Lessons I Learned From Info About Ifrs 9 Ias

All financial instruments and entities are in the scope of ifrs 9,.

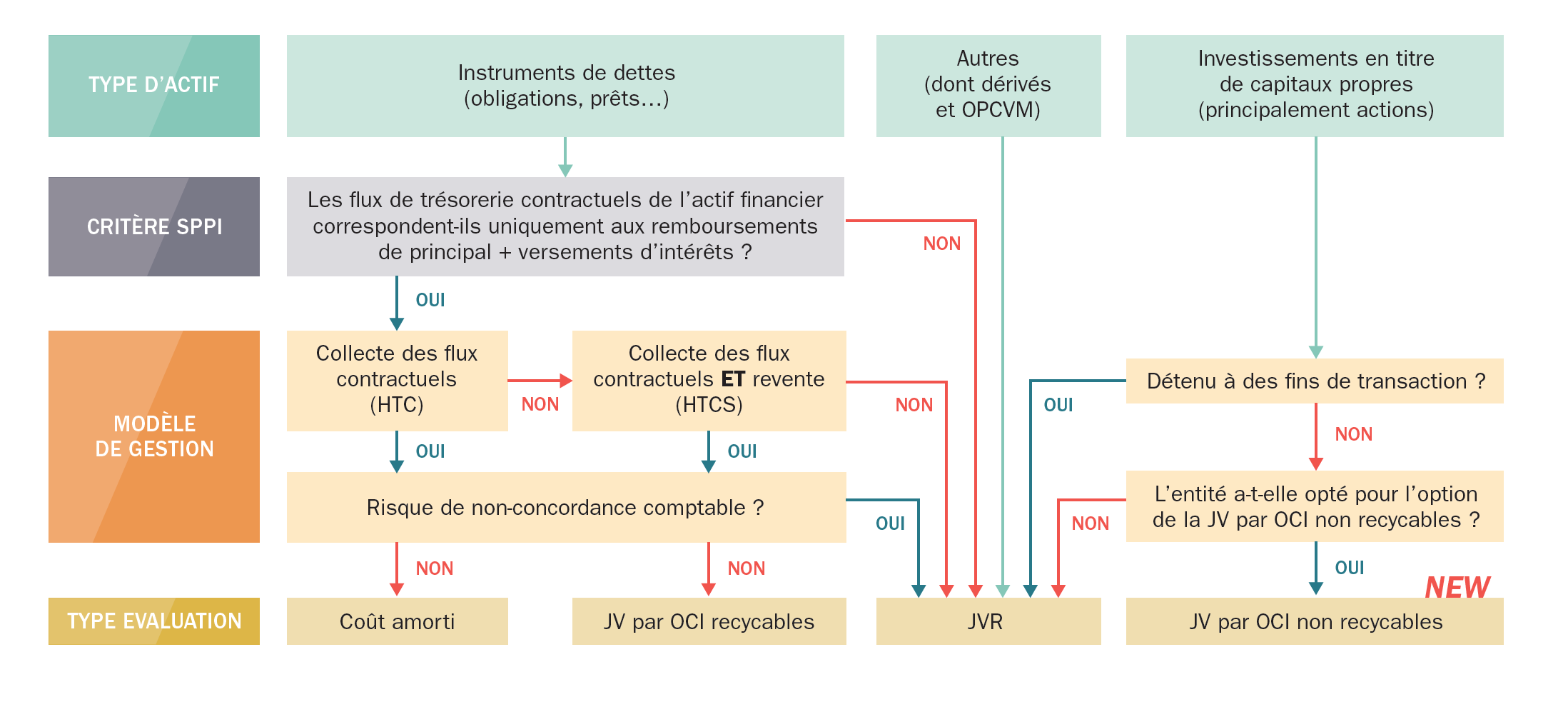

Ifrs 9 ias. Ifrs 9 is effective for annual periods beginning on or after 1 january 2018 with early application permitted. Ifrs 9 sets the guiding principles for financial reporting of financial assets and financial liabilities. These two factors are pivotal to classifying financial assets (ifrs 9.4.1.1):

