Beautiful Tips About Is Accounts Payable An Expense On The Income Statement

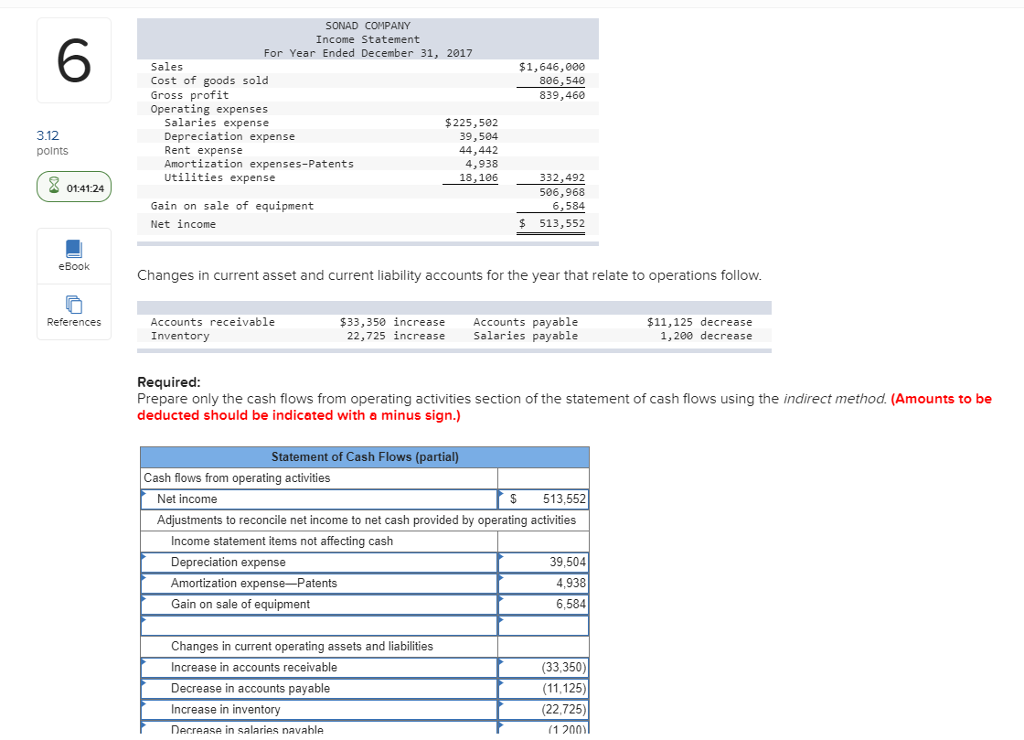

![[Solved] MOSS COMPANY Statement For Year Ended Dec](https://media.cheggcdn.com/study/772/772bb627-56b0-46a9-802d-965f445b4294/image)

Instead, it's a snapshot of their financial standing at any given moment.

