Impressive Tips About Bank Overdraft Which Side Of Balance Sheet

Read what is bank overdraft?

Bank overdraft which side of balance sheet. Definition of bank overdraft. In this type of overdraft account there is arrangement made in advance between the account holder and the bank. There is no journal entry required at the date of signing the agreement of the overdraft with the bank.

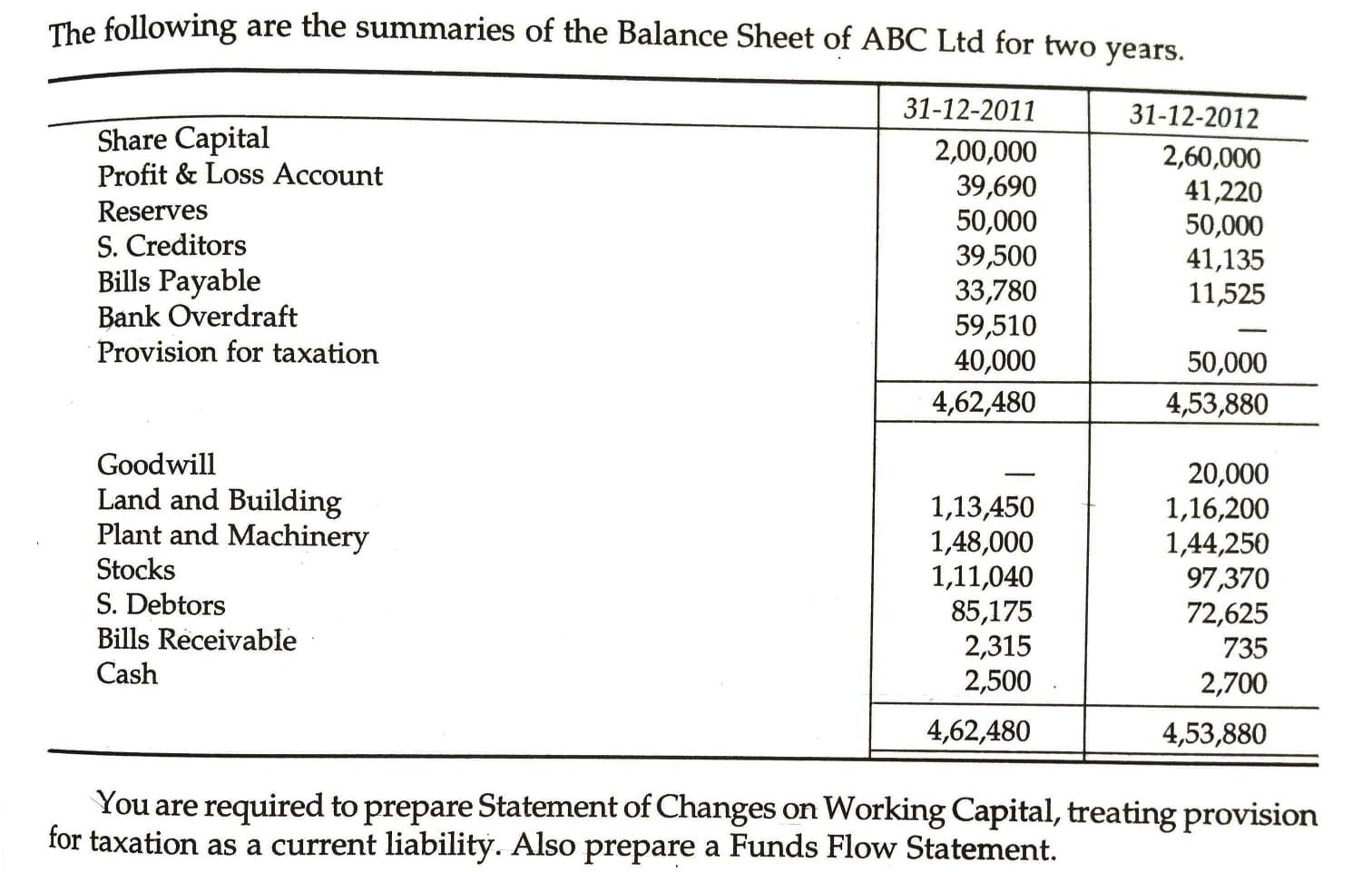

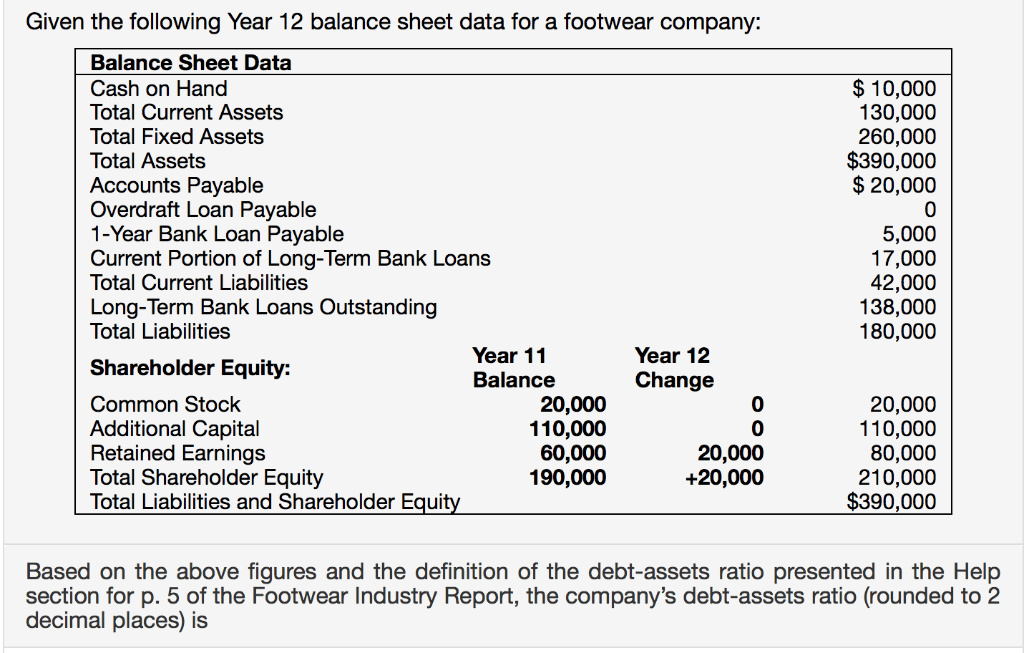

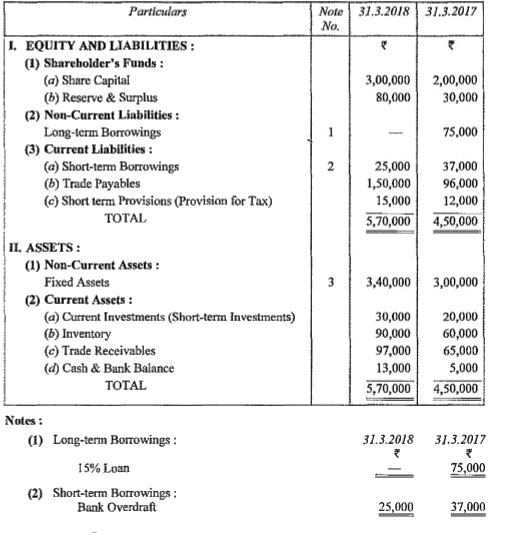

P, for the year ended 31 st march 2017. Both the parties mutually agree on. Assets property trading assets loans to customers deposits to the central bank liabilities loans from the central bank.

When an individual or a business signs an agreement for an overdraft with the bank, there is no need to record any journal entry. An overdraft (also known as a bank overdraft) generally means that the amount of a company's checks being presented at the bank for payment exceeded the amount on. An overdraft allows the individual to continue.

