Looking Good Tips About Treatment Of Sinking Fund In Balance Sheet

Sinking fund reserve account (bs) €4k.

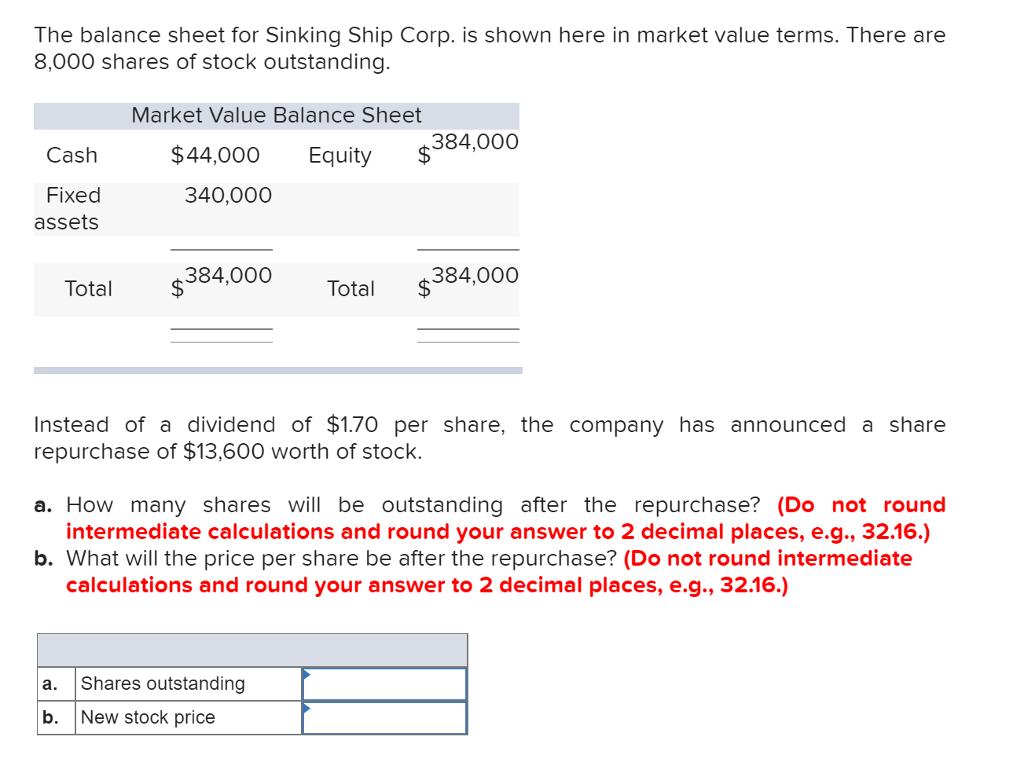

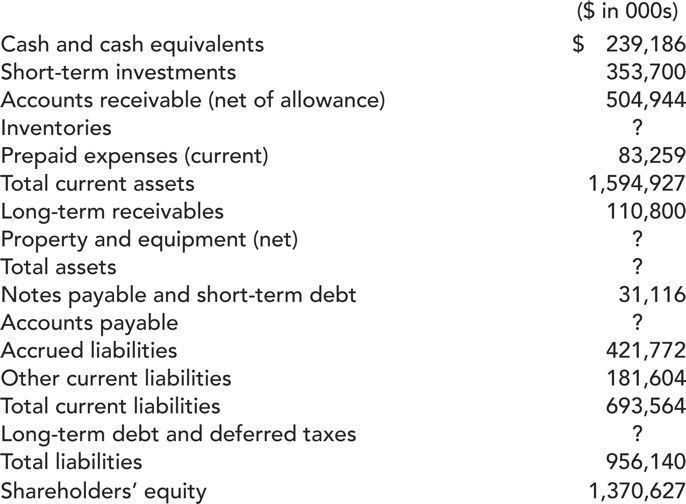

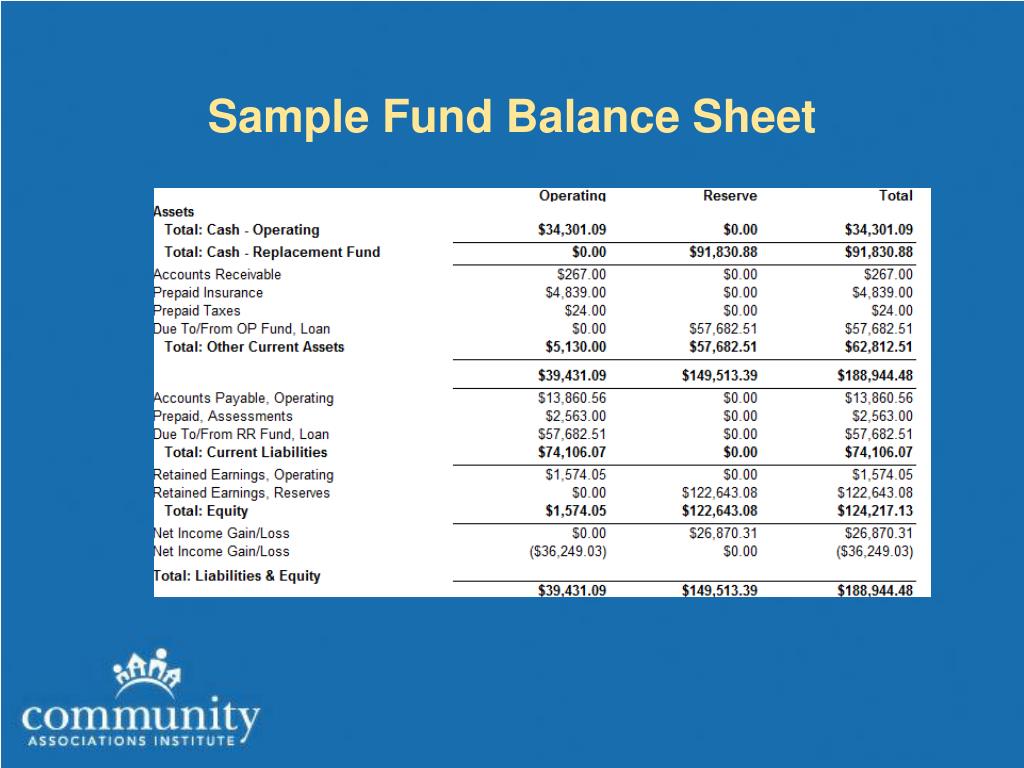

Treatment of sinking fund in balance sheet. The fund is a charge against profit in the form of depreciation and the profit and loss account is debited. The sinking fund itself exists as a balance sheet asset. Although sinking funds are listed on your balance sheets as an asset, they aren’t considered to be a current asset (assets that are.

Treasurer's guidebook advantages of a bond sinking fund the existence of bond sinking fund is beneficial in several ways. Reserve for sinking fund account should be analyzed in light of this aim. I am presuming that as £20,000 of money was not received from the tenants, that the sinking fund is similar to a p&l reserve account?

Market guide sinking fund sinking fund mutual funds by 5paisa research team last updated: The sinking fund method of depreciation involves the creation of a contingency fund that assures the availability of funds for asset replacement upon completing its useful life. Definition of bond sinking fund.

The owner of the account sets aside a certain amount of money regularly and uses it only for. Bond sinking fund explained. A bond sinking fund is an escrow account maintained by the company for the exclusive purpose of retiring the bond issued, and the company.

This means that the firm's sinking funds involve at least one accounting system account, and one bank savings account. Key takeaways a sinking fund is maintained by companies for bond issues, and is money set aside or saved to pay off a debt or bond. A sinking fund is a type of fund that is created and set up purposely for repaying debt.

A bond sinking fund is a corporation's noncurrent asset that is restricted for the purpose of redeeming or buying. First, it provides some security to bond. Or is this an error by the.

The sinking fund method is a technique for depreciating an asset while generating enough money to replace it at the end of its useful life. Is a sinking fund a current asset? A corporation's bond sinking fund appears in the first noncurrent asset section of the corporation's balance sheet.

The following accounting treatment applies for the sinking fund when the monies is spent (e.g. Although sinking funds are listed on your balance sheets as an asset, they aren’t considered to be a current asset (assets that are expected to be converted to cash within. The balance in the sinking fund account is then transferred to the profit and loss a/c or general reserve.

Most government utilities are financed in a large measure by the issuance of bonds. The annual amount of depreciation to be charged is calculated with the help of sinking fund tables. Example of reporting a sinking fund on the balance sheet.

Otherwise, draw a timeline for the sinking fund and identify known variables.