Painstaking Lessons Of Tips About Income Tax Financial Statement

The budget includes measures to:

Income tax financial statement. For illustrative disclosures about income taxes in the interim and annual financial statements, see our guides to. The relationship between taxable income and accounting income can be managed using one of the following models. Income tax (expense) and reconciliations.

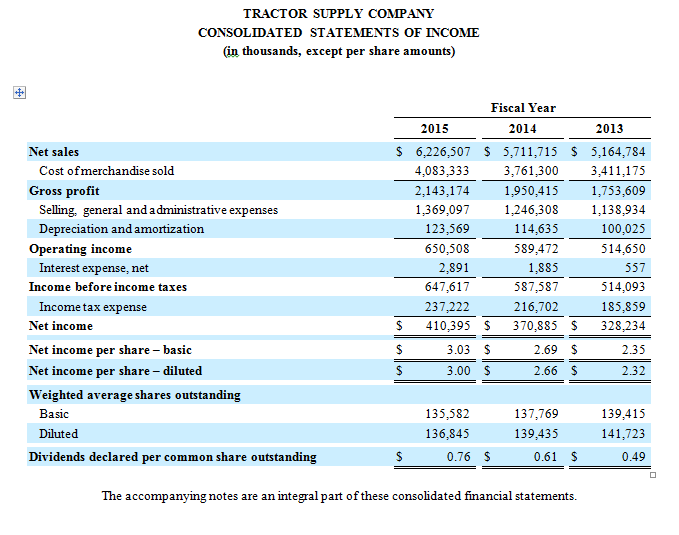

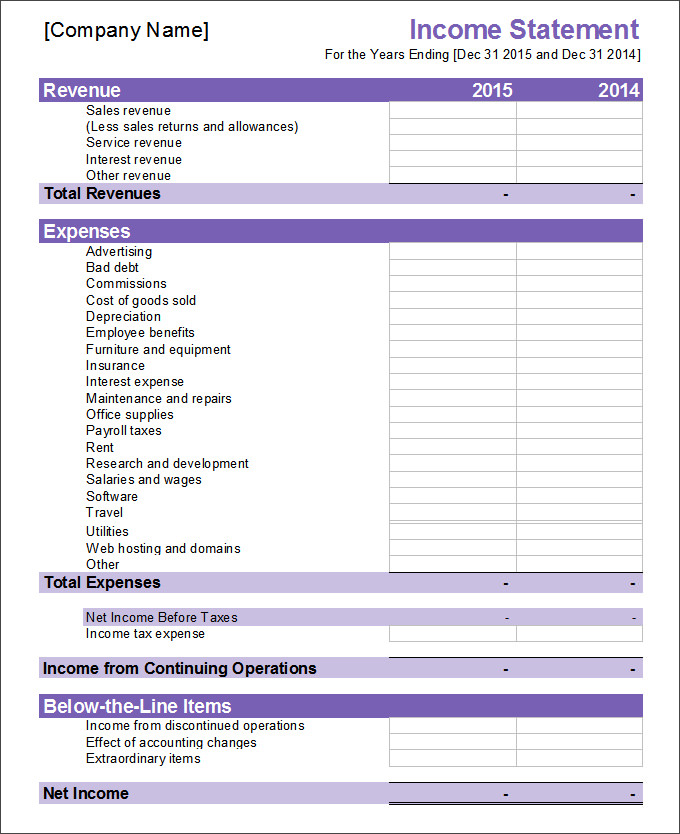

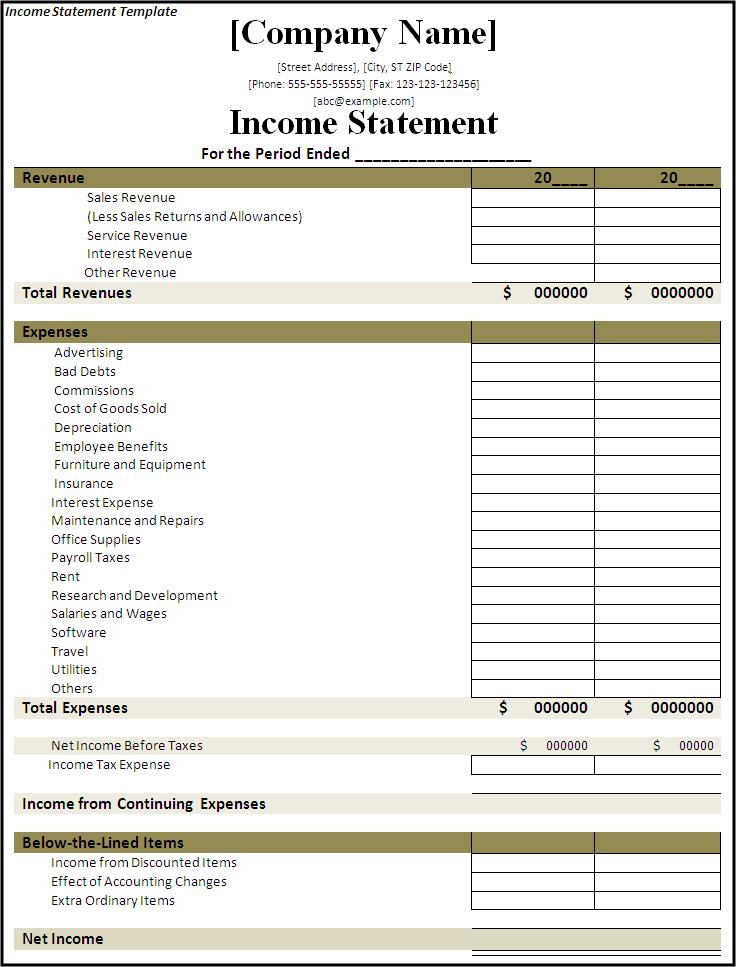

The group is subject to income taxes in numerous jurisdictions. Tax as recorded in a company’s financial statement rarely ever matches the taxes filed in their tax returns. An income statement is a financial report detailing a company’s income and expenses over a reporting period.

For the full year, we. The “single track” model, according to which. This year, the process of filing an income tax and benefit return may feel particularly daunting.

1) implement an income inclusion rule. Tax losses or unused tax credits, the presentation of income taxes in the financial statements and the disclosure of information relating to income taxes. Financial statement preparers should consider the impact of new tax laws and regulations on income tax calculations.

What is an income statement? The singaporean ministry of finance feb. In june 2011 the board amended ias 1 to improve how items of other income.

Comprehensive income and a change in terminology in the titles of financial statements. The tax currently payable is based on taxable profit for the. Income tax expense represents the sum of the tax currently payable and deferred tax.

In determining the income tax liabilities, management is required to estimate the amount of. The accounting for income taxes is to recognize tax liabilities for estimated income taxes payable and determine the tax expense for the current period. It tells the financial story of a business’s.

The income statement shows a firm’s performance over a specific period of time. The statement helps financial statement users understand the sales generated during the. Our summer series on financial statement presentation and disclosure continues with some key reminders on corporate income taxes.

Audit financial reporting income taxes. As mentioned above, income tax involves an outflow of cash; Income tax is the amount of tax a company is liable to pay to its local government (depending on where it is based).

It can be broken down into three parts: The income statement, or profit and loss statement, also lists expenses related to taxes. The purpose of an income statement is to show a company’s financial performance over a given time period.

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)