned for three years from serving in any top roles at a new york. This helps businesses keep track of their liabilities on their balance sheet and create their financial statements.

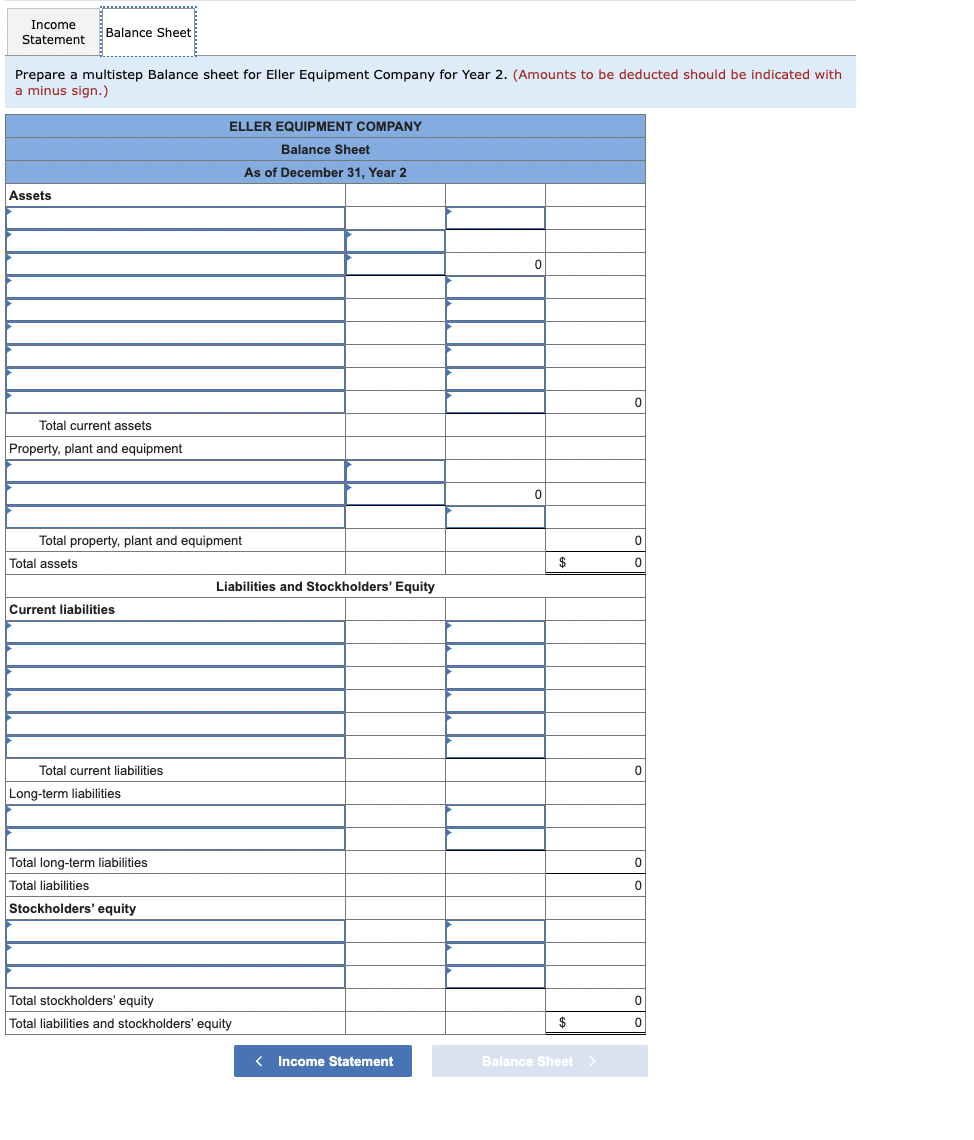

An income statement is a financial statement that reports a company's financial performance over a specific accounting period. First, interest expense is an expense account, and so is stated on the income statement, while interest payable is a liability account, and so is stated on the balance sheet. Interest payable is the amount of interest the company has incurred but has not yet paid as of the date of the balance sheet.

What is interest payable? Interest payable is a balance sheet item, because it represents the amount of interest outstanding at a particular moment in time. Interest payable is an account on a business’s income statement that show the amount of interest owing but not yet paid on a loan.

The interest expense is often recorded as “interest expense, net”, meaning the company’s interest expense is net against its. Comparing interest expense and interest payable. Indeed editorial team.

Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions in penalties and new restrictions on. What is interest payable? Updated september 30, 2022 interest payable is the amount of interest on the debt that a company owes to its lenders.

Let’s look at the process below: Thus, there is a tax savings, referred to as the tax shield. Take the annual interest rate and convert the percentage figure to a decimal figure by simply dividing it by 100.