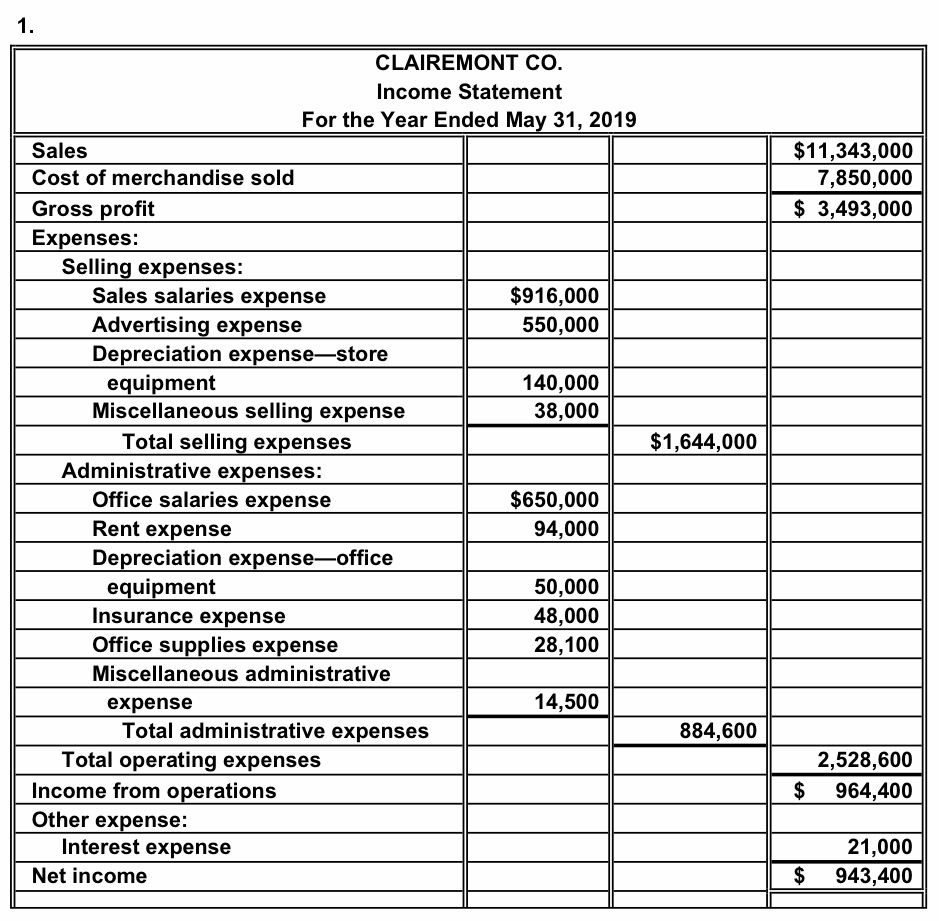

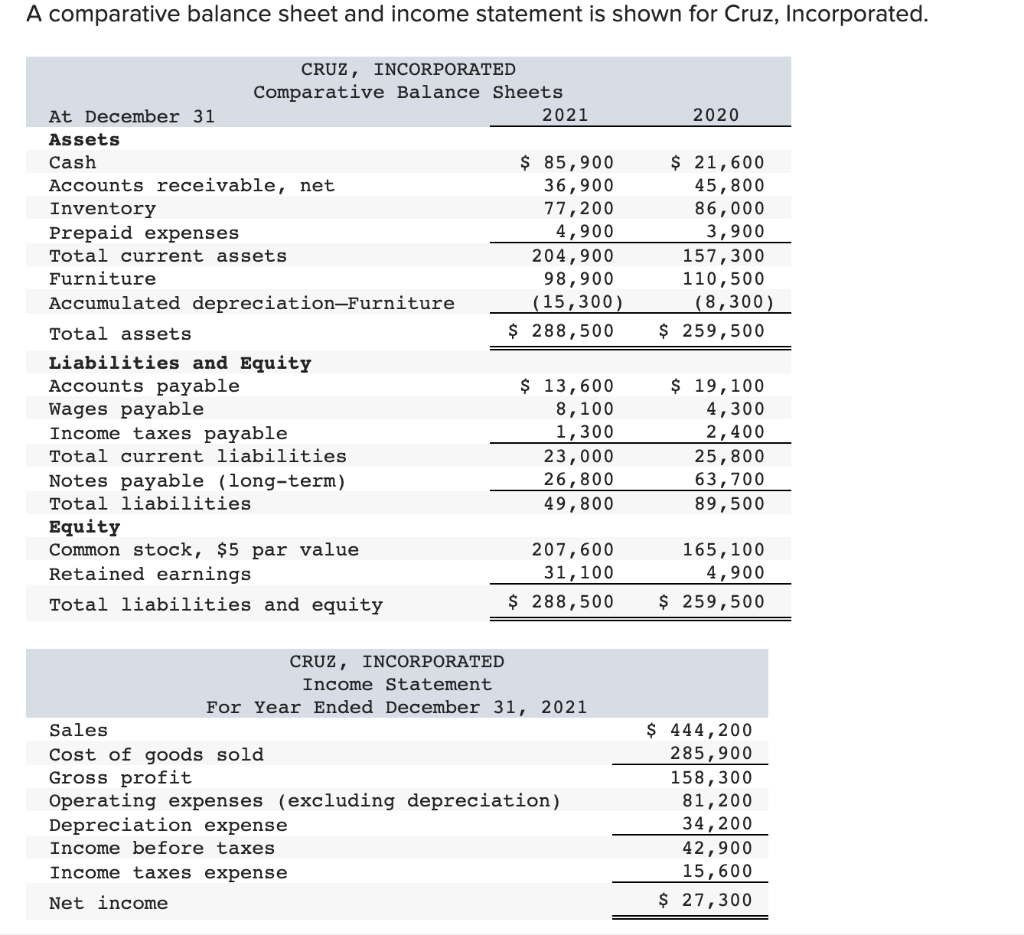

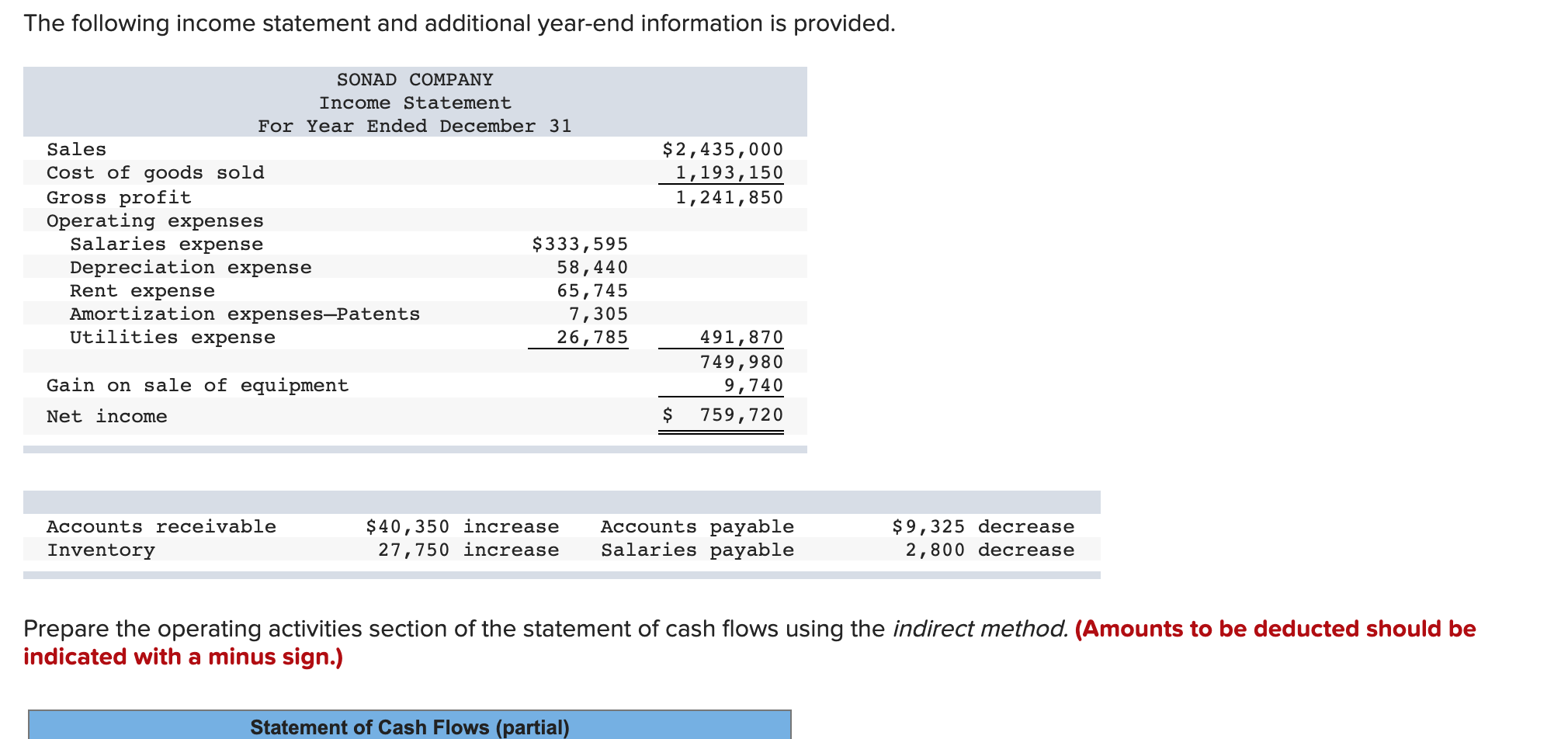

Is accounts payable an expense on the income statement. The income statement is a useful way to see how a company makes money and how it spends it. The most likely liability account involved in business obligations is accounts payable. As earlier discussed, these are expenses that need to be settled as these are reflected as liabilities on the balance sheet.

