Fabulous Tips About Net Income Statement Format

Some people refer to net income as net earnings, net profit, or simply your “bottom line” (nicknamed from its location at the bottom of the income statement ).

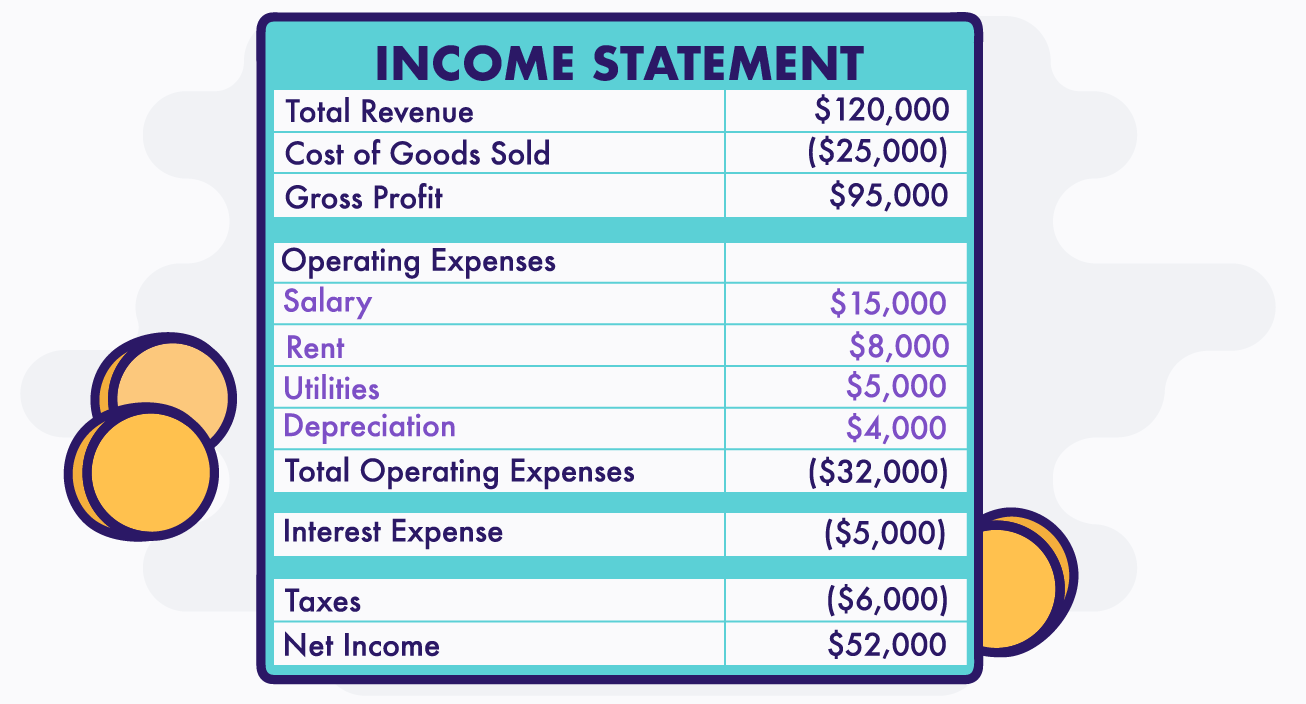

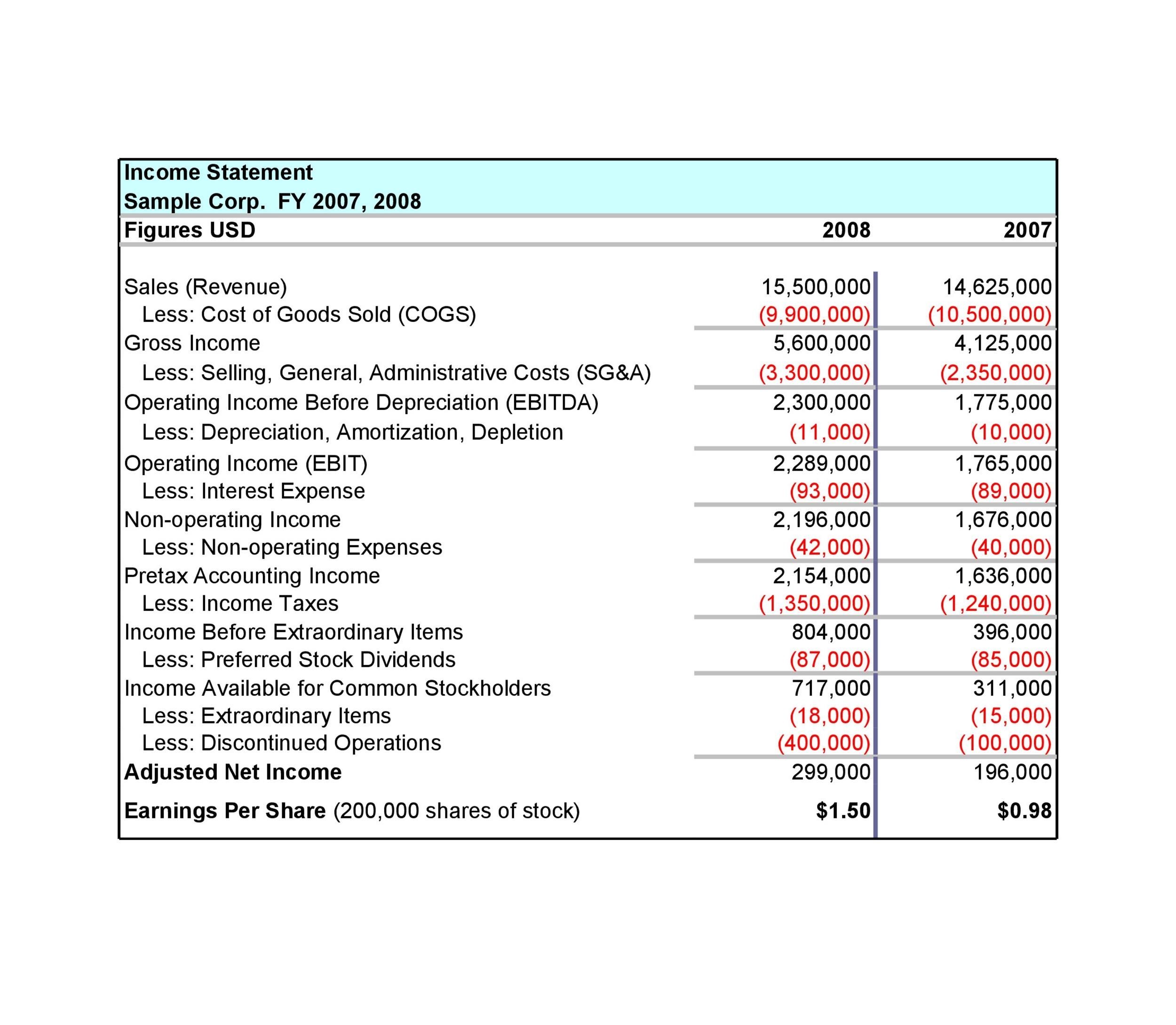

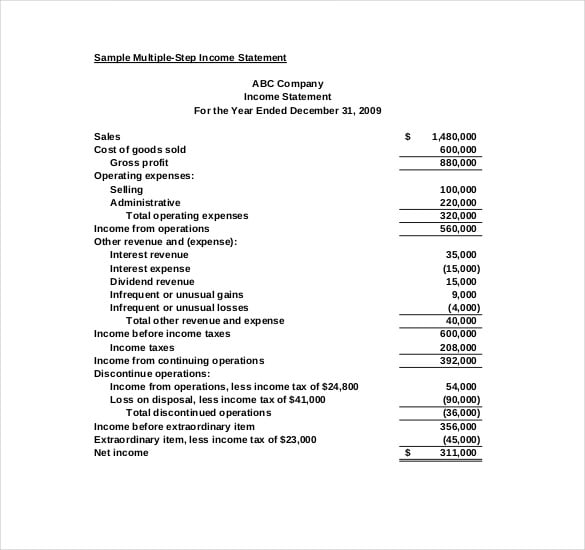