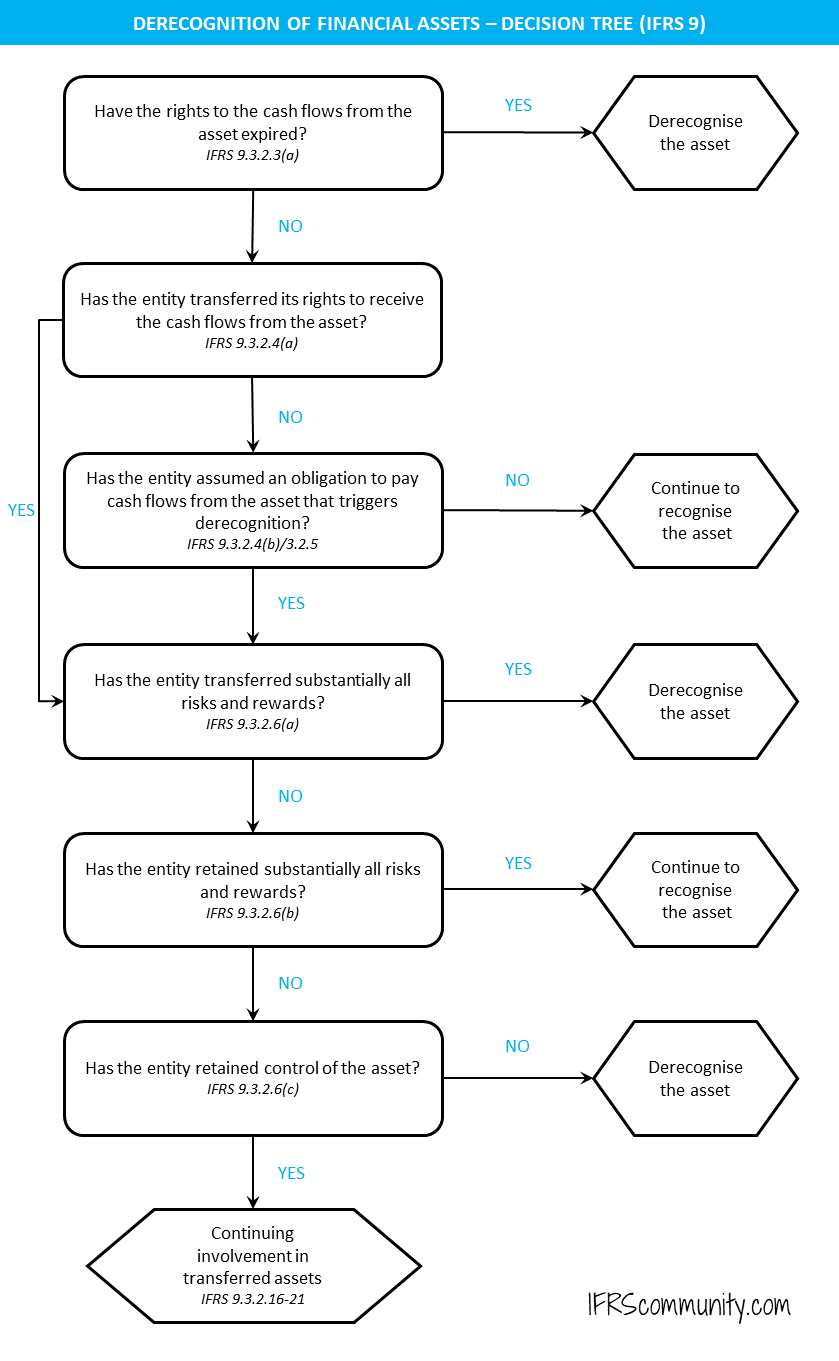

Ifrs 9 responds to criticisms that ias 39 is too complex, inconsistent with the way entities manage their businesses and risks, and defers the recognition of credit losses on loans. The standard is effective for annual. Ifrs 9 financial instruments sets out the requirements for recognising and measuring financial assets, financial liabilities and some contracts to buy.

