Outstanding Info About Throughput Costing Income Statement

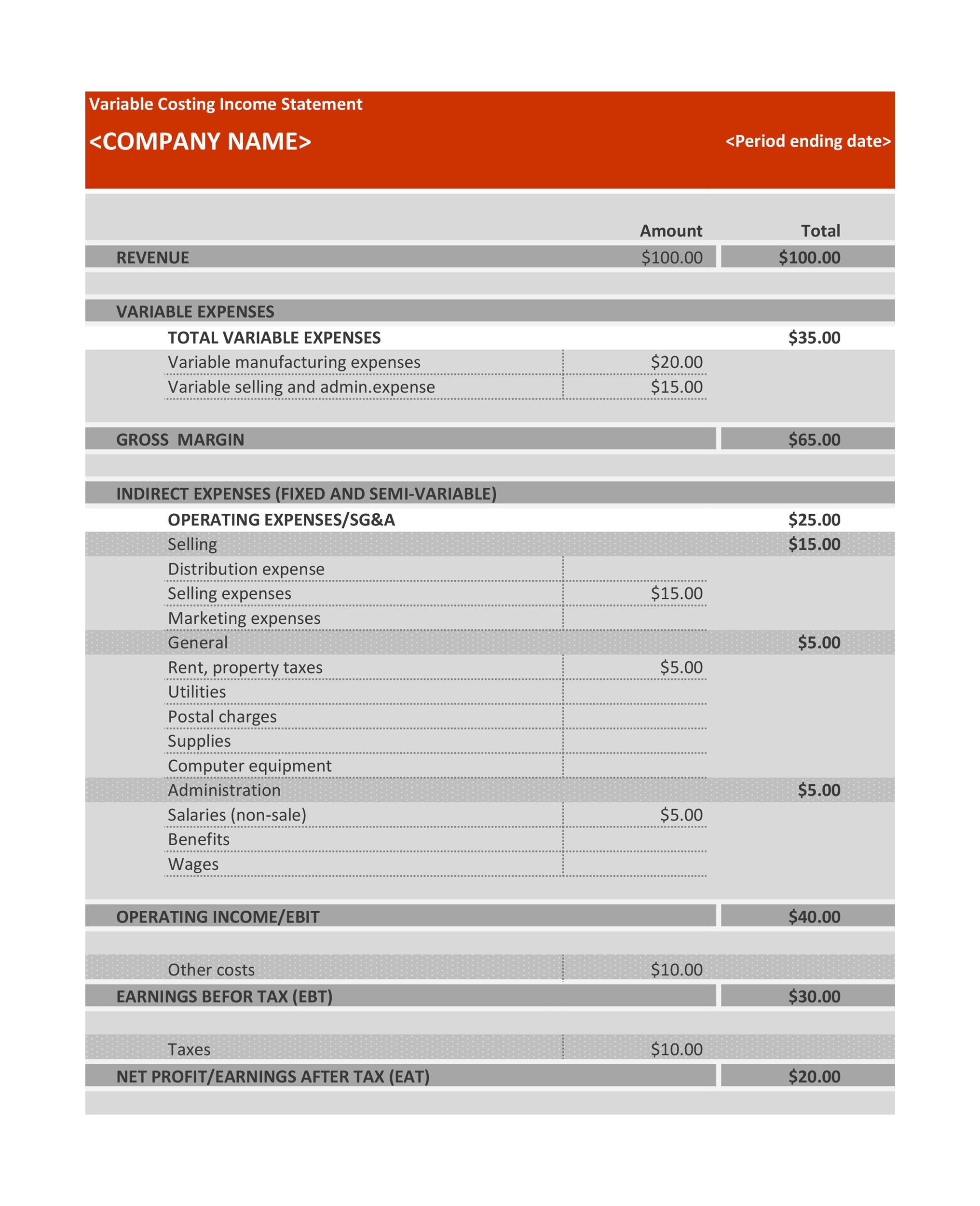

The variable costing income statement is one where all variable expenses are subtracted from revenue, which results in contribution margin.

