Outstanding Info About Strong Balance Sheet

Tourmaline's strong balance sheet and cost efficiency position it well for future growth.

Strong balance sheet. A balance sheet covers a company’s assets as defined. Updated april 05, 2022 reviewed by natalya yashina those who are familiar with balance sheet basics know that a company's balance sheet offers a snapshot in time of a company's financial. A strong balance sheet is the seventh criteria for stock selection at smead capital management.

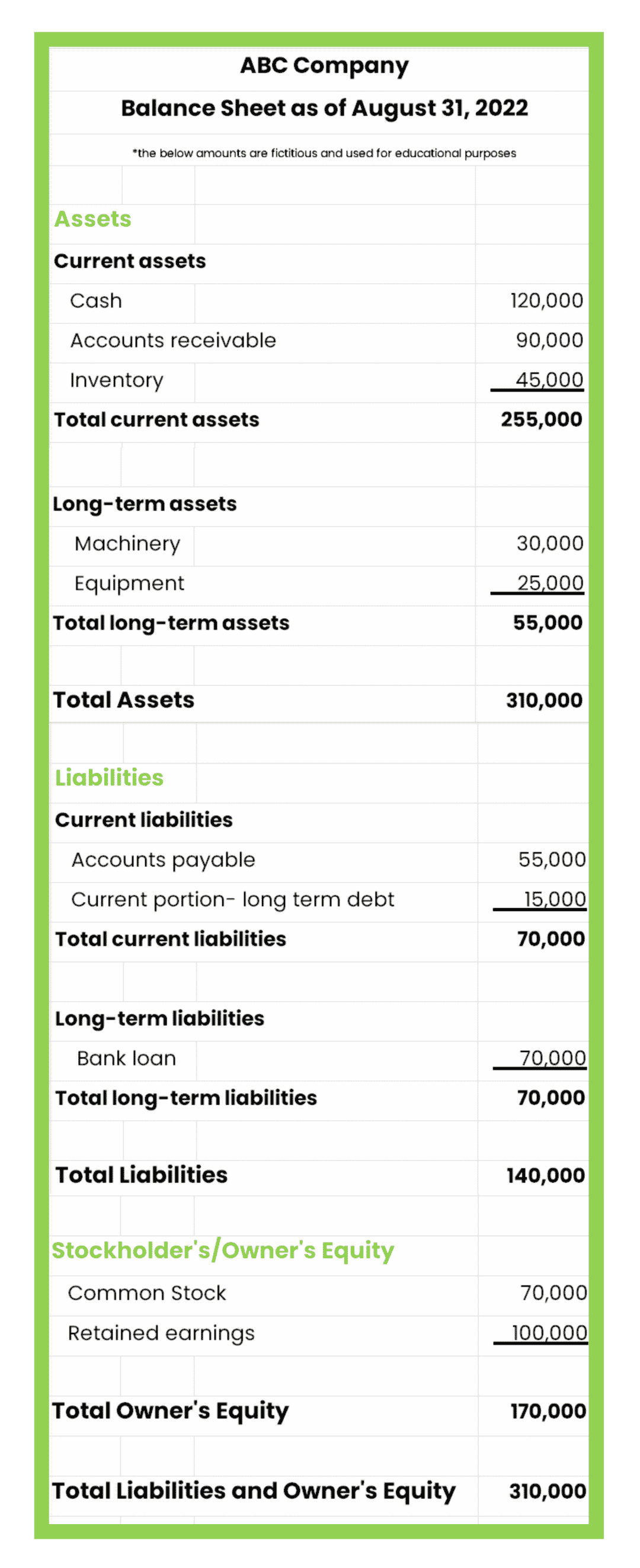

It gives a basic explanation of ownership versus debt. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Innovative industrial properties sported a yield at purchase of just 3.0% a few years ago, and in late 2021, its yield at purchase was still an uninspiring 2.34%.

What does a strong balance sheet look like & why is it important? Axa enters its new strategic plan in a position of strength. A balance sheet is simply a financial statement that summarizes an organization's assets, liabilities, and shareholders' equity.

