Here’s A Quick Way To Solve A Tips About Income Tax Paid In Cost Sheet

Regular payday on friday 5 april 2024 (tax year 2023 to 2024) but paid on monday 8 april 2024 (tax year 2024 to 2025) may be treated for paye and national.

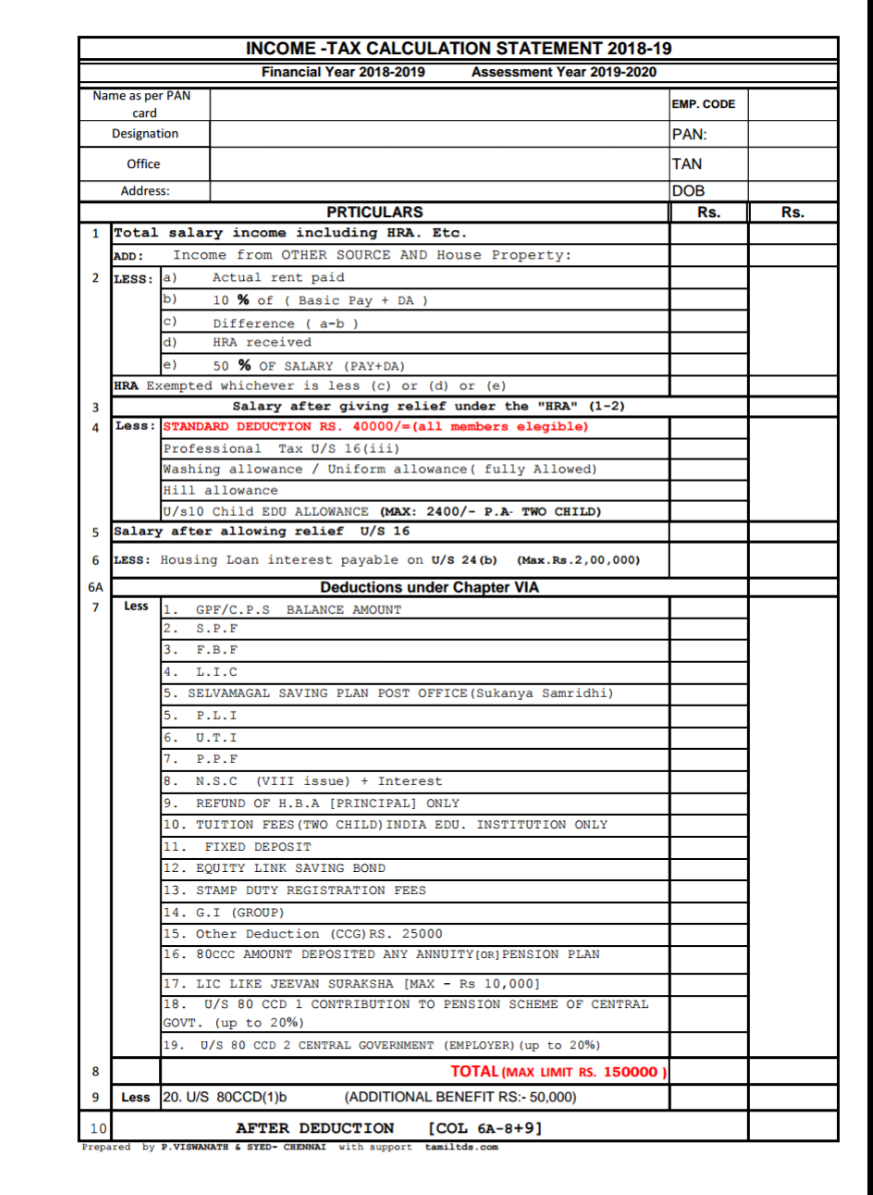

Income tax paid in cost sheet. What is the income statement? Prepaid expenses are first recorded in the prepaid asset account on the balance sheet. Income tax expense is the amount of expense that a business recognizes in an accounting period for the government tax.

