Recommendation Info About Dividend In Income Statement

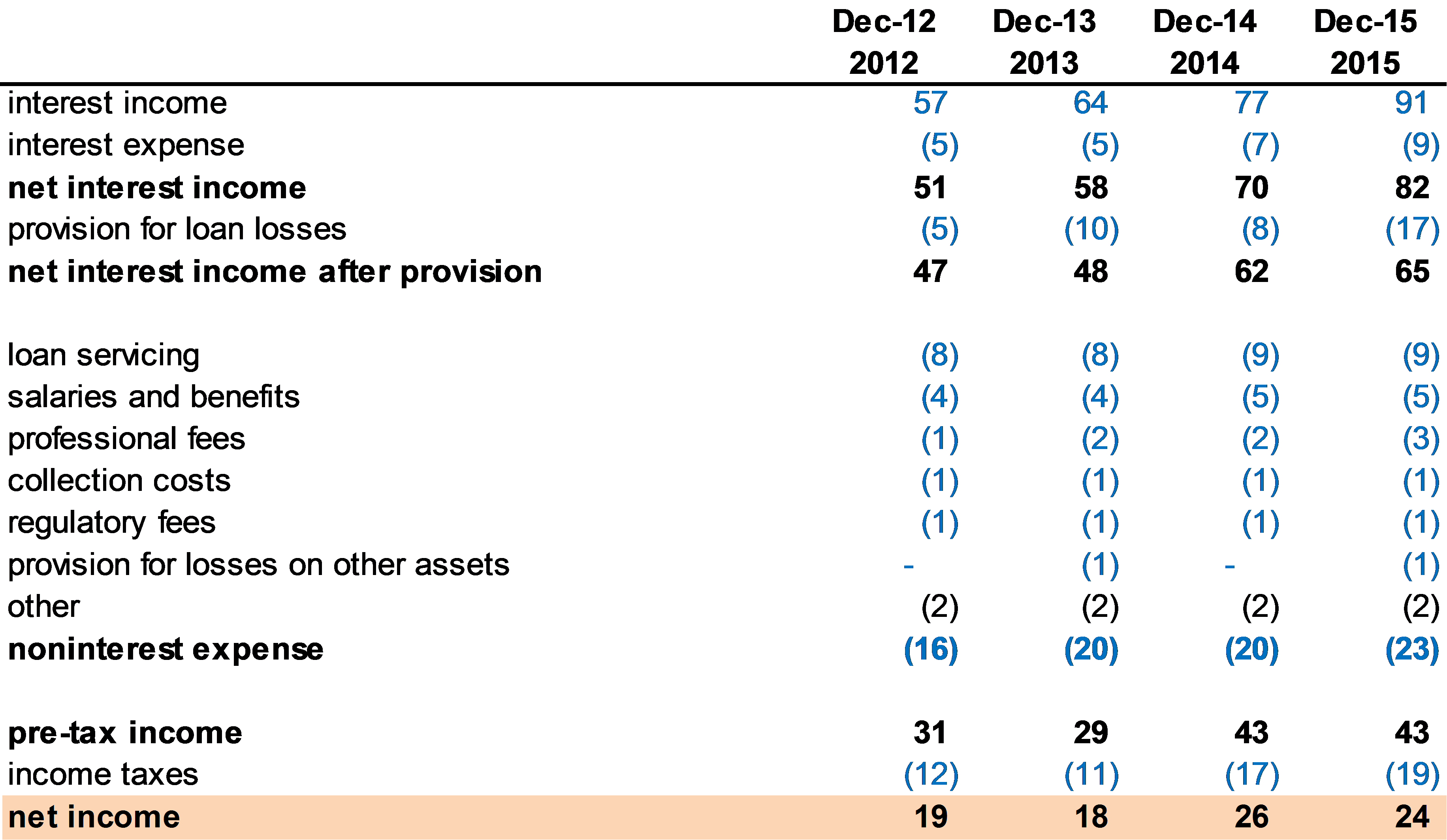

