Fun Tips About Negative Cash Flow From Operations

3 the rise is striking.

Negative cash flow from operations. Often, it reveals temporarily mismatched expenditures and income. Negative cash flow occurs when a business spends more than it makes within a given period. Sometimes, they even lose money and experience negative cash flow on purpose to invest in something that will produce massive profits in the future.

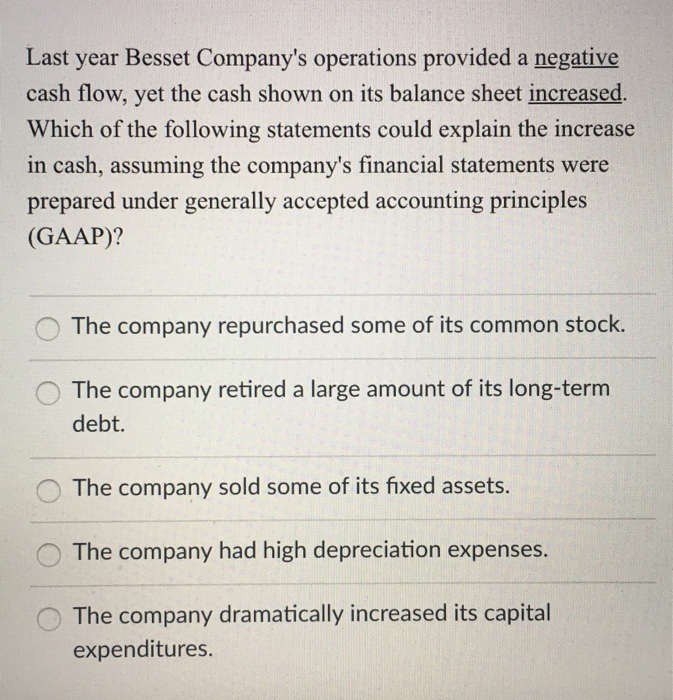

When you dig deeper, you could discover that you have; Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. A negative operating cash flow could signal trouble as it means the core business is not generating enough cash to sustain its operations.

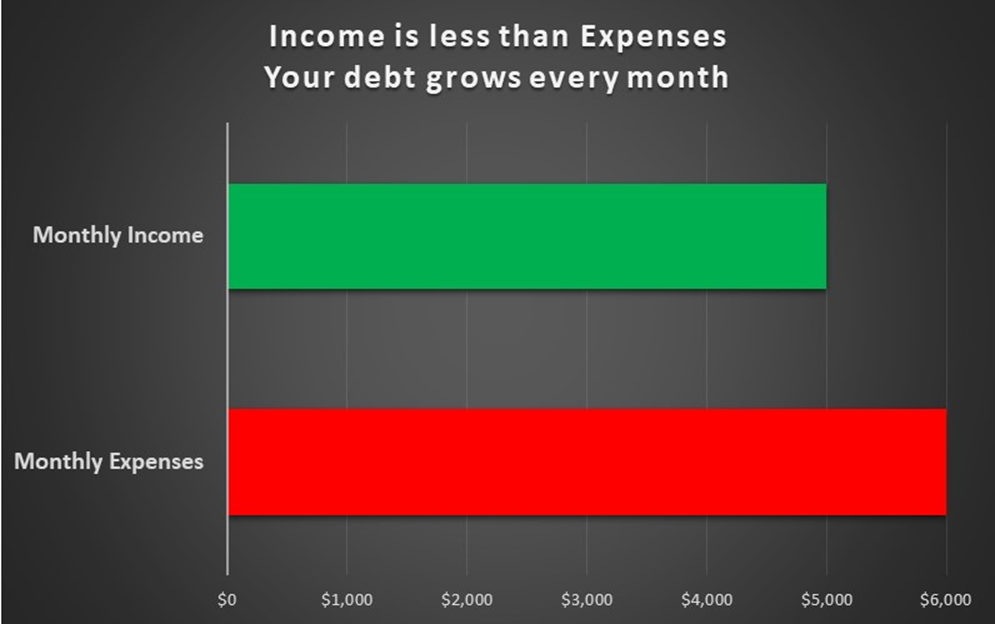

This means that the company has no excess cash on hand in a given period, which could be a sign of poor financial health. Negative cash flow occurs when a business spends more than it makes within a given period. For example, your payments may be due before you receive your income and you may spend more than what you have.

Will reduce spending on us shale operations as it seeks to improve cash flow to repay debt, resulting in largely flat production this year. Prior to 1980, the percentage of firms with negative ocfs. Negative cash flow is when your business spends more than what it receives, but this need not always indicate a loss.

In this case, depreciation and amortization is the only item. Sometimes, your cash flow is negative. Unlike other financing options, card payments could be treated like accounts payable.

To decide if a company's negative. A negative operating cash flow reflects the fact that a company has not been able to generate real positive cash flows from its operations within the measured time period. Adjust for changes in working capital.

Negative cash flow is a common financial. This implies the total cash inflow from the various activities, which include operating activities, investing activities, and financing activities during a specific period under cons. Often, it reveals temporarily mismatched expenditures and income.

A company with a positive cash flow from operations is able to generate enough cash to meet its financial obligations, while a company with a negative cash flow may struggle to meet its obligations and may be at risk of defaulting on its debts. Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the gdp of all but two. Cash flow from operating activities:

By providing a means to unlock cash flow and improve working capital, credit cards effectively allow corporations to bridge the gap between when they have to pay their suppliers and when they get paid. 1 plots the percentage of the sample that reports negative operating cash flows (ocfs) in a given year, defined as cash flow from operations as reported on the statement of cash flows. This category records a company's operating cash movement, the net of which is where operating cash flow is derived.

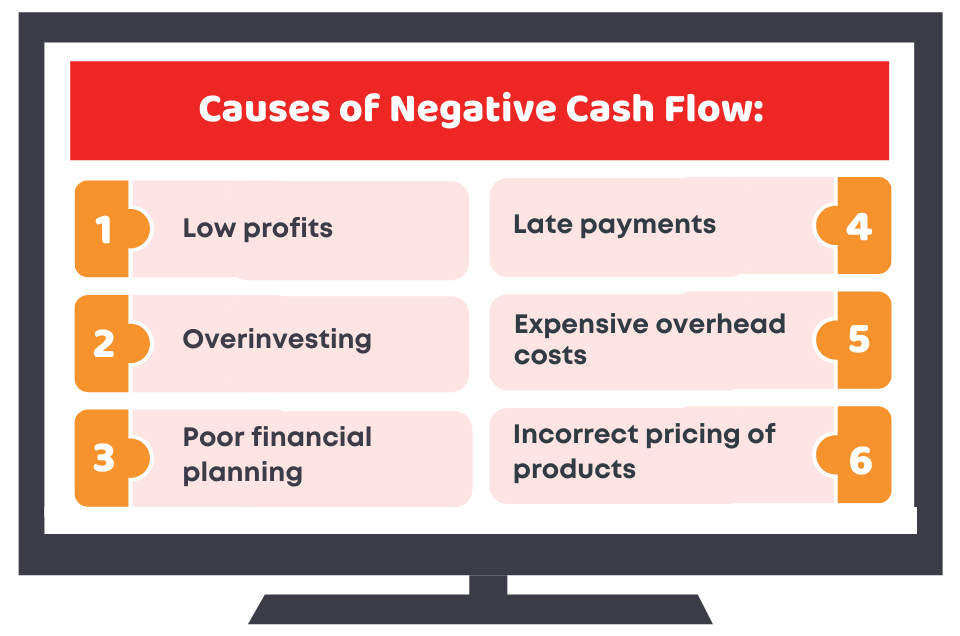

What are the reasons for negative cash flow? The ocf calculation will always include the following three components: February 13, 2024 at 10:00 pm pst.

/GettyImages-612737000-005e93c7d1614e3dbfd3b424f0570349.jpg)