Beautiful Info About Primerica Mutual Funds Performance

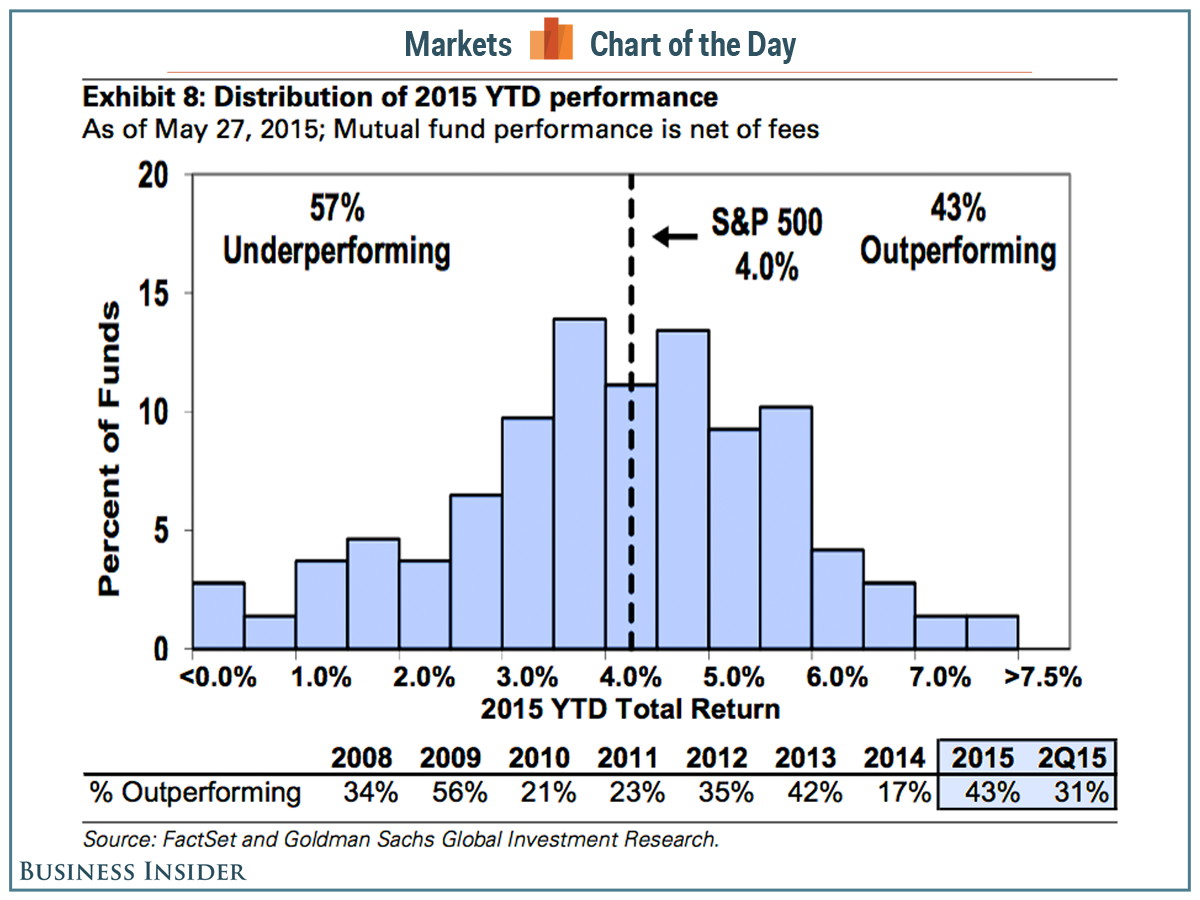

Share classes are subject to different fees and expenses, which will affect their performance.

Primerica mutual funds performance. In total, primerica advisors manages $7.1 billion in assets. Invesco greater china class a: For detail information about the quantiative fair value estimate,.

(see edit) i am a 22yr old investor who just started putting money into a mutual fund through primerica. Primerica has been helping main street families invest for the future since 1977. Mutual funds and variable annuity subaccounts that invest in foreign securities, particularly emerging markets, generally have annual expenses that can be significantly higher than.

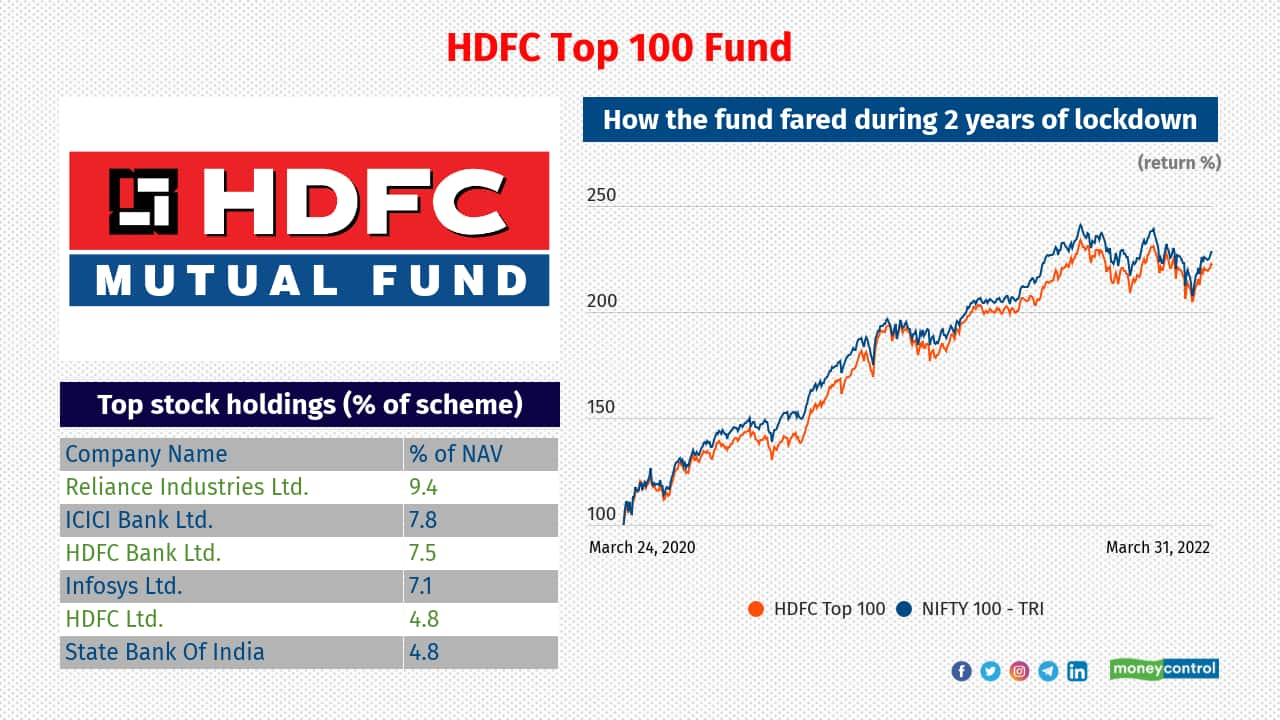

Past performance of a security may or may not be sustained in future and is no indication of future performance. The fund’s performance drivers: Primerica offers mutual funds and variable annuities to help families build a secure financial future.

With the large number of mutual funds available in the marketplace today, pfsi believes that it can better service its clients by focusing the firm and our representatives on a. Neither the sec nor finra tracks. While many financial professional aren't interested in working with the middle class,* primerica.

Large cap equity & aggressive bond funds:. The fund is legg mason clearbridge and they seem to have. Each fund may have more than one class of shares.

Primerica performance | primerica mutual funds fund facts the primerica concert allocation series of funds (concert funds) point of sale documents are available. Sector & international equity funds: Sector & international equity funds:

For detail information about the quantiative fair value estimate,. A mutual fund is an opportunity for you, together with many other investors, to pool your money. Past performance of a security may or may not be sustained in future and is no indication of future performance.

The search results for any particular search will show only the class(es) of a fund whose performance. What is the historical performance of primerica advisors? Currently, the fund aims to maintain at least 65% of its portfolio in mutual funds that hold bonds and other fixed income securities and up to 35% of its portfolio in mutual funds.

Most funds offer multiple share classes. An optimally diversified investment program, primerica concerttm allocation series of funds is designed to meet the needs of canadian investors.

/GettyImages-471118891-5780500a5f9b5831b5e90849.jpg)