What Everybody Ought To Know About Accounting Standards And International Financial Reporting

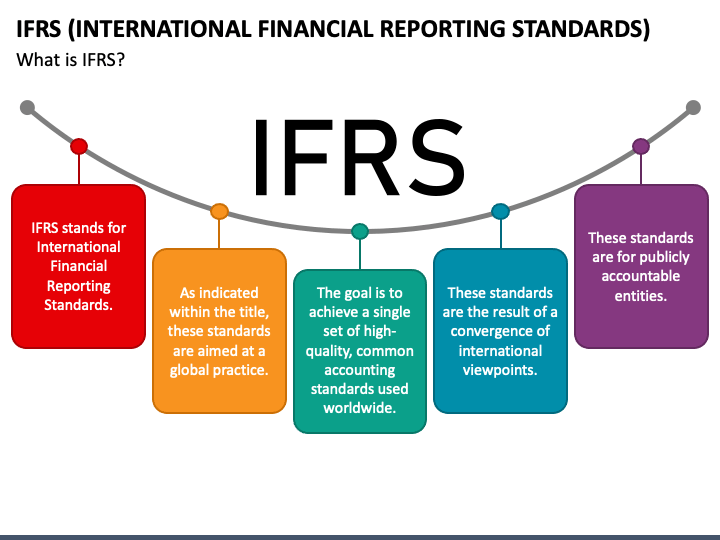

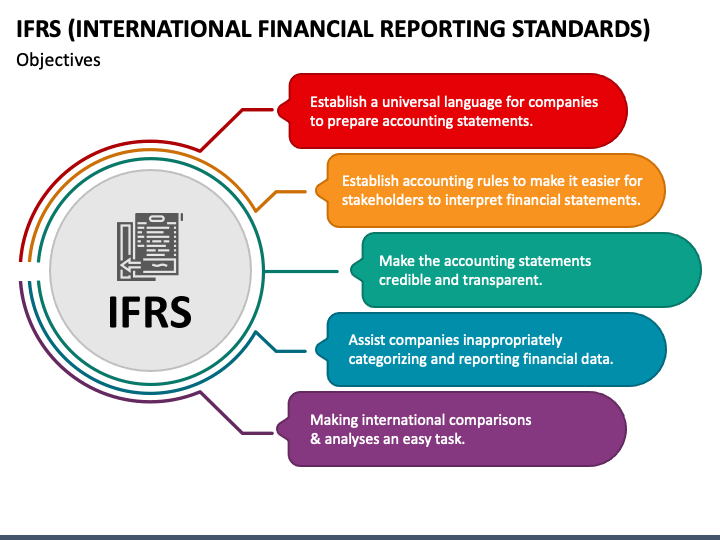

The iasb (international accounting standards board) issued the ifrs, a set of accounting rules standardized across companies of 167 different jurisdictions.