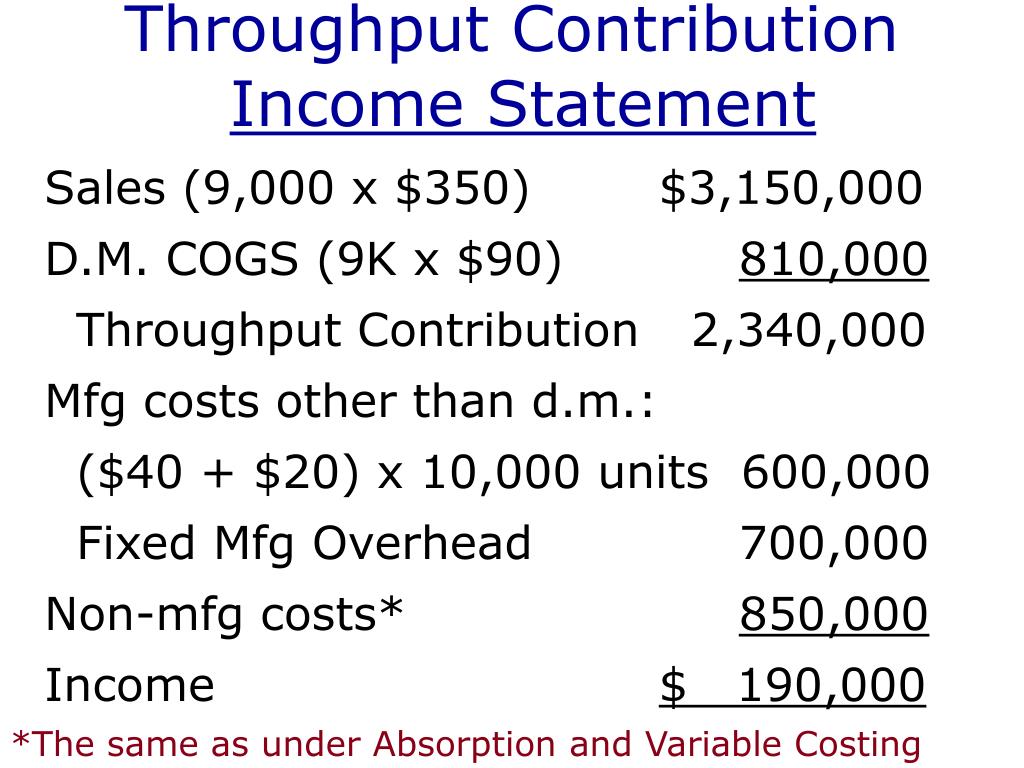

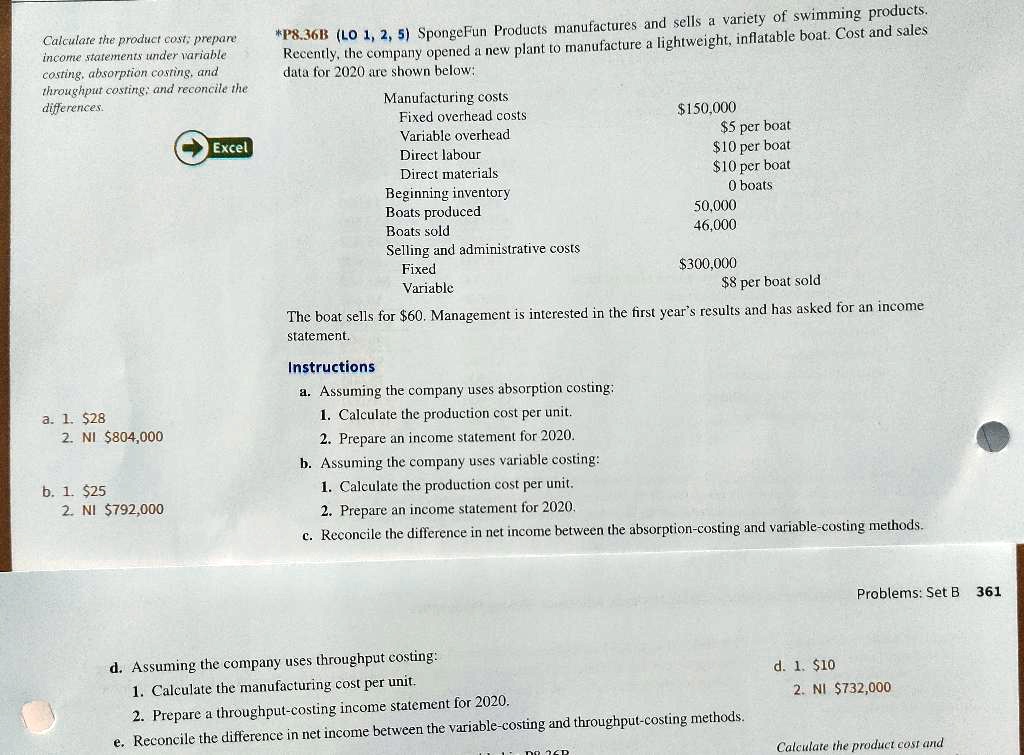

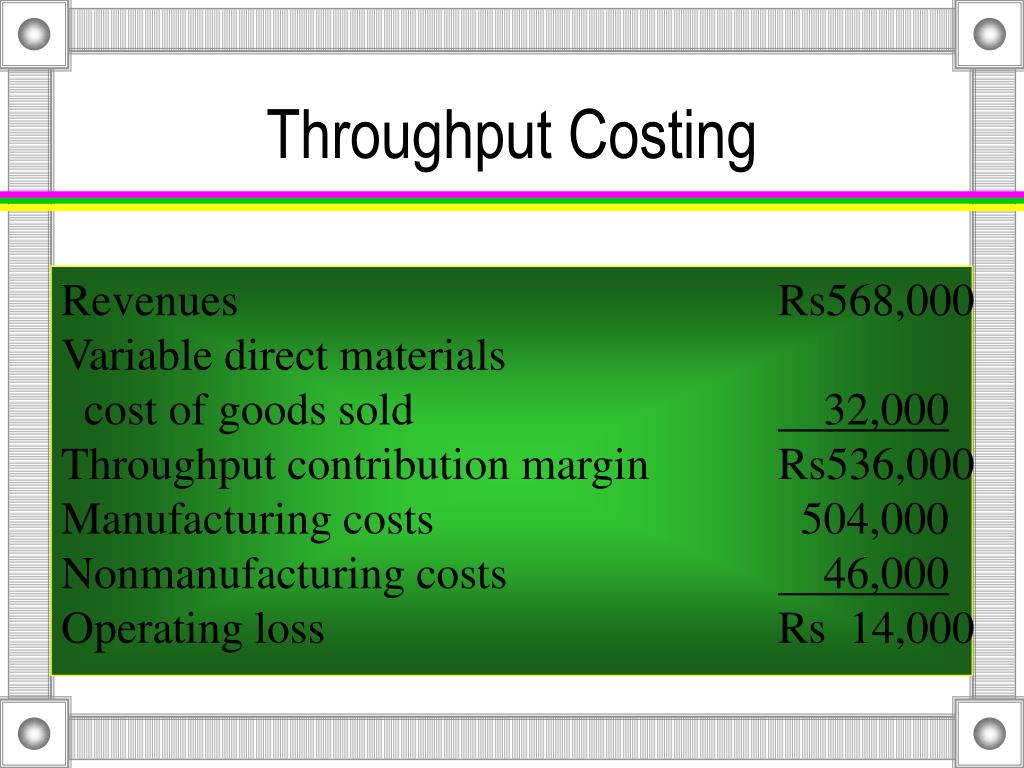

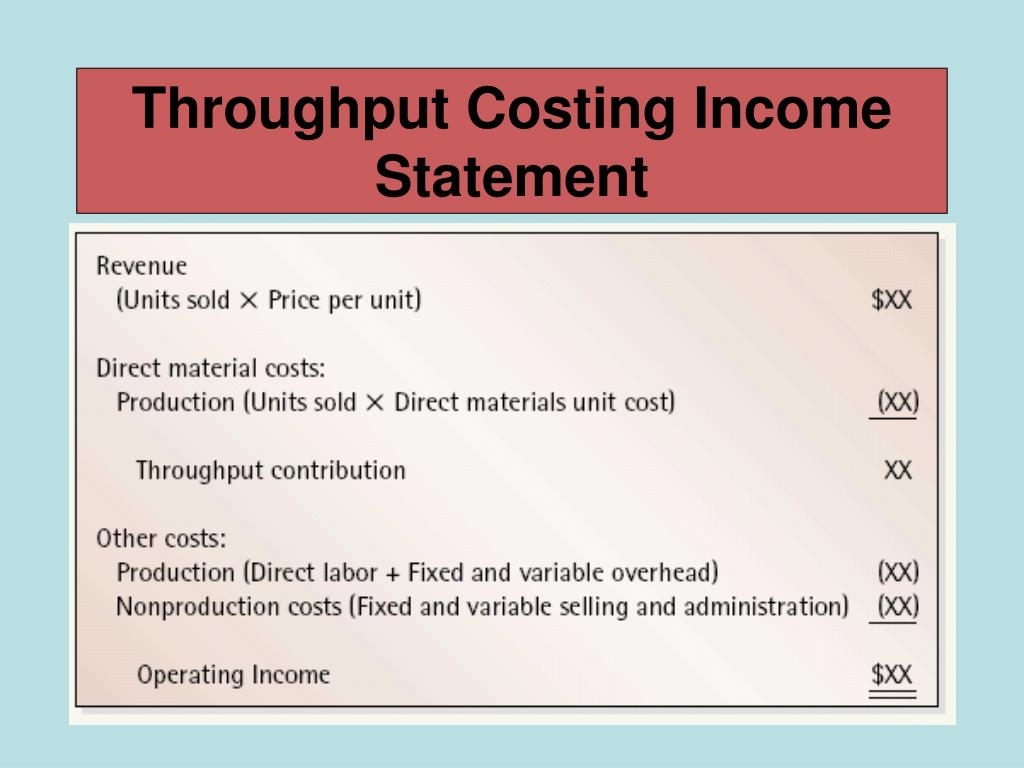

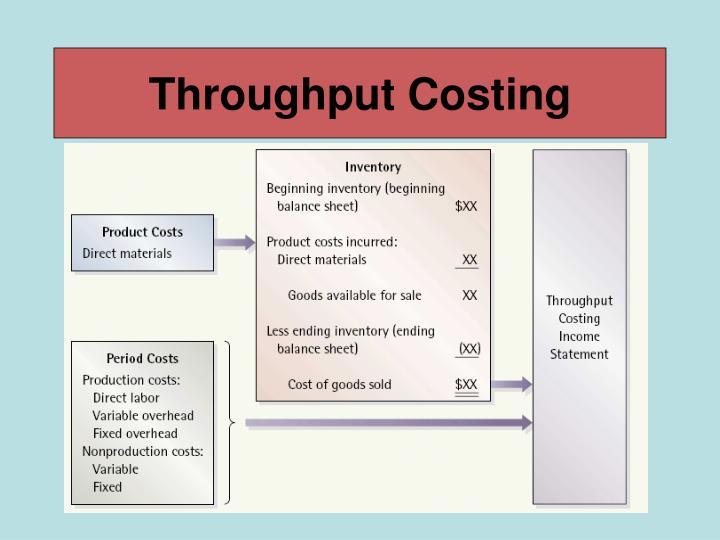

Throughput costing income statement. Rc all of the following are inventoried under absorption costing except: Income statement (variable costing): Variable costing and throughput costing are two methods that accountants use to provide managers with incremental cost information.

