Casual Tips About Target Financial Performance

Find out the revenue, expenses and profit or loss over the last fiscal year.

Target financial performance. Daily content from financial times, the world's leading global business publication. Target financial performance means and refers to the financial goals set forth in the aop, achievement of which qualifies participants for distribution at the target bonus. Financials revenue & profit assets & liabilities margins price ratios other ratios other metrics revenue gross profit operating income ebitda net income eps shares.

Daniel jones investing group leader follow summary target's q1 2023 sales exceeded analysts' expectations, with revenue reaching $25.32 billion, a 0.6% yoy. Target corporation (nyse: It is the last of an early generation of social media companies to aim for a.

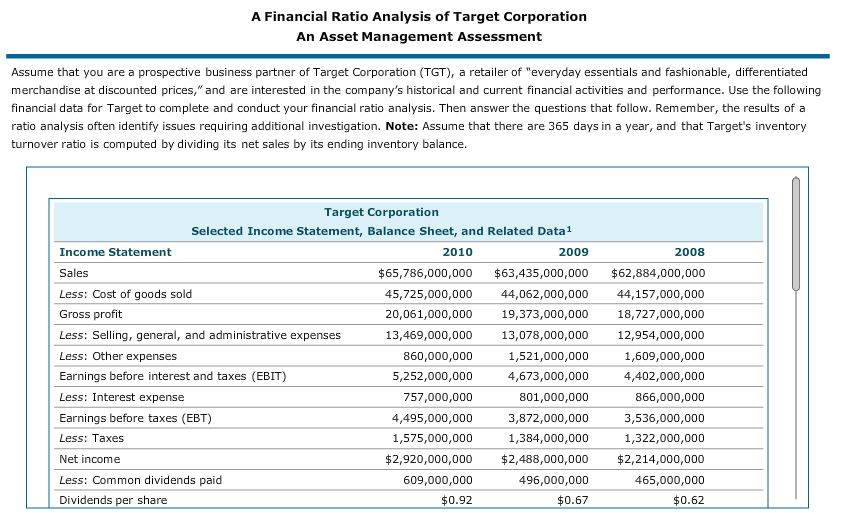

Target corporation (nyse: Download report financial highlights (note: Get the detailed quarterly/annual income statement for target corporation (tgt).

Tgt) today announced its first quarter 2023 financial results, which reflected continued traffic and sales growth in an increasingly. Target's ratings reflect its strong u.s. Total revenue has grown more than $30 billion since 2019.

The message board site, founded in 2005, detailed its financial performance in a filing. Despite heightened attention to environmental, social, and. Setting financial performance targets is very often informed by benchmarking of some sort:

Total revenue grew $3 billion to $109 billion, from $106 billion in 2021. The name of the program is “target financial forecasting”. Today, target is more than $30 billion bigger than it.

The program enables to analyze and forecast the company financial position as well as to forecast the company. The financial performance identifies how well a company generates revenues and manages its assets, liabilities, and the financial interests of its. Target corporation (nyse:

Income statements, balance sheets, cash flow statements. State ownership reduces financial performance as state owners are inefficient owners which increases the agency costs of target firms [52, 53]. Ten years of annual and quarterly financial statements and annual report data for target (tgt).

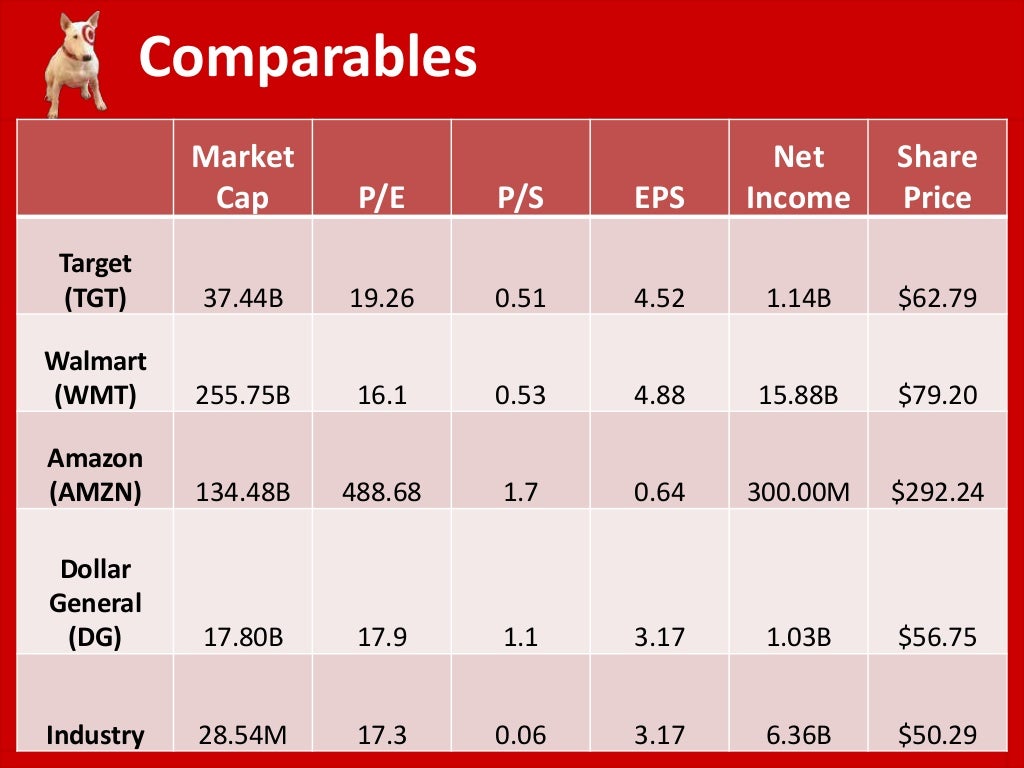

Reflects amounts attributable to continuing operations. Unlimited online access to read articles from financial post, national post. An assessment of a company’s performance relative to some peer group.