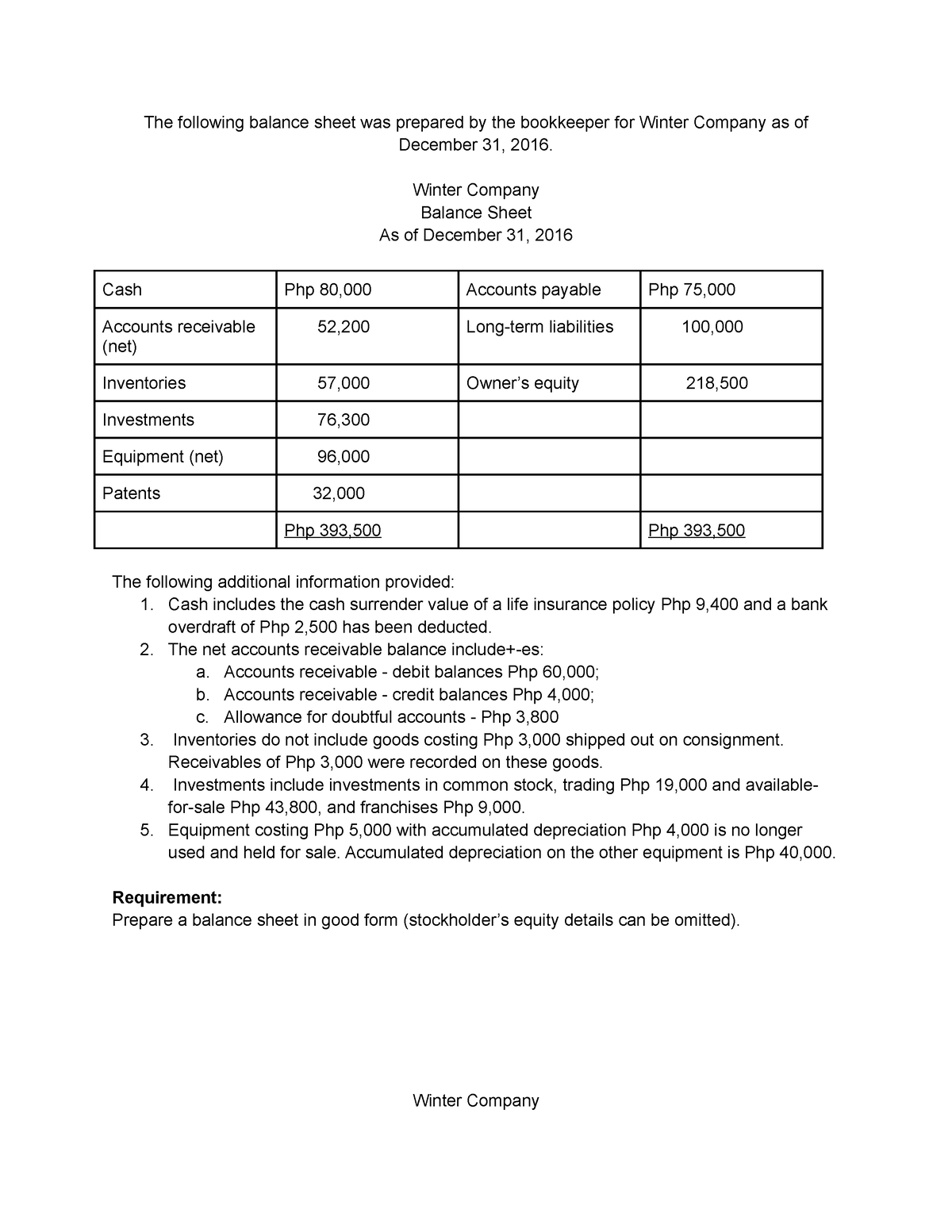

A book overdraft represents the amount of outstanding checks in excess of funds on deposit for a particular bank account, resulting in a credit cash balance reported on an. Find the best banks of 2024. The term “bank account overdraft” refers to the situation in which an individual’s bank account balance drops to zero or below, resulting in a.

Generally, the bank overdraft in the balance sheet will be reported as a bank overdraft double entry. The typical structure of a balance sheet for a bank is: Generally, the bank overdraft in the balance sheet will be reported as a bank overdraft double entry.