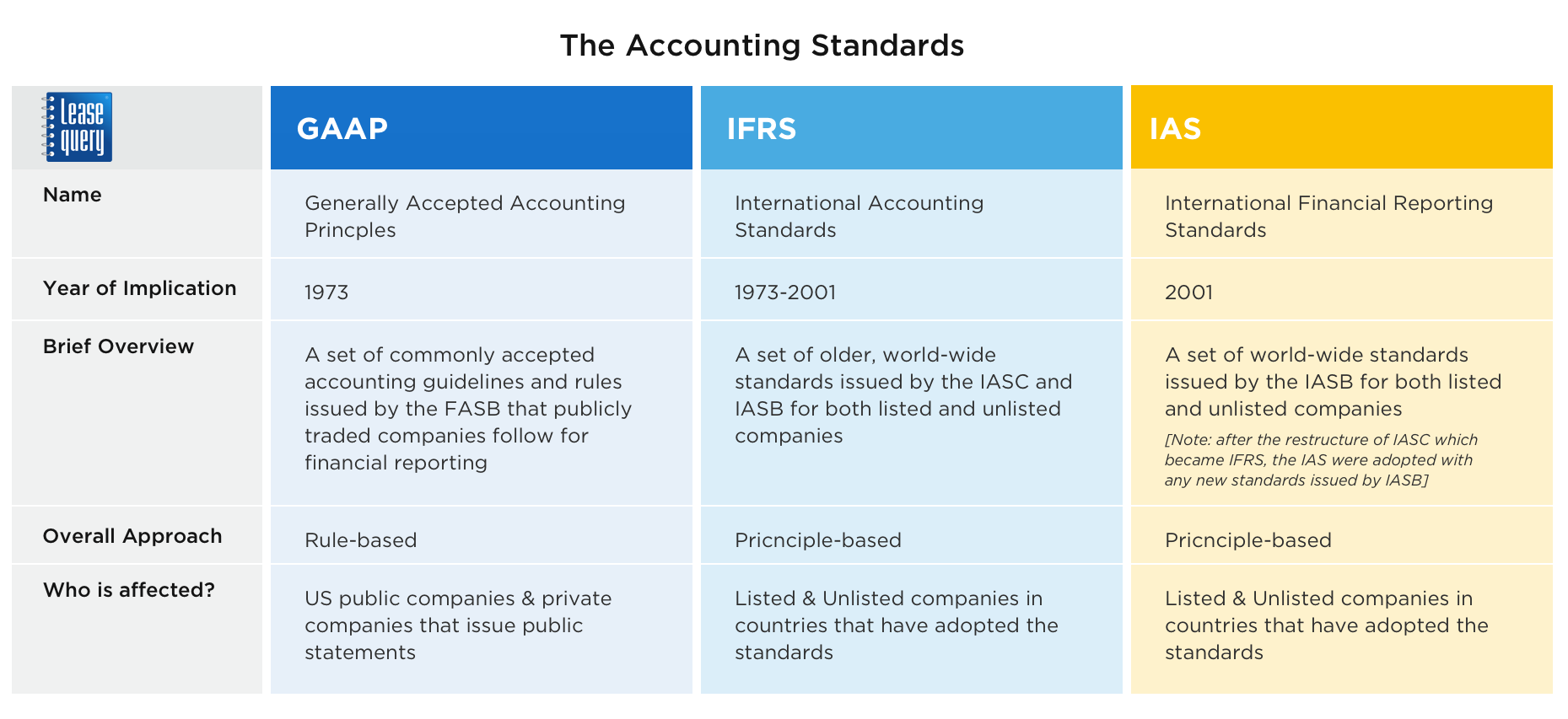

Accounting standards and international financial reporting standards. The iasb was formed in 2001 to replace the international accounting standards. Broad geographical diversity is also required. This combination has made ifrs in your pocket an annual, and indispensable, worldwide favourite.

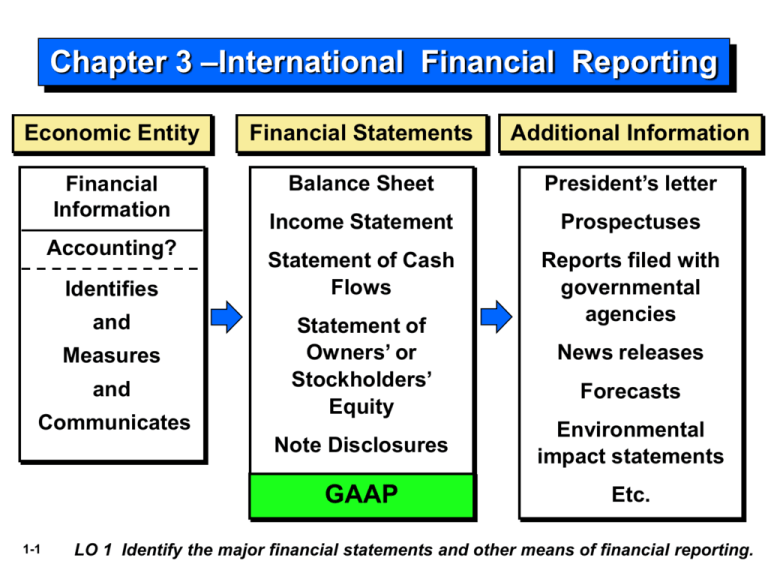

Illustrative ifrs consolidated financial statements for 2022 year ends. Conceptual framework for financial reporting (conceptual framework) describes the objective of, and the concepts for, general purpose financial reporting. They were developed and are maintained by the international accounting standards board (iasb).

