Build A Info About Cash Flow From Operations Indirect Method

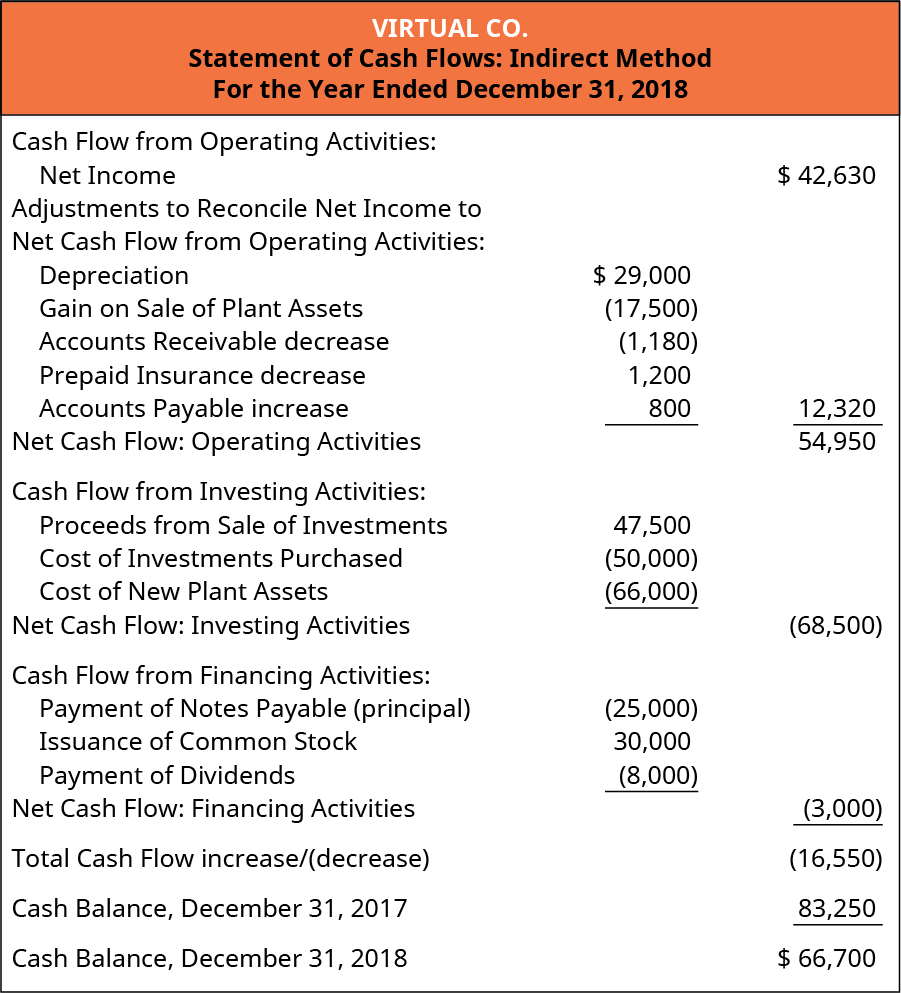

Determine net cash flows from operating activities.

Cash flow from operations indirect method. (a) the direct method and (b) the indirect method. The indirect method of preparing a statement of cash flows is a technique that begins with the net profit from the income statement, which is then. Under the indirect method, cash flow from operating activities is calculated by first taking the net income from a company's income statement.

