Cool Tips About Consolidated Financial Statements Accounting Standard

The proposals may be modified in the light of the comments received before being issued as an international financial reporting standard (ifrs).

Consolidated financial statements accounting standard. Comments on the draft ifrs and its accompanying In april 2001 the international accounting standards board (board) adopted ias 22 business combinations,. Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health.

Requires an entity (the parent) that controls one or more other entities (subsidiaries) to present consolidated financial statements; Terms defined in appendix a are in italics the first time they appear in the standard. The accounts comply with ifrs accounting standards as issued at 30 june 2023 and that apply to financial years commencing on or after 1.

That form an integral part thereof. The australian accounting standards board makes accounting standard aasb 10 consolidated financial statements under section 334 of the corporations act 2001. This publication presents pwc's illustrative consolidated financial statements for a fictitious listed company, containing illustrative disclosures for as many common scenarios as possible.

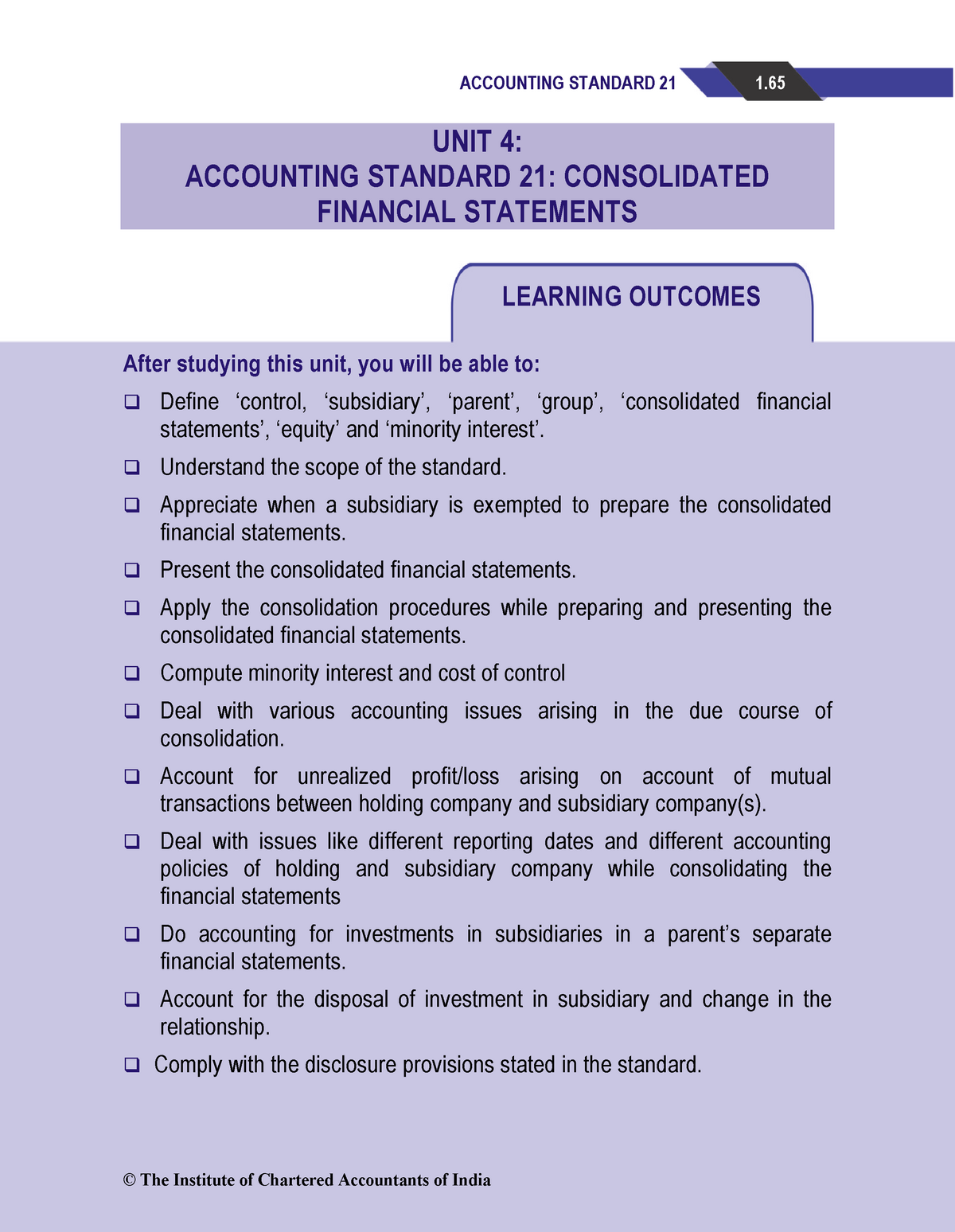

Accounting standard (as) 21 consolidated financial statements1 (this accounting standard includes paragraphs set in bold italic type and plain type, which have equal authority. Ias 27 consolidated and separate financial statements outlines when an entity must consolidate another entity, how to account for a change in ownership interest, how to prepare separate financial statements, and related disclosures. Consolidated financial statements in april 2001 the international accounting standards board (board) adopted ias 27 consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april 1989.

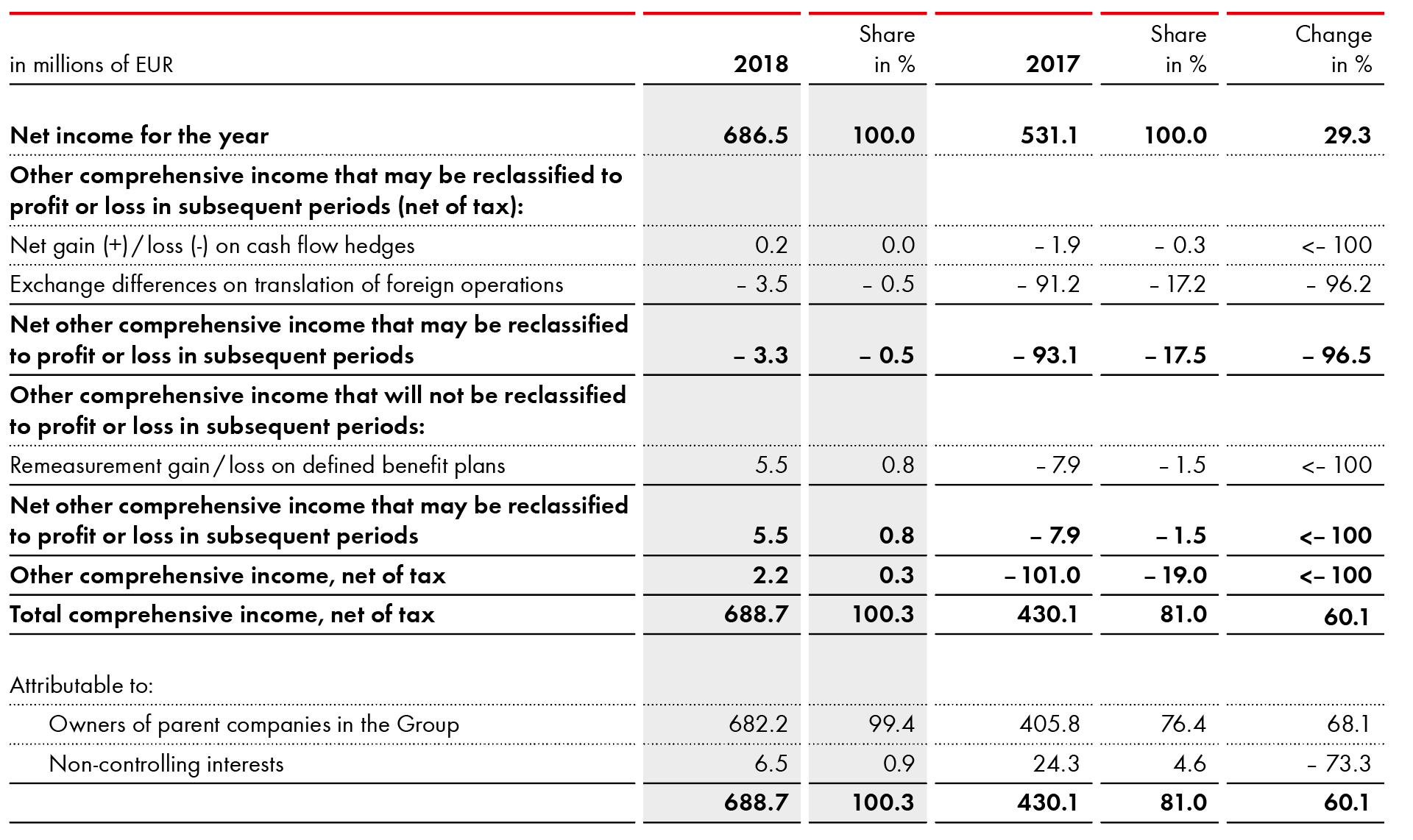

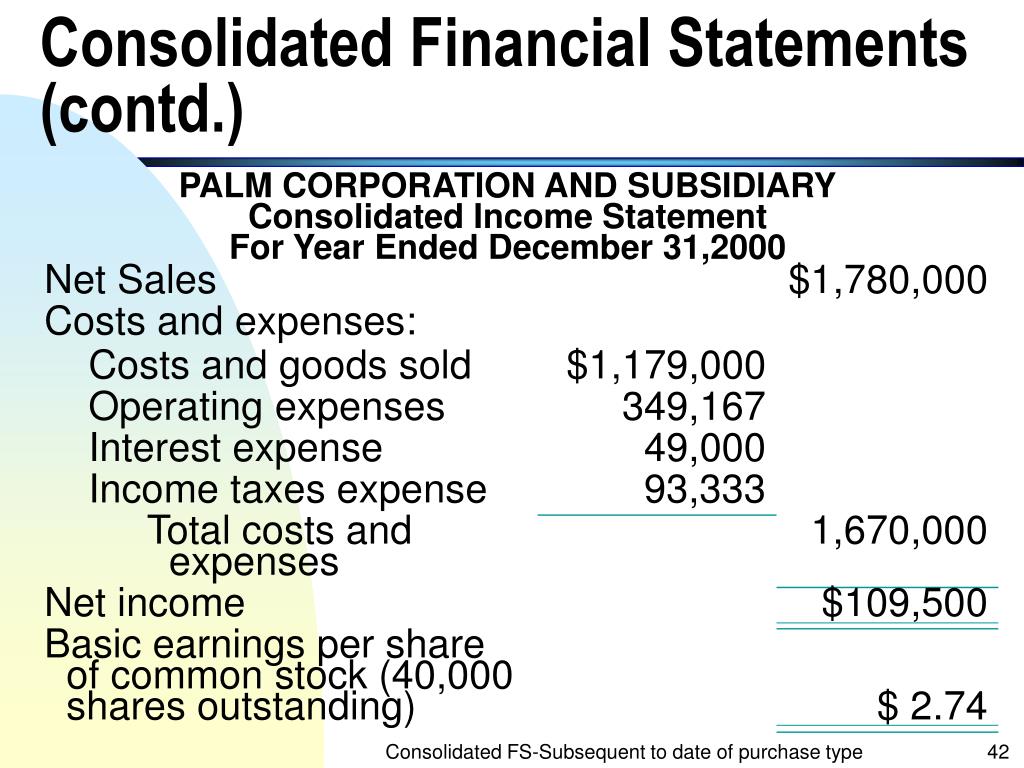

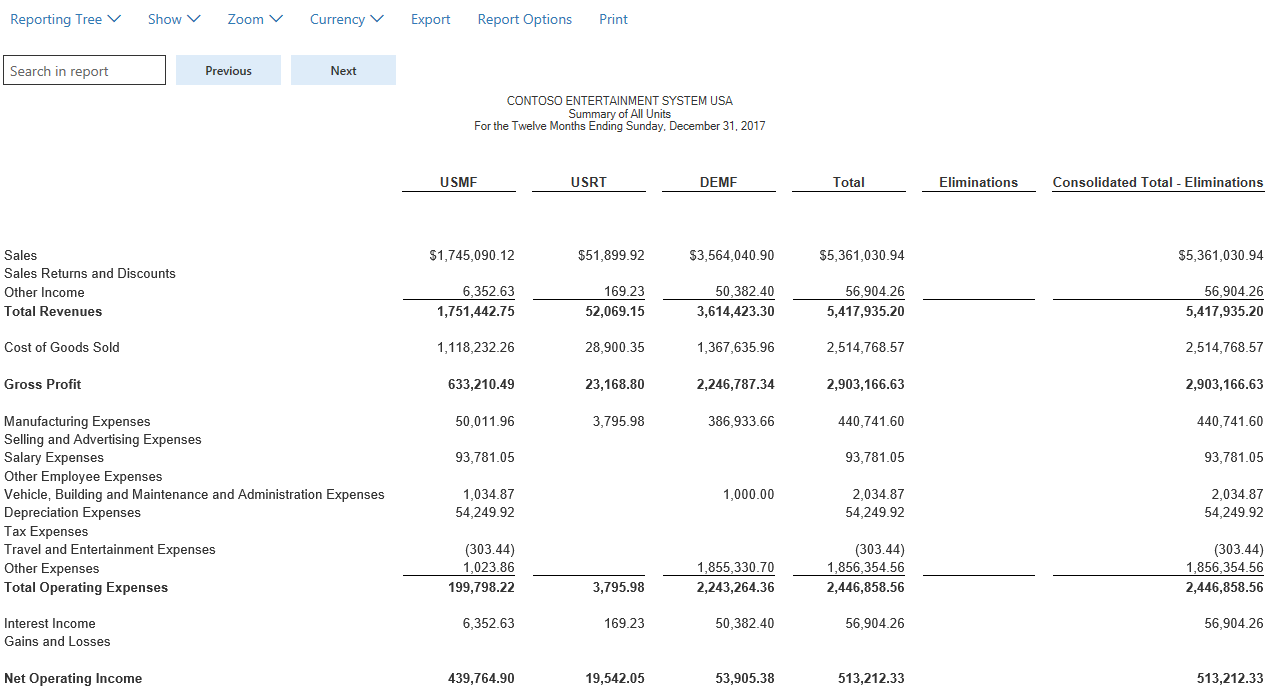

Our net income of the quarter, of $1.1 billion was positively affected by: Ed 10 consolidated financial statements is published by the international accounting standards board (iasb) for comment only. This statement amends arb 51 to establish accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary.

Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee. Ifrs 10 was issued in may 2011 and applies to annual. Ifrs 10 outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to consolidate entities it controls.