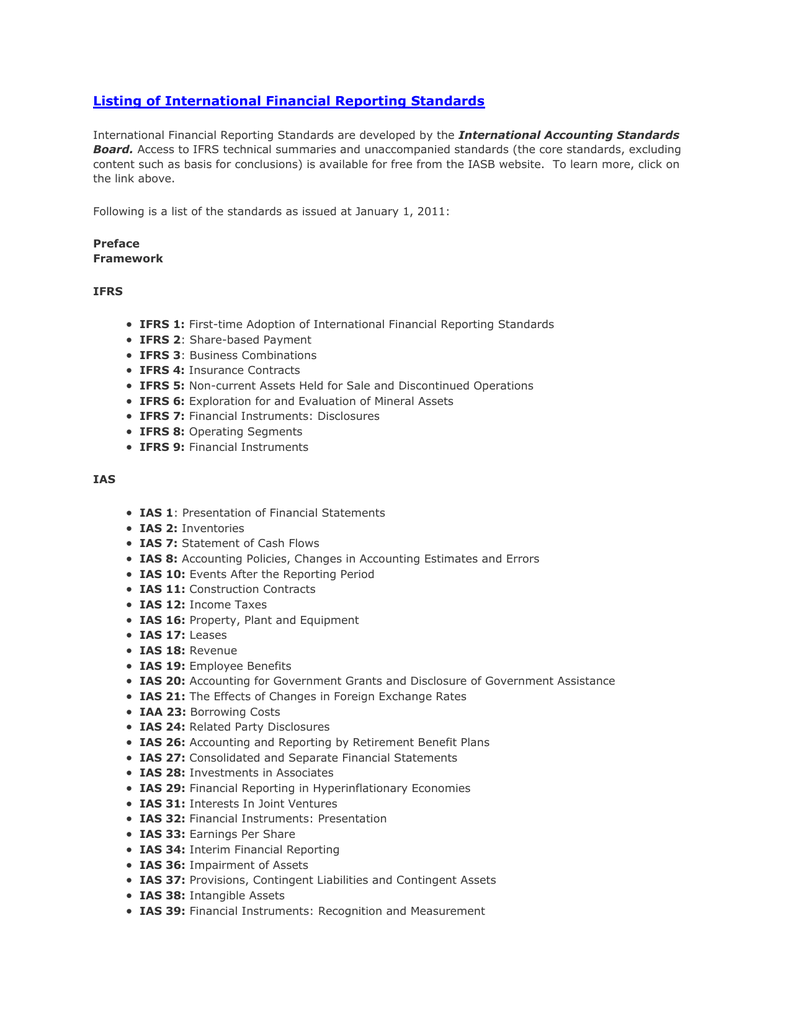

Accounting problems as part of international financial reporting standards (ifrs). International financial reporting standards this page contains links to our summaries, analysis, history and resources for international financial reporting standards (ifrs) issued by the international accounting standards board (iasb). International financial reporting standards, commonly called ifrs, are accounting standards issued by the ifrs foundation and the international accounting standards board (iasb).