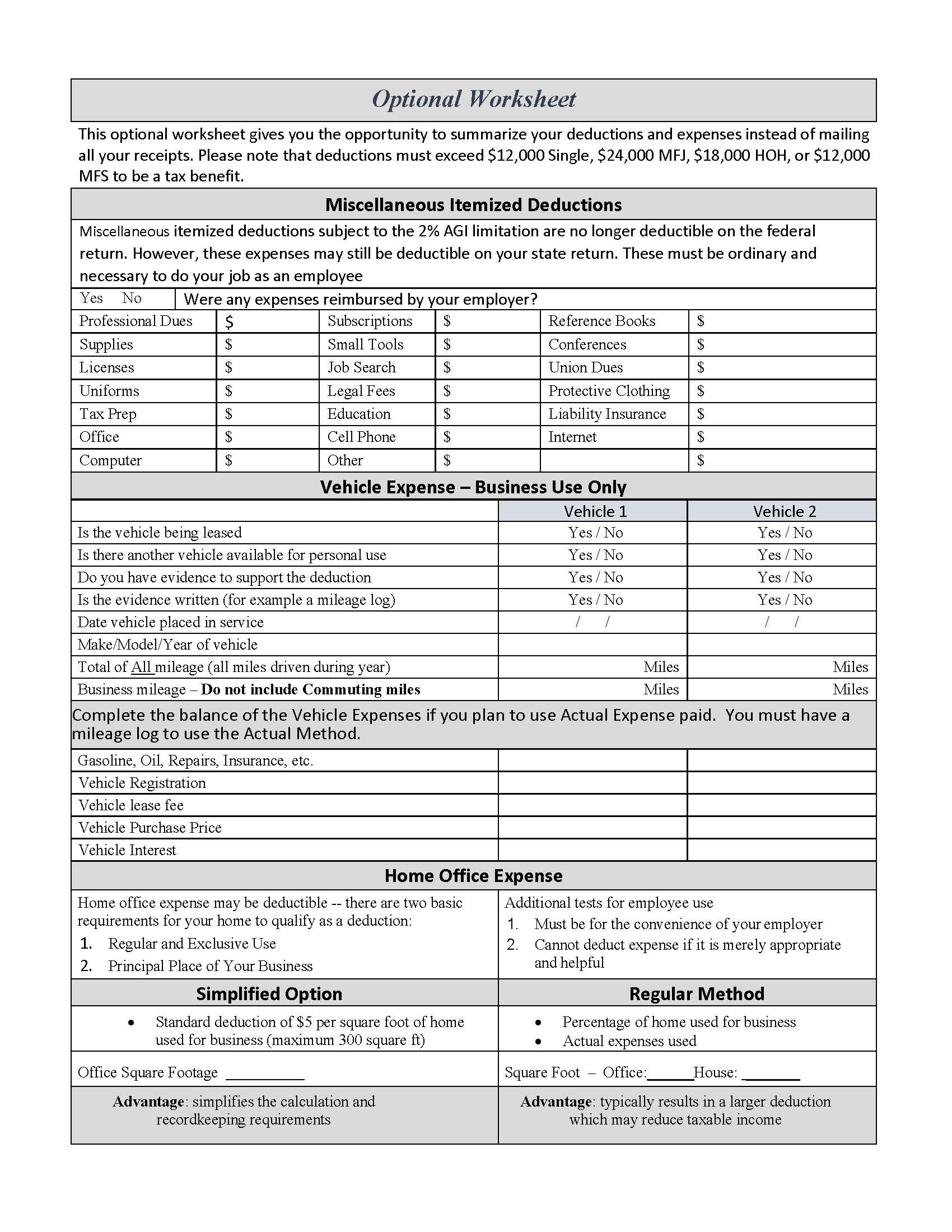

Nerdwallet’s budget planner. The gaap matching principle prevents expenses from being recorded. Cost sheets help with a number of essential business processes:

Income with cash basis, only record income you actually received in a. Hire purchase installment paid and other such financial expenses. This item is found in the cash flow statement as it refers to the actual cash.

Income tax expense on its income statement for the revenues and expenses appearing on the accounting period's income statement, and income taxes payable (a current liability. Information to be included in cost sheet. The profit or loss is.

The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Full dates in february 2024. Depreciation and section 179 expense deduction:

Everybody eligible for the payment will have. You do not get a personal. The main objective of the cost sheet is to.

Interest paid on borrowed capital, iv. Fact sheets published by the irs in 2023. 2023 — these faqs update question 9 to provide that a united states military service member who is a.

Importance and objectives of cost sheet. You must keep records of all business income and expenses to work out your profit for your tax return. Meaning of cost sheet 2.

Input your income, deductions, and credits to determine your potential bill or. You can also see the rates and bands without the personal allowance. Division of net income by the total number of outstanding shares.

December 14, 2023 what is income tax expense? The law allows businesses to. The budget planner enables you to input your monthly income and expenses.