This page tracks all of our publications tracking the. Reasons for issuing ifrs 9. It addresses the accounting for.

Ifrs 9, financial instruments, as issued by the iasb on july 24, 2014 (ifrs 9 (2014), supersedes all other prior versions of ifrs 9. Ifrs 9 financial instruments is the iasb’s replacement of ias 39 financial instruments: Consequently, although ifrs 9 is effective (with limited exceptions for entities that issue insurance.

International accounting standards (iass) were issued by the antecedent international accounting standards council (iasc), and endorsed and amended by the. The standard includes requirements for recognition and.

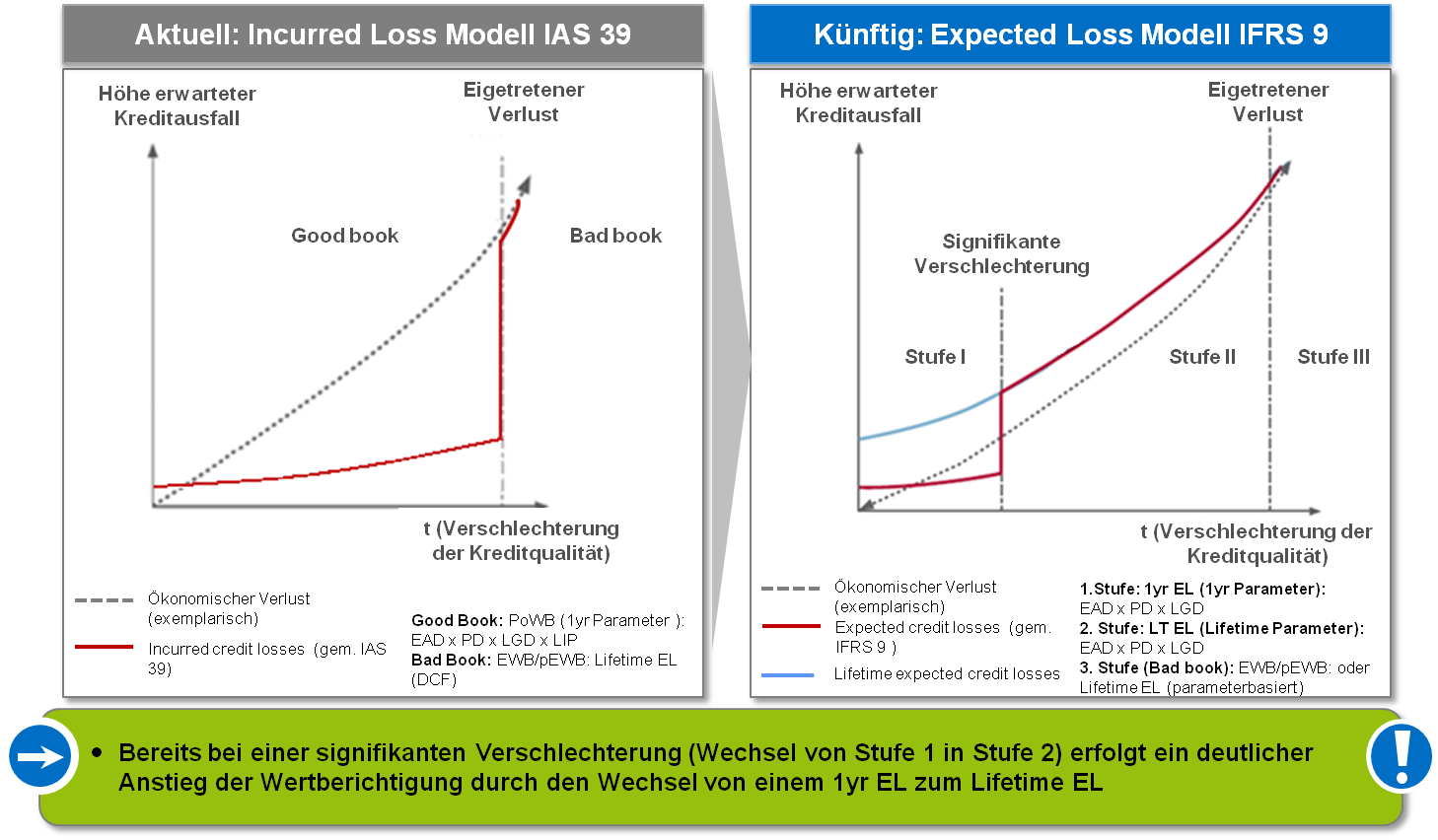

