Formidable Info About Salaries Expense In Balance Sheet

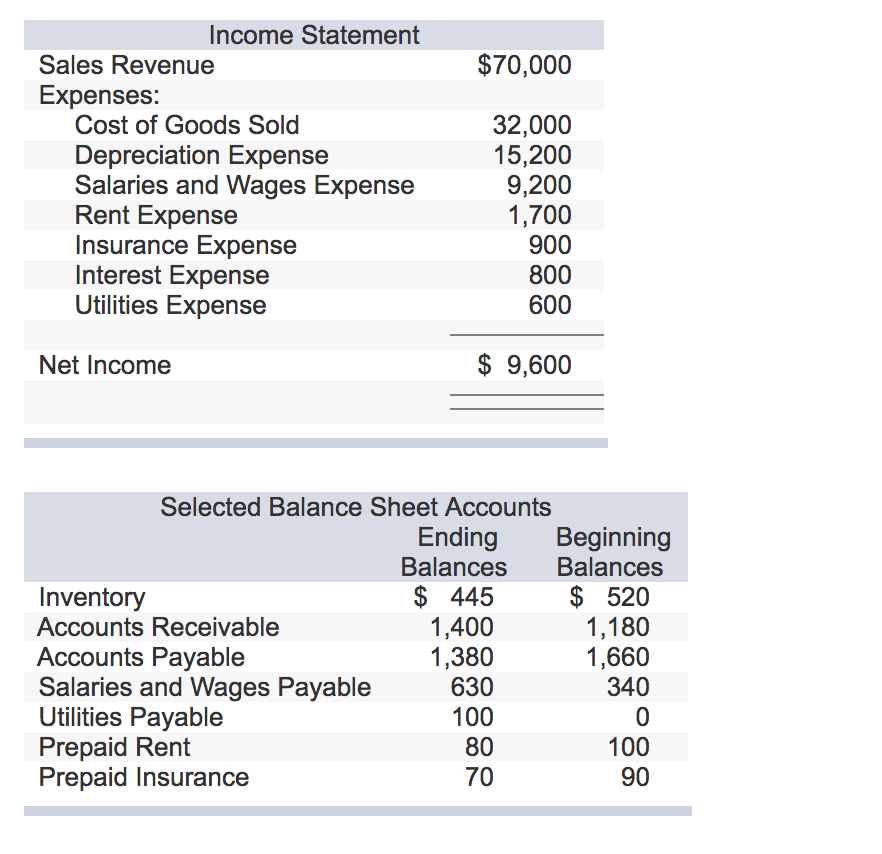

A decrease in cash, prepaid expenses, supplies on hand, inventory;

