Top Notch Info About Cash Flow From Financing Activities Accounts Payable Balance Sheet Example

Cash flow from investing, cash flow from financing, and cash flow from operating activities.

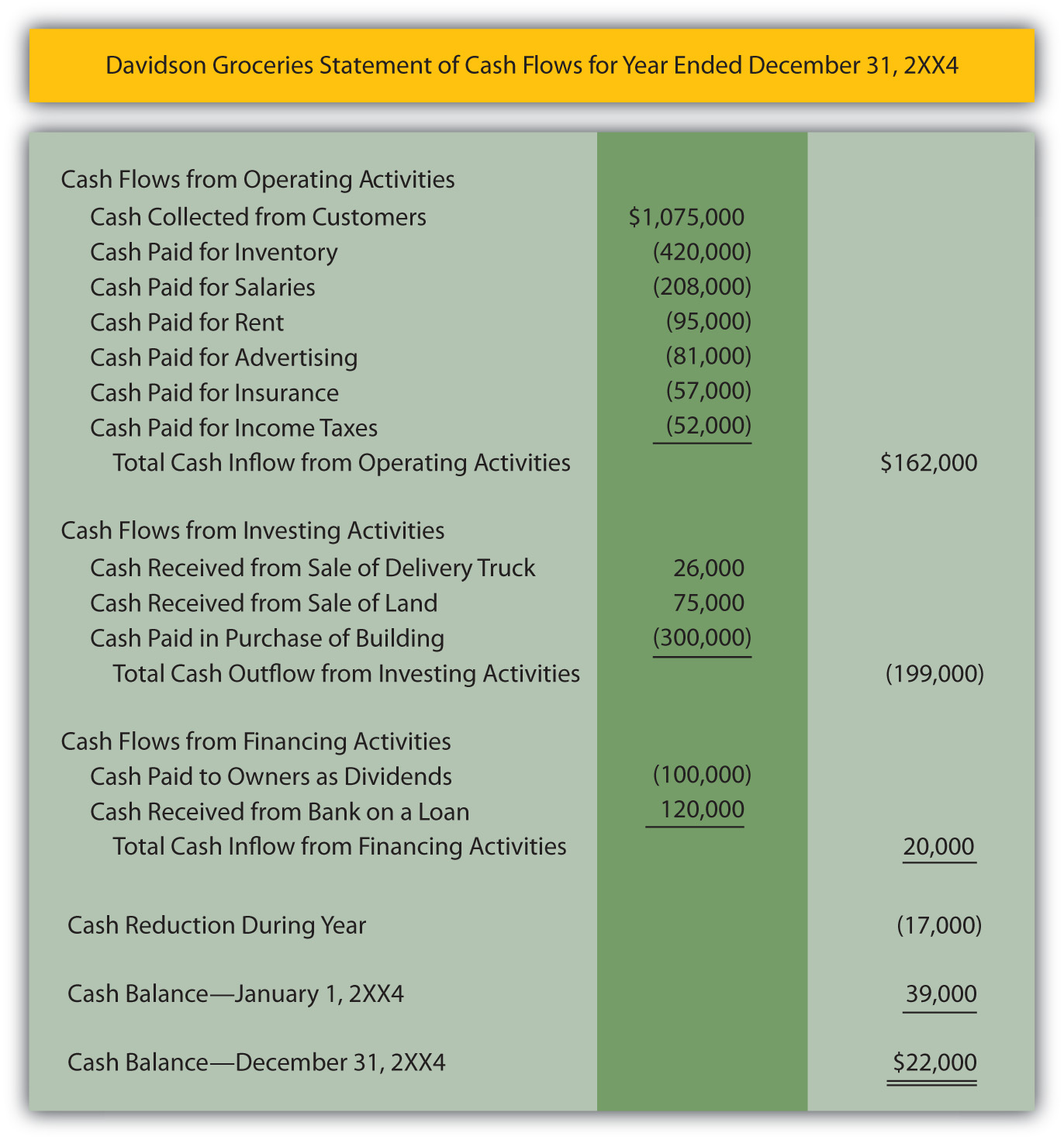

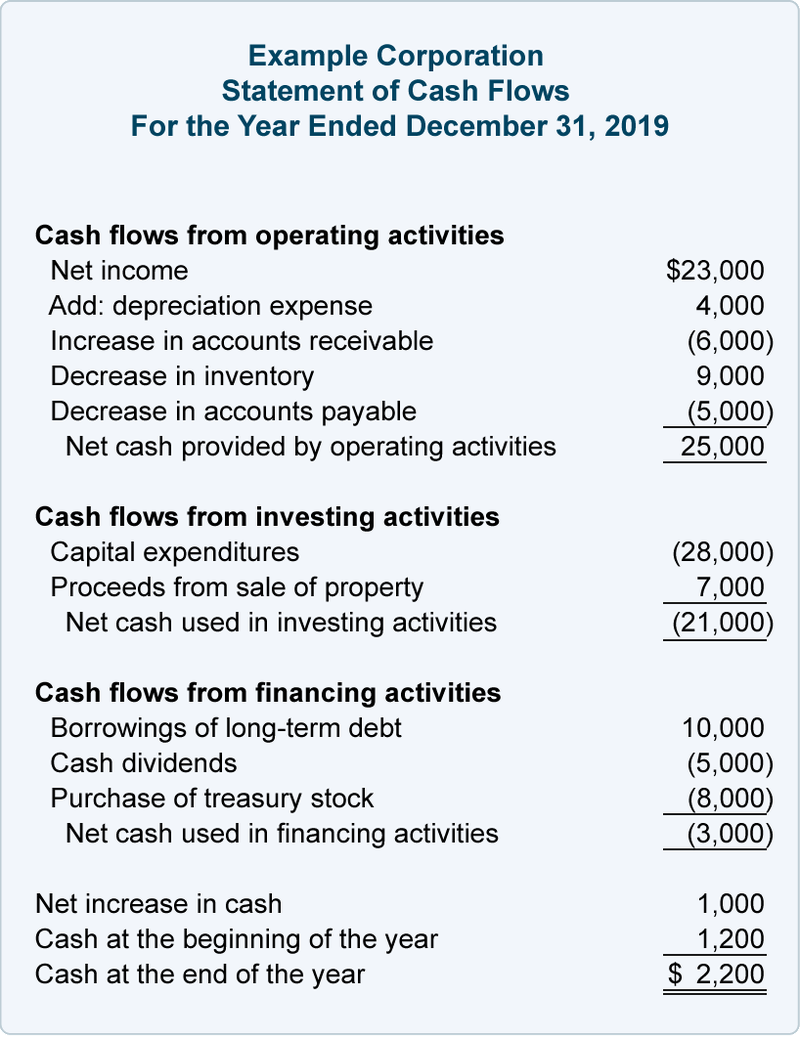

Cash flow from financing activities accounts payable balance sheet example. The cash flows from financing activities section reports the cash flows associated with the issuance and repurchase of a corporation's bonds and capital stock, the payment of. Decrease in bonds payable on the balance sheet from 50,000 to 0. To prepare the statement of cash flows for clear lake sporting goods, we need the beginning cash balance from the balance sheet, net income and depreciation expense.