Ifrs 9 is an international financial reporting standard (ifrs) published by the international accounting standards board (iasb). Changes in scope t financial instruments that are in the scope of ias 39 are also in the scope of ifrs 9. The ecl model constitutes a change from the guidance in.

The entity’s business model for managing financial assets, and. All the paragraphs have equal authority but retain. Ifrs 9 requires entities to use ‘expected credit losses’ (ecls) to.

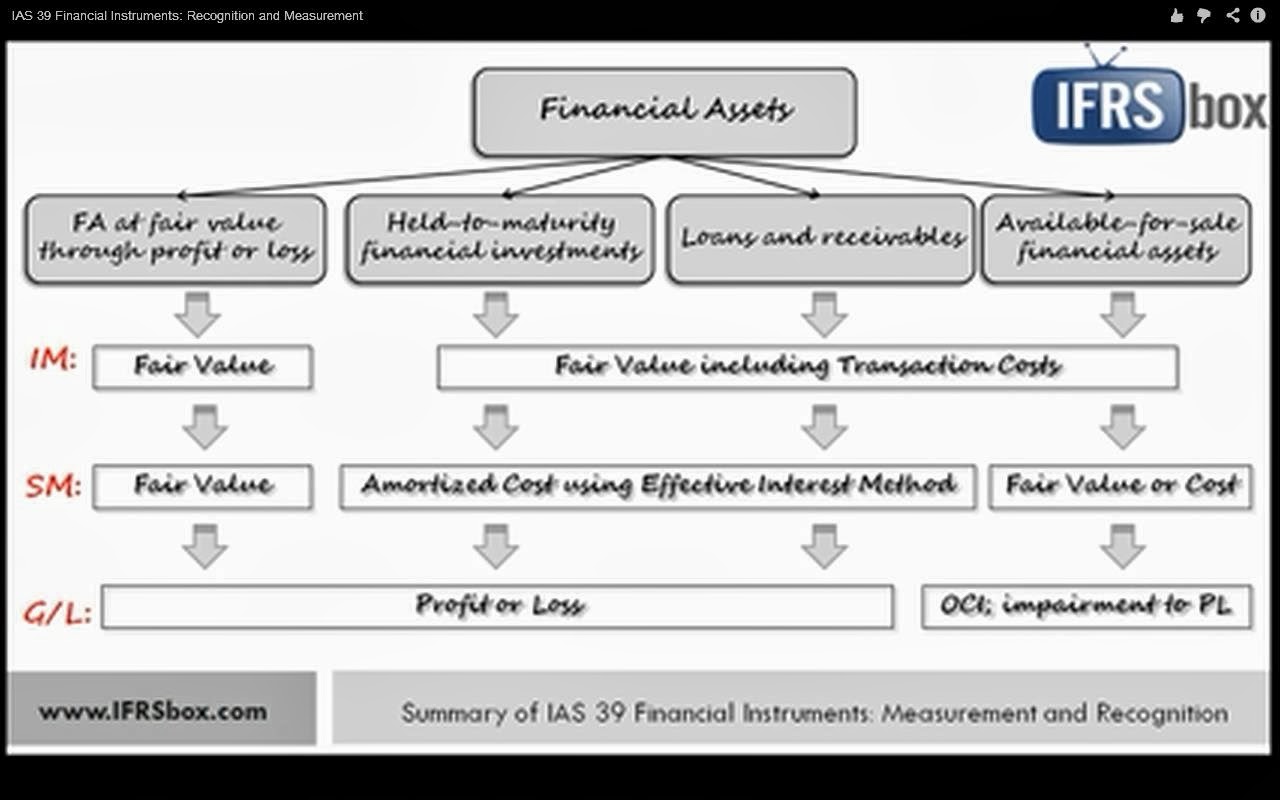

As a replacement of ias 39, financial instruments: Ifrs 9 or to continue to apply the hedge accounting requirements in ias 39. Recognition and measurement, ifrs 9 includes requirements for recognition and measurement,.