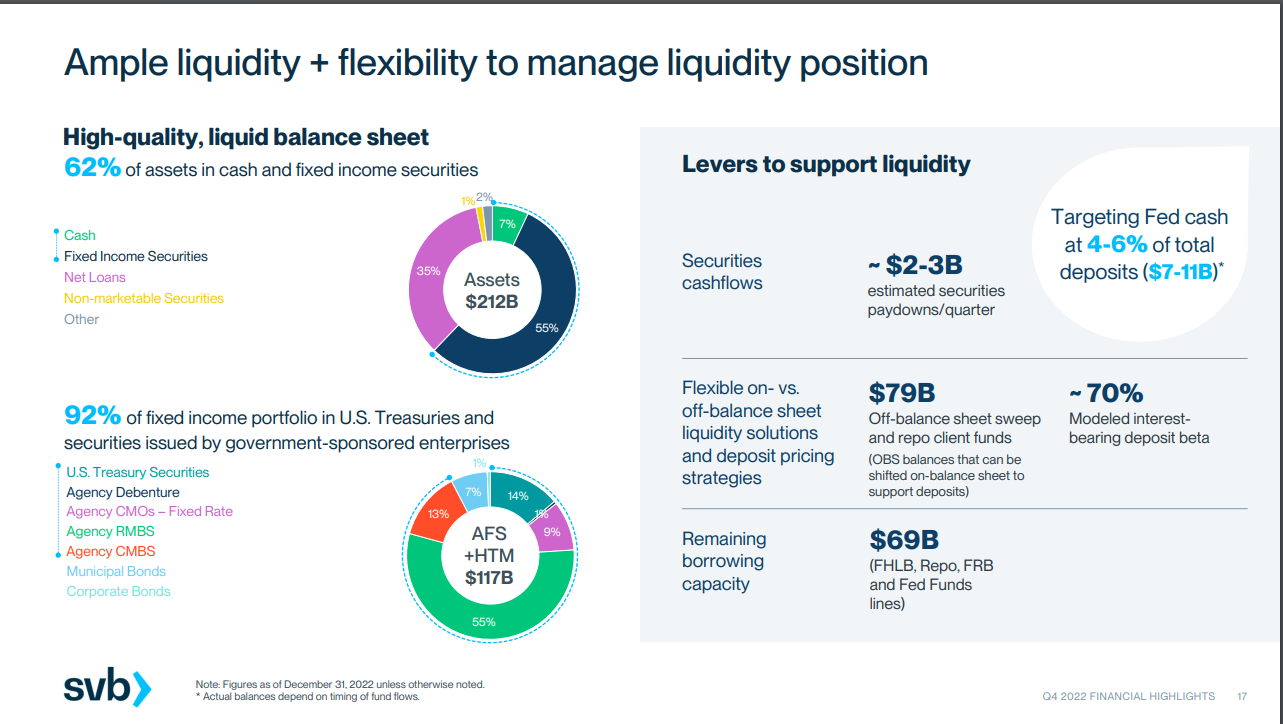

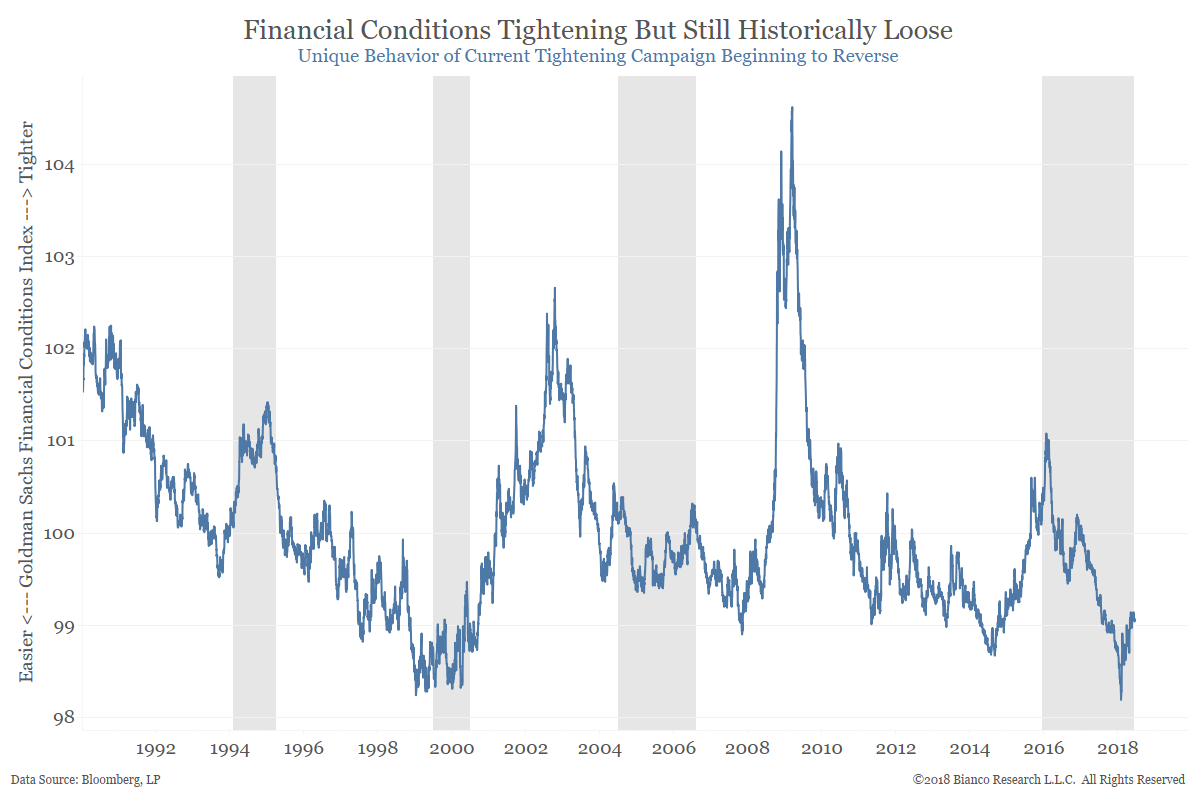

The fed has been reducing the size of its holdings since 2022. Essentially, a balance sheet is a financial statement that outlines the assets and liabilities of your company. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