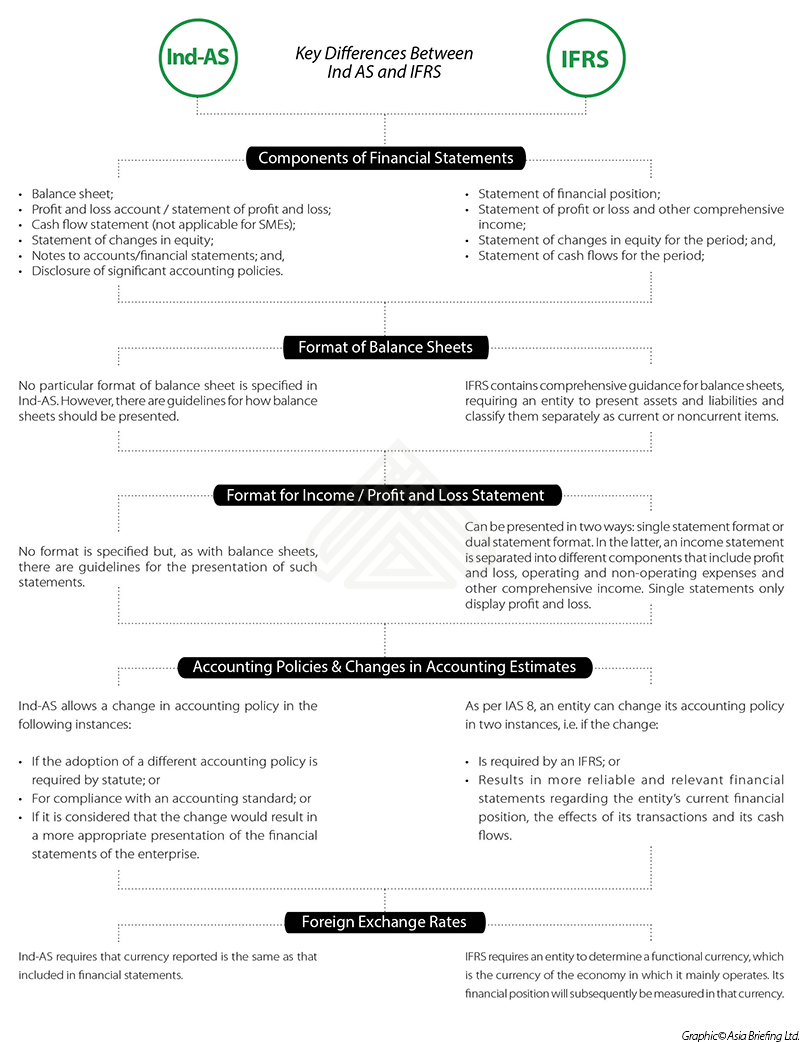

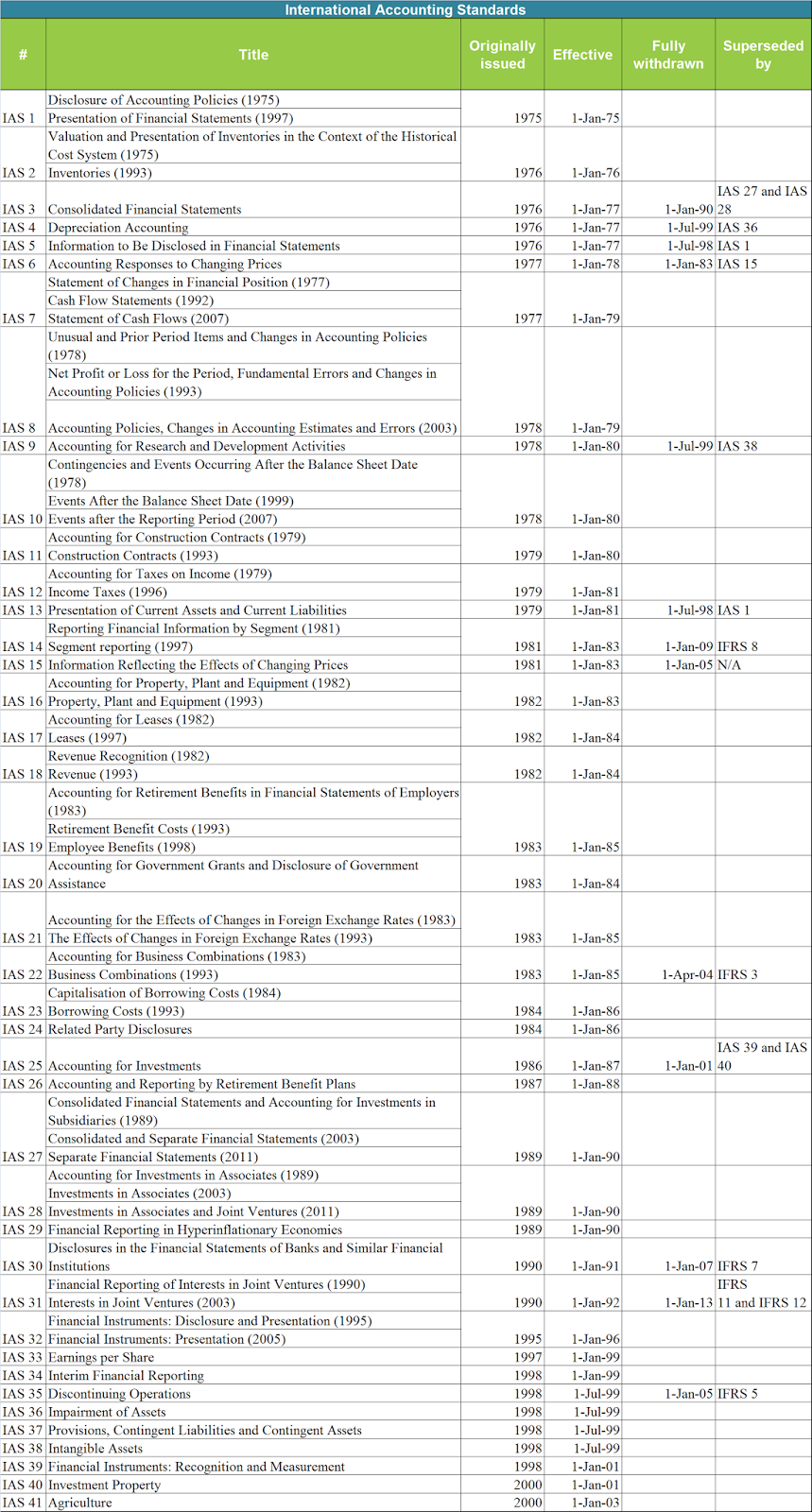

International accounting standards. They constitute a standardised way of describing the company's financial performance and position so that company financial statements are understandable and. It should be mentioned that the accounting standard for intangible assets (ias 38) provides for the possibility for a company to revaluate intangible assets, in which both a decrease and an increase in the.

Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when. It also provides a snapshot of iasb’s standard setting. Links to summaries, analysis, history and resources for ifrs sustainability disclosure standards.

Ifrs standards are international financial reporting standards (ifrs) that consist of a set of accounting rules that determine how transactions and other accounting events are required to be reported in financial statements. The iasb replaced the iasc in 2001. It is the ideal guide, update

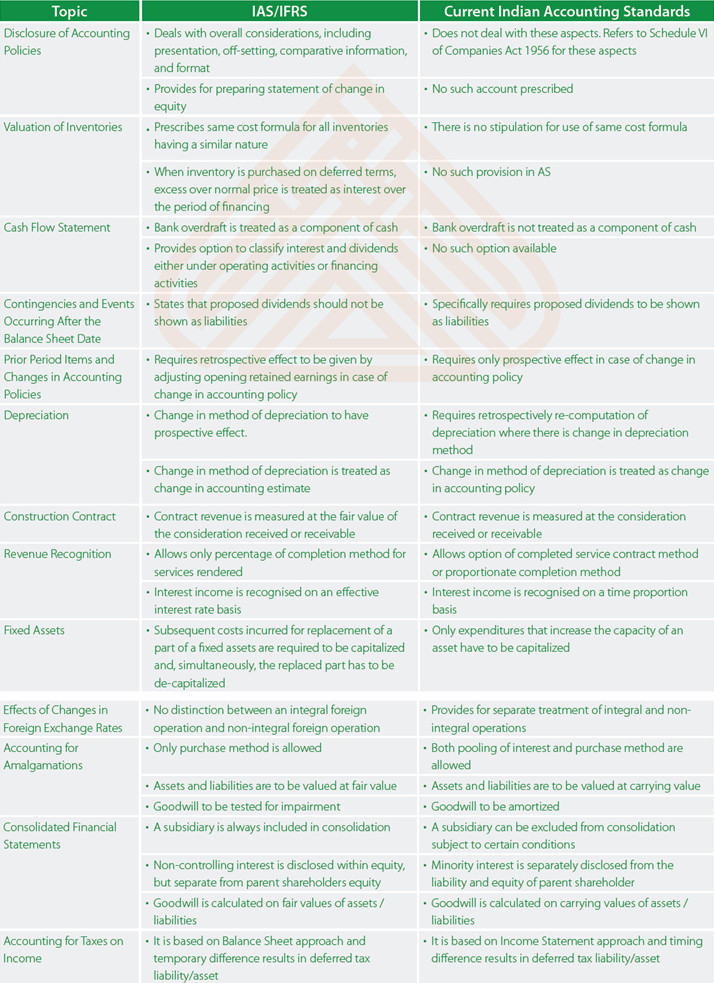

International financial reporting standards (ifrss) and ifrics are accounting standards and interpretations published by the international accounting standards board (iasb). In preparation for the adoption of ind as 117, the equivalent to ifrs 17 'insurance contracts', the insurance regulatory and development authority of india (irdai) has announced the reconstitution of its expert committee dedicated to the implementation of indian accounting standards (ind as) and international financial reporting. International accounting standards (iass) and international financial reporting standards (ifrss) —developed by the international accounting standards committee (iasc) and adopted by the international accounting standards board (iasb);

The bulletin provides a concise list of standards and amendments that became effective during the last year or will become effective in the coming years. International financial reporting standards (ifrs) are a set of accounting standards that govern how particular types of transactions and events should be reported in financial statements. The comprehensive guide to international financial reporting standards.

Bdo has released ifr bulletin 2024/01 summarising the activities in standard setting by the iasb during the year 2023. Our standards tracker is a unique tool that allows members to quickly and easily identify the version of a standard which is applicable to a particular accounting. Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health.

International accounting standards (iass) were issued by the iasc from 1973 to 2000. The iasb will also reissue standards in this series where it considers it appropriate. Backing this up is information about the board and an analysis of the use of ifrs standards around the world.

/paper-with-title-international-financial-reporting-standards--ifrs---850740234-6e303822ed5e4800b523b0ac24db396c.jpg)