Ideal Tips About Companies With Qualified Audit Opinion

(a) the auditor, having obtained.

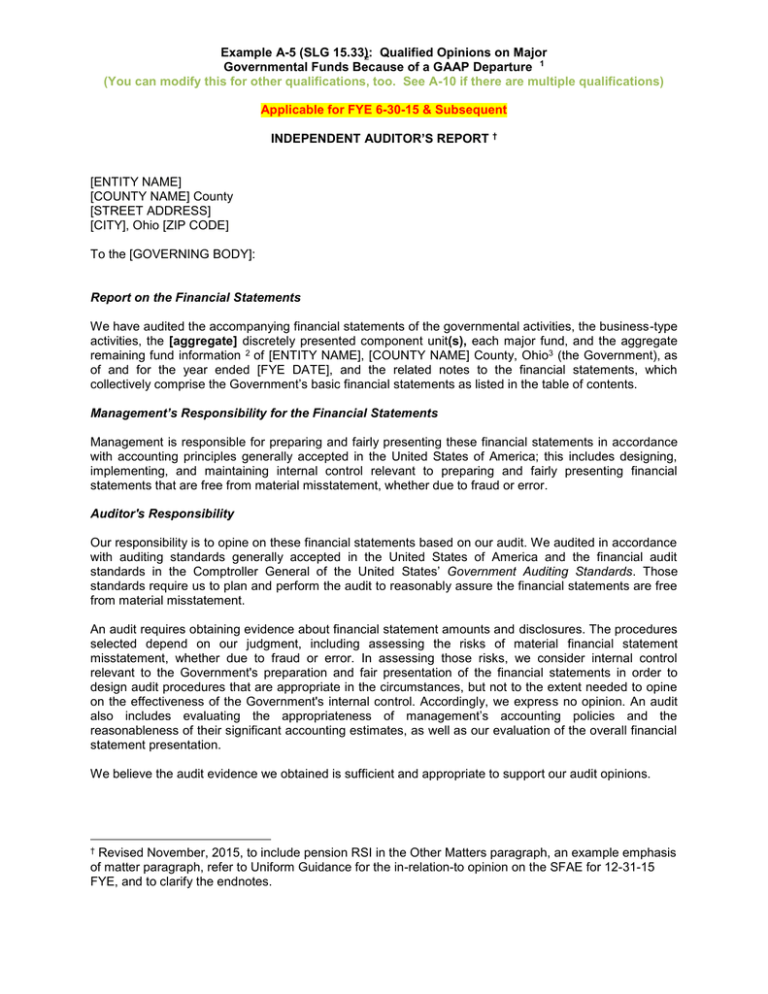

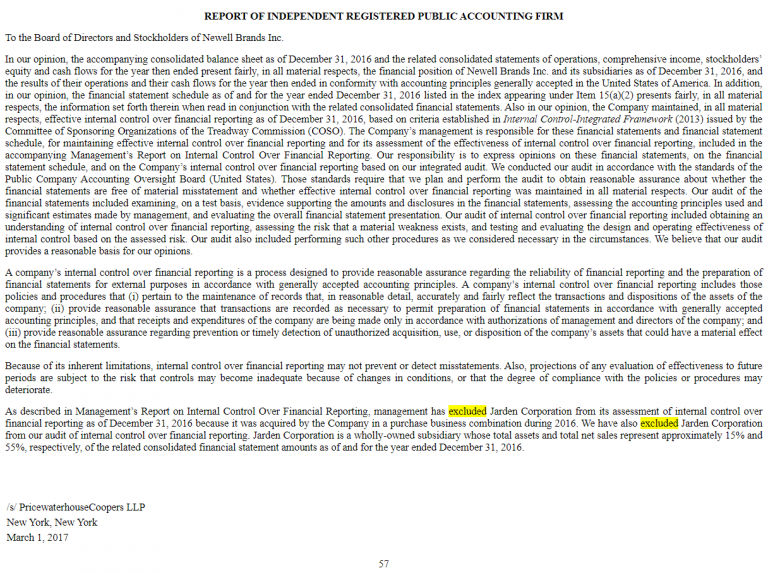

Companies with qualified audit opinion. 16 independent auditors’ report to the members of hmt watches limited report on the audit of the financial from cabinet committee of economic. Uhy lee seng chan & co (“auditors”), have issued a “qualified opinion” and included an “emphasis of matter” in the independent auditor’s report in respect of the audited. The first section of the.

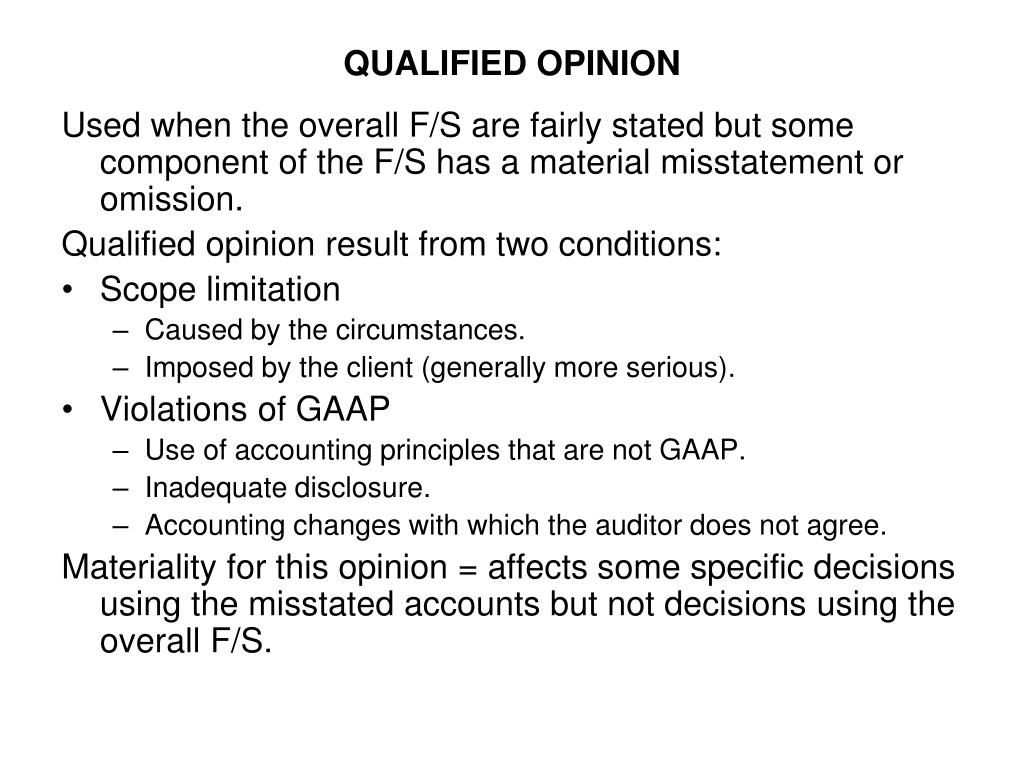

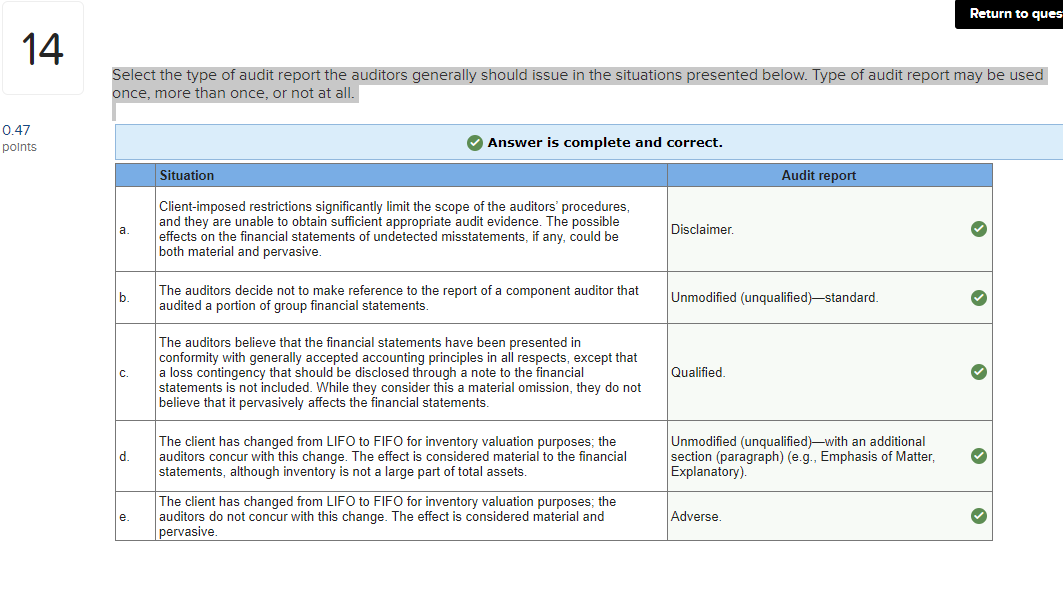

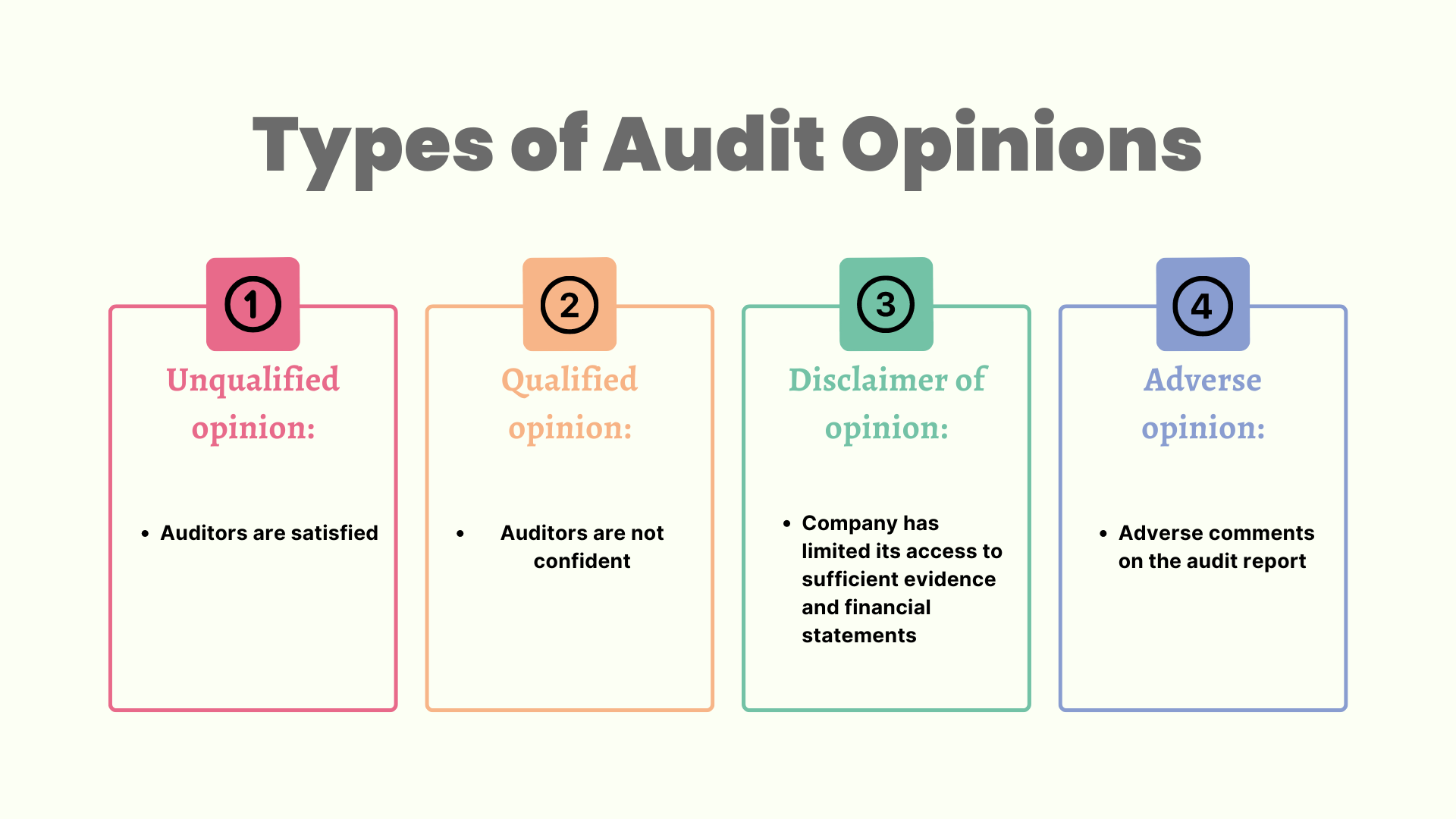

Rule 11 of the companies (audit and auditors) rules, 2014, as amended in our opinion and to the best of our information and according to the explanations given to us: So, in total, there are four types of audit opinion right? This paper aims to investigate the impact of qualified audit opinions on the returns of stocks listed at amman stock exchange (ase) after the.