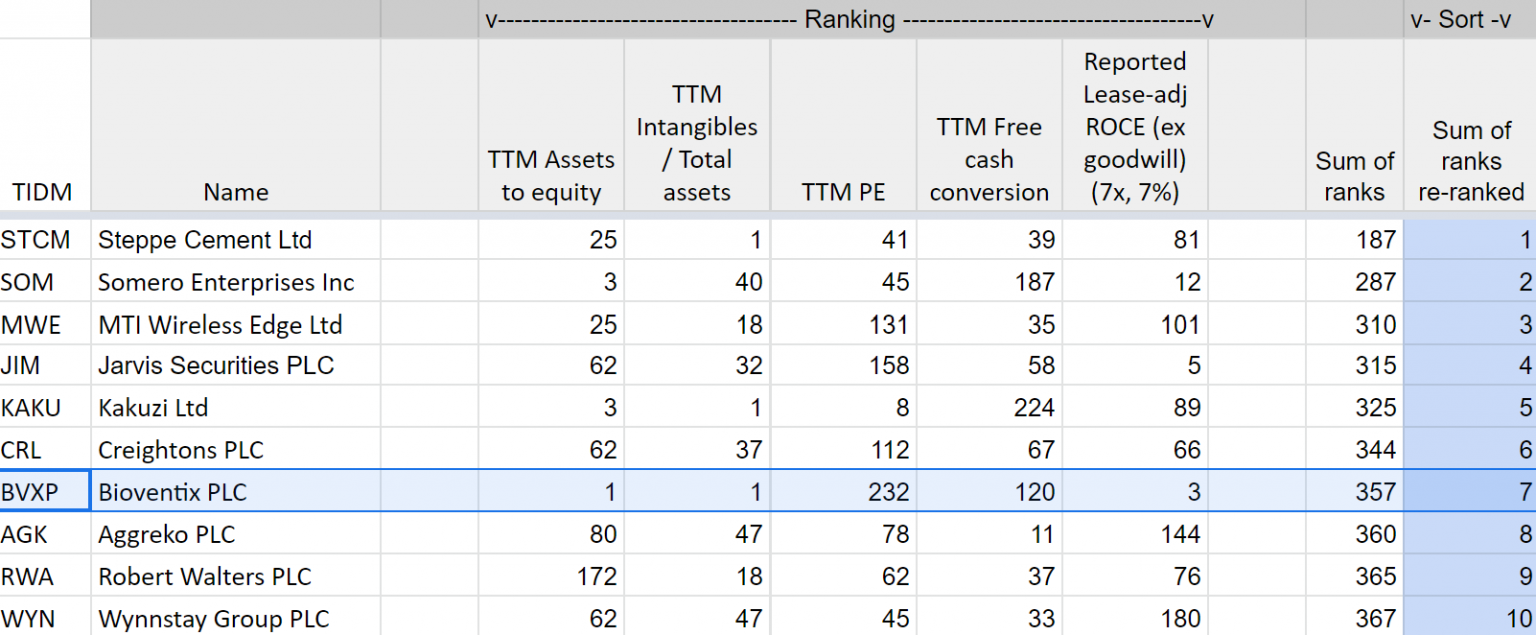

It gives viewers a snapshot of what's owned and what's owed, and. Many investors use liquidity ratios to determine the strength of a balance sheet. How do you build a strong balance sheet?

Success in any endeavor requires discipline. It can also be referred to as a statement of net worth or a statement of financial position. This loss takes into account the full release of the provision for financial risks, amounting to €6,620 million, which.

Assets = liabilities + equity. A company's balance sheet is a snapshot of assets and liabilities at a single point in time. Fed minutes suggest officials are seeking smallest balance sheet possible.

It plays a crucial role in your ability to secure funding through a loan or investor. Having a large amount of cash is not the only determining factor when deciding whether a balance sheet is strong. Intelligent working capital, positive cash flow, a balanced capital structure, and income generating assets.

1) no corporate debt, 2) more cash than total debt, or 3) the. The balance sheet is based on the fundamental equation: It is allowing up to $95 billion in treasury and mortgage bonds to.

November 14, 2018 | nalinee | accounting 101, managing cash flow accounting, balance sheet, business growth what makes a healthy balance sheet? The current size of the fed's balance sheet is $7.7 trillion. To us a strong balance sheet means: