Here’s A Quick Way To Solve A Info About Examples Of Off Balance Sheet Financing

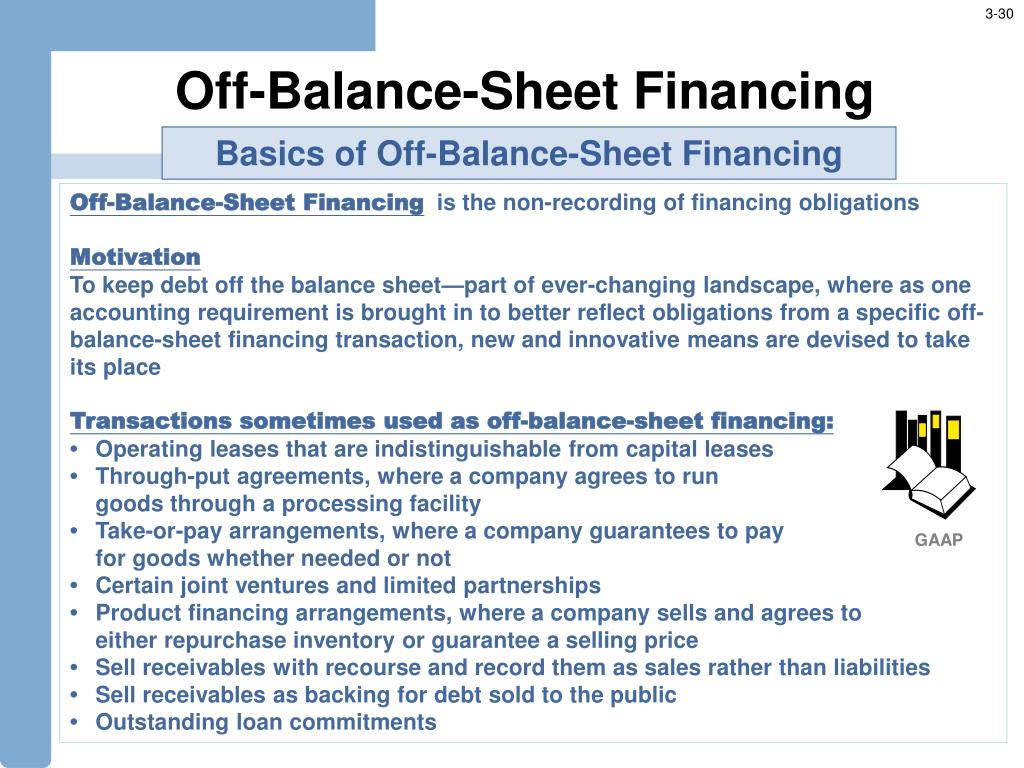

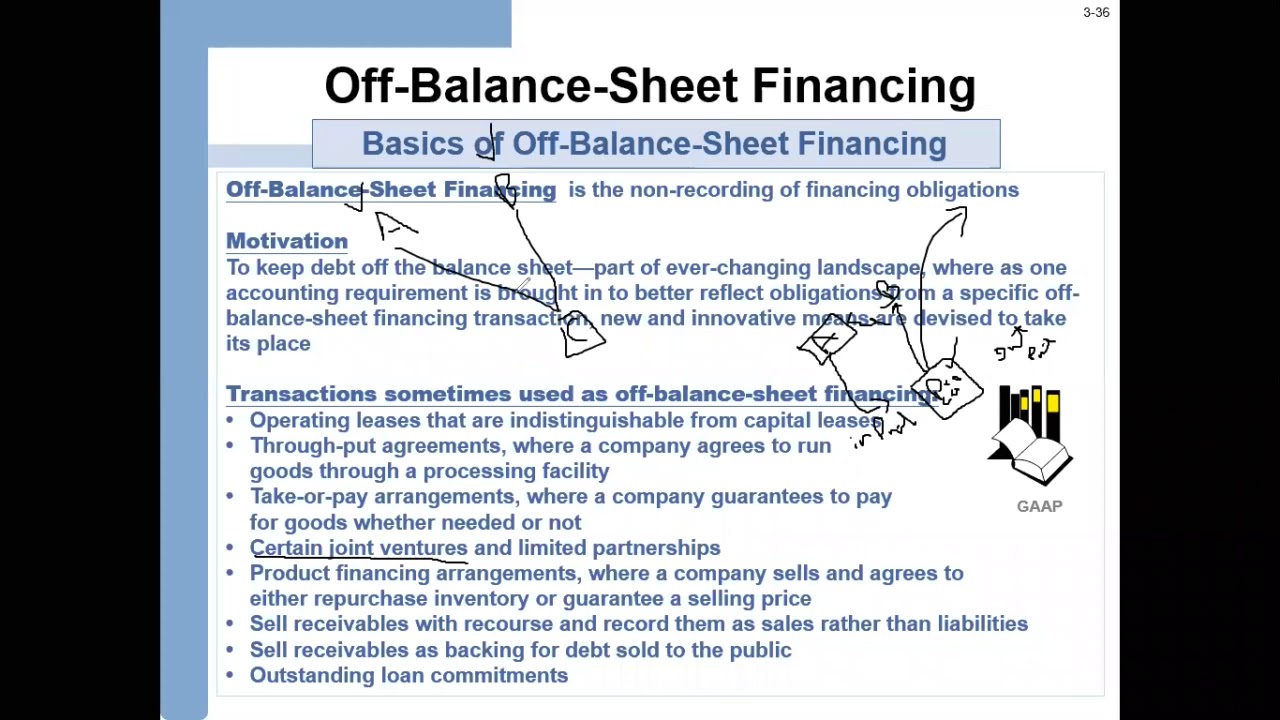

A full example in short, capital leases, which are now classified as finance leases under asc 842, were.