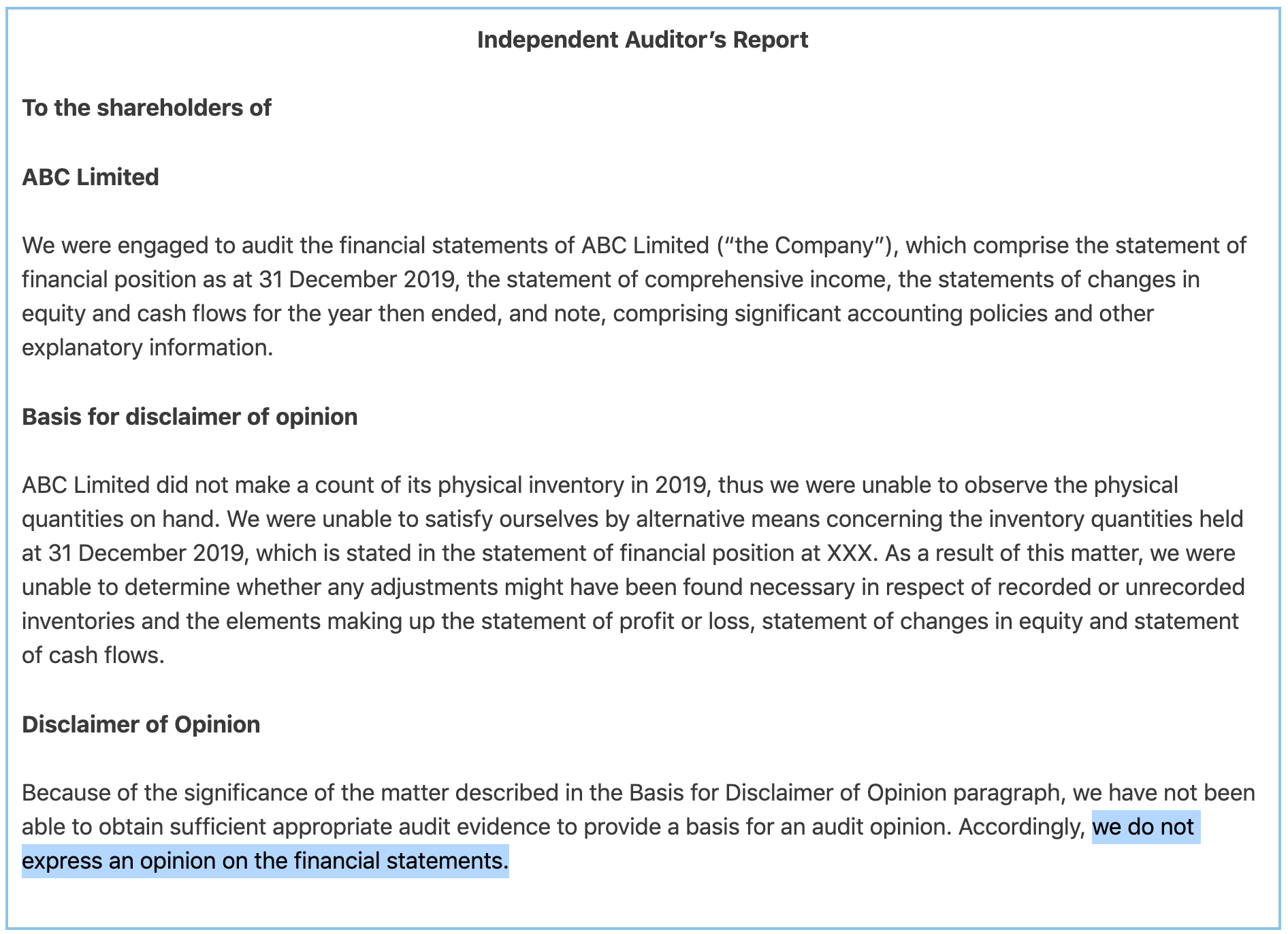

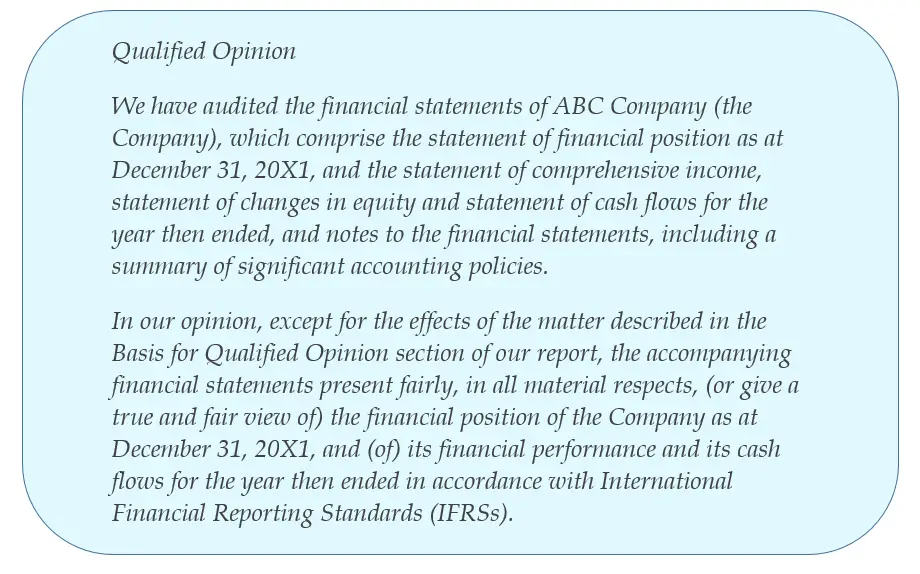

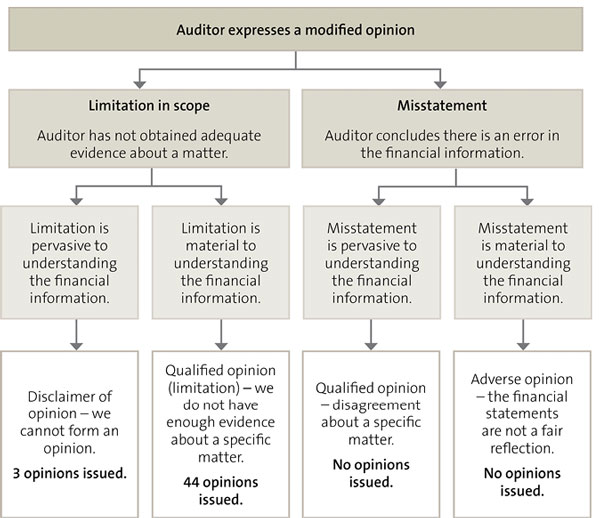

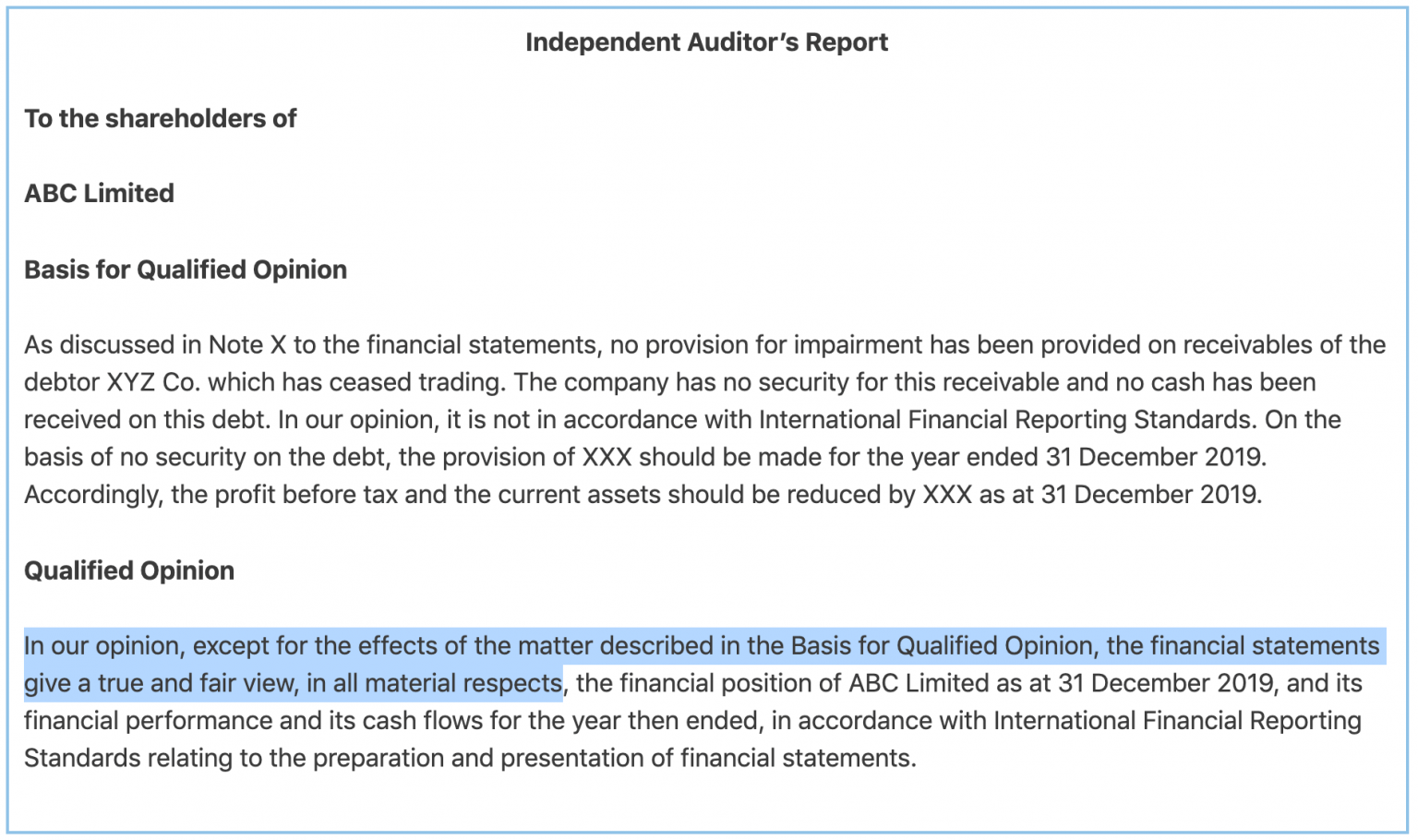

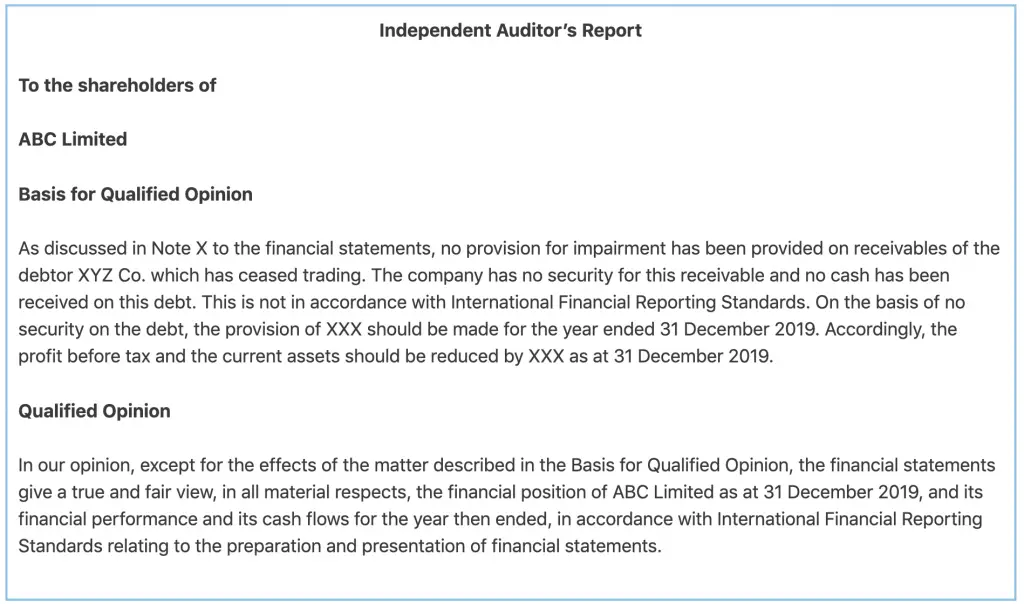

Let’s see the audit opinion flow chart below to gain. Except for that uncertainty, the financial. A qualified opinion is an auditor's declaration that there is an area of uncertainty in a company's financial statements.