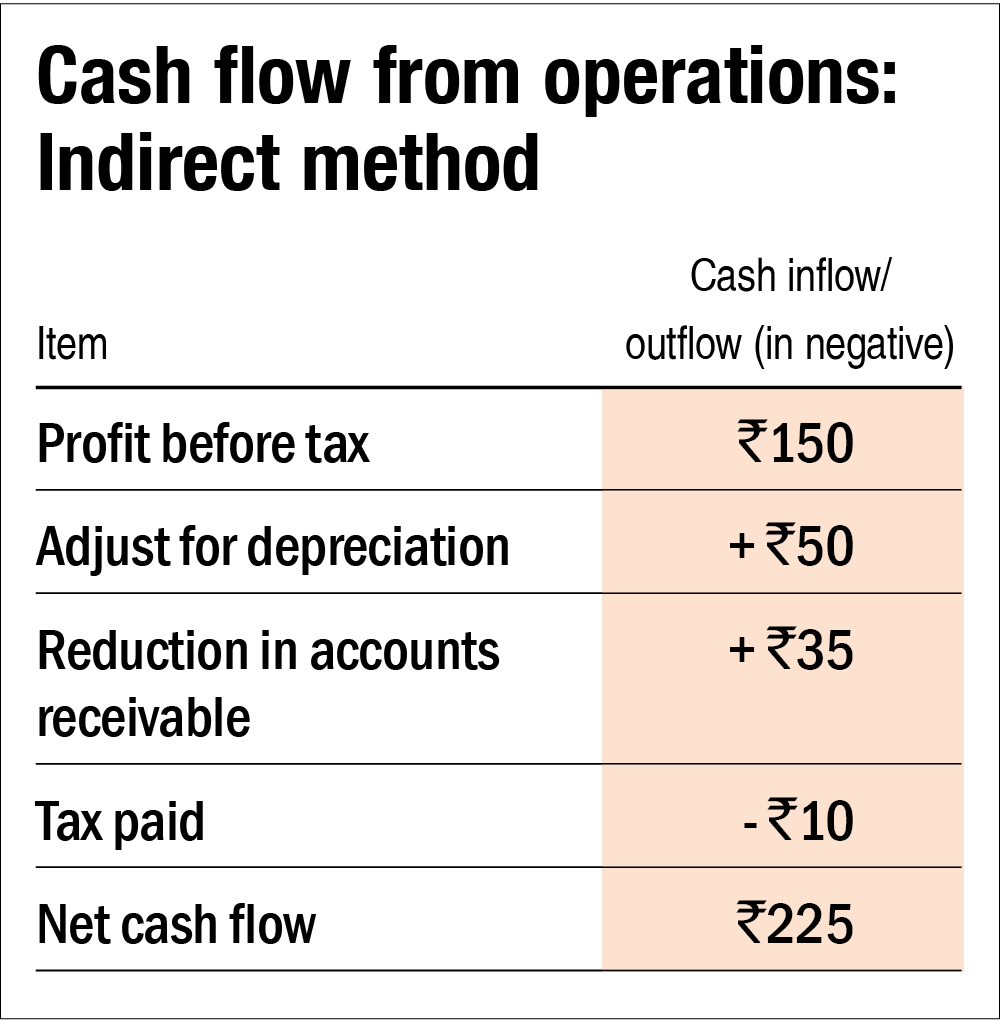

Being the simpler of the two, it is the method of choice for most accountants and is therefore seen applied in the cash flow statement for most businesses. Explain the difference in the start of the operating activities section of the statement of cash flows when the indirect method is used rather than the direct method. Indirect method cash flow from operations:

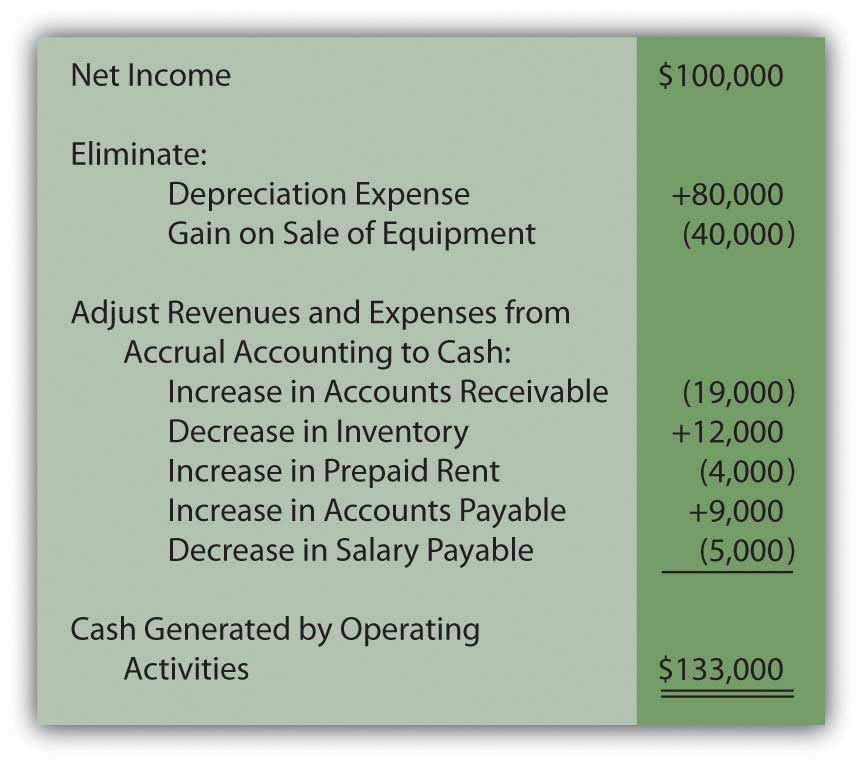

The indirect method uses increases and decreases in balance sheet line items to modify the. Add back noncash expenses, such as depreciation, amortization, and depletion. There are two methods for depicting cash from operating activities on a cash flow statement:

Using the indirect method, operating net cash flow is calculated as follows: It starts with a business’s net income and then lists cash flows, both received and paid, for various activities (i.e., the three cash flow categories: Concepts teaching (and learning) accounting involves starting with simple transactions and gradually layering in complexity.

The idea is to use simple transactions to: The following example shows the format of the cash flows from operating activities section of cash flows statement prepared using. Begin with net income from the income statement.

Indirect method an overview of these methods is given below. Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital. Add back noncash expenses, such as depreciation, amortization, and depletion.

We can work out the cash flow from operations using two methods: In this case, depreciation and amortization is the only item. Adjust for changes in working capital.

In the presentation format, cash flows are divided into the following general classifications: The cash flow statement indirect method is one of the two ways in which accountants calculate the cash flow from operations (another way being the direct method ). Begin with net income from the income statement.

Cash flow indirect method: The indirect method and the direct method. Start calculating operating cash flow by taking net income from the income statement.

Cash flows from operating activities. Using the indirect method, operating net cash flow is calculated as follows: In this method, you begin with the net income and adjust it to calculate the company’s operating cash flow.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)