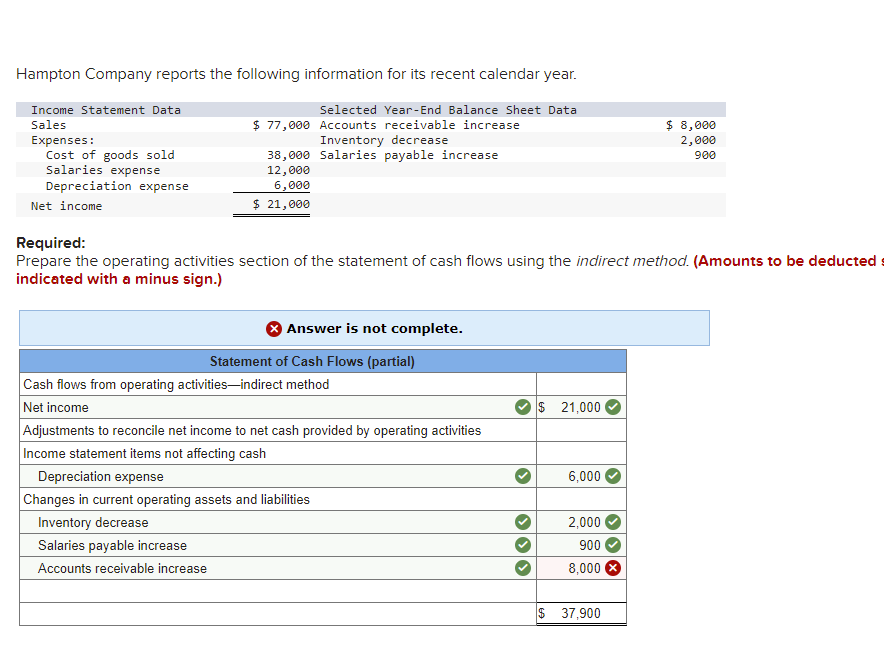

Is accounts payable an expense? Typical periods or time intervals covered by an income statement include: The main difference between accounts payable and expenses is how they are recorded on a company’s financial statements.

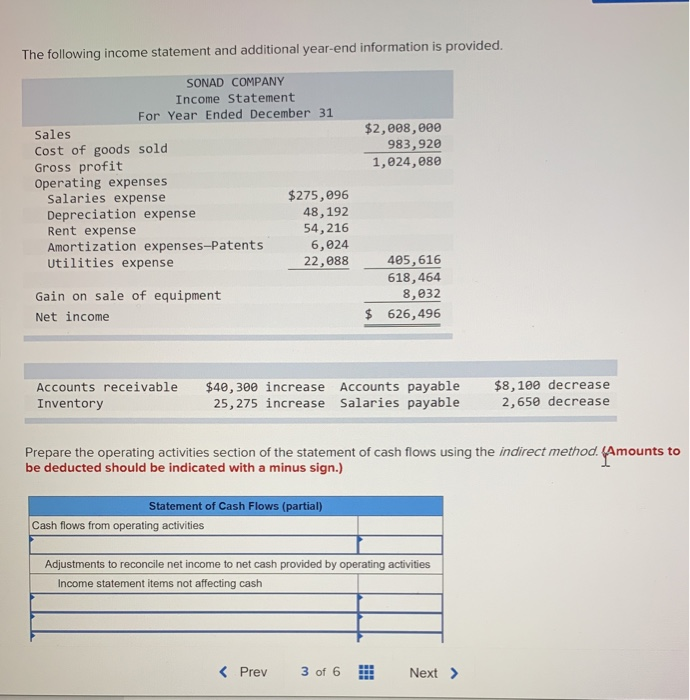

Accrued expenses and accounts payable are two methods companies use to track accumulated expenses under accrual accounting. (if a box is not used in the table, leave the box empty; Expenses, on the other hand, are payments that were already made and are listed on your income statement.