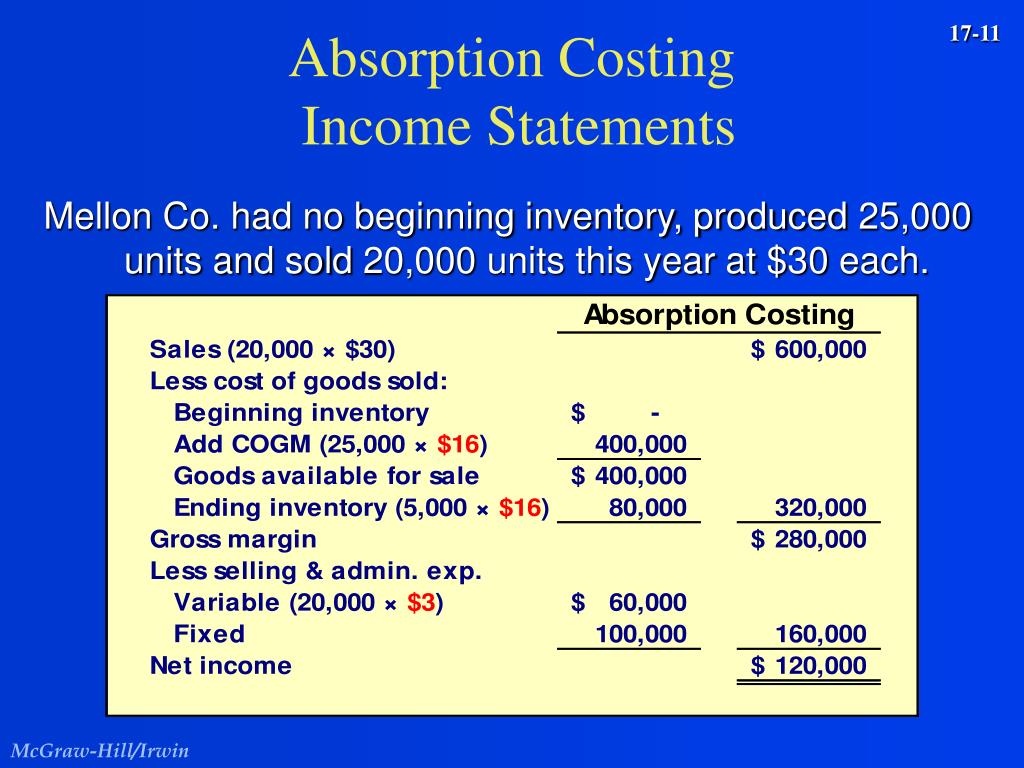

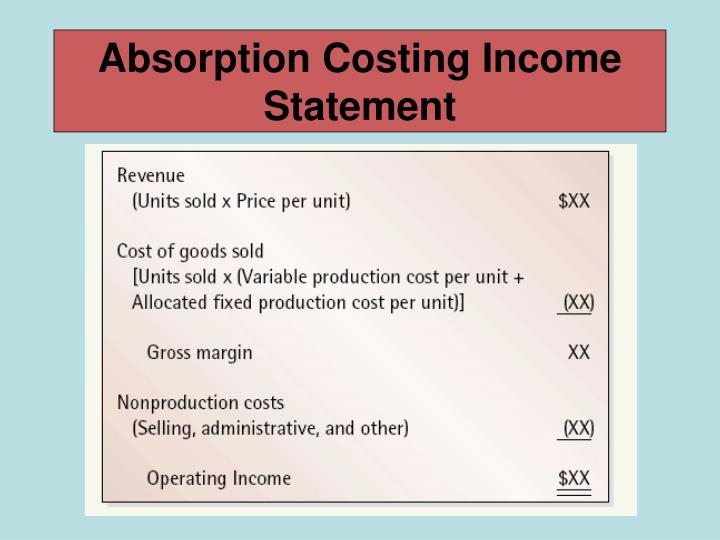

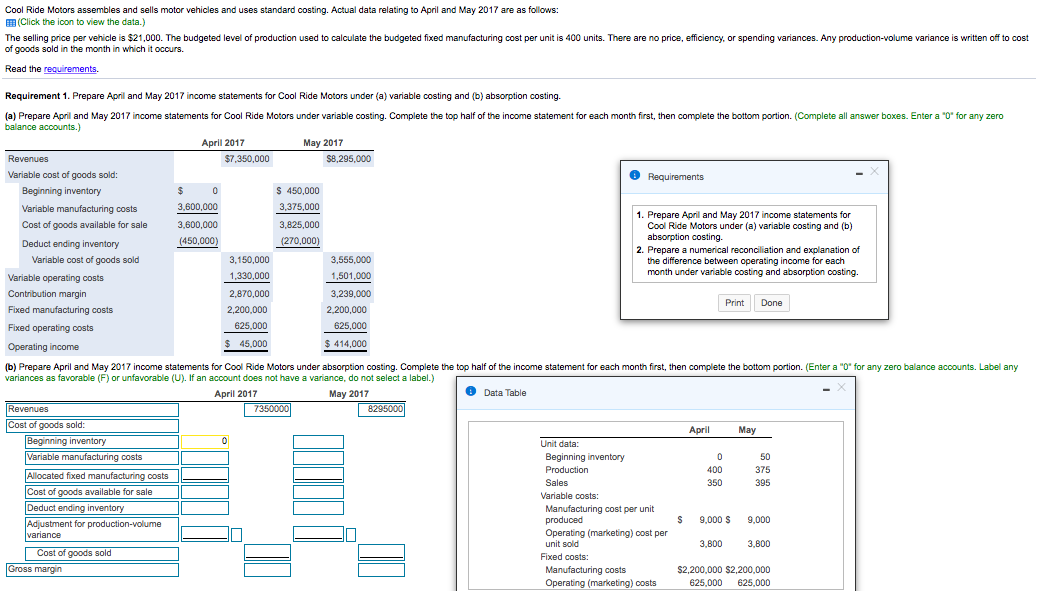

Prepare an income statement under absorption costing. Variable costing income statement: This chapter addresses the following.

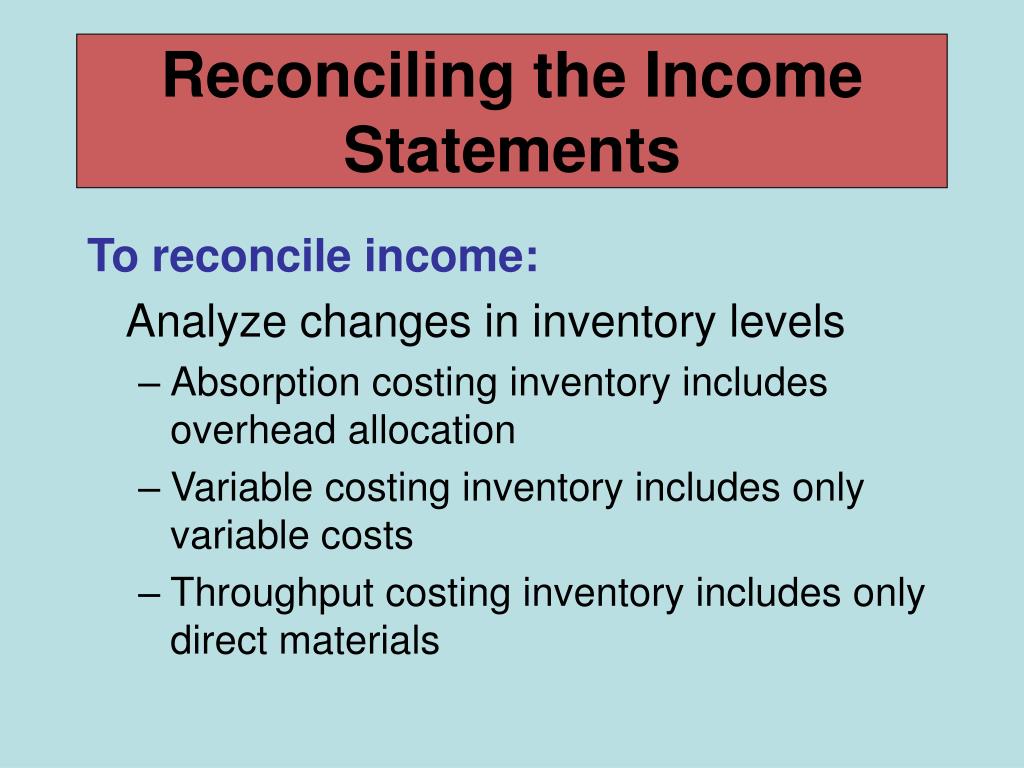

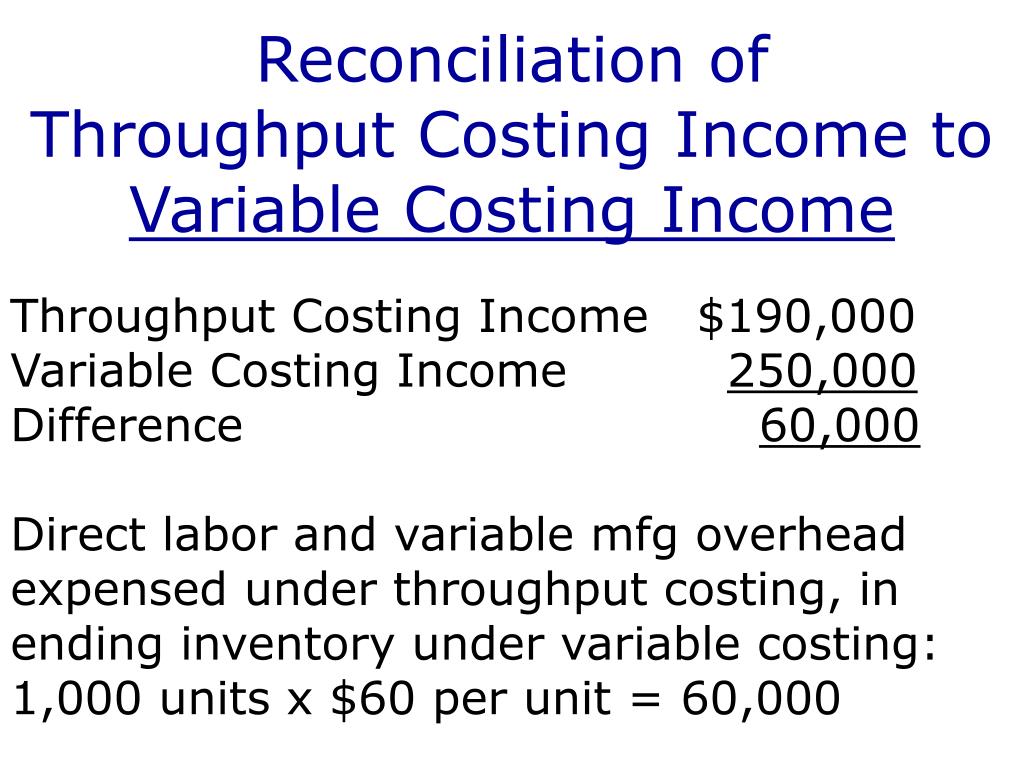

Increases in inventory cause income to be higher under absorption costing than under variable costing, and vice versa. Explain the accounting treatment of fixed manufacturing overhead under absorption and variable costing. Why company a’s net operating income is different under variable and absorption costing.

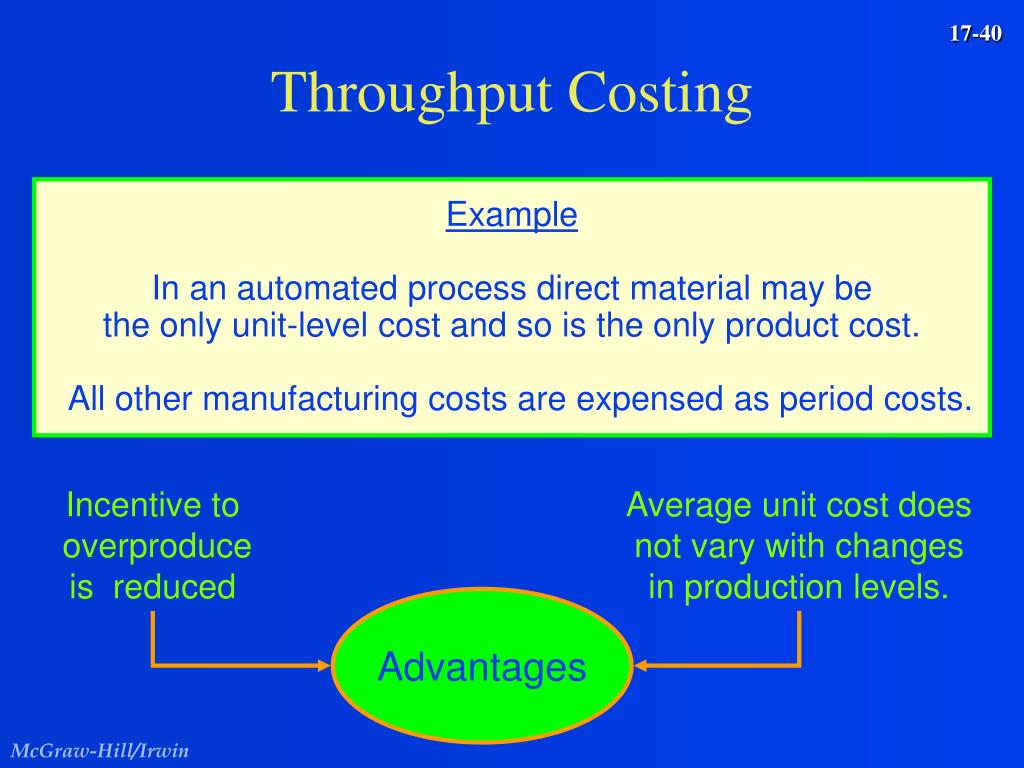

Two criteria should be met before it chooses throughput costing : Throughput (in $) = sales revenue figures less tvc or total variable costs.

Computations from financial statements prepared with absorption costing need computations to break out the fixed and variable costs from the product costs. There are three accounting approaches used to assign costs for income statement reporting purposes: Creating an income statement using the throughput accounting approach, based on the results of calculating and determining the share of each product in operating.

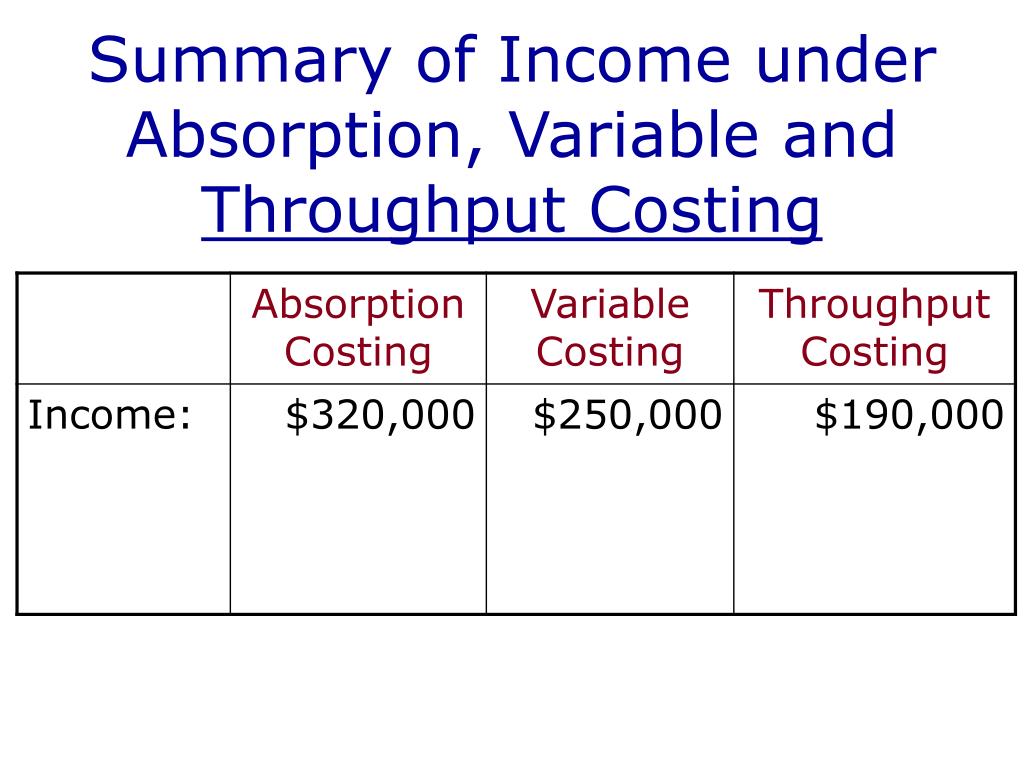

After reading this chapter, you should be able to: Absorption, variable, and throughput costing income statements having learned how absorption, variable, and throughput costing approaches treat inventory and period. Objectives describe standard costing and explain why it is the predominant costing method.

I want to finish off by briefly mentioning throughput ratios. Under variable costing, fixed factory (manufactured) overhead costs are not included in the product unit costs and costs of. Nature of the manufacturing process 2.

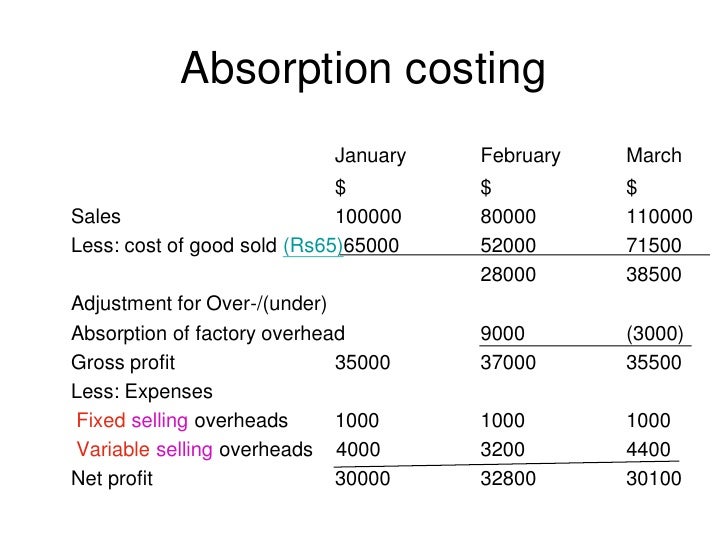

(1) return per factory hour, (2) cost per factory hour and (3) the. Raw materials used in production. You are required to present income statements using (a) absorption costing and (b) marginal costing account briefly for the difference in net profit between the two income.

Absorption costing, variable costing, and throughput costing. This is consistent with a general rule of thumb: There are three main ratios that are calculated:

Management preference of cost accounting information. From this, all fixed expenses are. These methods are differently used for external and internal reporting purposes.