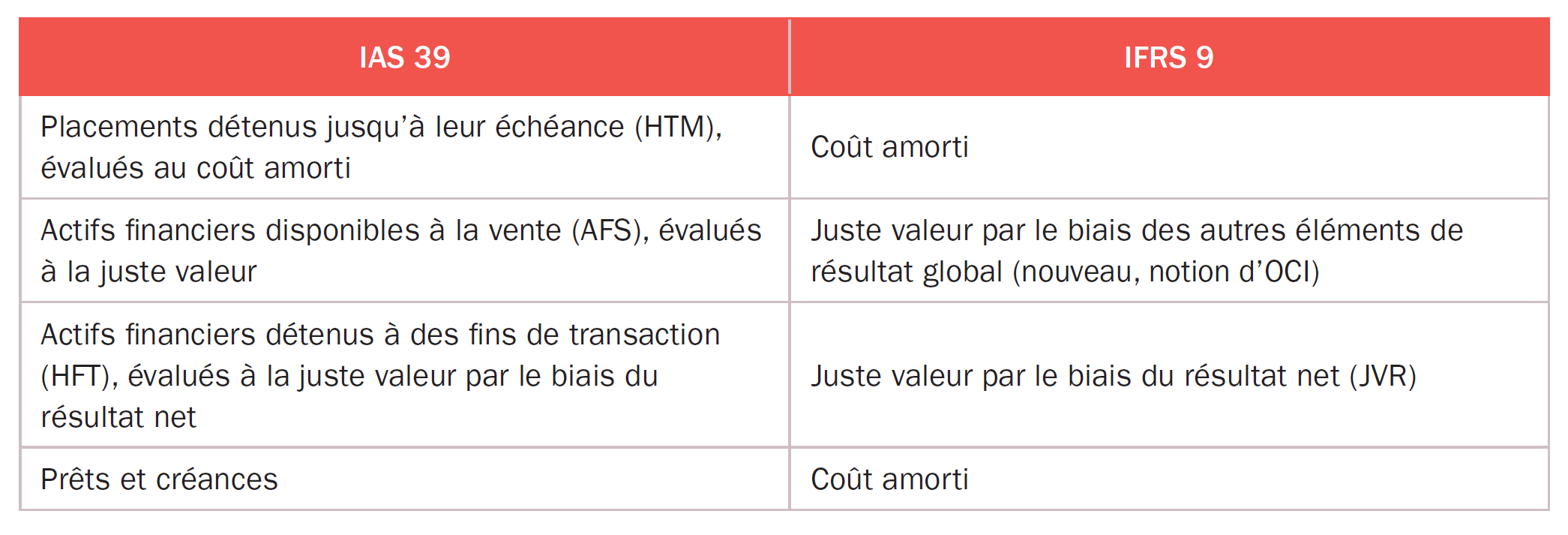

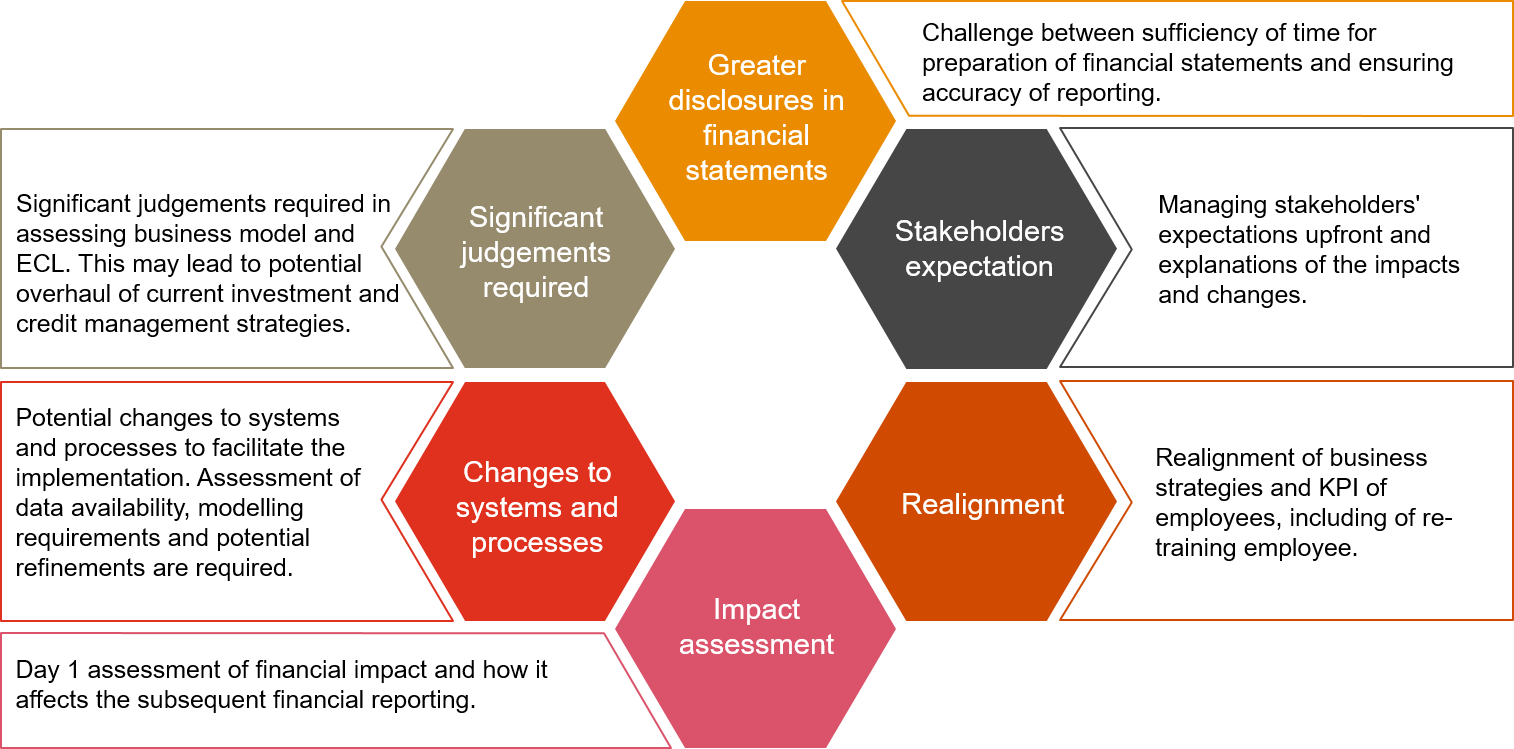

Ifrs 9 financial instruments has been published and is effective for periods beginning on or after 1 january 2018. Disclosuresincluding adding disclosures about investments in equity instruments designated as at fvtoci, disclosures on risk management activities and hedge accounting and disclosures on credit risk management and. The key changes between ifrs 9 and ias 39 are summarized below.

One of the main differences in relation to ifrs 9 vs ias 39 is the approach to impairment. Background (project to replace ias 39) ifrs 9 introduces a single classification and measurement model for financial assets, dependent on both: [ifrs 9 an entity shall apply the impairment requirements in to financial assets that are measured at in accordance with paragraph 4.1.2 and to financial assets that are.

![[PDF] Comparison of IAS 39 and IFRS 9 The Analysis of Replacement](https://d3i71xaburhd42.cloudfront.net/67b3ca92d6a9916b419602abe09bd860d20fc48b/3-Table1-1.png)