Formidable Tips About Income Statement And Balance Sheet Format

If the company reports profits worth $10,000 during a.

Income statement and balance sheet format. The income statement, also called a profit and loss statement, is one of the major financial statements issued by businesses, along with the balance sheet and cash flow statement. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned lawn mowing revenue, and common stock. Balance sheet has two major elements.

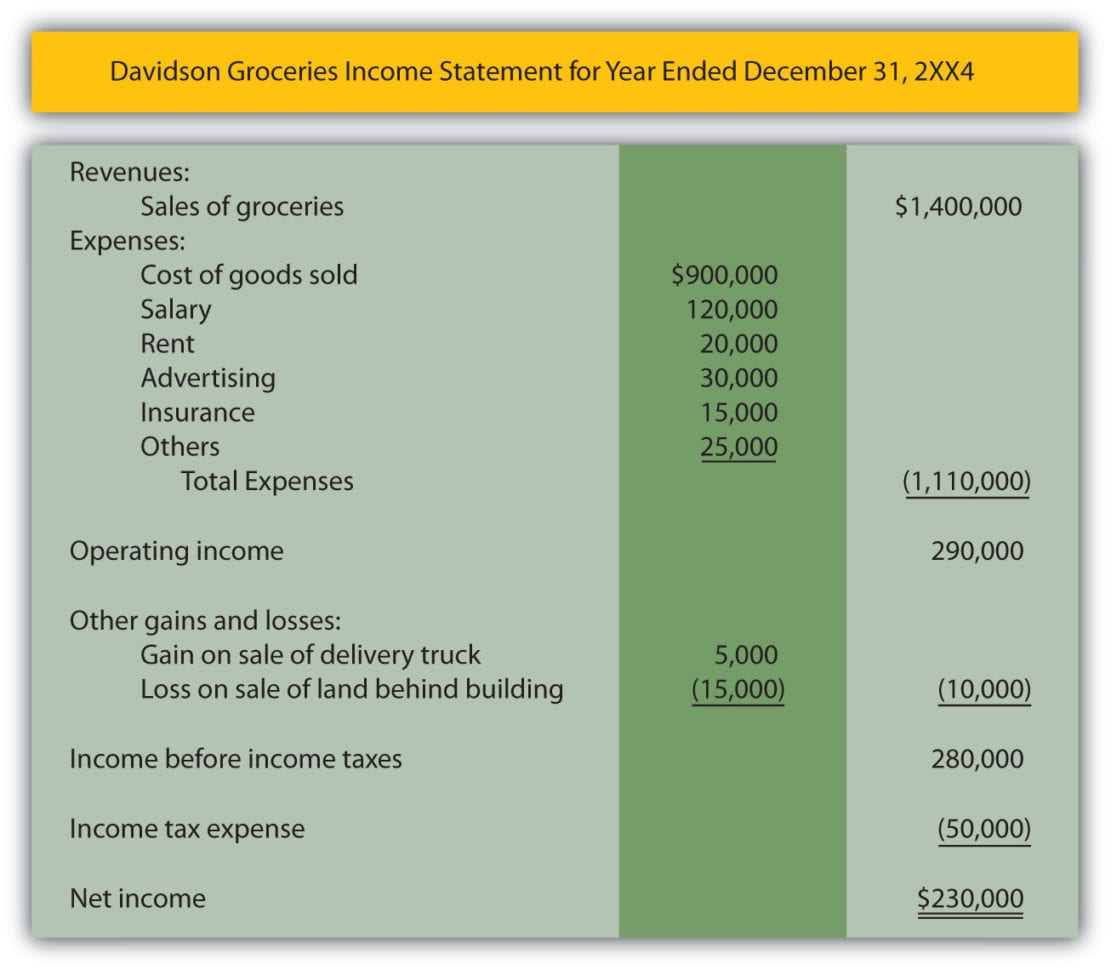

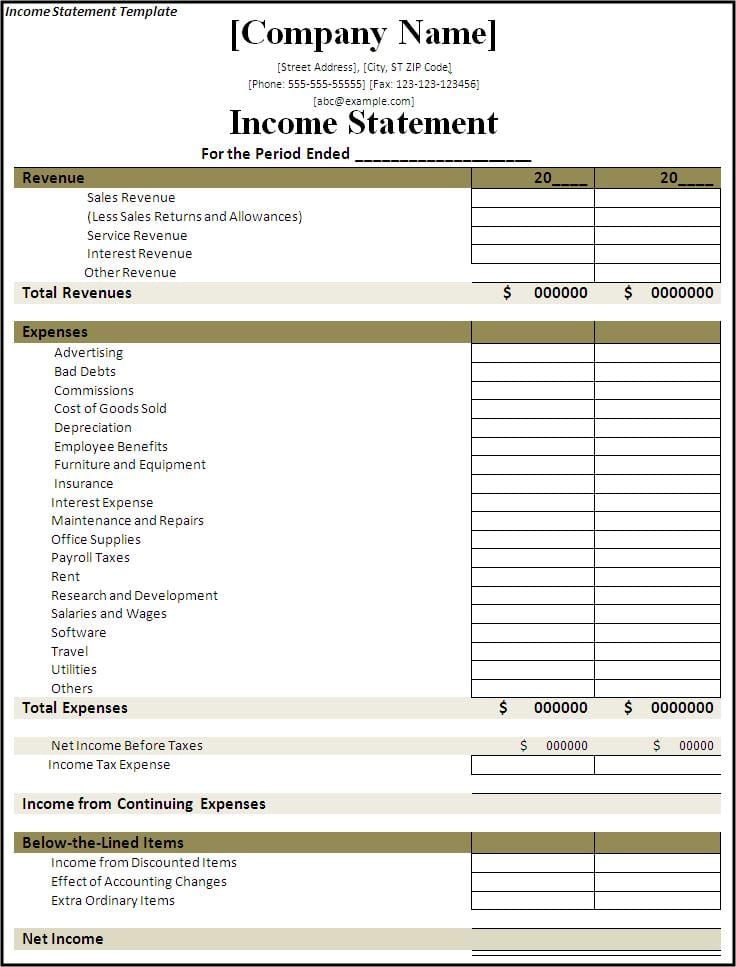

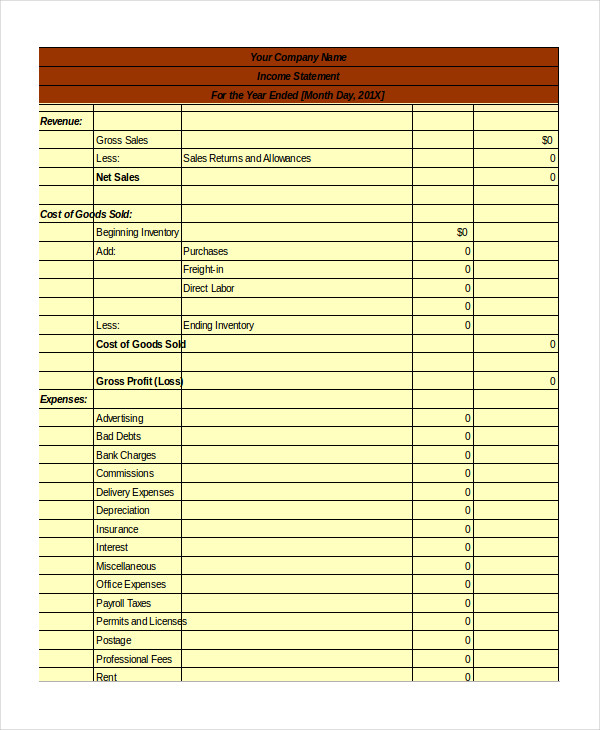

Expenses expenses, commonly referred to as operating expenses, are costs the company incurs related to sales. An income statement tallies income and expenses; What is an income statement?