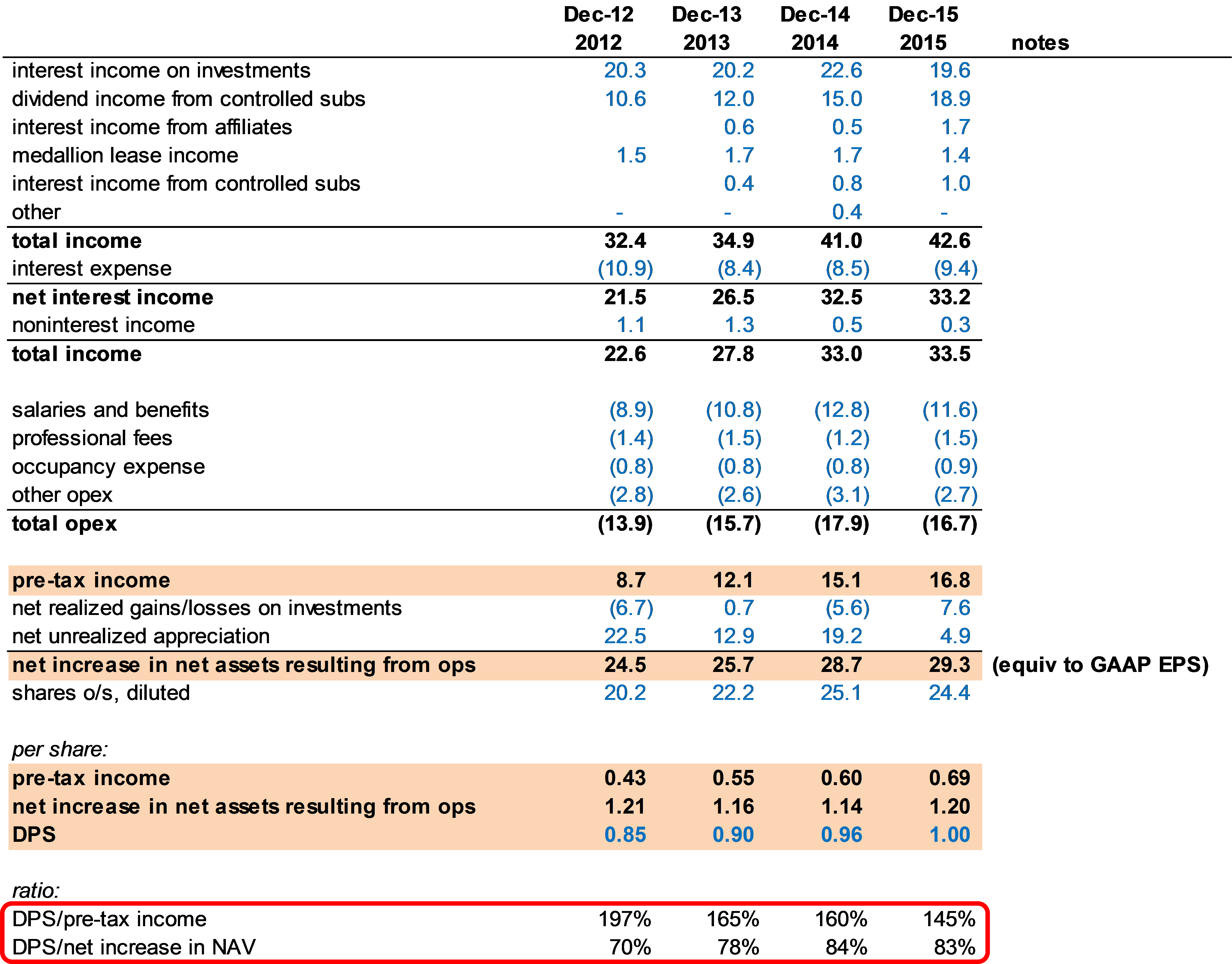

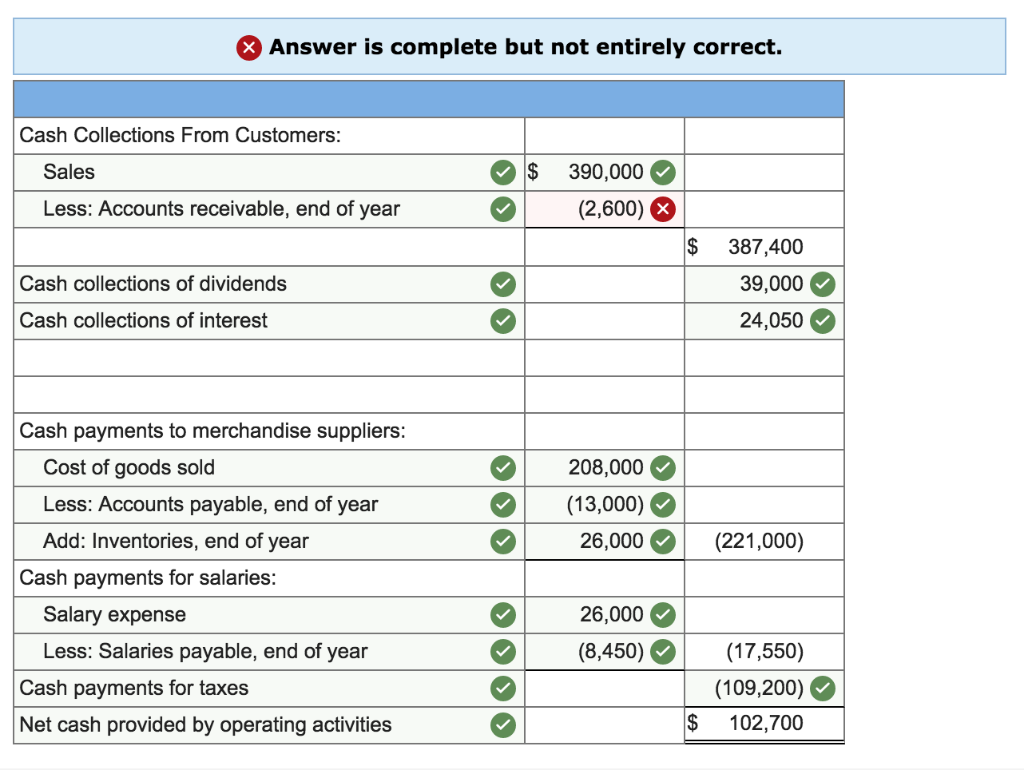

The motley fool take total dividends divided by net income and you will get dpr.