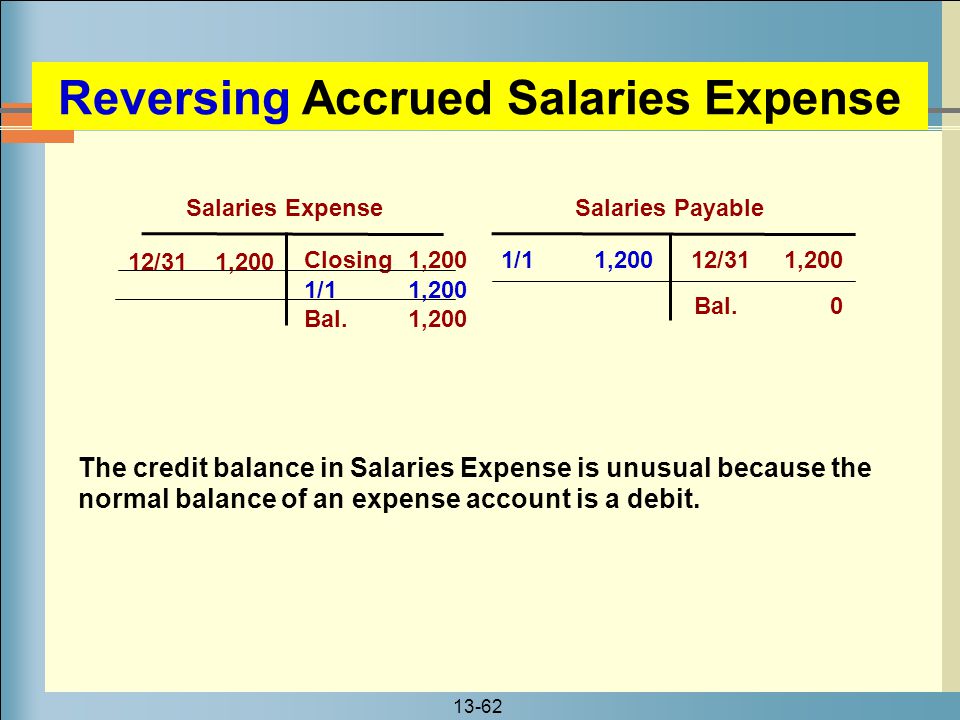

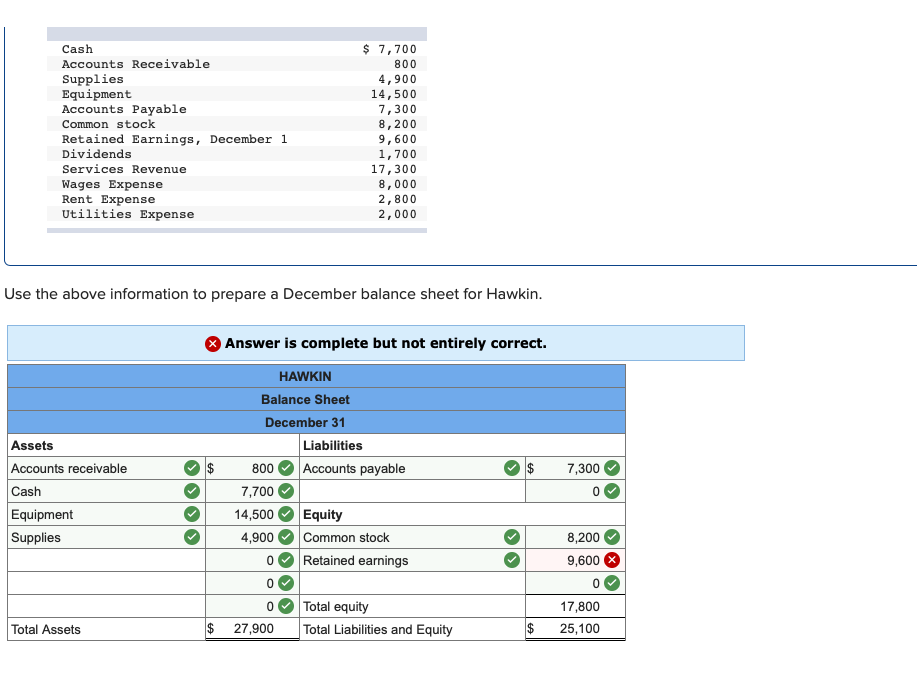

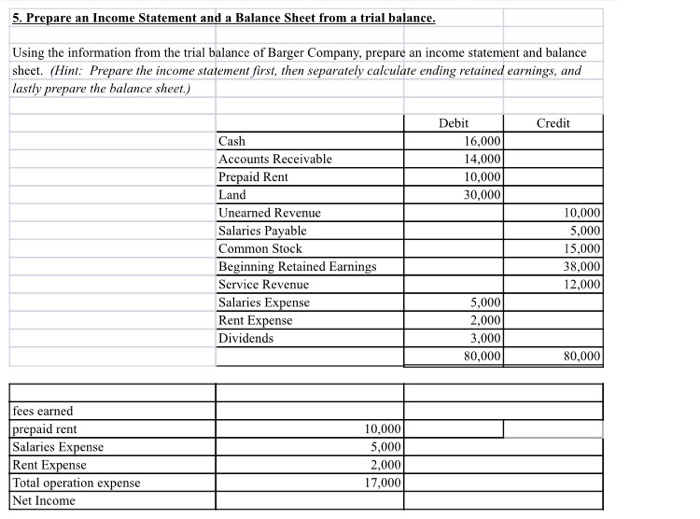

Salaries expense in balance sheet. Salaries payable is a liability account and will increase total liabilities and equity by $1,500 on the balance sheet. Any salaries owed by not yet paid would appear as a current liability, but any future or projected salaries would not show up at all. Journal entries for salaries payable there are two steps to think about when we think about salaries payable.