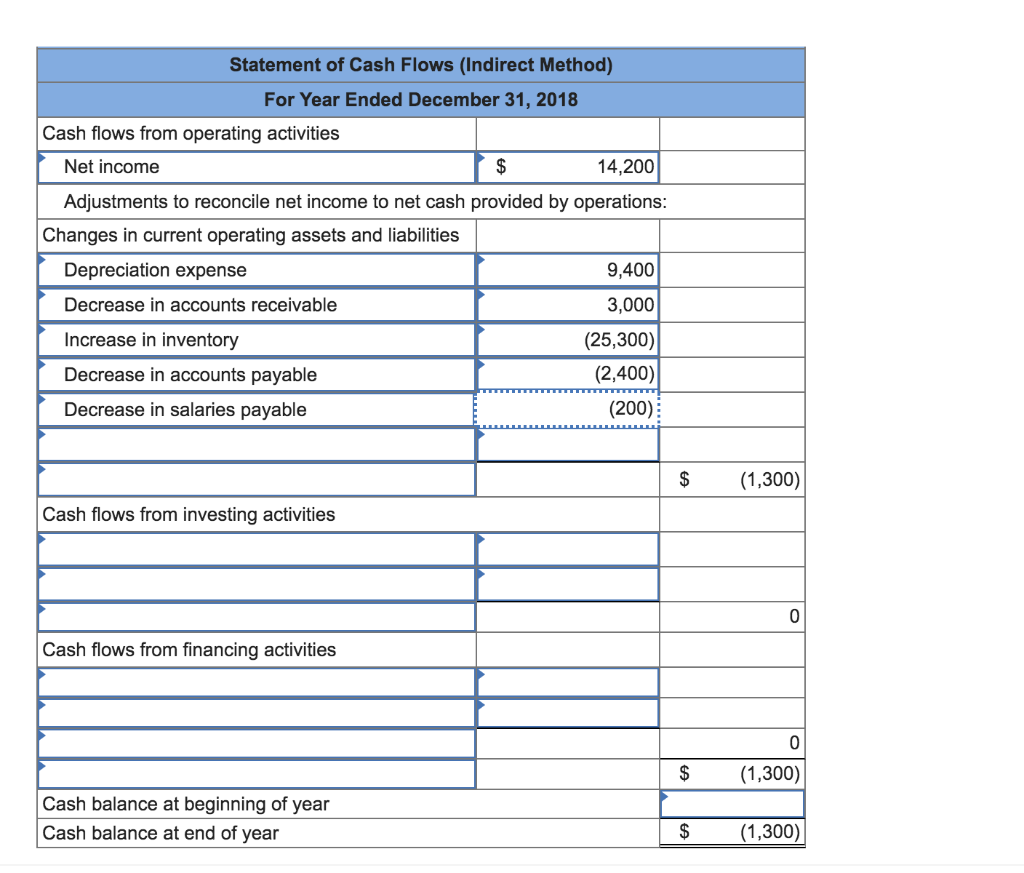

The income statement reports revenues, expenses, gains, losses, and the resulting net income which occurred during the accounting period shown in its heading. Use i for income statement, re for statement of retained earnings, b for balance sheet, and c for statement of cash flows. An increase in accrued expense means a decrease in the income statement and.

As such, accrued accounts payable will increase the cogs or operating expenses on the income statement depending on what was purchased. A personal financial statement is an overview of a person or household's finances. However, under accrual accounting, the expense associated with an account payable is recorded at the same time that the account payable is recorded.

Accounts payable is often mistaken for a company's core operational expenses. Read on to learn what goes into a personal financial. It includes all income and loss accounts generated by a business.

Under the accrual method of accounting, the amounts are reported in the. Open bills or invoices from vendors and suppliers for goods and services already provided are listed as. Salaries and wages of a company's employees working in nonmanufacturing functions (e.g.

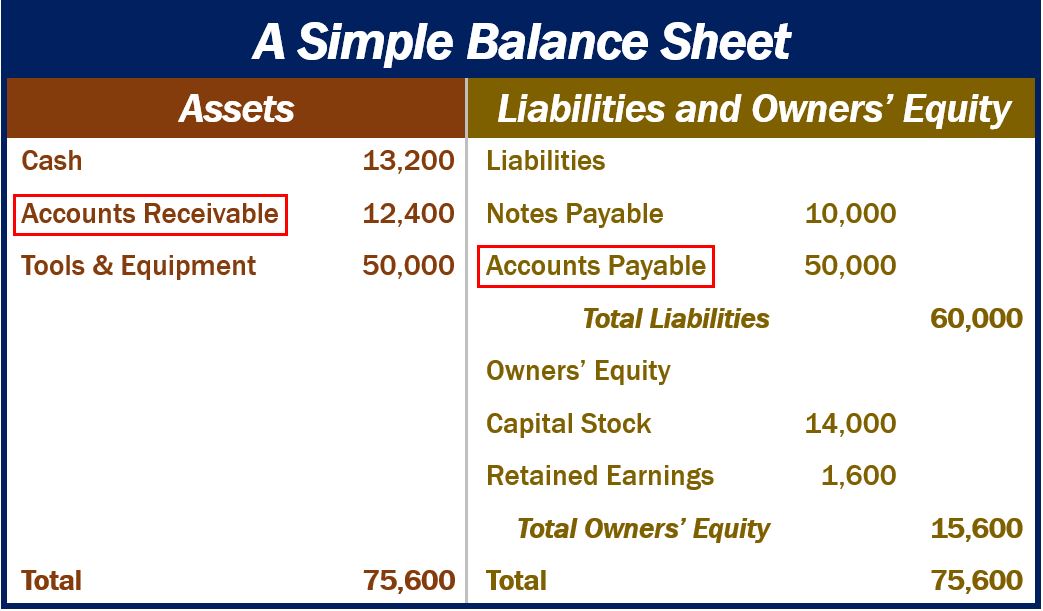

Selling, general administration, etc.) are part of the expenses reported on the company's income statement. Revenues and expenses appear on the income statement as shown below: Accounts payable (ap) is a liability, where a company owes money to one or more creditors.

It is a liability due within a specific time frame usually one year. Revenue, expenses, gains, and losses. Accounts payable is a liability account, not an expense account.

While accounts payable may seem similar to an expense at first, here's how they differ: On the other hand, interest expense can also be affected by accounts payable if there are unpaid bills with associated interests charges added to them. The income statement focuses on four key items:

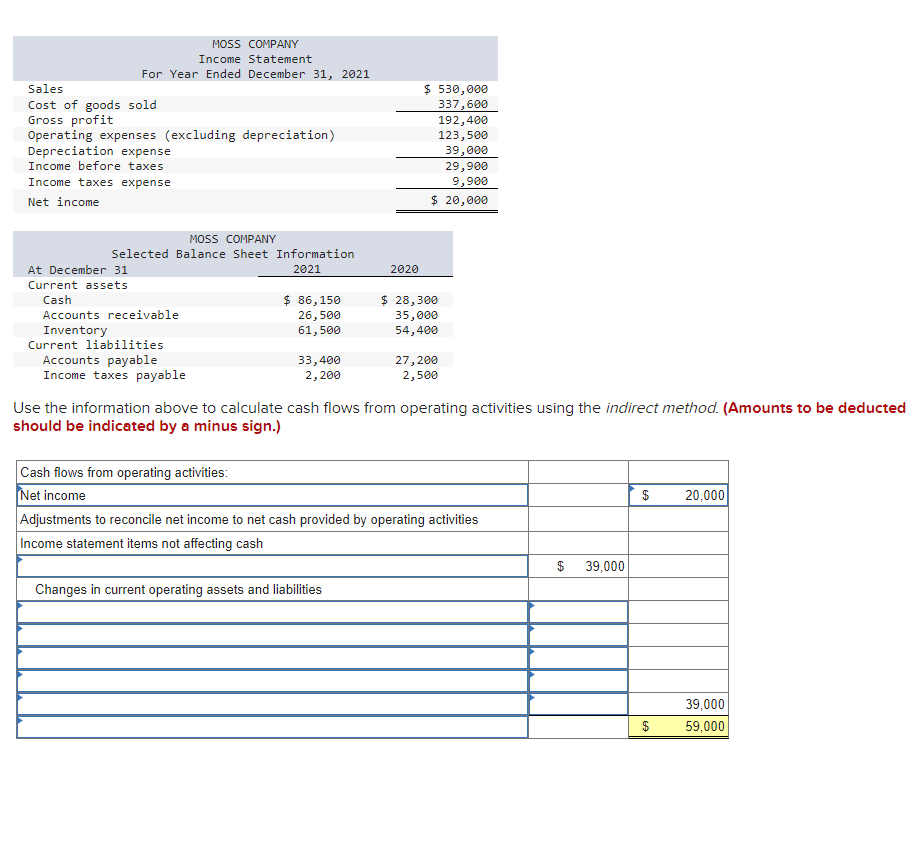

![[Solved] MOSS COMPANY Statement For Year Ended Dec](https://media.cheggcdn.com/media/c50/c50cca1f-cfa5-4c81-a37f-2810754a3a83/phpTzrprB)