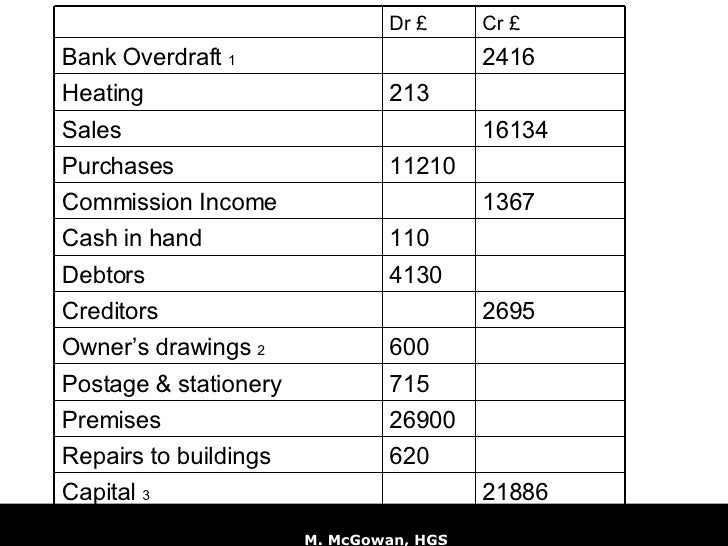

Questions on liabilities side of balance sheet. A bank overdraft or simply overdraft is a credit facility offered by banks. Capital ₹ 500000, drawings ₹150000, cash in hand.

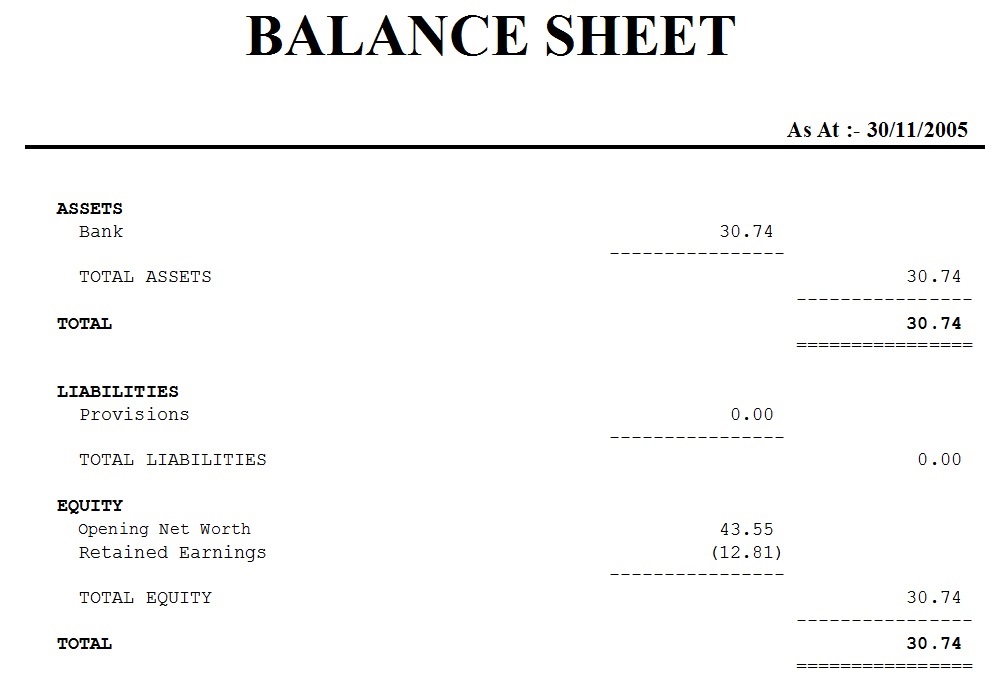

Prepare a balance sheet of mr. Search accountingweb advertisement latest any answers quickfile software help. Presentation in the balance sheet bank overdraft is adjusted with the cash and cash equivalent.

When a company's bank account has a negative balance it is said to be running a bank overdraft (also referred to as an overdraft). An overdraft is an extension of credit from a lending institution when an account reaches zero. Journal entry for bank overdraft.

If there is not a sufficient balance in the cash and cash equivalent, the. Unique characteristics are included in the balance sheet and income statement of a bank's financial statements that help investors decipher how banks make.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

![Solved [34 marks] Question 2 Statement of Cash Flows Set](https://media.cheggcdn.com/media/aa2/aa2fb3f8-596e-4c8e-8a90-7697dc8a1212/phpIToR6o.png)