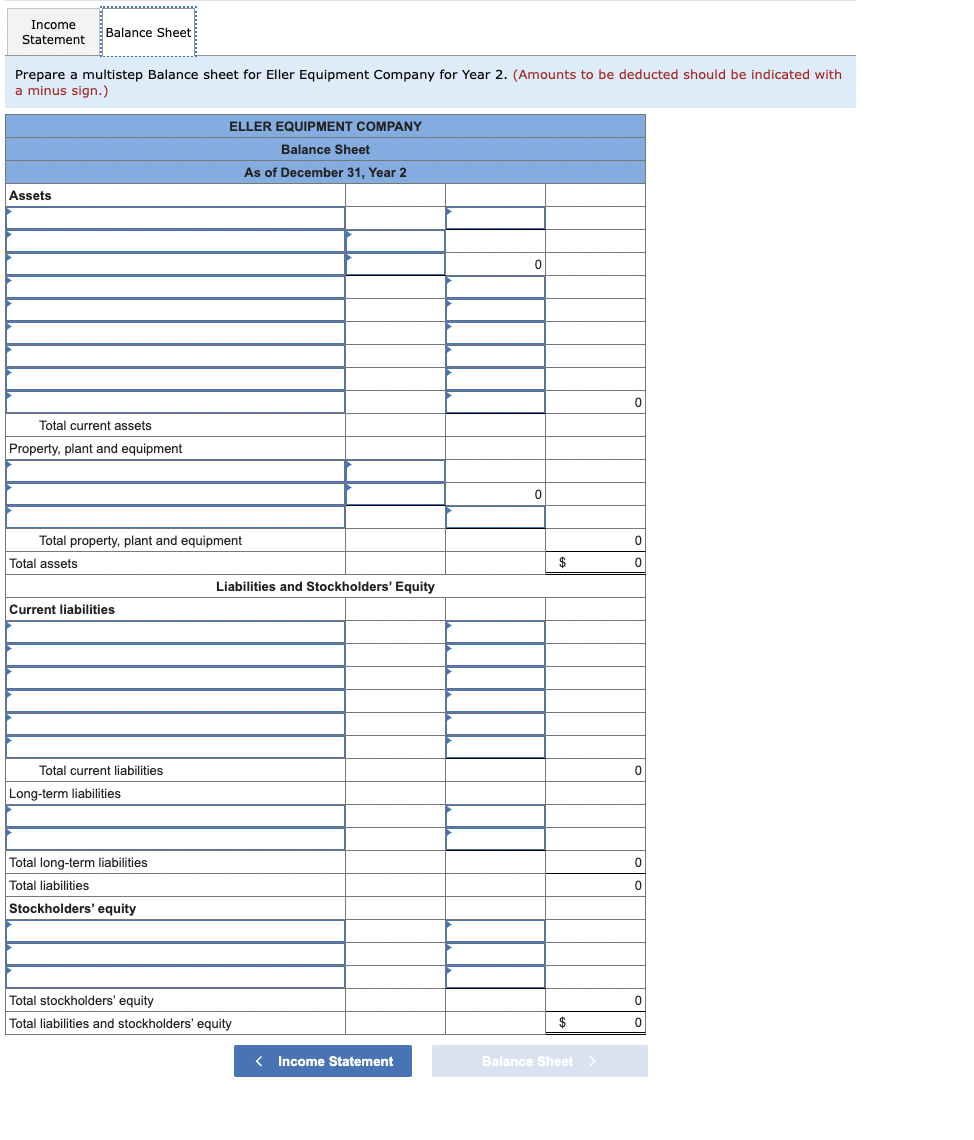

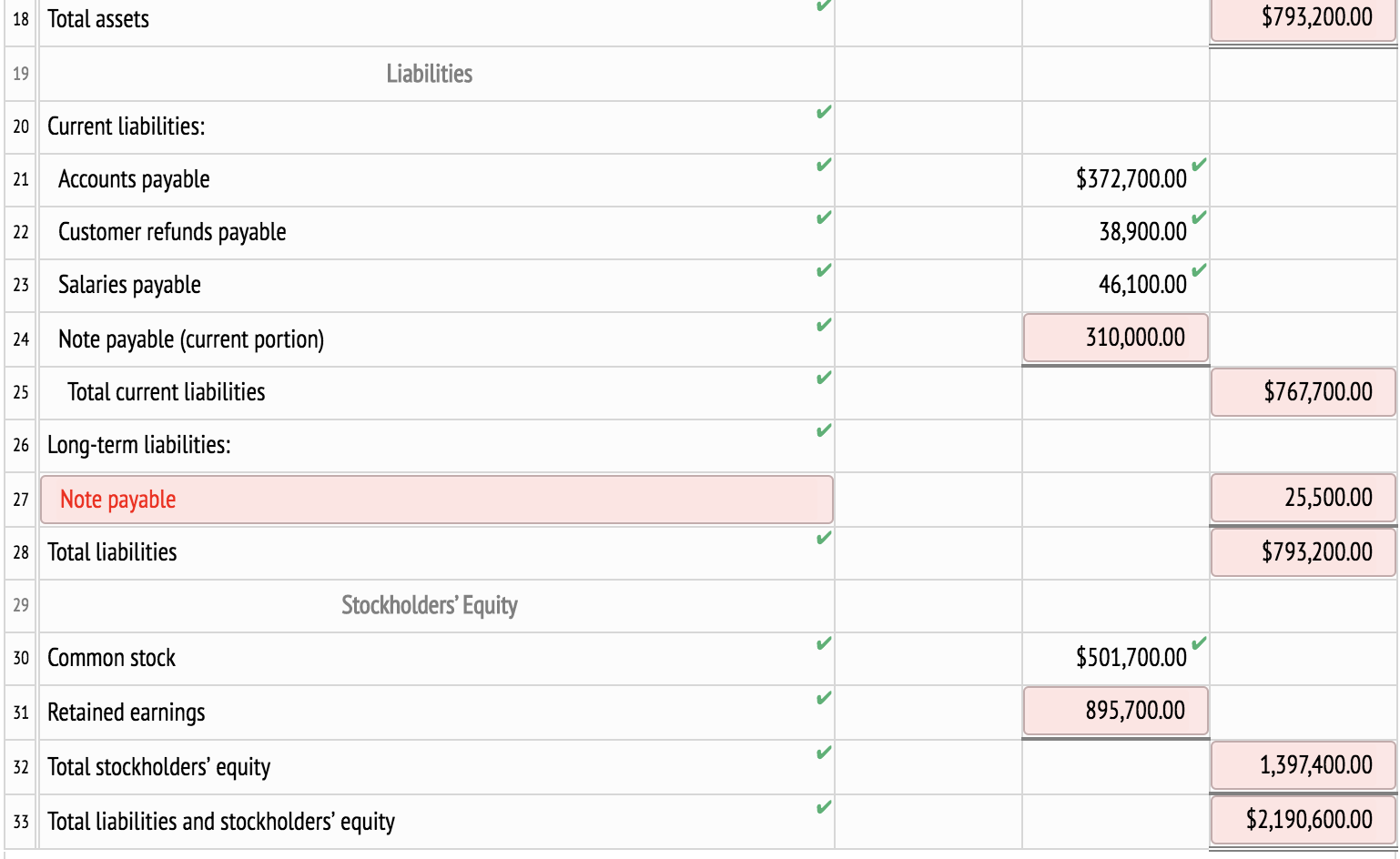

However, labor expenses appear on the balance sheet as well, and in three notable ways: Salaries payable indicate the number of salaries accrued but not yet paid as of the balance sheet. The amount of salary payable by the employer to the employee is specified in the employment contract.

The difference between salaries and wages. Your balance sheet shows salaries, wages and expenses indirectly. Wage expense is typically combined with other expenses on the income statement.