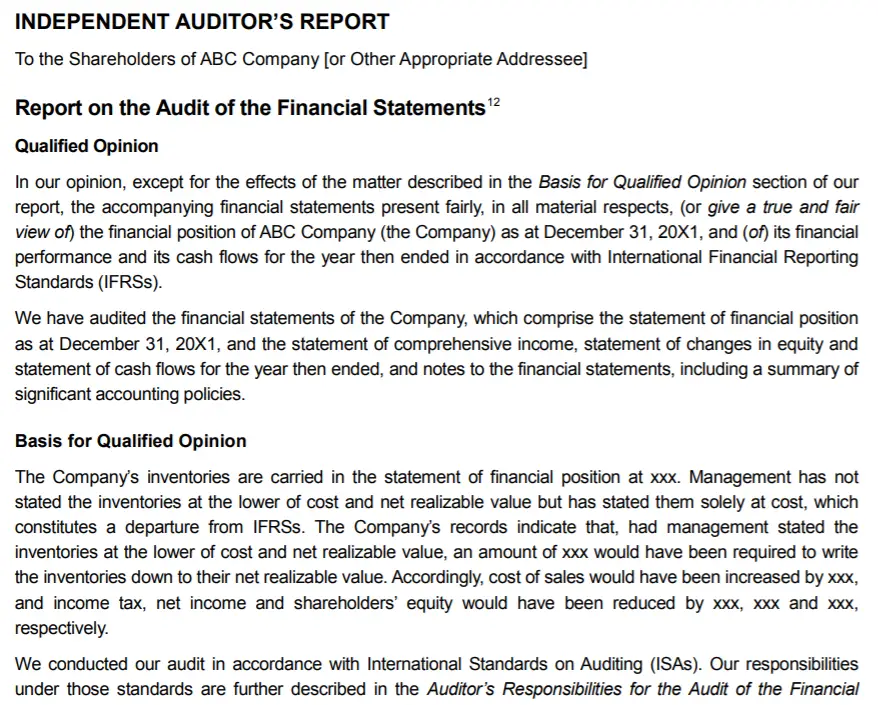

Companies are required to file an independent auditor's written report that contains an opinion as to whether the financial statements are fairly stated and comply in all material. Determining the type of modification to the auditor’s opinion qualified opinion 7. Qualified opinion, an opinion provided by the auditor in the audit report of a listed company, states that the financial statement of the company is not showing true.

Below are three types of modified audit opinions that auditors may form after finding that a firm’s financial statements are pervasive and have material misstatements. The auditor’s report shall be addressed, as appropriate, based on the circumstances of the engagement. An unqualified audit opinion is a “clean report”.

The basics of audit opinions. This means an auditor believes that all gaap metrics and accounting policies. The opinion section is required to be headed up “qualified opinion”.

A qualified opinion is a statement issued in an auditor's report that accompanies a company's audited financial statements. A qualified audit opinion may damage the company’s reputation, result in the loss of investors and lenders, increase regulatory scrutiny, decrease creditworthiness, and result. The auditor shall express a qualified opinion when: