Have A Tips About Retained Earnings Consolidation

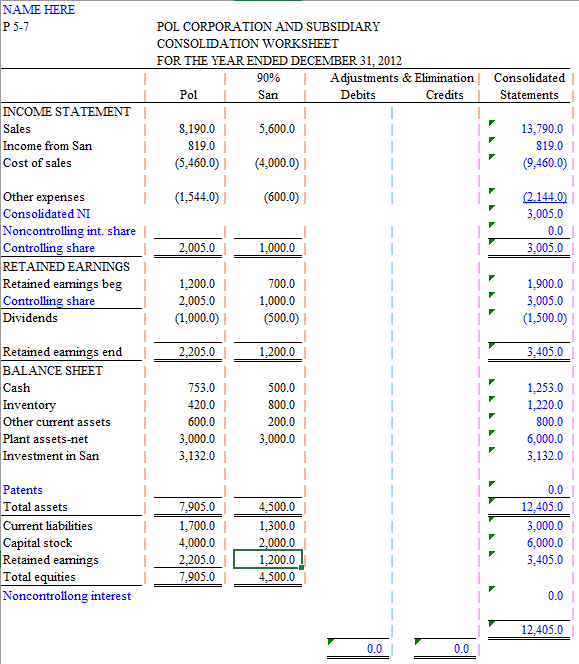

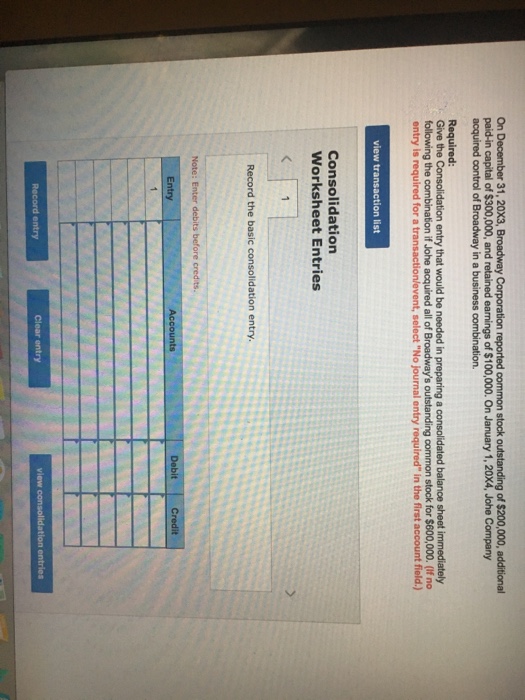

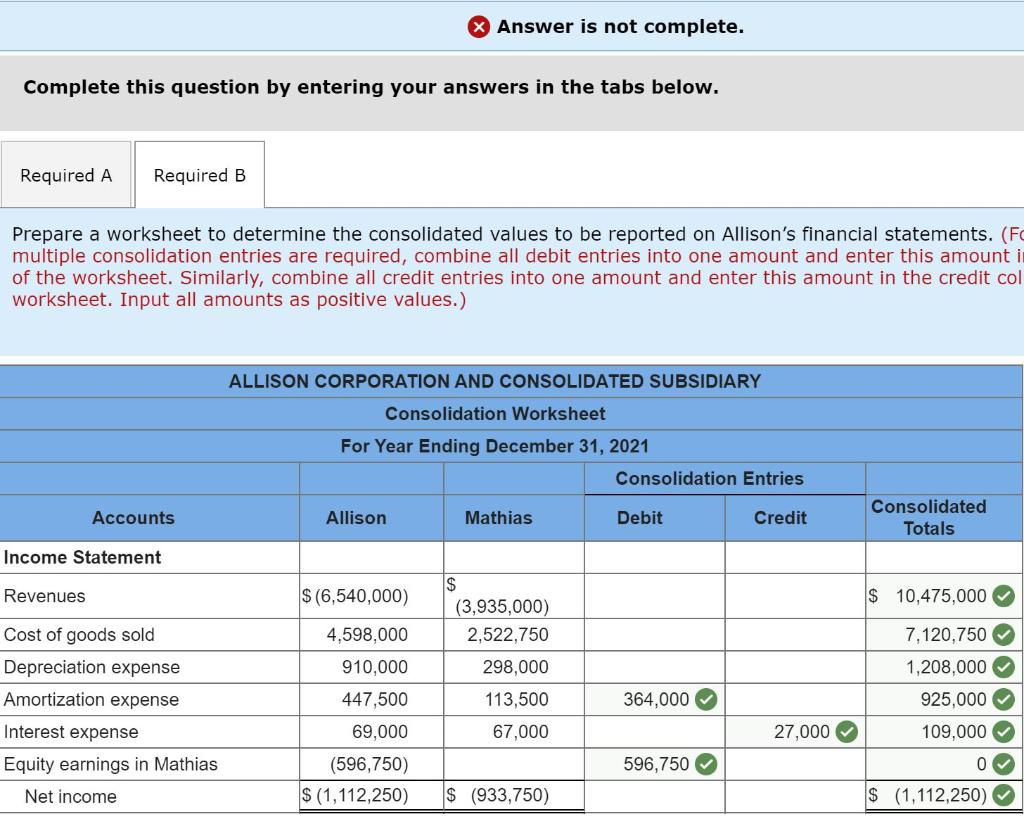

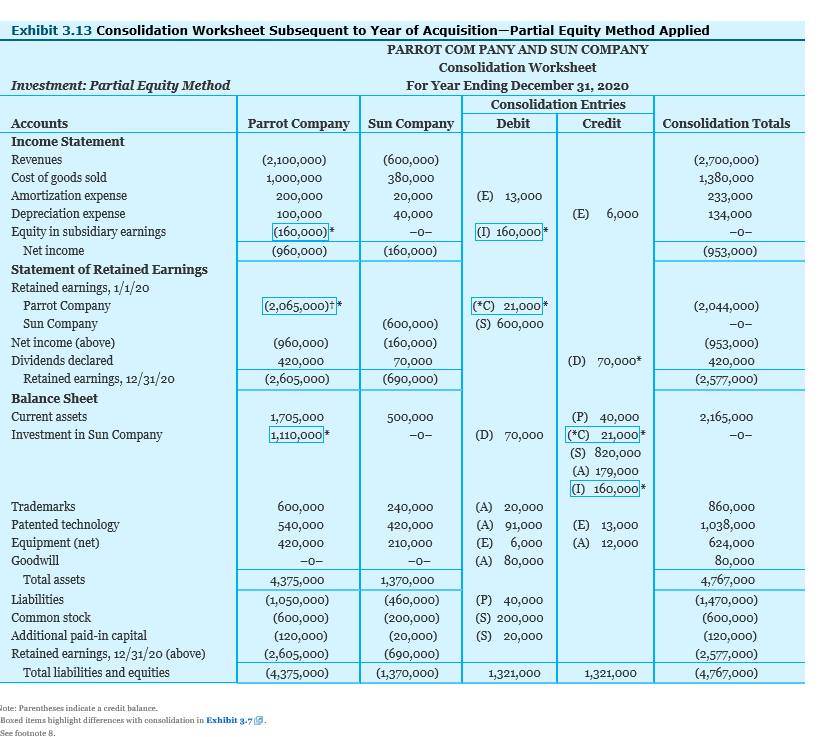

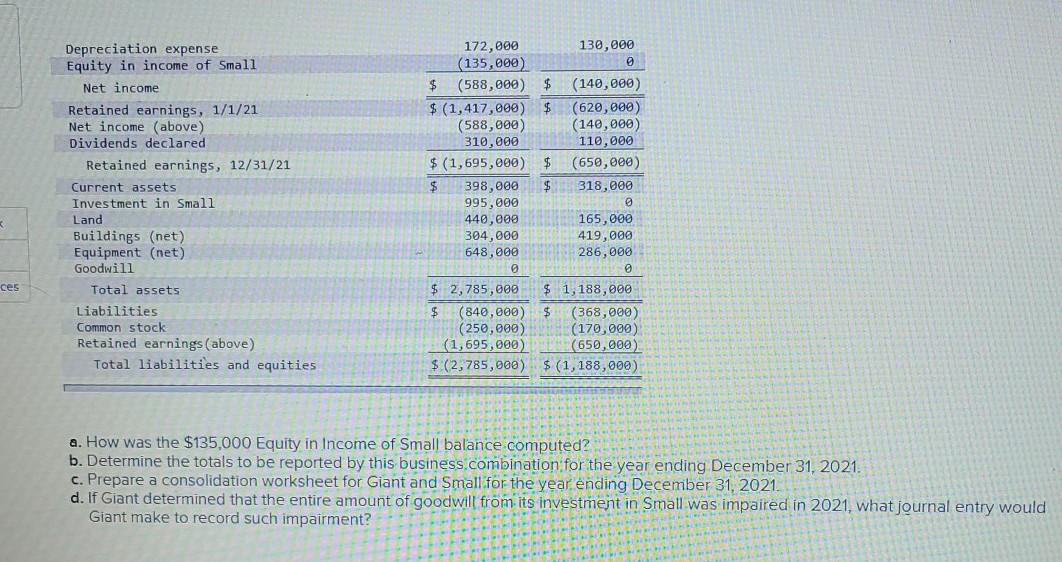

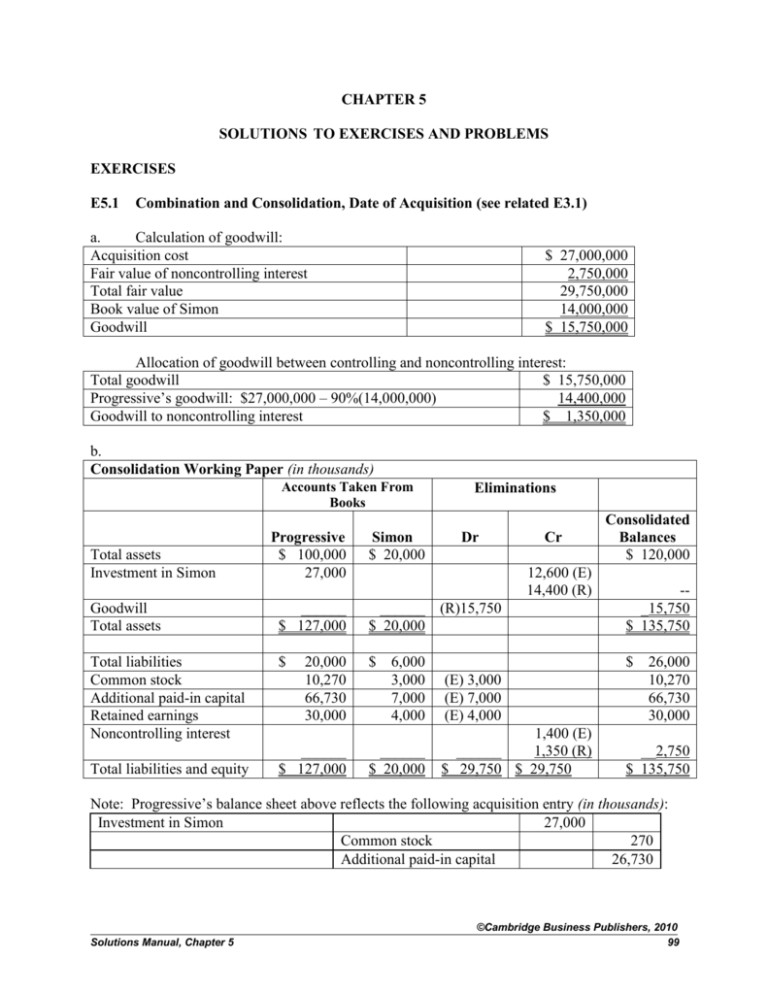

Retained earnings consolidation. While the term may conjure up images of a bunch of suits gathering around a big table to talk about. This section summarises ifrs 10’s main requirements, provides insights into areas where ifrs 10 most often impacts consolidation assessments and explains how ifrs 10 fits. With the above calculations, the following pair of consolidated adjustment entries were prepared:

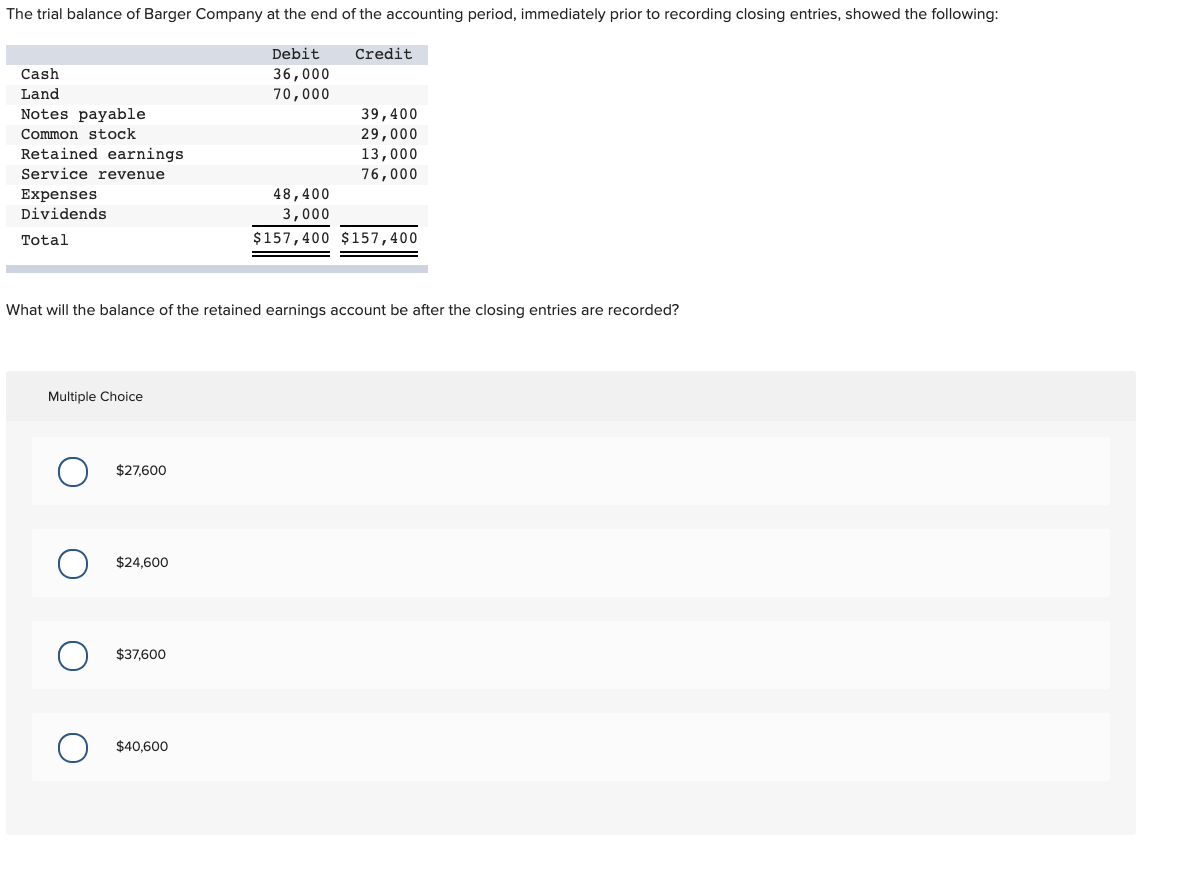

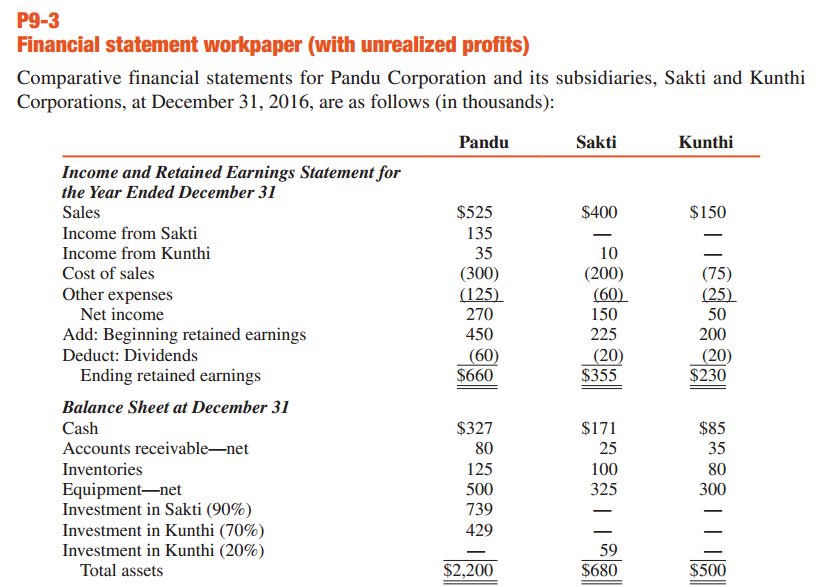

In this example, it’s appropriate to present the retained earnings by the individual years when they were generated, because you need to apply different rates to translate them. It is all of the retained earnings of alice (189,000). Calculate ending retained earnings balance.

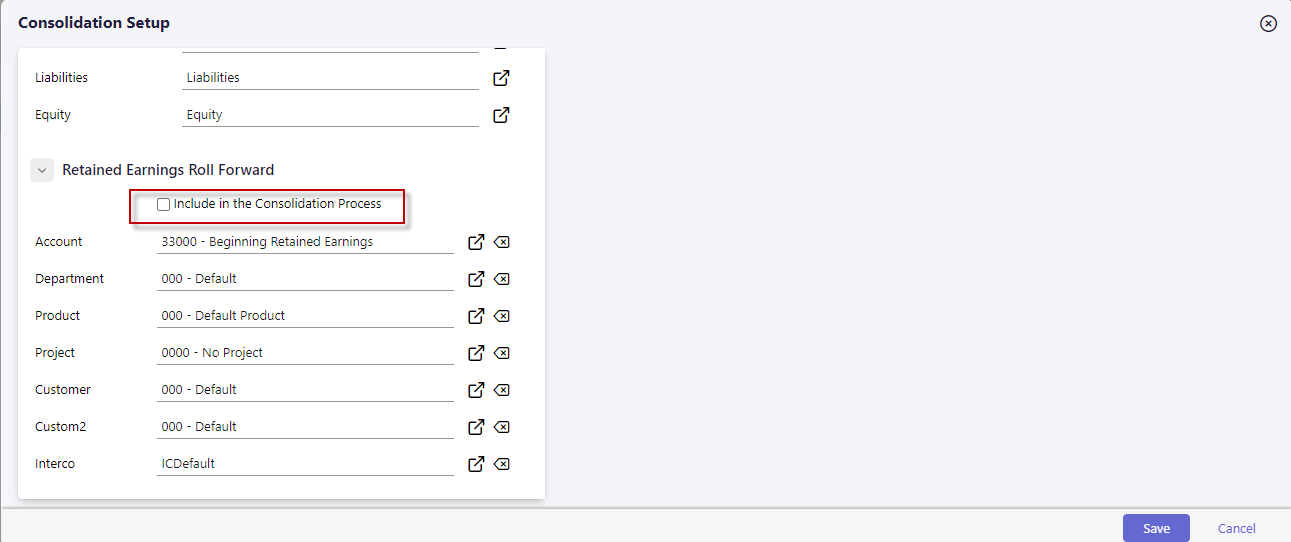

January 2, 2022 6 minutes to read accounting & taxes retained earnings. This chapter builds an understanding of the techniques used to consolidate the separate balance sheets of a parent and its subsidiary immediately subsequent to. What should the consolidated retained earning be?

S is purchased on the reporting date,. Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and. Share premium may be presented as ‘other components of equity’.

Retained earnings is translated using the historical exchange rate because we have assumed that exchange rate at 1/1/x2 had not changed since britannia plc. The statements of financial position of d and j as at 31 december 20x8 are included below: Consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april.

The portion of any gain (loss) recognized that relates to the remeasurement of any retained interest in the deconsolidated subsidiary (or derecognized business) to fair value the. And retained earnings instead of presenting separately a statement of comprehensive income and a statement of changes in equity; For purposes of presenting consolidated financial statements, the reporting entity should reflect its retained earnings balance, which includes its proportionate share of the.

At this date j's retained earnings. Retained earnings comprising profits made by the group. Consolidated retained earnings is a component of shareholders equity on a consolidated balance sheet which represents the accumulated earnings that accrue to the parent.

It equals the parent’s retained earnings purely from its own operations plus. Beginning period retained earnings + net income /. Here this will only include the $30,000 retained earnings of the parent company.

It may also be necessary to ascertain the correct balance on the retained earnings. Retained earnings are calculated by subtracting distributions to shareholders from net income. Ending retained earnings = $230,000.

:max_bytes(150000):strip_icc()/appropriated-retained-earnings.asp_Final-bd22f4f9a28c4dc3a07e7d95890f5910.png)