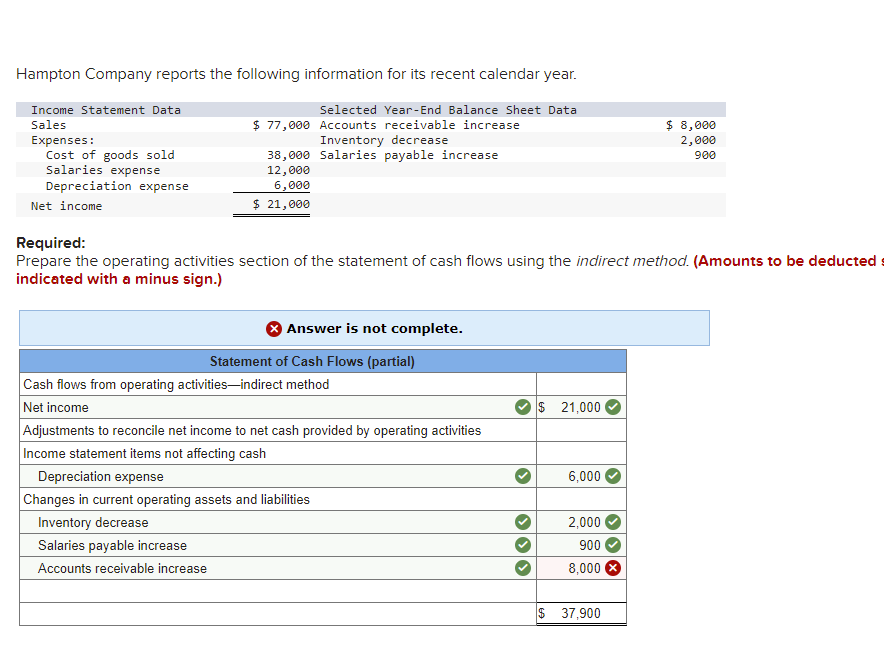

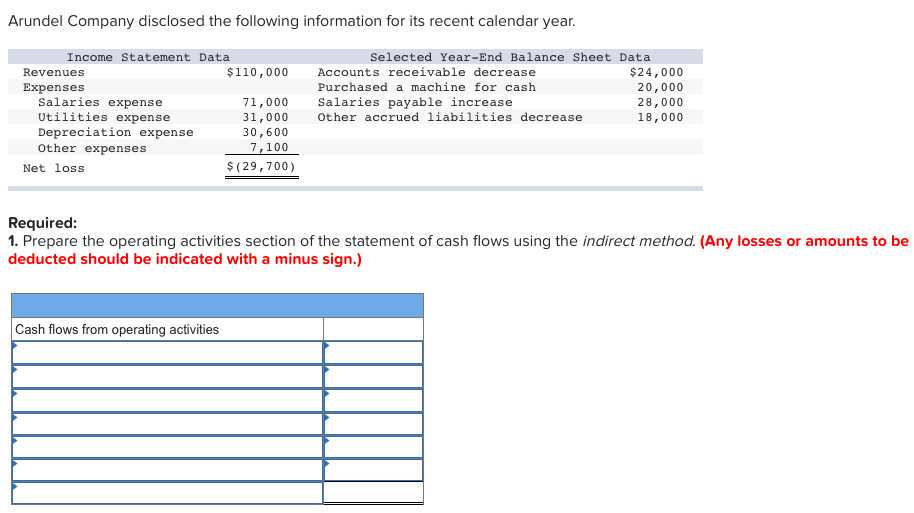

Under the accrual method of accounting, the account salaries expense reports the salaries that employees have earned during the period indicated in the heading of the income statement, whether or not the company has yet paid the employees. Write this number in the credit column to show that it is an outstanding balance. (1) times wages, (2) piece wages, and (3) contract wages.

The balance sheet is divided into three main sections: Are reported directly on the current income statement as expenses in the period in which they were earned by the employees. Depending on the income statement format, operating expenses are can be classified as selling, administrative or general.

Journal entry for salary paid (in cash/cheque) The balance sheet is based on the fundamental equation: Salary payable refers to the liability of the company towards its employees against the amount of salary of a period that became due but has not been paid yet to them by the company, and it is shown in the balance of the company under the head liability.

The balance sheet accounting for salaries payable there are several steps involved to properly account for salaries payable. Assets = liabilities + equity. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

Balance sheets provide the basis for. When gross profit is subtracted by operating expenses, you get income from operations. There are three main types of wage expenses:

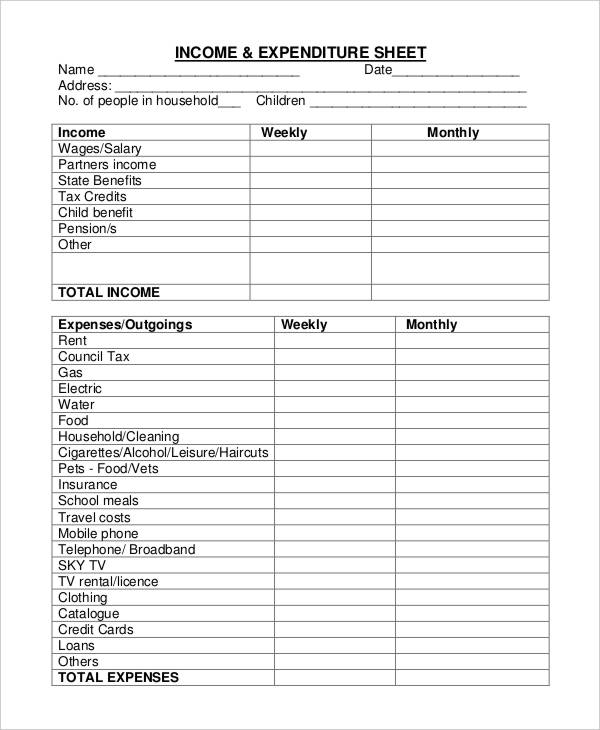

First, calculate the number of days for which salaried employees have not yet been paid. People earning wages are entitled to overtime if they work more than 40 hours per week. Accrued expenses can encompass a variety of costs, including salaries, interest expenses, rent, utilities, and vendor invoices.

Calculate the accrued salary expenses, or how much money your company expects to owe their employees for salary based on the hours they work and their pay rate. The payable is in default if the company does not pay the payable within the terms outlined by the supplier or creditor. Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees remaining at the end of a reporting period.

![[Solved] statement and balance sheet excerp SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1543/4/8/9/0145bffc5f6069c91543471535041.jpg)