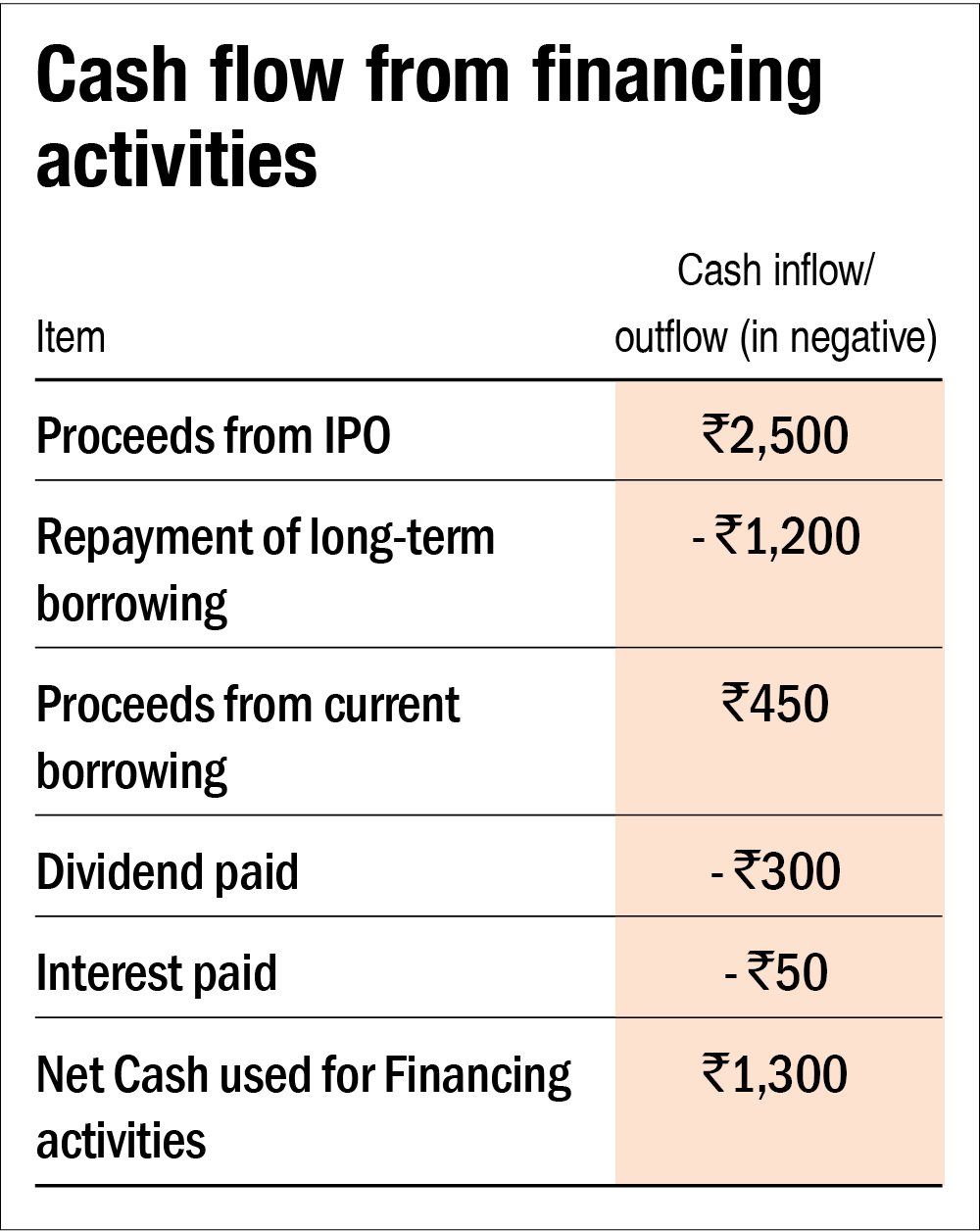

Cash flow from financing activities example. To understand the cash flow financing activities, consider the following example. Let’s take an example to calculate cash flow from financing activities when balance sheet items are provided.

Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Below are examples of items listed on the balance sheet: In this blog, we'll discuss the impact of accounts.

Despite accounts payable noted as a liability in the balance sheet, it is accounted for differently than expected. Assets cash and cash equivalents are liquid assets, which may include treasury bills and certificates of. Unless you went to business school—or at least took an accounting or finance course—you’ve probably never given much thought to financial statements.

Accounts payable is the sum of money owed to suppliers and creditors by a business. The following are the changes in balance sheet of a traders for year ended. A large corporation often has 10.

Cash flow from financing activities in our example notes payable is recorded as a $7,500 liability on the balance sheet. Begin with net income from the income. The cash flow from operating.

The net cash impact of raising capital from equity/debt issuances, net of cash used for share buybacks, and debt. There are three types of cash flows: The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating,.

Cash flow from financing activities (cff): Cash flows from financing activities: Since we received proceeds from.

In the bottom area of the statement, you will see the cash inflow and outflow related to financing. Data found in the balance sheet, the income statement, and the cash flow statement is used to calculate important financial ratios that provide insight on the.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)