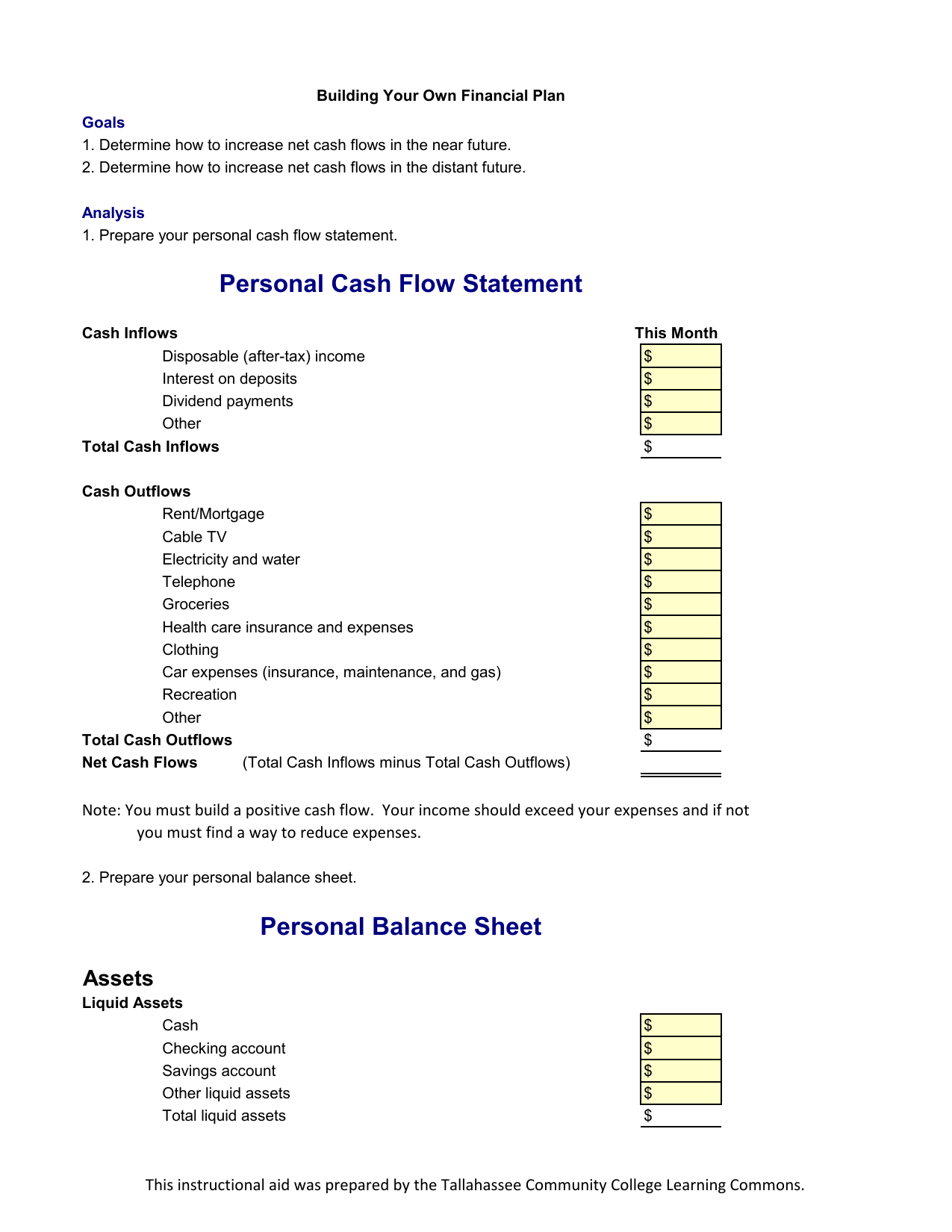

Income statement vs balance sheet; An income statement is one of the three major financial statements, along with the balance sheet and the cash flow statement, that report a company’s financial performance over a specific. The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time, highlighting its financial position.

The balance sheet while the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually. As fixed assets age, they begin to lose their value.

Generally, we use vertical format. Clear lake’s net income flows from the income statement into retained earnings, which is reflected on the statement of retained earnings. The income statement and statement of cash flows also provide valuable context for assessing a company's finances, as do any notes or addenda in an earnings report that might refer back to.

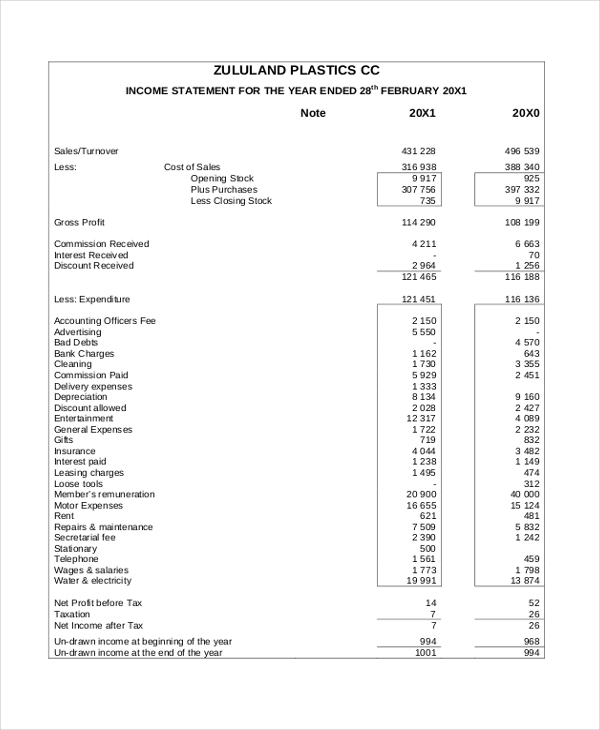

Start free written by cfi team what is the income statement? Income statements depict a company’s financial performance over a reporting period. These statements are helpful tools for understanding revenues versus expenses, and assets versus liabilities, providing the business owner with an understanding of their financial position.

Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for. A balance sheet, on the other hand, records assets, liabilities, and equity. Difference between an income statement and balance sheet;

The income statement reports how the business performed financially each month—the firm earned either net income or net loss. The income statement is also known as a profit and loss statement, statement of operation, statement of financial result or income, or earnings statement. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.

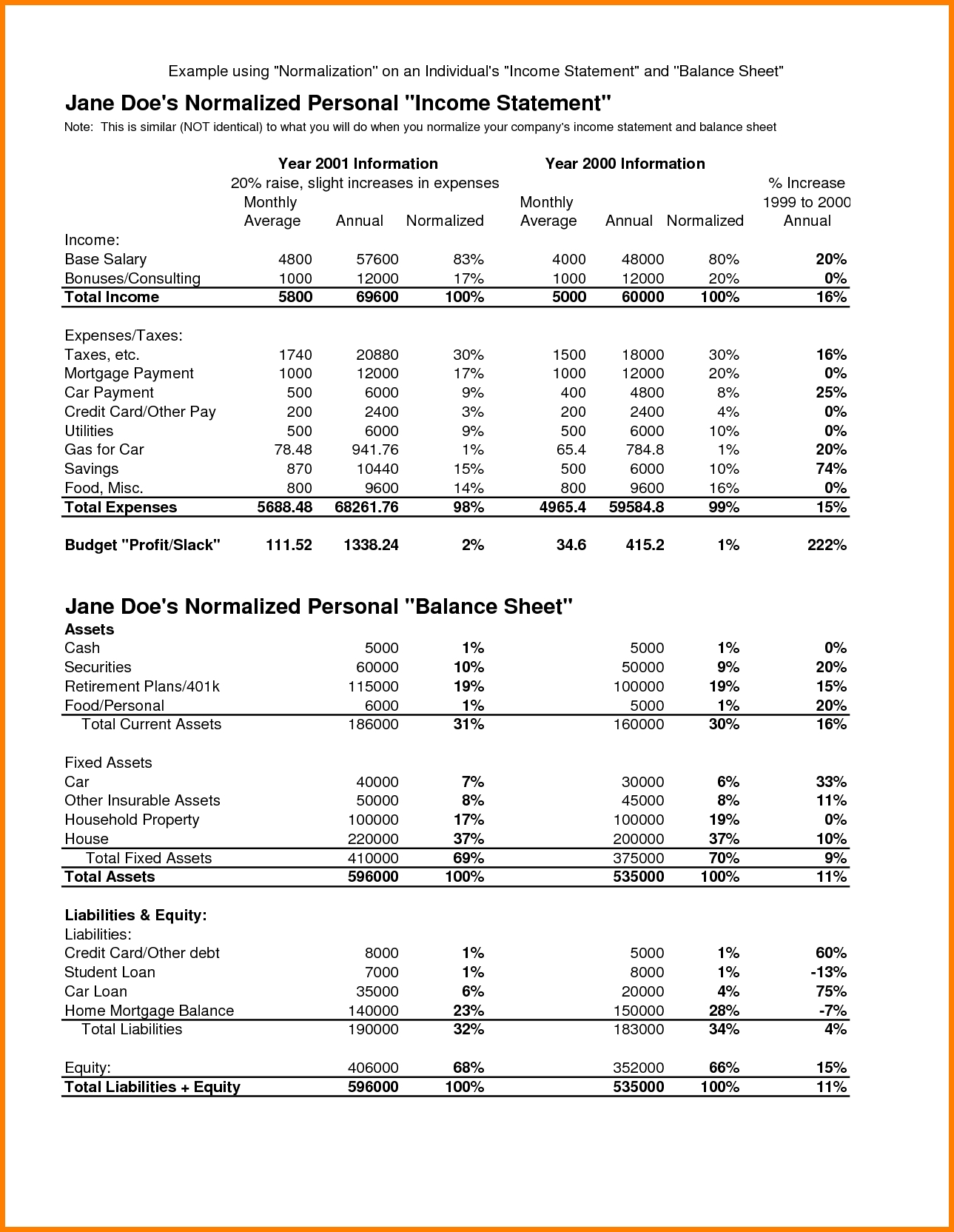

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. The balance in retained earnings is then reflected on the balance sheet. Let's take a look at how each would look like.

The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. These topics will show you the connection between financial statements and offer a sample balance sheet and income statement for small businesses: Assets mean resources owned by a company and which has future economic.