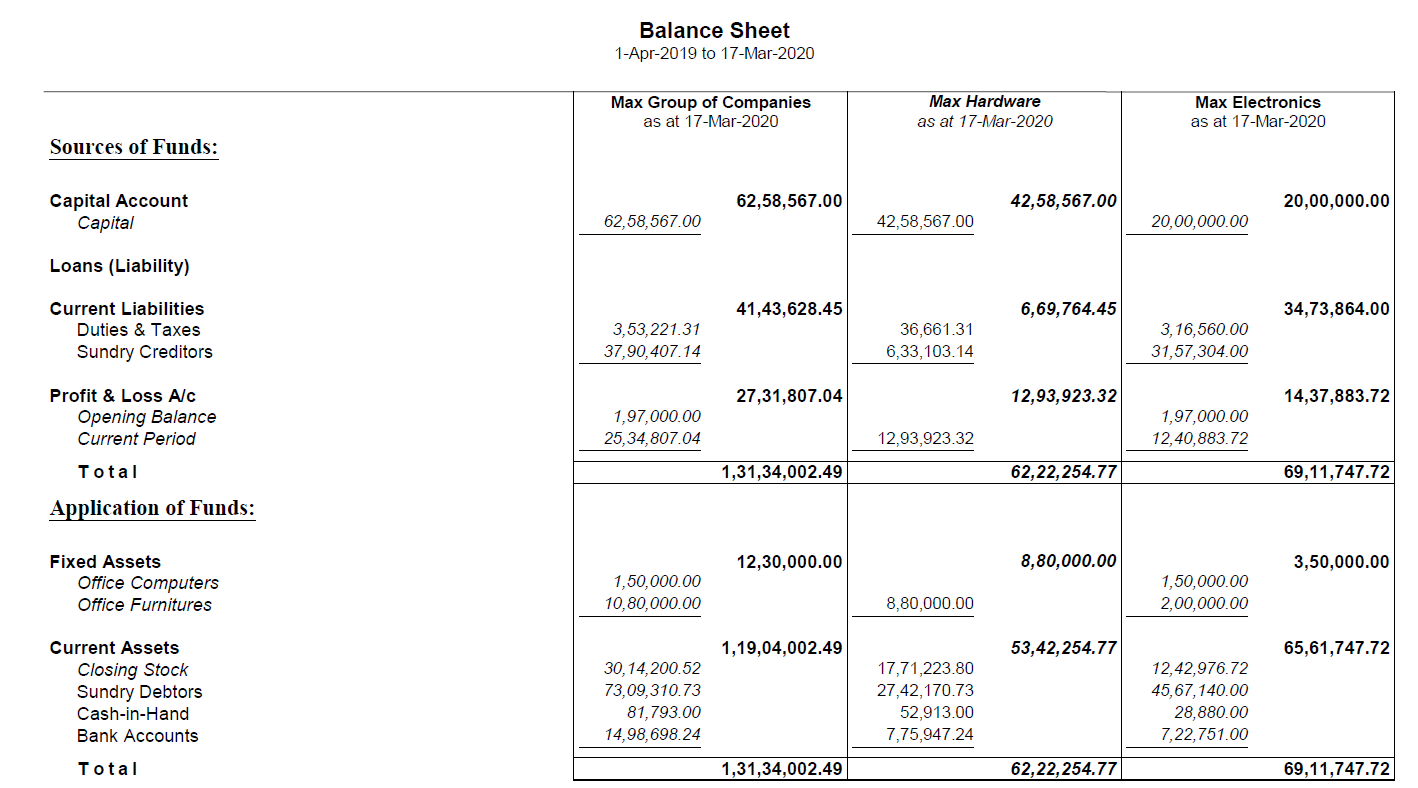

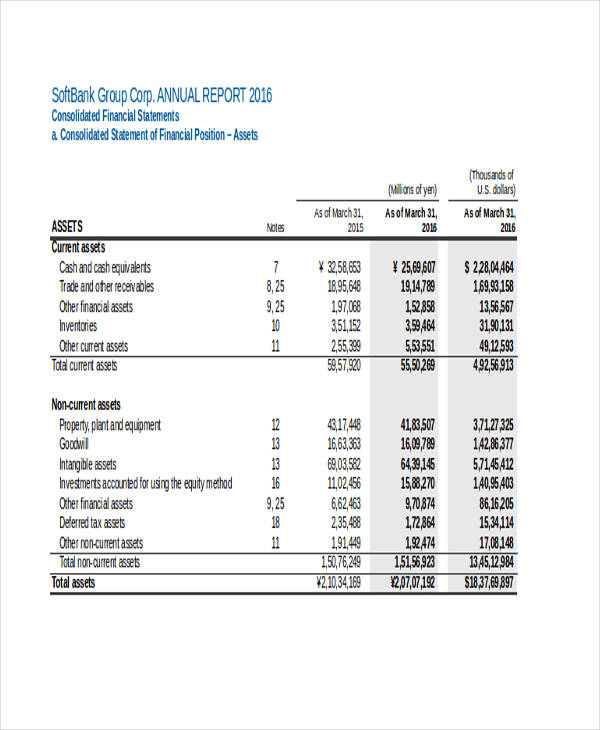

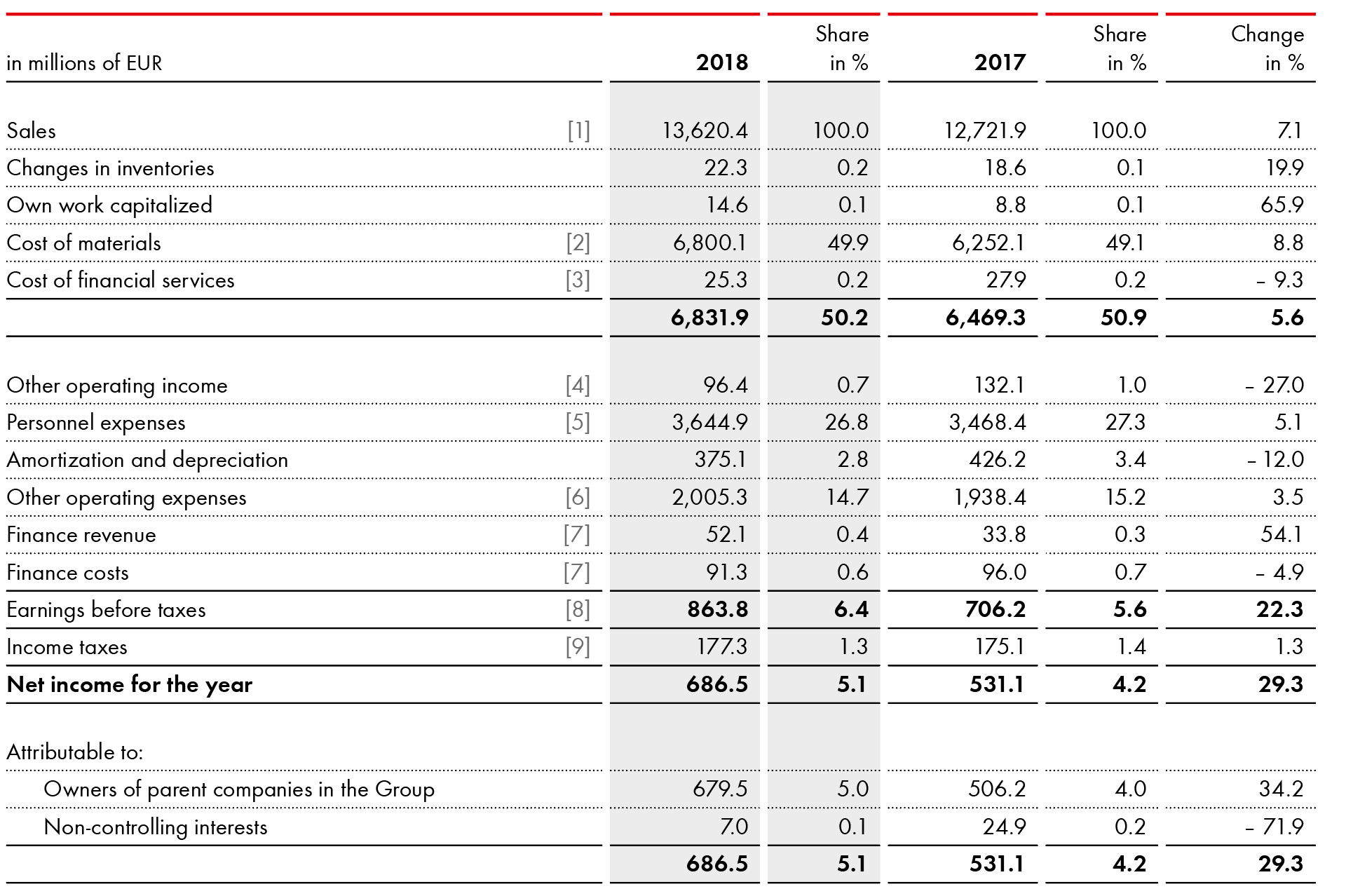

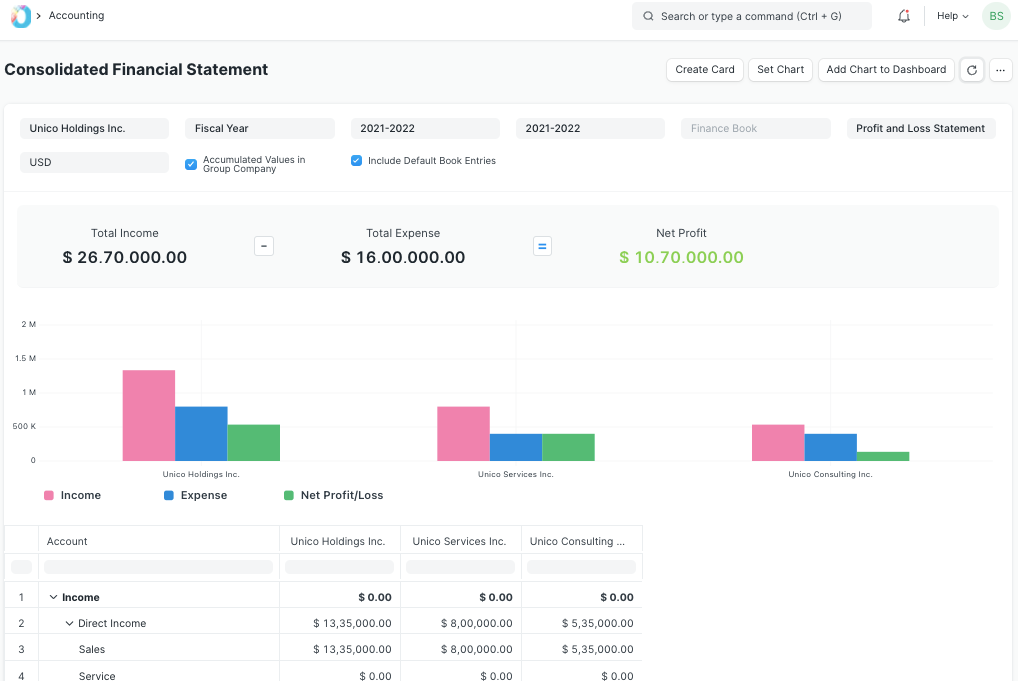

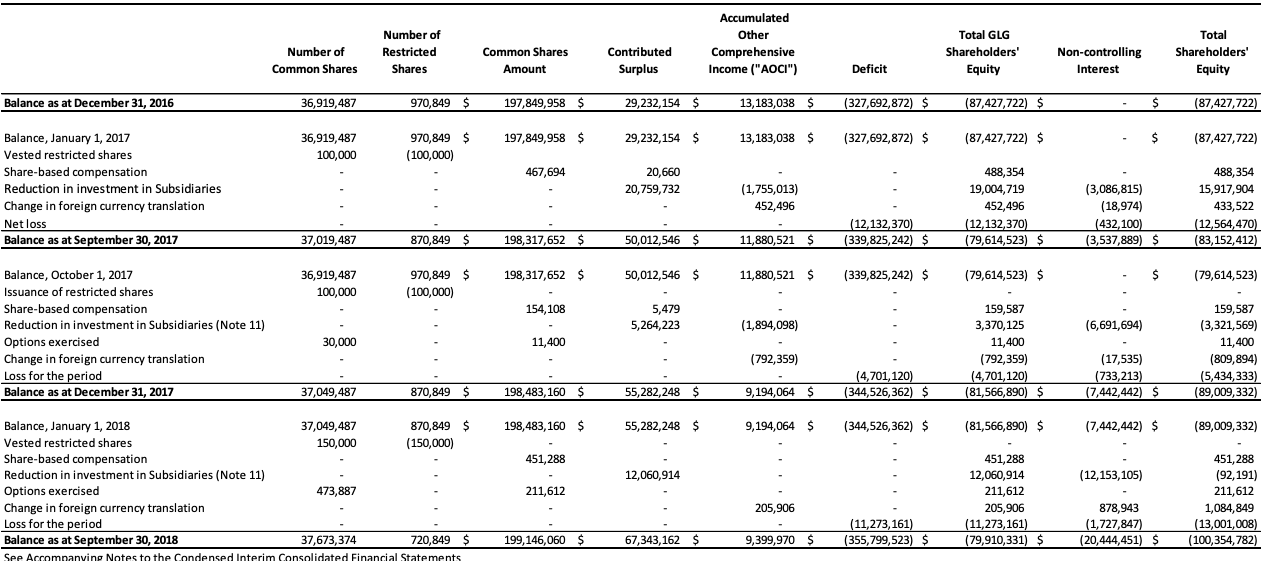

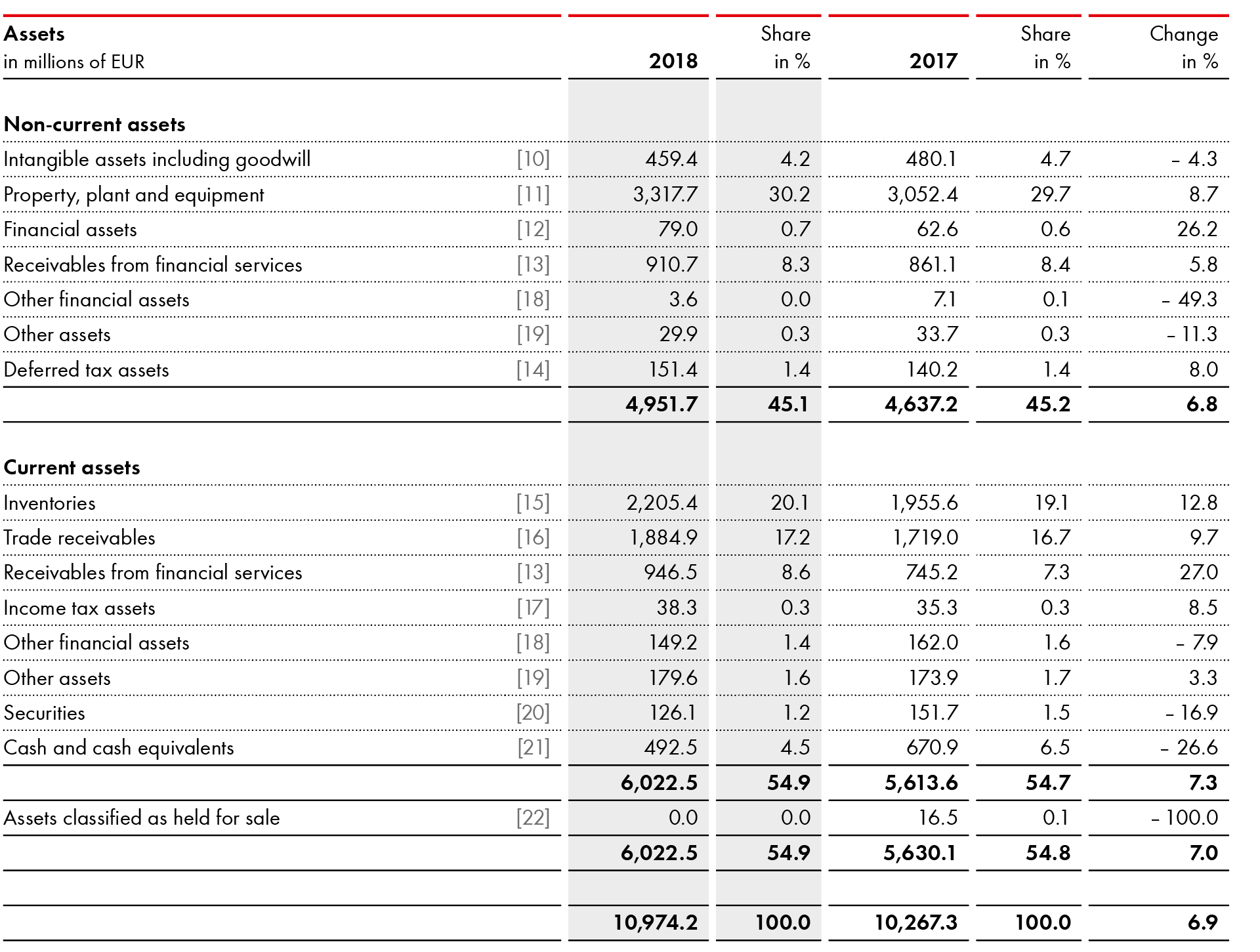

Consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april 1989. Consolidated financial statements normally include consolidated balance sheet, consolidated statement of profit and loss, and notes, other statements and explanatory material. Consolidated financial statements are financial statements that present the assets, liabilities, equity, income, expenses and cash flows of a parent and its subsidiaries as those of a single economic entity.

Paragraphs in bold type state the main principles. The ultimate or any intermediate parent of the parent publishes consolidated financial. Limited exceptions exist when a subsidiary has specialized industry accounting principles.

May 17th, 2021 | 9 min read contents [ show] as 21 consolidated financial statements should be applied in preparing and presenting consolidated financial statements for a group of enterprises under the sole control of a parent enterprise. This page provides information on the standard and amendments, with icaew factsheets and guides. It clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial.

That standard replaced ias 3 consolidated financial statements (issued in june 1976), except for those parts that dealt with accounting for investment in associates. Ifrs 10 consolidated financial statements (issued may 2011), ifrs 13 fair value measurement (issued may 2011), investment entities (amendments to ifrs 10, ifrs 12 and ias 27) (issued october 2012), Fourth quarter highlights.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)