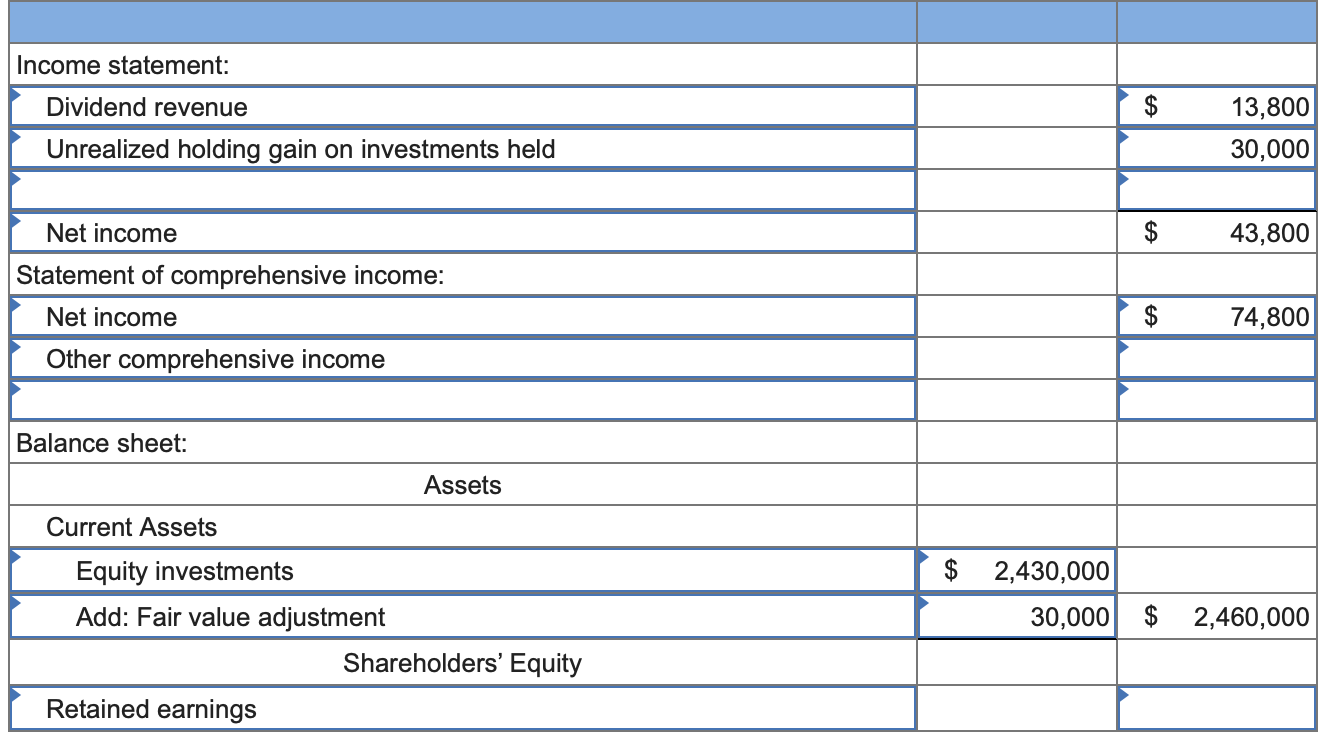

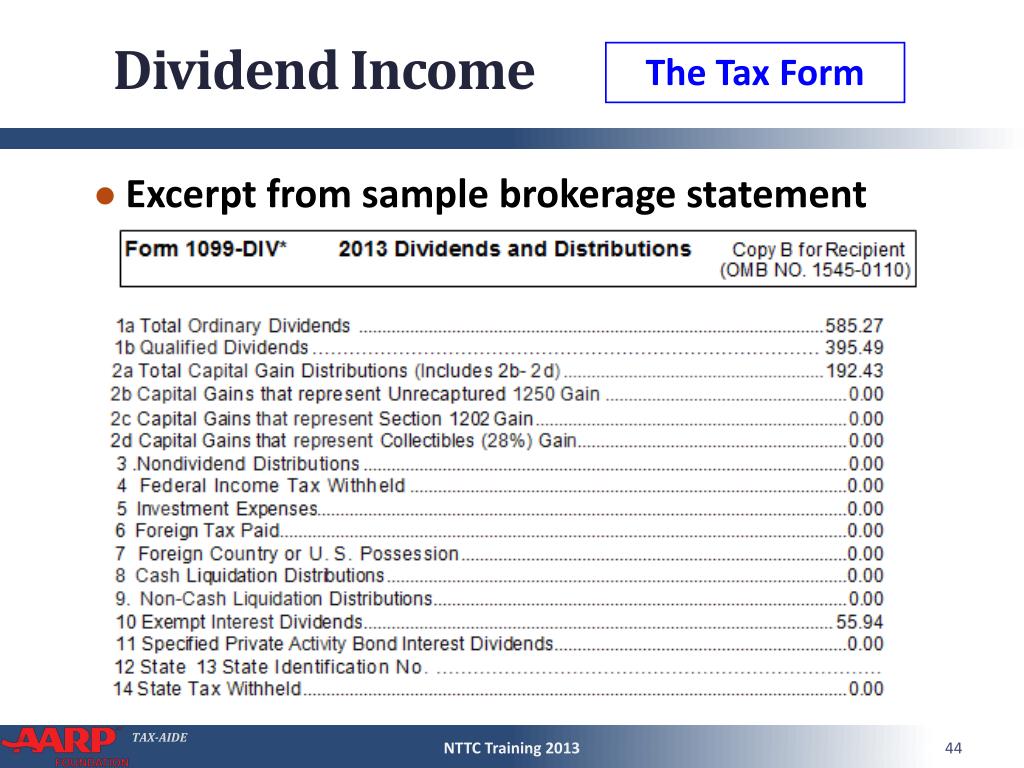

Dividend in income statement. Calculating dps from the income statement. Updated may 23, 2021 reviewed by margaret james cash or stock dividends distributed to shareholders are not recorded as an expense on a company's income statement. Consolidated net income (2) was € 3,789 million (2022:

Deputy prime minister and minister for finance lawrence wong announced changes related to cpf during the fy2024 budget statement in parliament on 16. What is the dividend formula? It is a result of the company's earnings or profits over the year.

When an organization or a firm earns a profit at the end of the accounting year, they may take a resolution in the board meeting or through. Usually dividend income is the distribution of a company's taxable. This is useful in measuring a company's ability to keep paying or even increasing a dividend.

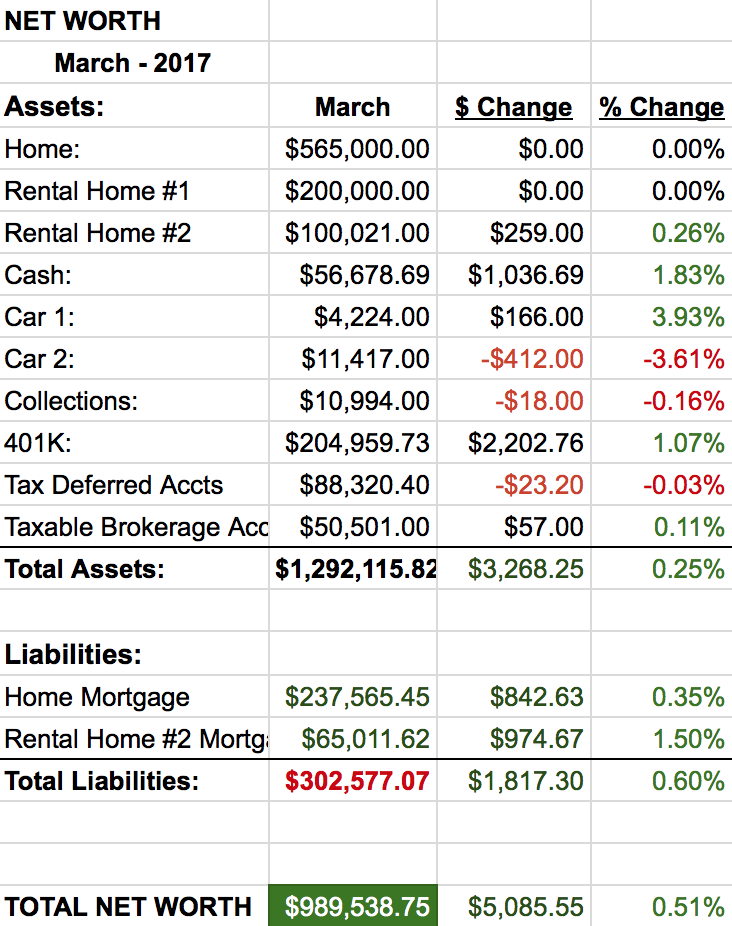

Dividend payments and amounts are determined by a company's board of directors. 5 rows dividends in the balance sheet. You will need to file a return for the 2024 tax.

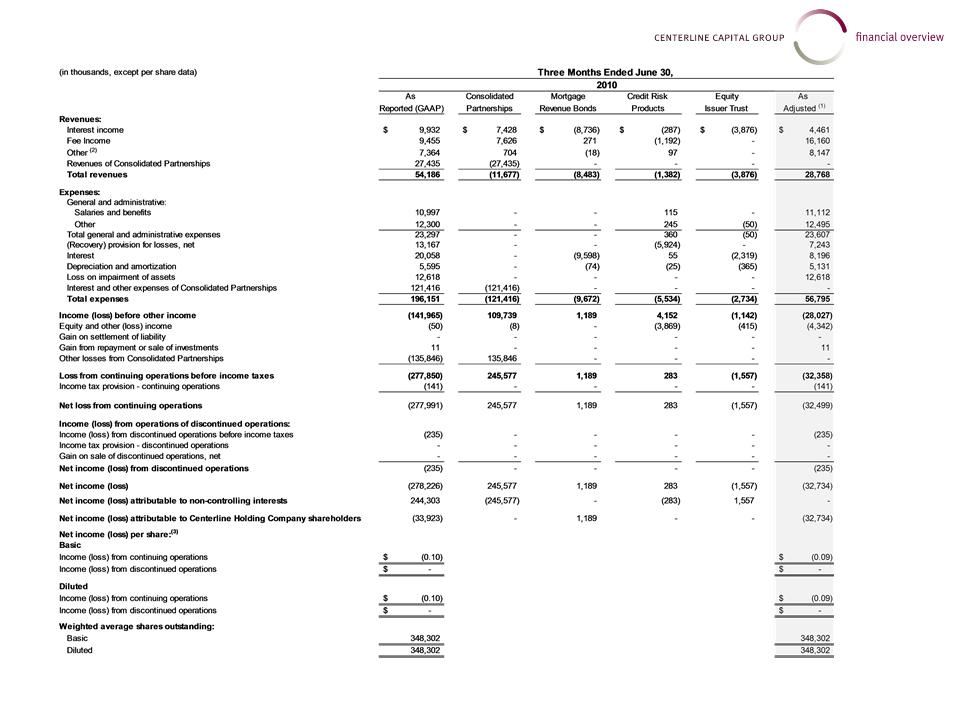

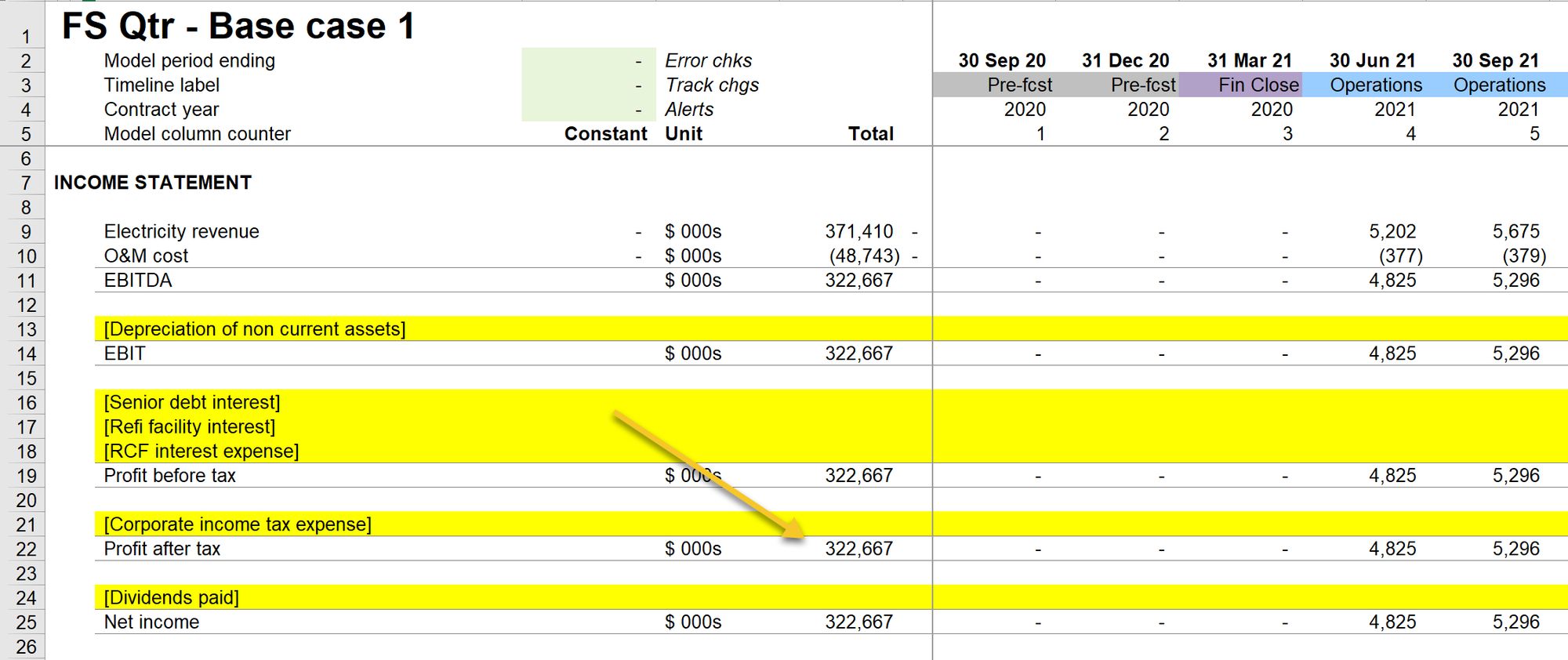

Dividends have a direct impact on a company’s financial statements, specifically the income statement,. Dividend income is the amount distributed to the company's shareholders. Cash dividends affect the cash and shareholder equity on the balance sheet;

How do dividends affect financial statements? While they are usually cash, dividends can also be in the form of stock or any other property. The dividends declared and paid by a corporation in the most recent year will be reported on these financial statements for the recent year:

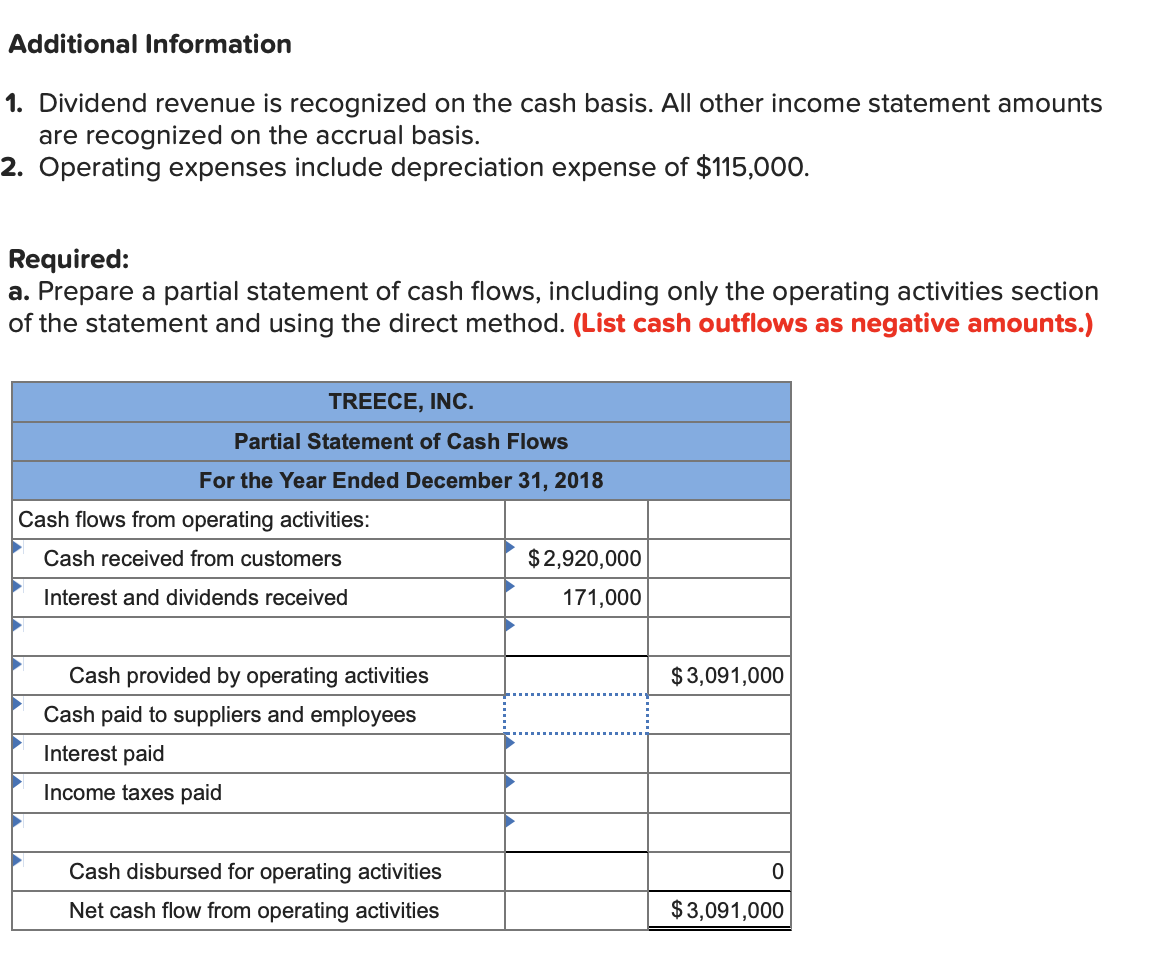

Before dividends are paid, there is no impact on the balance. Dividends impact the income statement by reducing the company’s net income. Statement of cash flows as a use of.

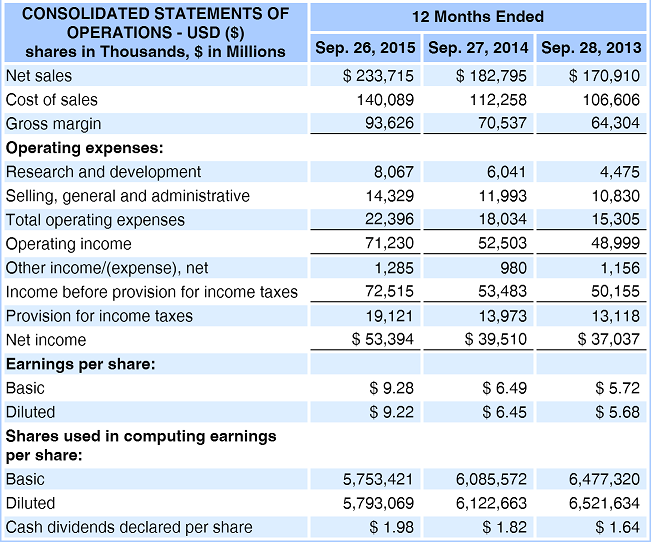

When dividends are declared and paid to shareholders,. If a company follows a consistent dividend payout ratio (i.e., the company is known to pay a consistent percentage of its earnings as. Nvidia will pay its next quarterly cash dividend of $0.04 per share on march 27, 2024, to all shareholders of record on march 6, 2024.

Retained earnings and cash are reduced by the total value of the dividend. So that answers a common question of is dividend expense on the income statement. One way to understand whether your benefits are taxable is to consider gross income, which is your total earnings before taxes.

Special dividend of € 1.00 per share. The dividend yield is the dividend per share, and expressed as a percentage. A dividend is usually declared quarterly after a company finalizes its income statement and dividends are paid either by check or in additional shares of stock.