Ideal Info About Preliminary Expenses Treatment In Cash Flow

Using the indirect method, operating net cash.

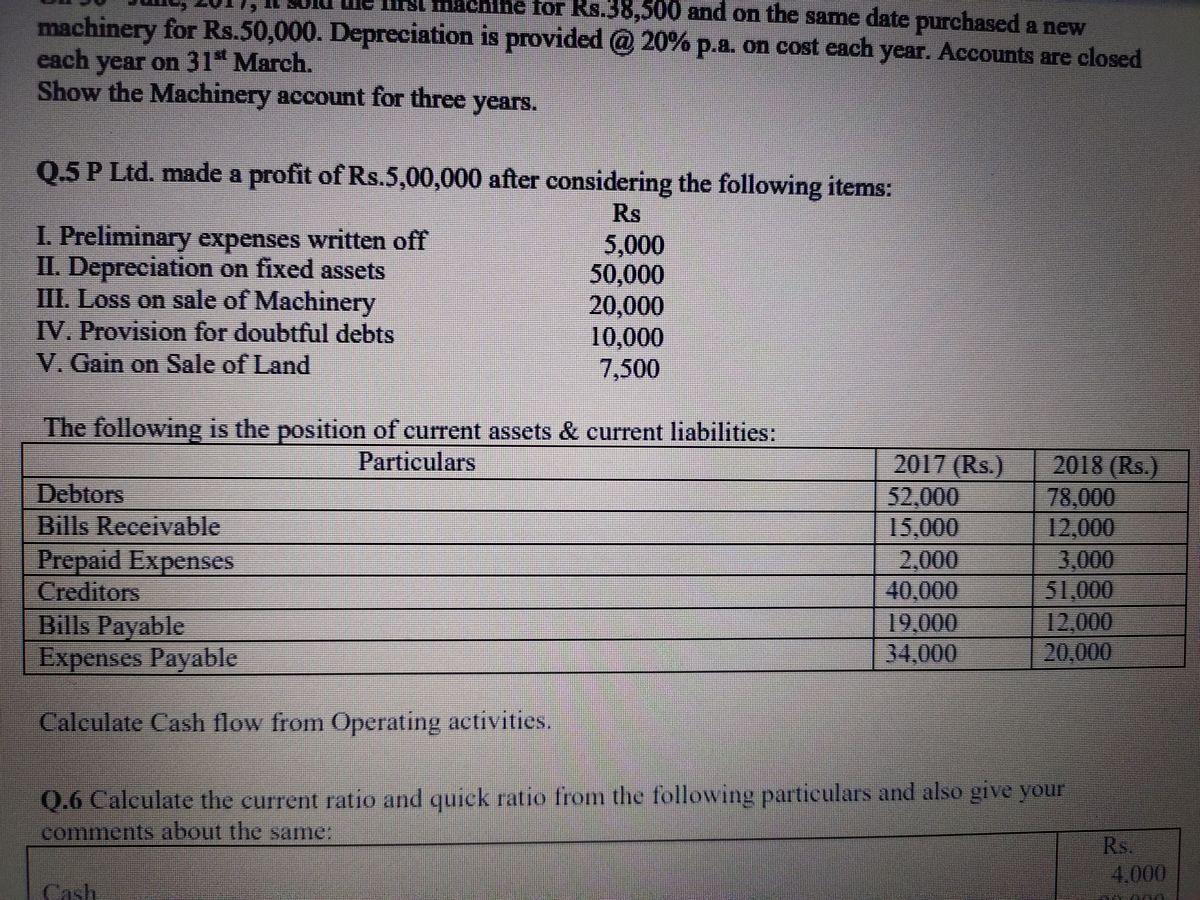

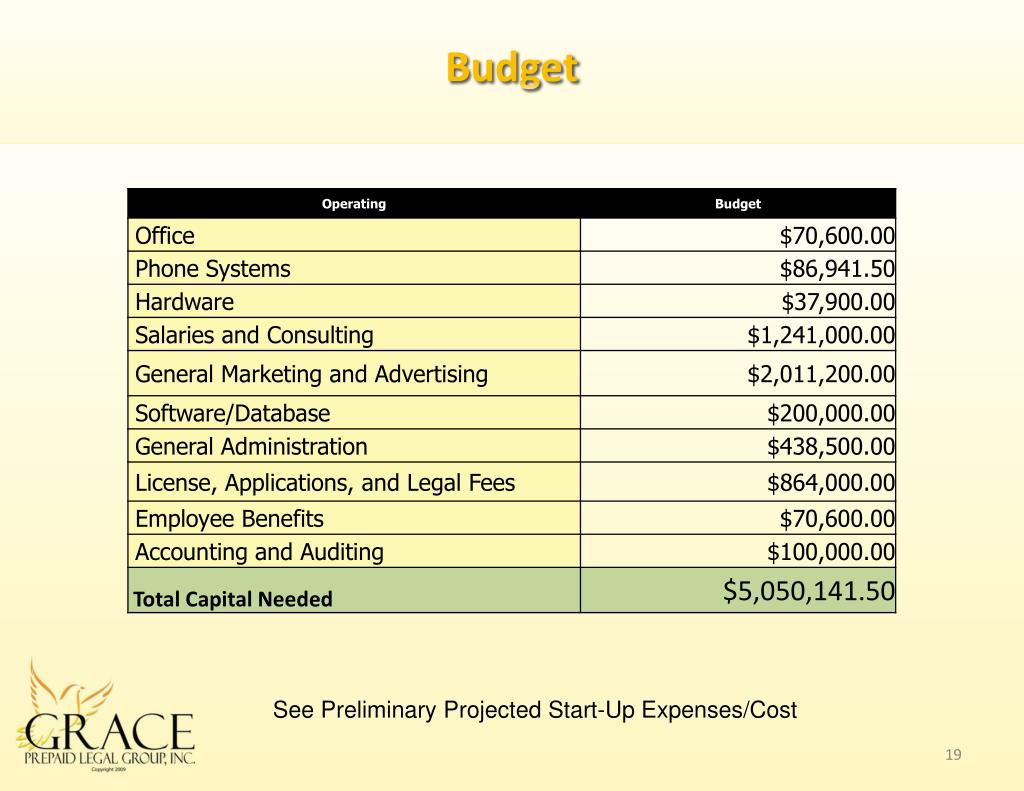

Preliminary expenses treatment in cash flow. The expenses incurred by a company for its establishment are known as preliminary expenses. The expenses included under preliminary expenses are as. Preliminary expenses treatment.

When company repays preliminary expenses preliminary expenses. So, after paying all these expenses, we treat all these preliminary expenses with following ways : Expense in connection with a marketing survey or feasibility study.

As we have seen above, an increase in prepaid expenses has a negative effect on cash flow as there is a cash. Normally preliminary expense are treated as intangible asset and shown on the asset side of the balance sheet under the head miscellaneous asset. Expenditure that is incurred in connection with the following:

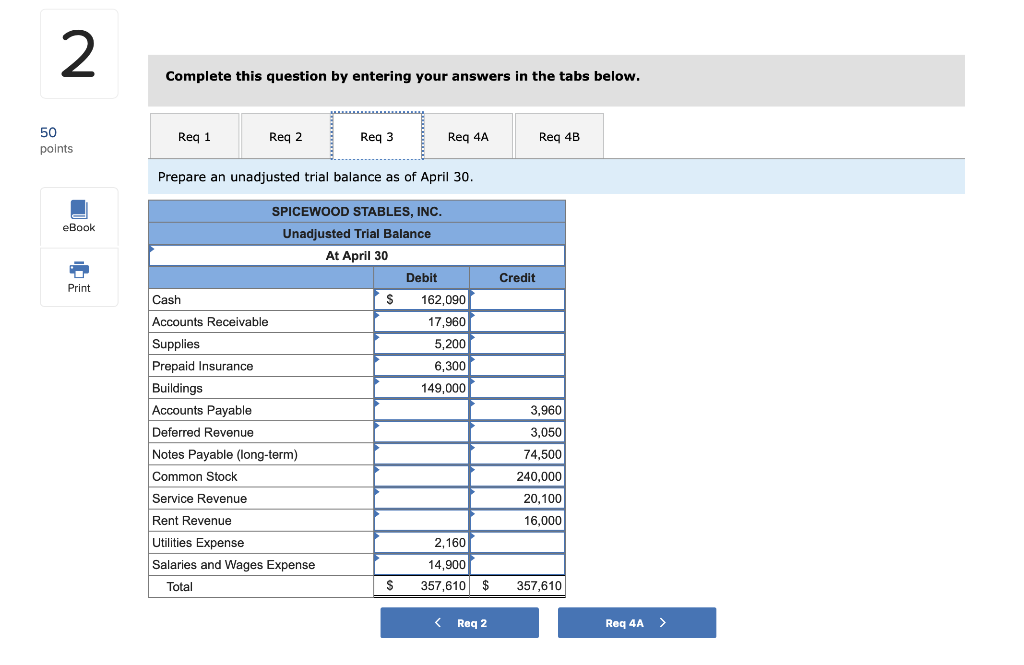

This method is called the direct method because it calculates the net cash flows from operations in a much more straightforward fashion than the indirect method. The statement of cash flows is prepared by following these steps: The preliminary expenses if given in the question are added to determine profit before.

The cash flow statement indirect method is one of the two ways in which accountants calculate the cash flow from operations (another way being the direct method ). Accounting treatment of preliminary expenses in cash flow statement. Increase in prepaid expenses on cash flow statement.

Cash flow expenses items placed under the operating expenses section of a cash flow statement are things that reduce current assets, such as a decrease in inventory or. It is also useful in checking the accuracy of past. Determine net cash flows from operating activities.

These expenses are already incurred and paid for during the. What are the preliminary expenses that are eligible to be amortized? To answer the question, let us discuss the concept of preliminary expenses.

Historical cash flow information is often used as an indicator of the amount, timing and certainty of future cash flows. Examples of preliminary expenses are:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)