Awe-Inspiring Examples Of Info About Trial Balance Debit And Credit List

Bookkeepers and accountants use this report to.

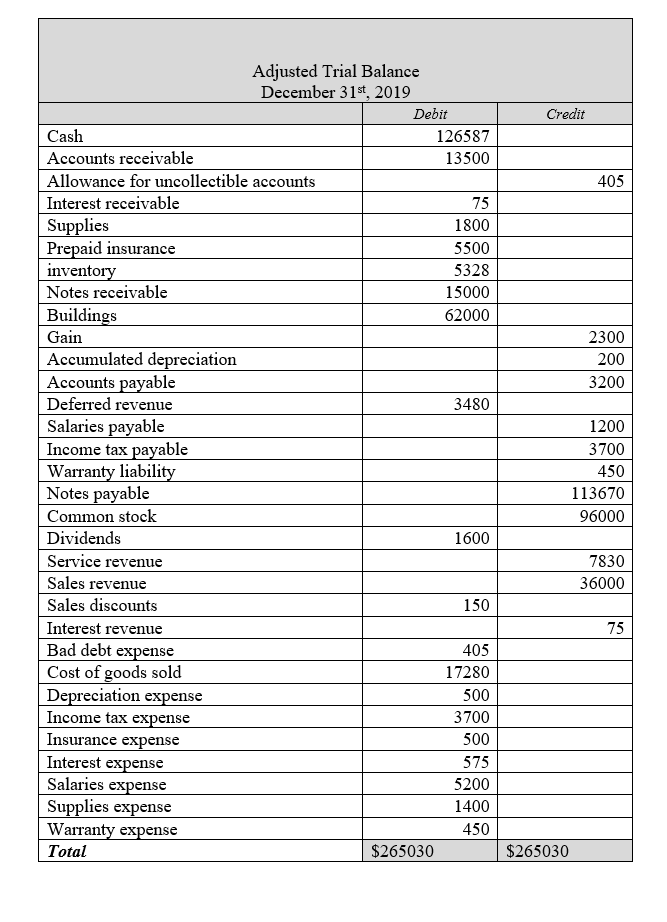

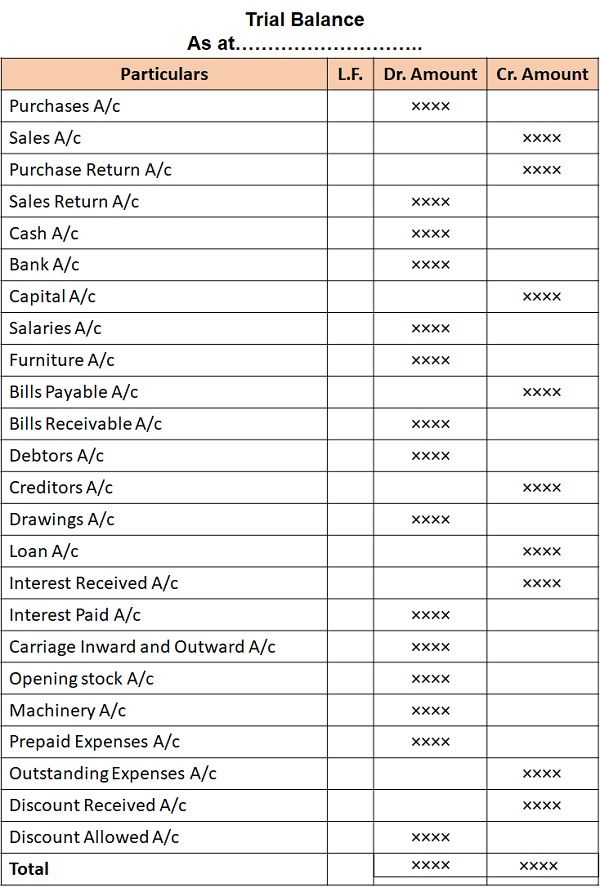

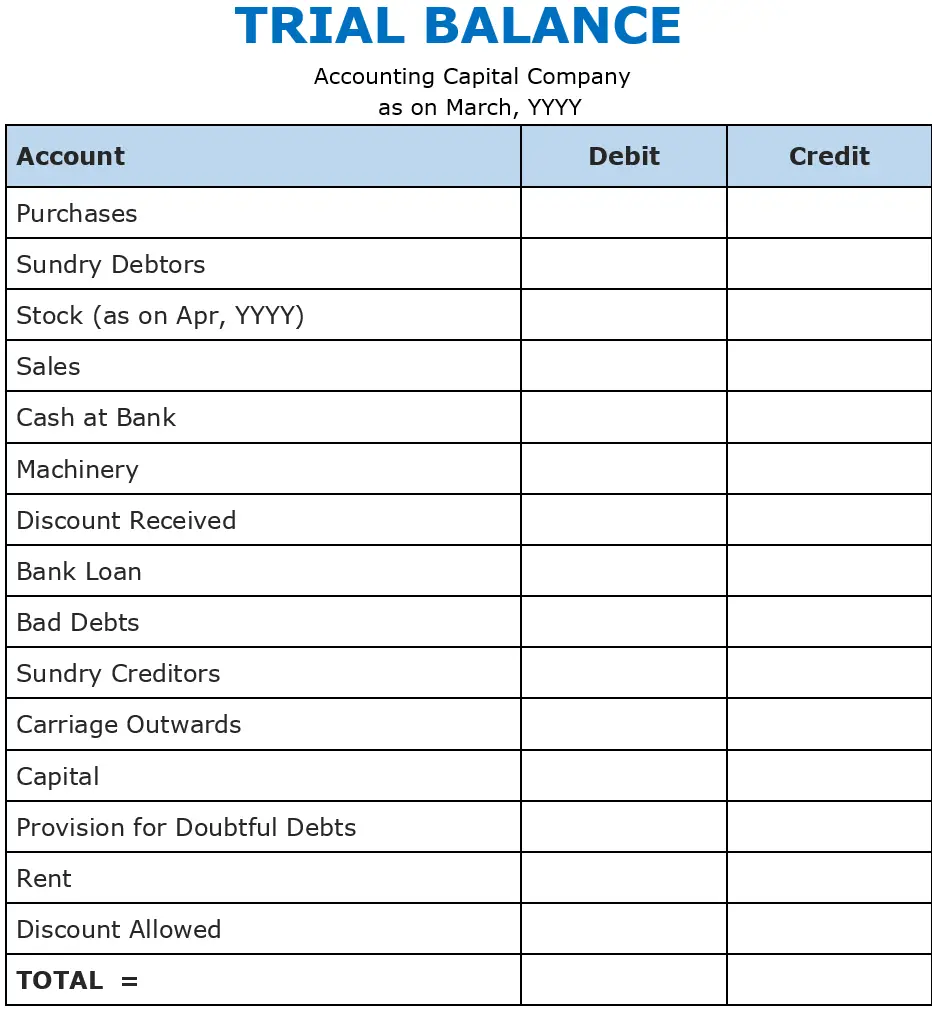

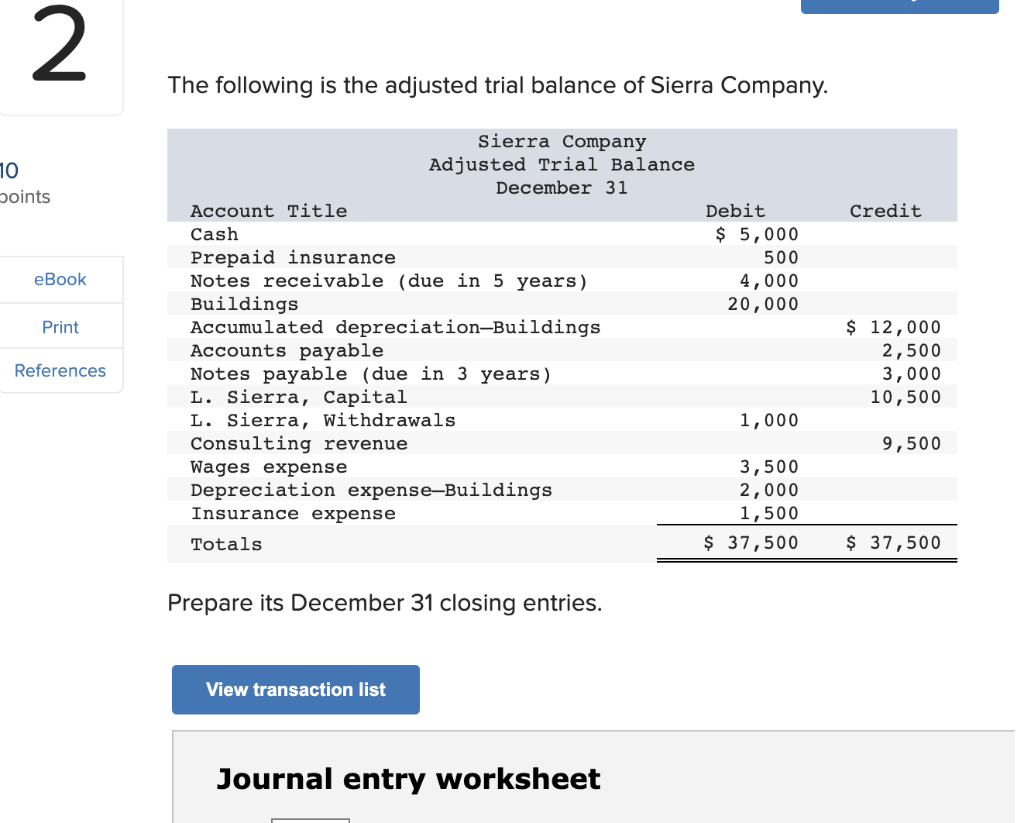

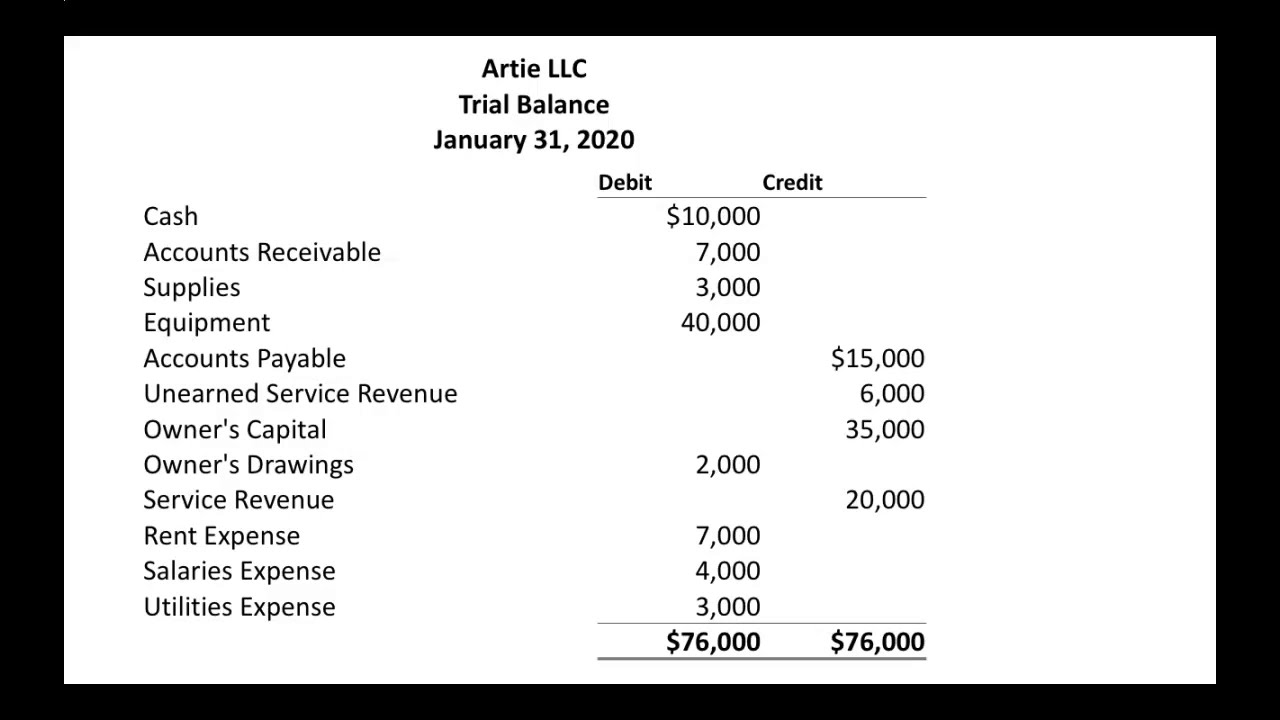

Trial balance debit and credit list. Learn how to prepare a trial balance, a list of debit and credit balances from various accounts in the ledger, using an equation and a formula. Exclusive list of items 1. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order.

Reports april 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. It is used to identify the balance of debits and credits entries. Key takeaways to prepare financial statements and conduct audits, trial balances are essential because they assist in discovering possible accounting issues by.

Generally capital, revenue and liabilities have credit balanceso they are placed on the credit side of the trial balance. Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other. A trial balance is an accounting report used by business accountants during the accounting close process to ensure that all general ledger accounts have equal debit and credit.

The total of your debit entries should always equal the total of your credit entries on a trial balance. The trial balance is a summation of or list of credit and debit balances drawn from the many ledger accounts like the bank balance, cash book etc. The trial balance is used to test the equality between total debits and total credits.

It lists the balances on ledger accounts and totals them. A trial balance is a list of ledger balances shown in debit and credit columns. The format of the trial balance is a two.

This is done to determine that. Total debits should equal total credits. This statement comprises two columns:.

A trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. On the other hand, a. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

Definition of a trial balance a trial balance is a bookkeeping or accounting report that lists the balances in each of an organization's general ledger accounts. The capital, revenue and liability increase when it is credited and vice versa.