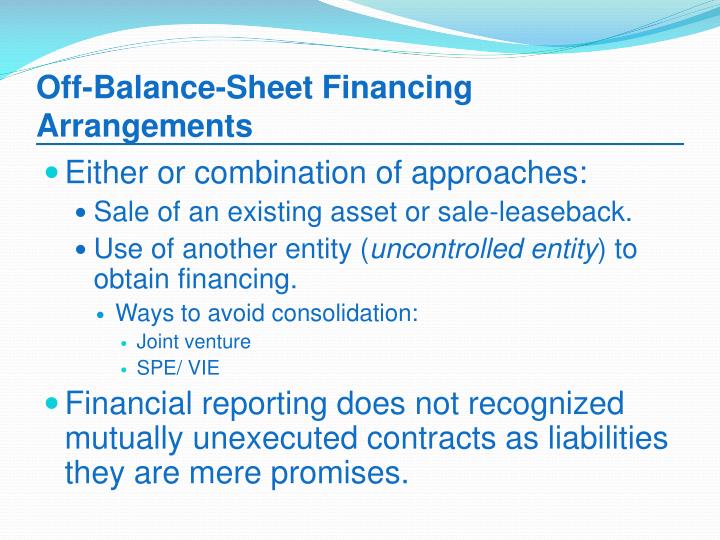

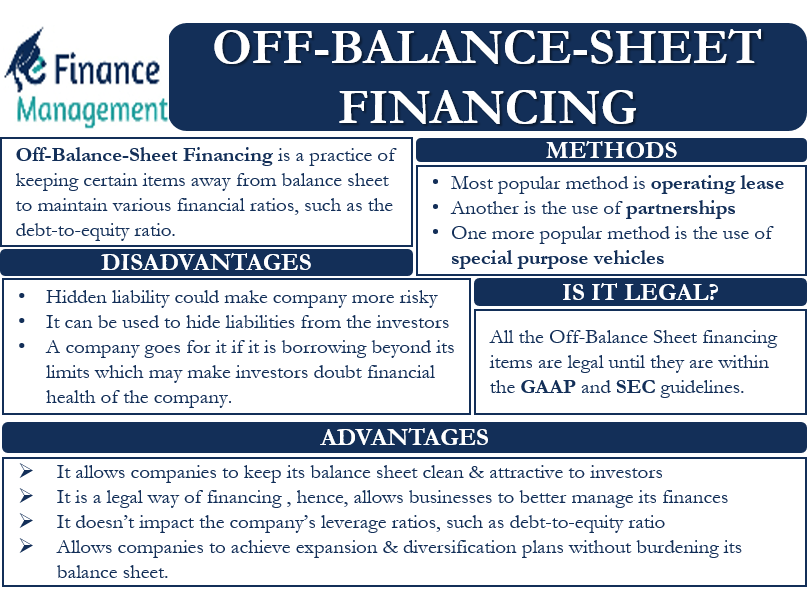

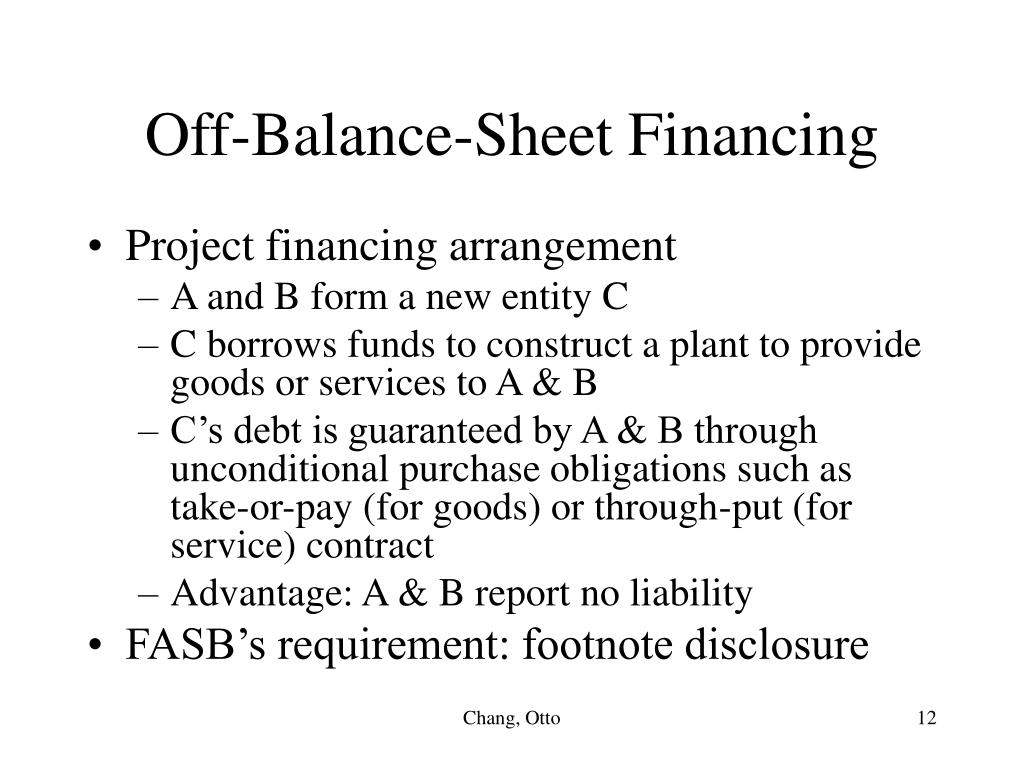

Examples of off balance sheet financing. With an operating lease, the lessor keeps the asset on its balance sheet and. These allow the lessee to use an asset without owning it. The lease payments are considered operating expenses.

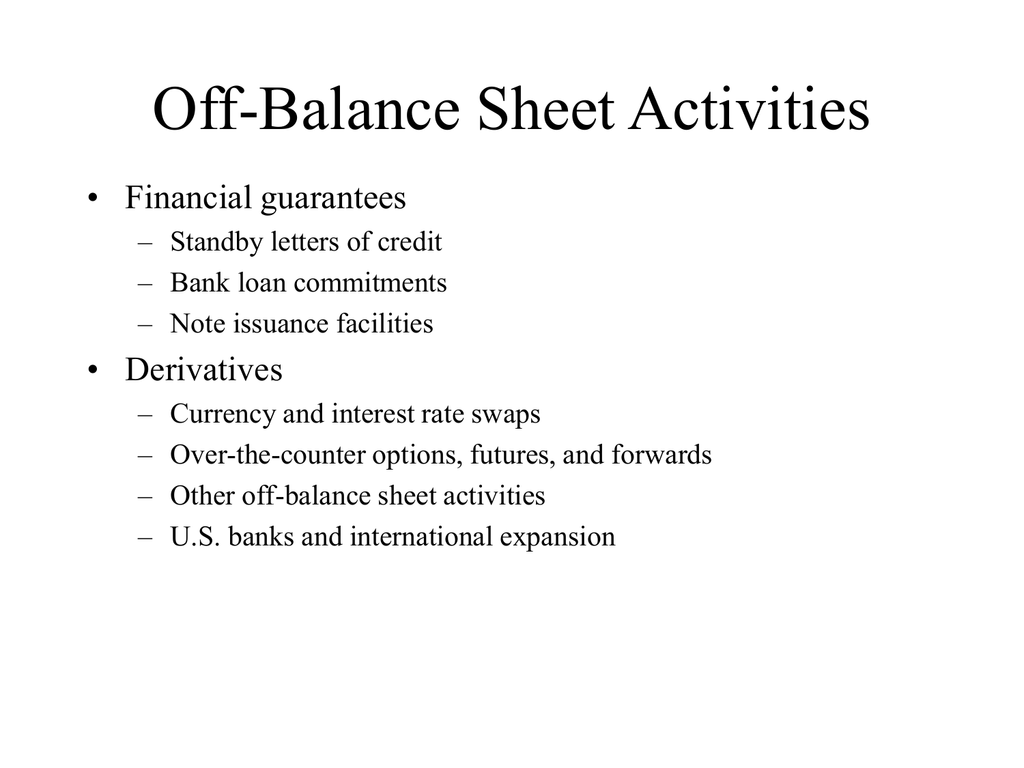

On a company’s balance sheet, owners’ equity. Those bonds are thus listed as liabilities on the company’s balance sheet. The company traded its quickly rising stock for cash or notes from the spv.

What is net worth or owners’ equity? Trump was penalized $355 million, plus millions more in interest, and banned for three years from. It is used to finance assets and activities without incurring.

An example of obs items is financial firms that provide investment management services. Even though they continue to bring in money, their investments. The spv used the stock for hedgingassets on enron's balance sheet.

In an operating lease, the company records only the rental expense for the equipment rather than the. Like with any other thing, it also has its advantages and disadvantages both for the companies as. Capital lease accounting and finance lease accounting: