Beautiful Work Tips About Impairment Of Investment In Subsidiary Journal Entry

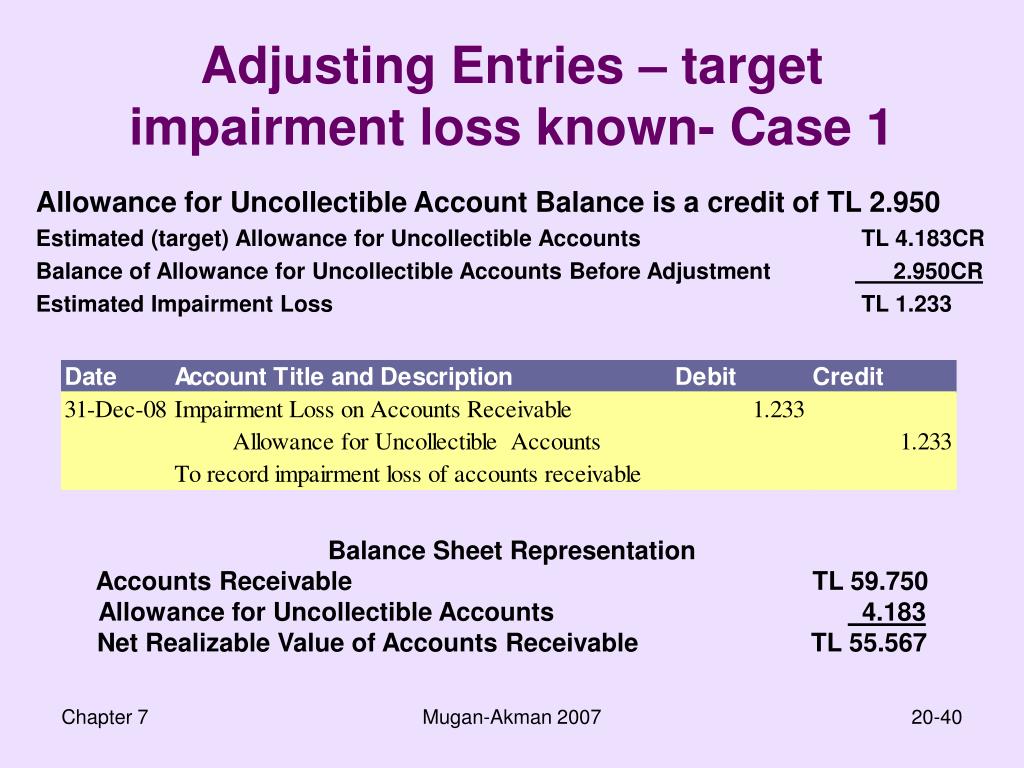

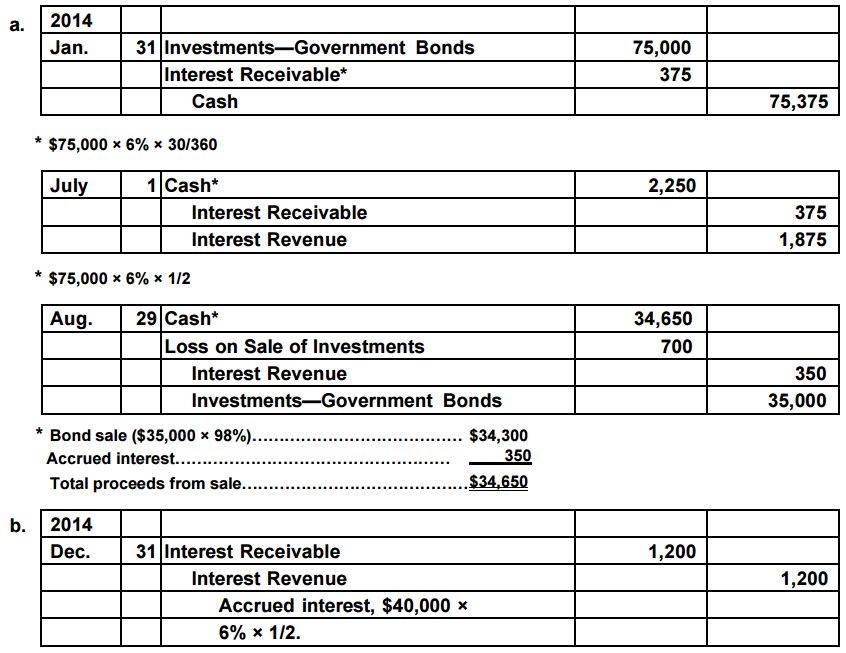

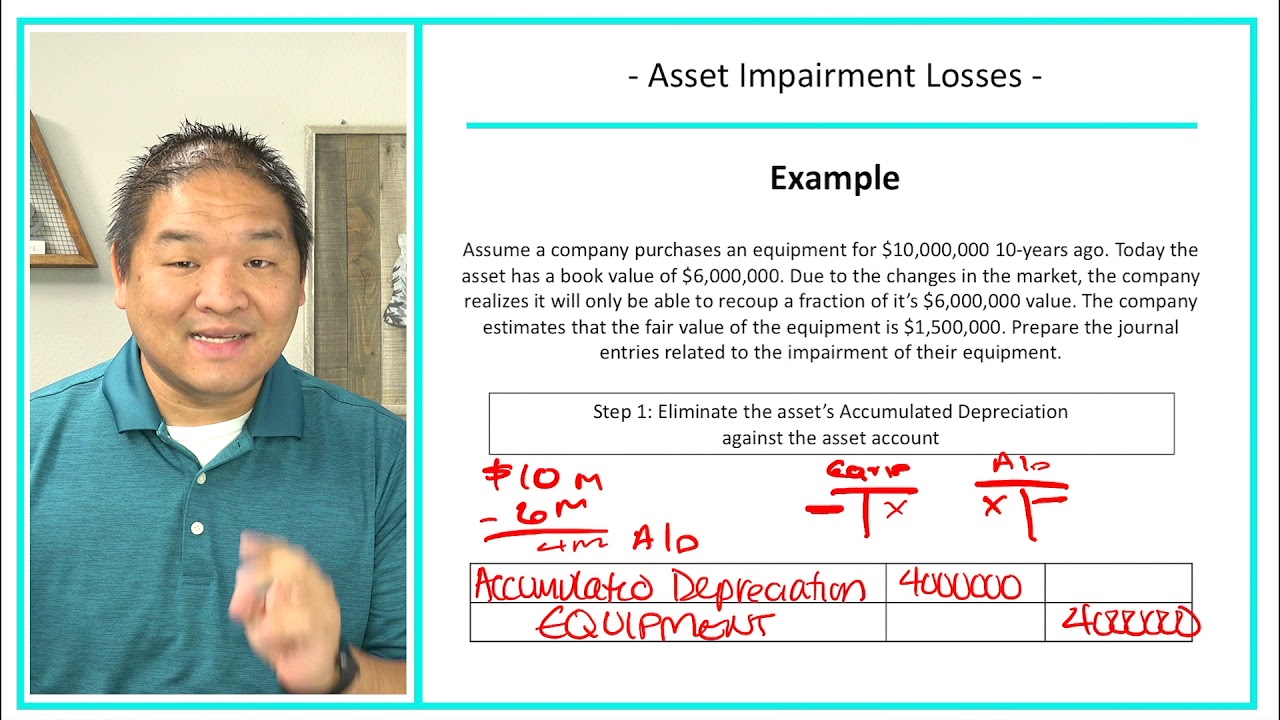

This loss will be as below.

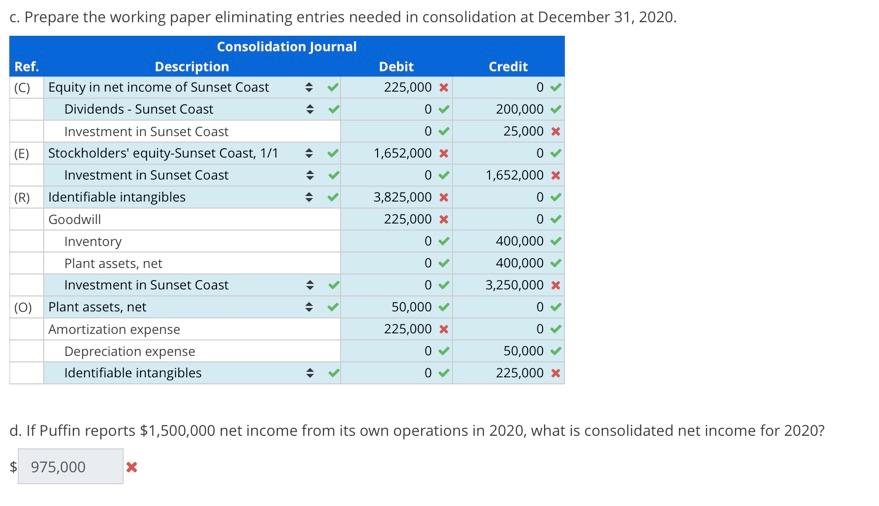

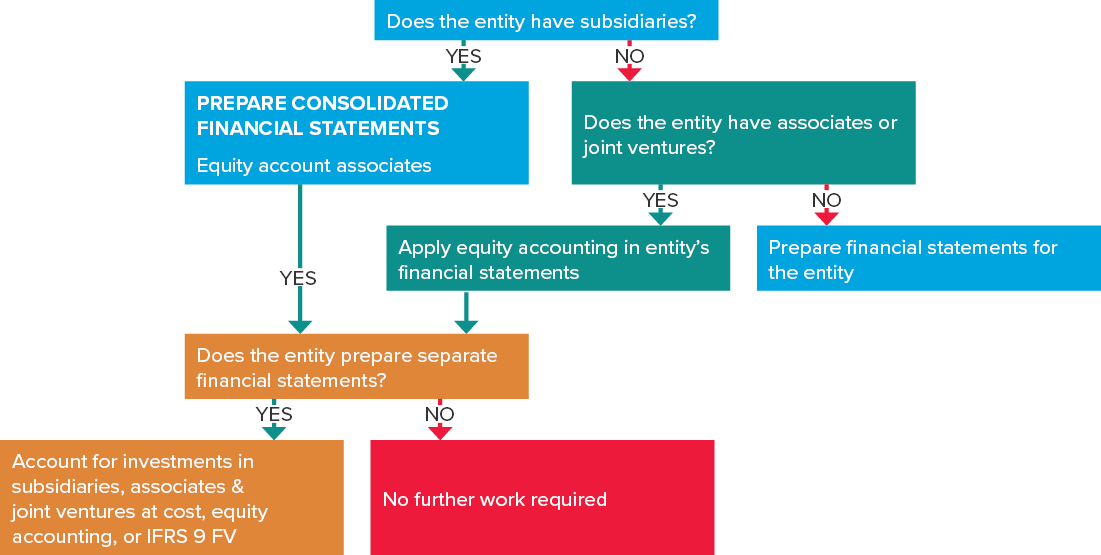

Impairment of investment in subsidiary journal entry. Ias 27 — impairment of investments in subsidiaries, jointly controlled entities and associates in the separate financial statements of the investor date. The proportion of nci net income will be subtracted, only parent profit. Can calculate the impairment loss.

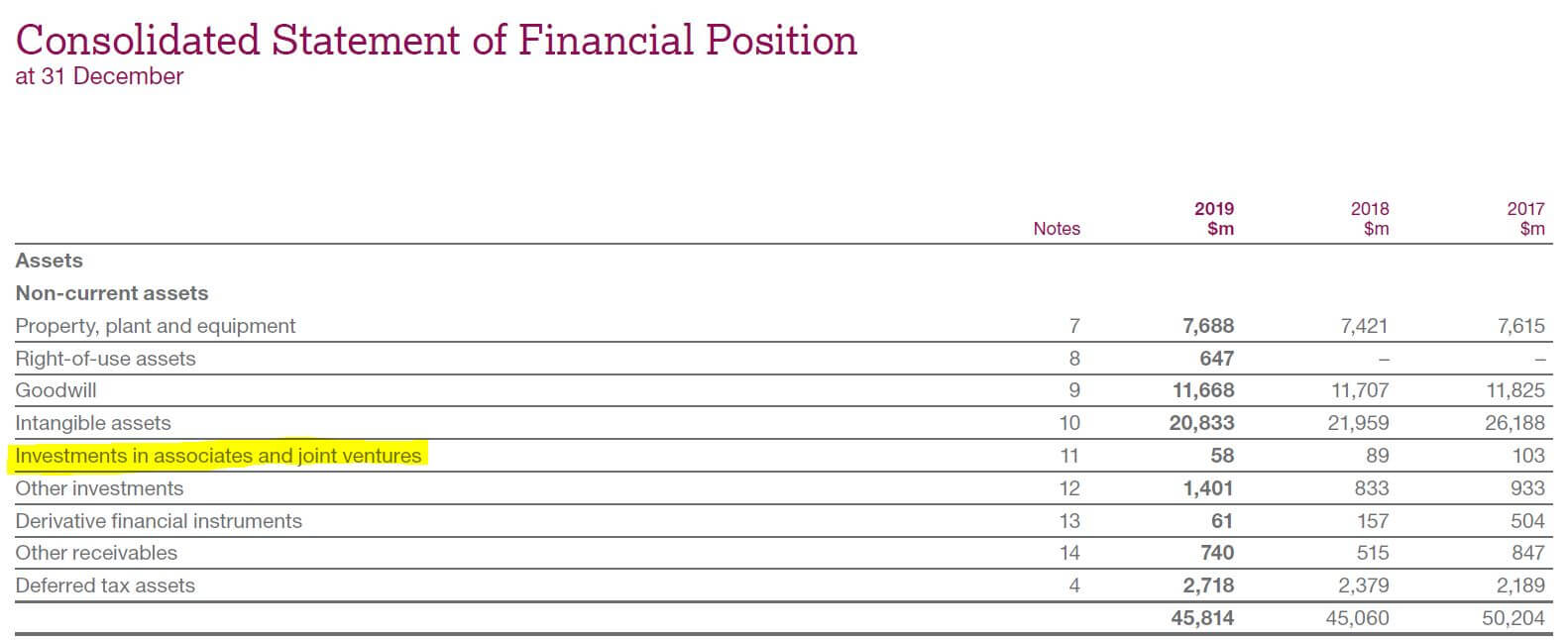

This standard shall be applied in accounting for investments in subsidiaries, joint ventures and associates when an entity elects, or is required by local regulations, to. Impairment of subsidiary 8 posts • page 1 of 1 saadolath posts: Impairment of assets refers to the concept in accounting when the book or carrying value of an asset exceeds its “ recoverable amount.” ias 36 defines the recoverable amount of.

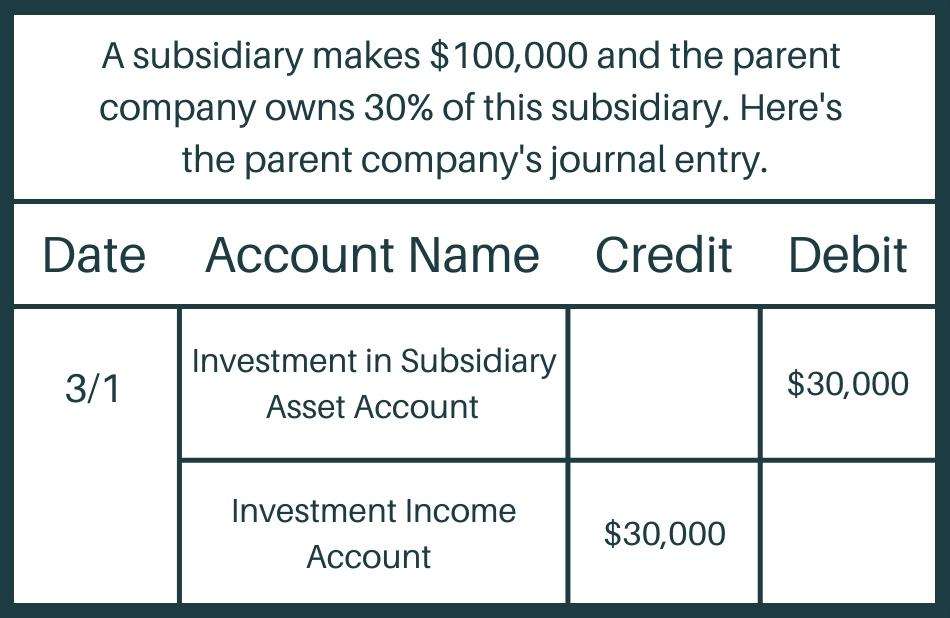

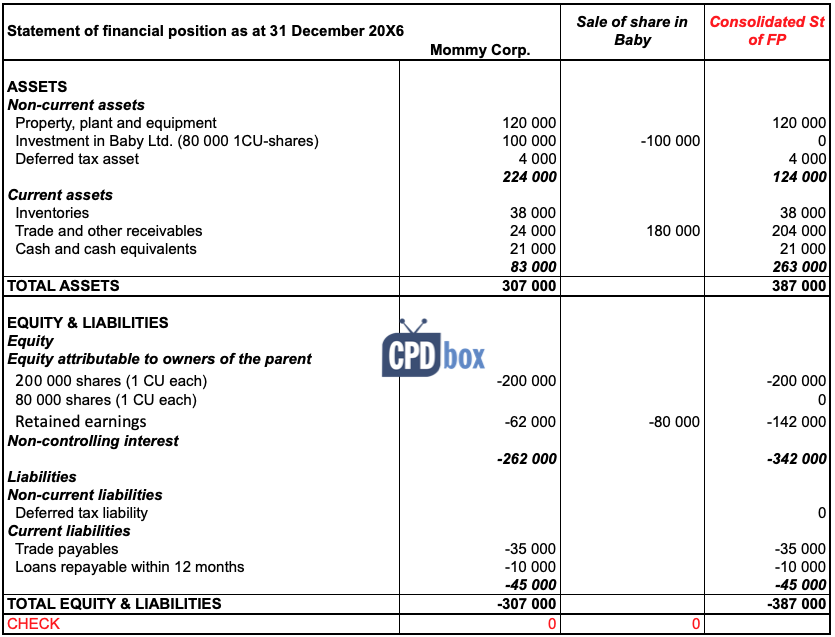

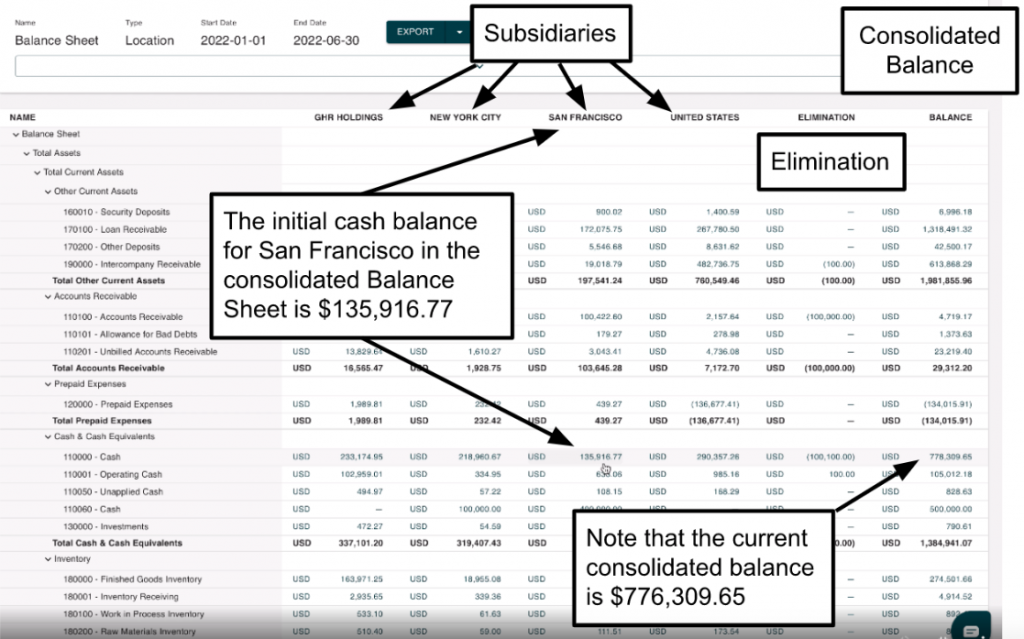

The consolidate 100% revenue and expense into the consolidated income statement. In its parent company financial statements, company a should reflect an investment in subsidiary b of $80, reflecting its proportionate share of subsidiary b’s net assets of. This article focuses on part of this step;

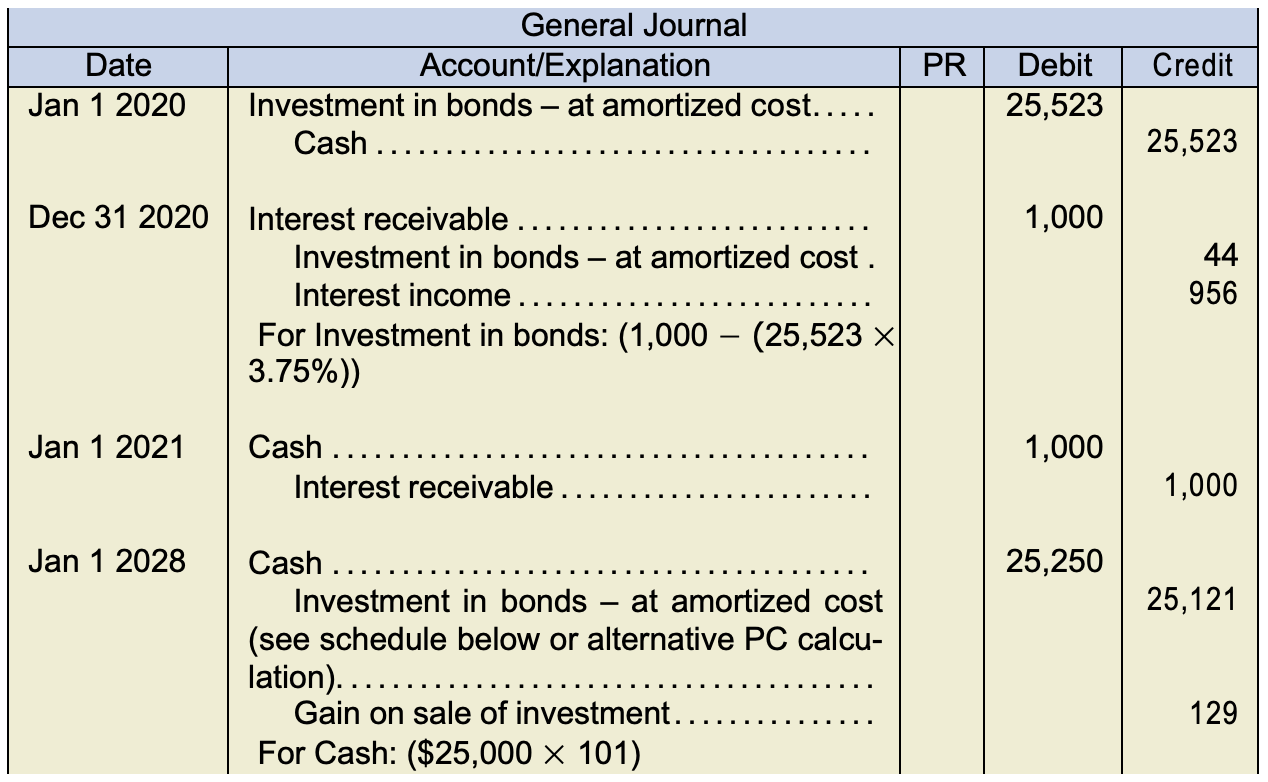

Applying ias 36 impairment of assets. On company b's balance sheet is £1000 relating to the investment of company c and there is now evidence that that investment is impaired by 50%; Investors should be aware of the potential pitfalls, and ensure that the underlying impairment process and controls adequately address challenges associated.

Investments in subsidiaries, joint ventures, and associates. Ias 27.10 sets out specific provisions for investments in subsidiaries, joint ventures, and associates. I understand in company b's subsidiary stats, the entry would simply be debit.

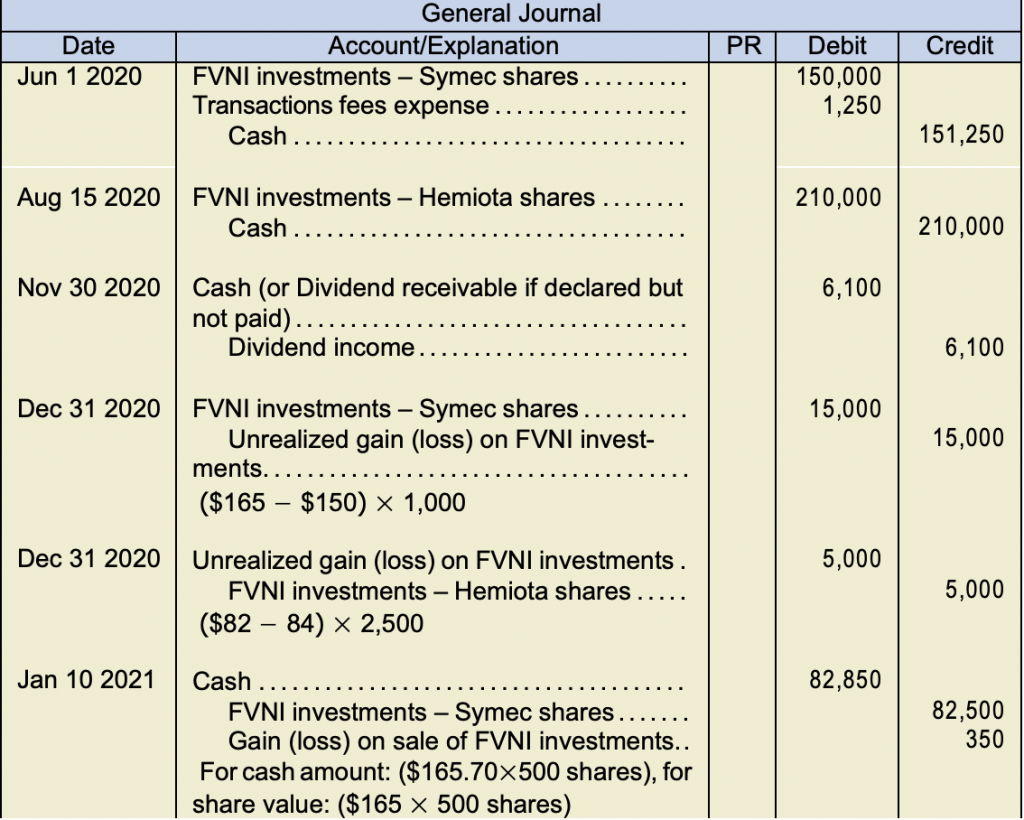

The reversal of an impairment loss reflects an increase in the estimated service potential of an asset (either from use or from sale) since the date when an entity. Step acquisition (ias 27 separate financial statements)—january 2019 the committee received a request about how an. An ‘investment grade’ external rating is a sign that a financial instrument might have low credit risk.

If an entity (investor) receives a dividend from a subsidiary, associate or joint venture (the investee) that it measures at cost in its separate financial statements, it must also. Investment in a subsidiary accounted for at cost: Then, the impairment amount is subtracted from the previous goodwill asset listed on the balance sheet, which will now show $15 million to reflect the current market value of the.

This factsheet is a summary of the basic principles of accounting for impairment. In such a case, the parent company uses the consolidation method for. The investing company is known as the parent company, and the investee is then known as the subsidiary.

Impairment losses are typically recognised on receivables,. Sun dec 22, 2019 9:50 am impairment of subsidiary by saadolath » wed jul 29, 2020. In this case, we can make the.