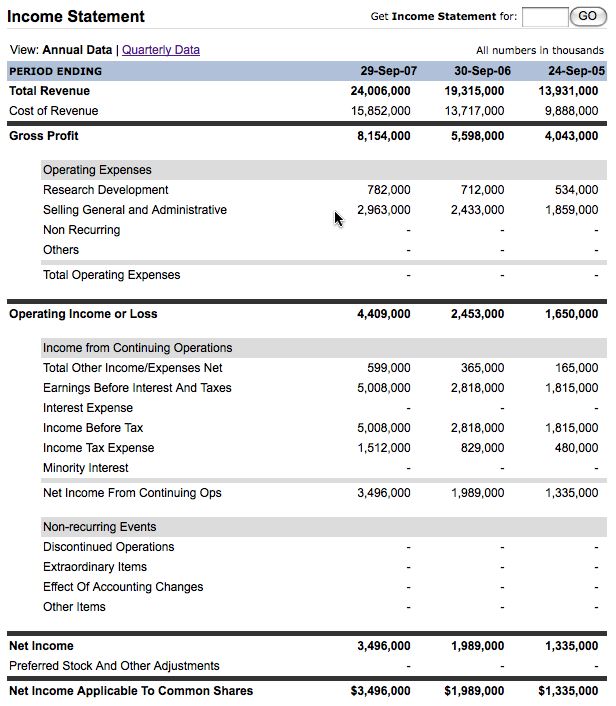

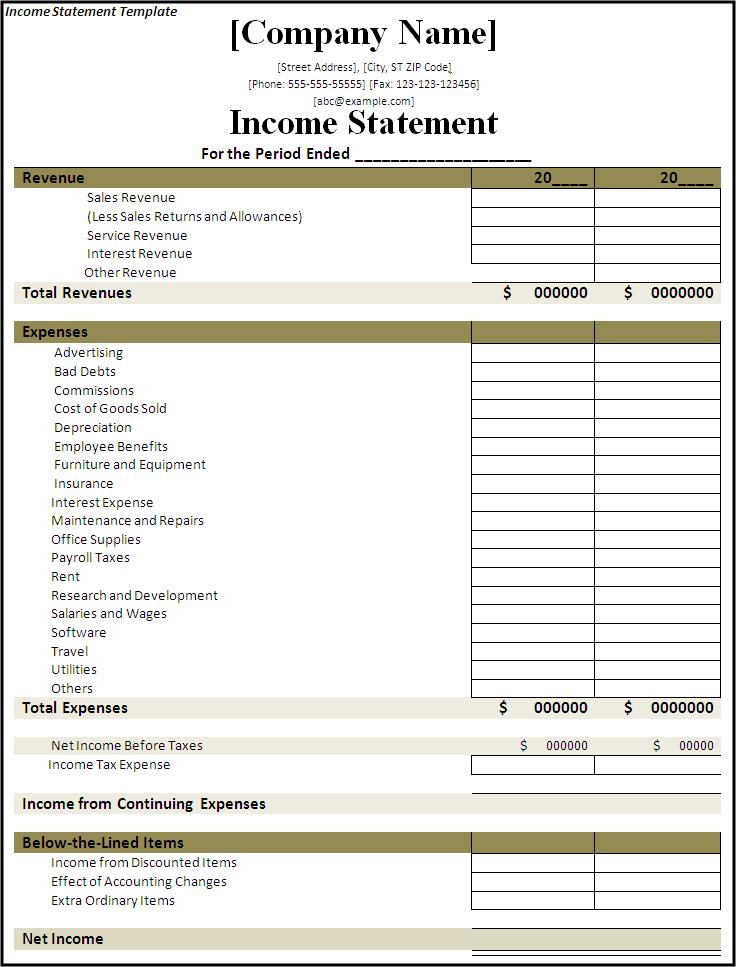

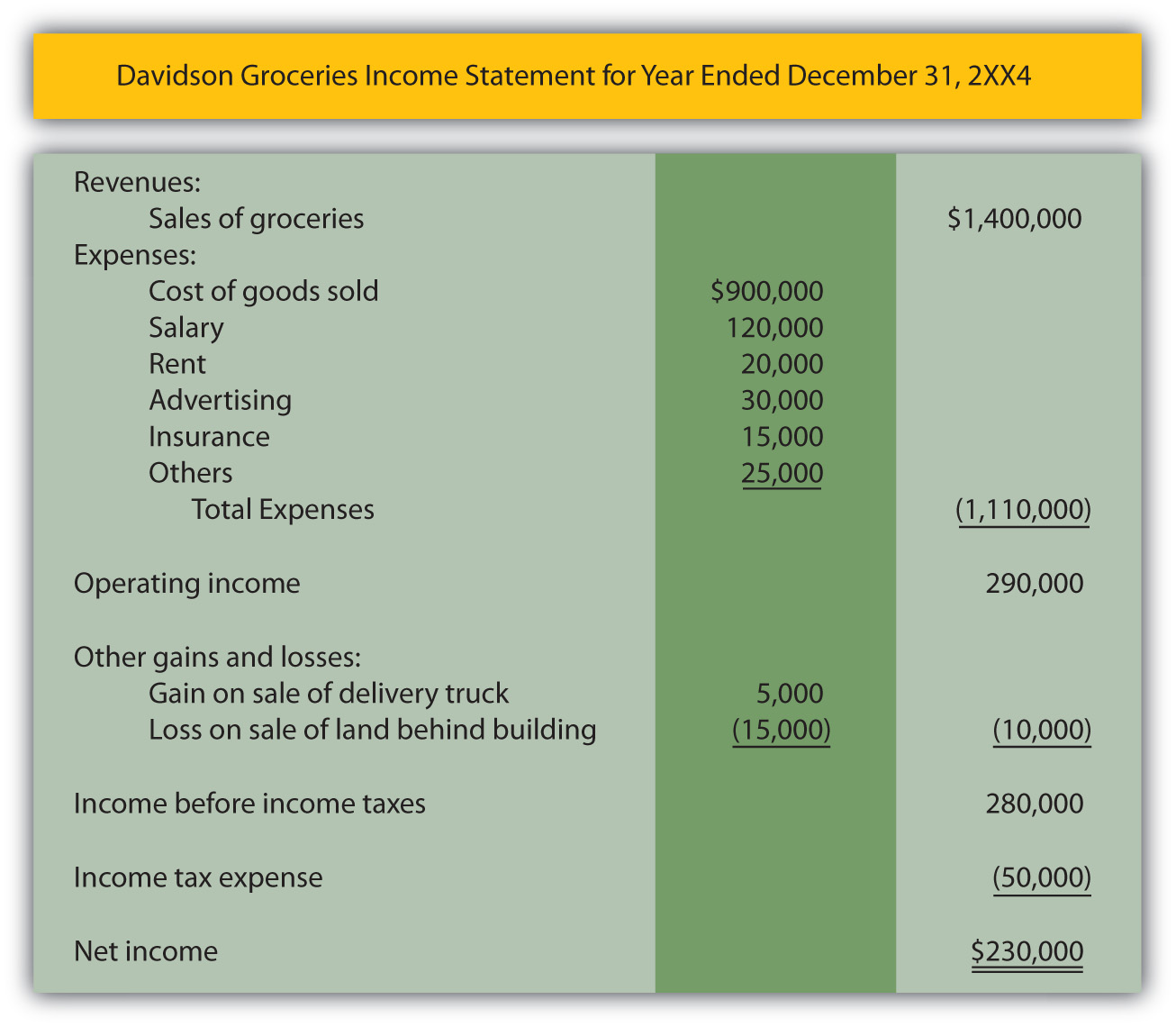

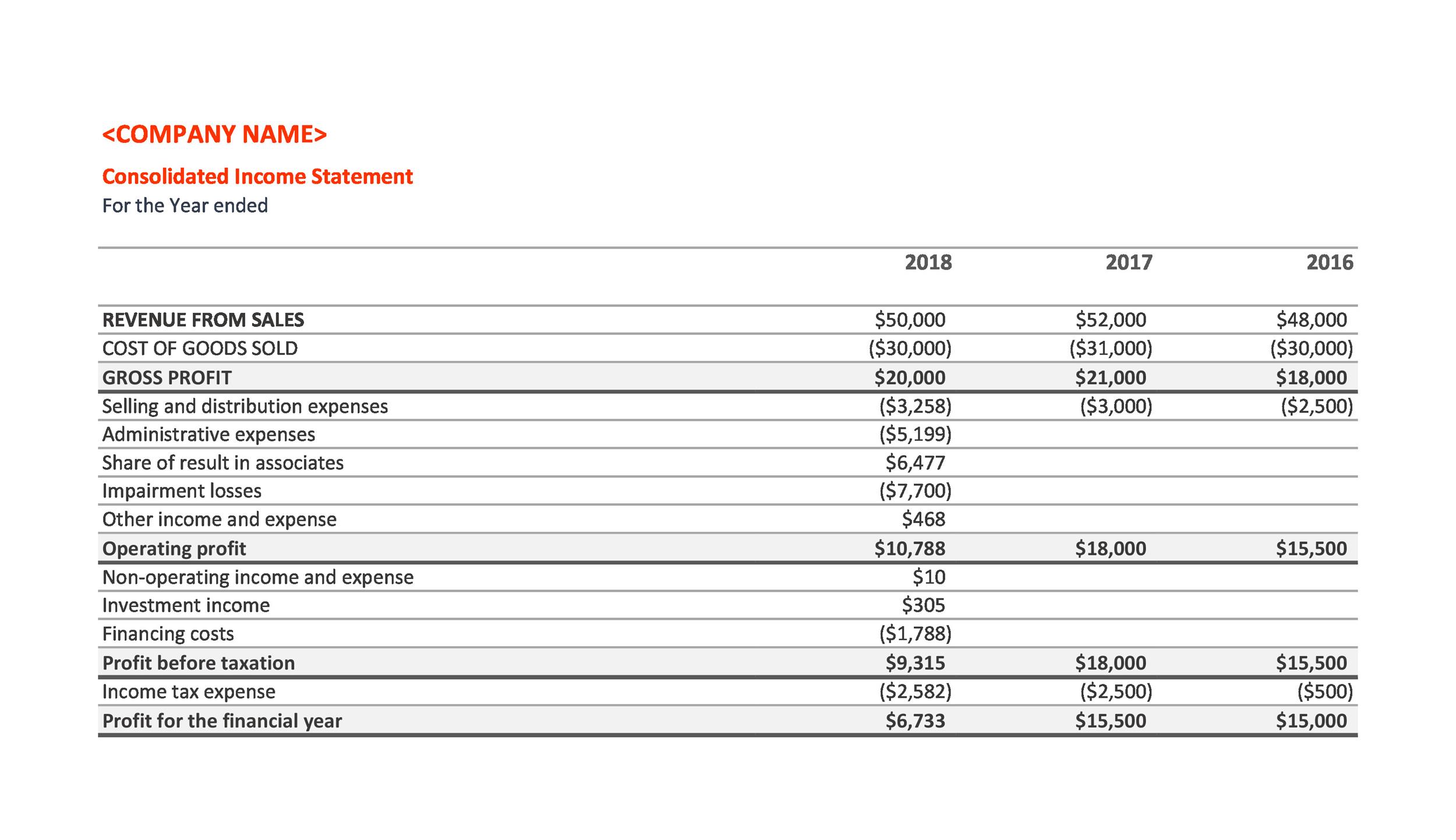

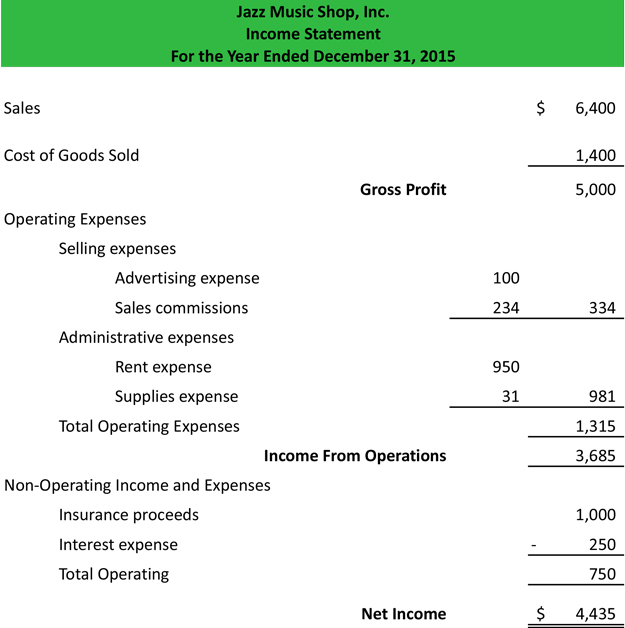

Net income statement format. This income statement includes gross profit, revenue, costs, taxes paid, net profit, selling and administrative expenses, other expenses, and income, etc. It also shows whether a company is making profit or loss for a given period. How to find net income on the income statement?

Net income is your company’s total profits after deducting all business expenses. Advertisement income statement items copied as discussed above, the income statement starts with a company’s revenue and ends with its net profit after subtracting operating and. It's calculated by subtracting expenses, interest, and taxes from total revenues.

This document gauges the financial performance of a business in terms of profits or losses for the accounting period. The income statement focuses on four key items: For example, zen phones, an electronic store selling phones and computers.

Net income, or net earnings, is the bottom line on a company's income statement. An income statement includes a company’s revenue, expenses, gains, losses and profit for a specific accounting period. Revenue revenues are the amounts from the sale of goods and services in the normal course of business.

It is also practical to use this format when you do not need to separate operating expenses from the cost of sales. Guides | 5 min read | 26 comments what is income statement? While it is arrived at through the income statement, the net profit is also used in both the balance sheet and the cash flow statement.

Net income divided by the total number of outstanding shares; Income statement analysis. Revenue, expenses, gains, and losses.

There are two ways of presenting an income statement. Value lost by assets, such as inventory, equipment, and property, over time; An income statement is a financial report that summarizes the revenues and expenses of a business.

This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues. Income before taxes: The income statement calculates the net income of a company by subtracting total expenses from total income.

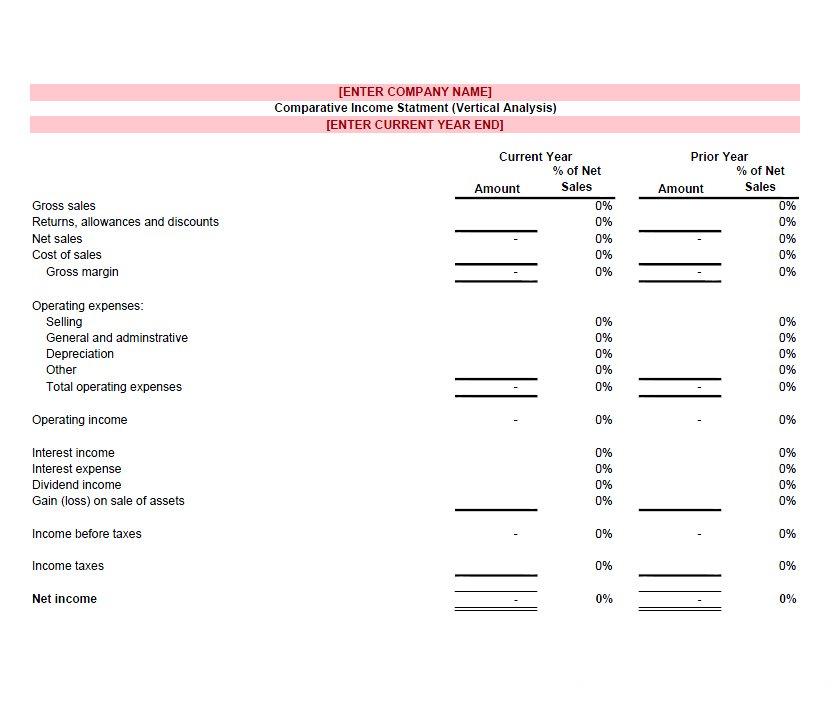

The difference between the two is in the way a statement is read and the comparisons you can make from each type of analysis. Sales on credit) or cash vs. The income statement format is revenues, expenses, and profits (or losses) of an entity over a specified period of time.

Let's take a look at how each would look like. Income statements are also known as statements of earnings, statements of income, net income statements, profit and loss statements or simply “p&ls,” among other names. And net revenue means all proceeds from the sale of goods and services excluding the returns.