First Class Info About Profit And Loss Statement Independent Contractor

Balance sheets tell you where the money is located.

Profit and loss statement independent contractor. Profit and loss account and balance sheet for your uk contractor company share this guide, choose your platform! Profit and loss statements tell you if you’re making or losing money. More advanced profit and loss statements also include.

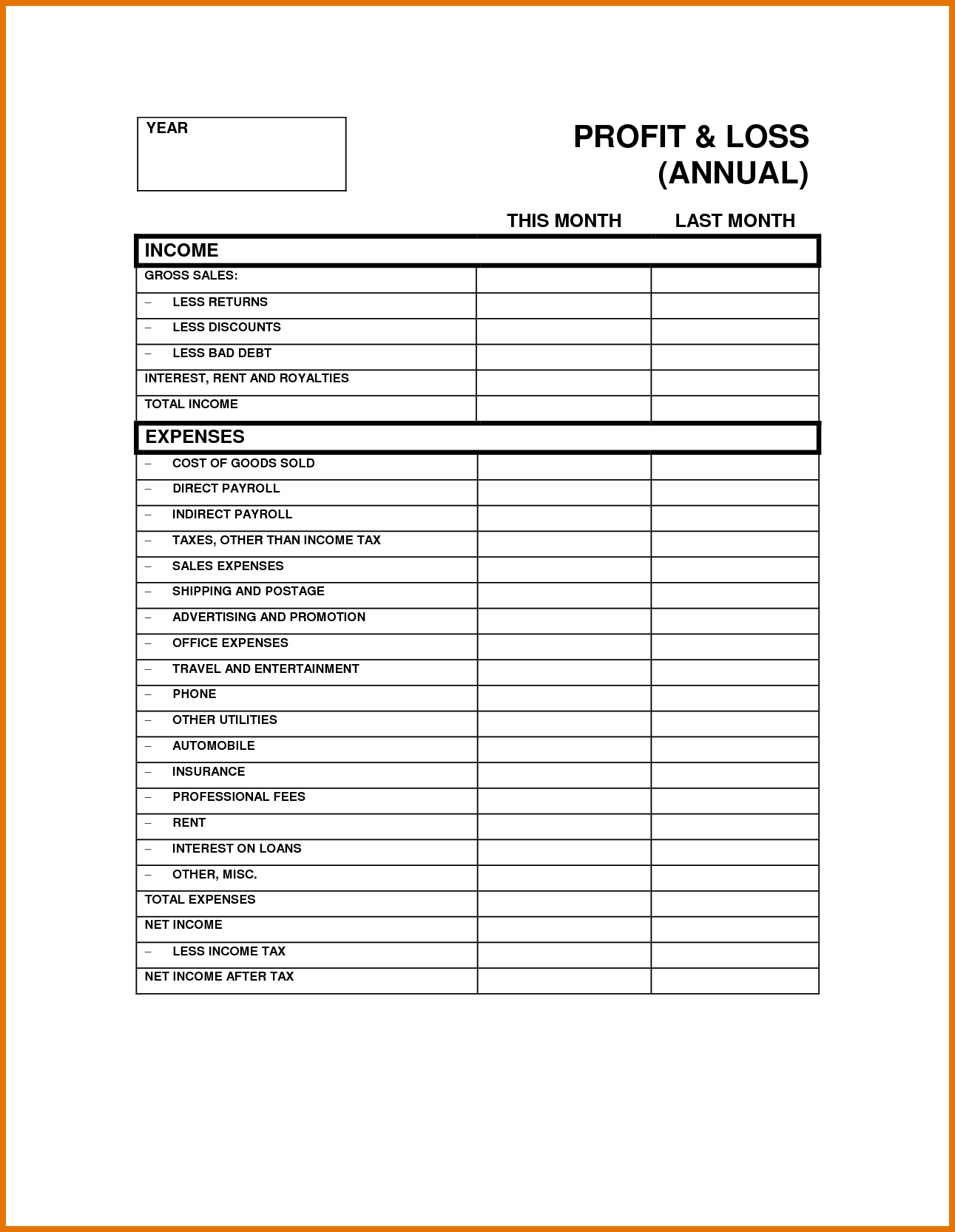

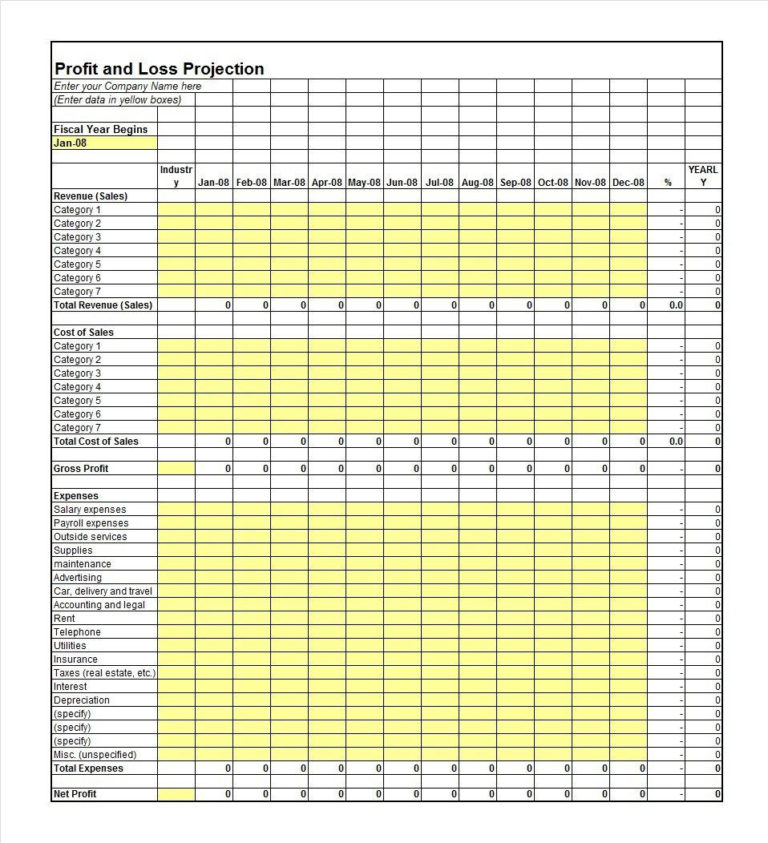

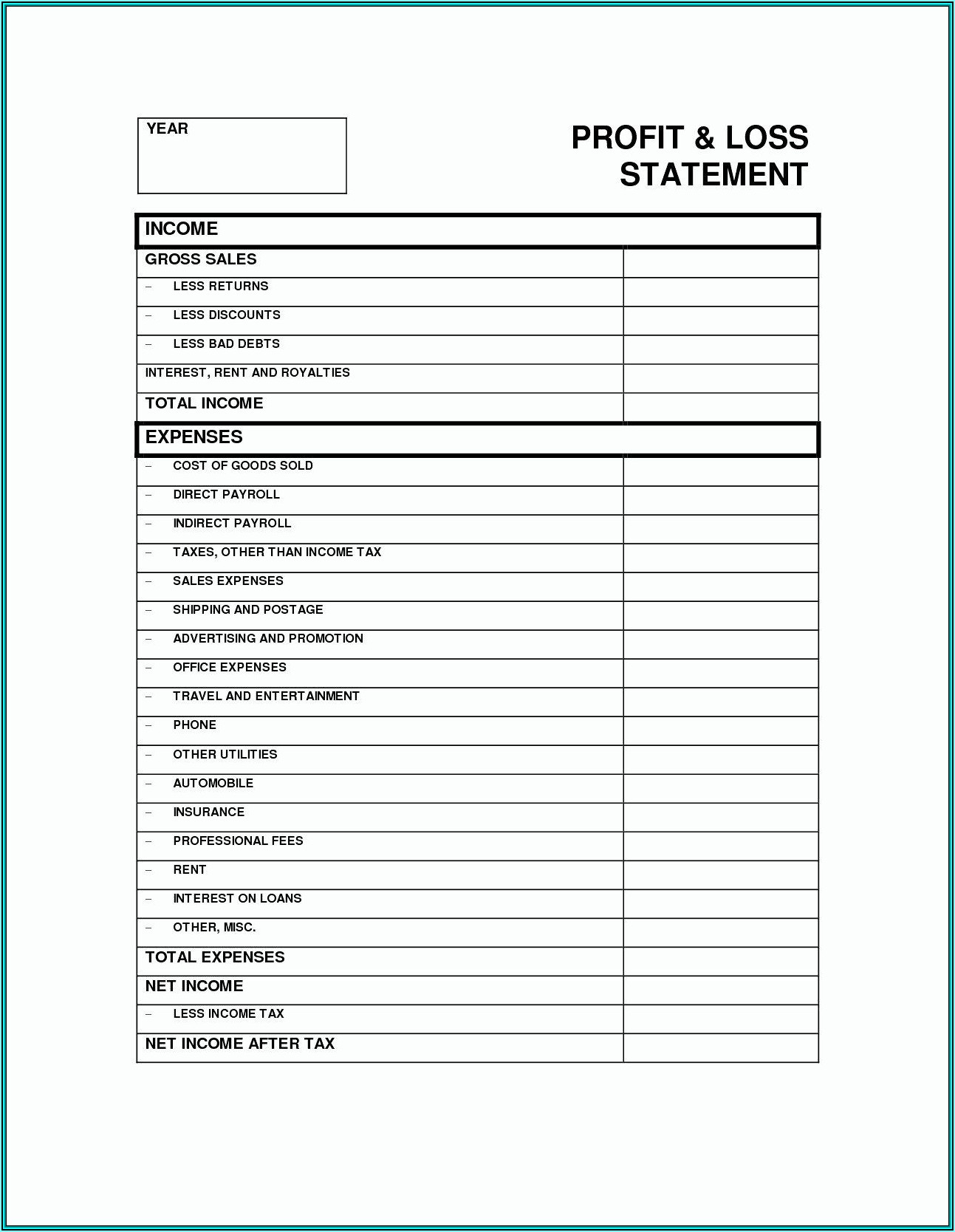

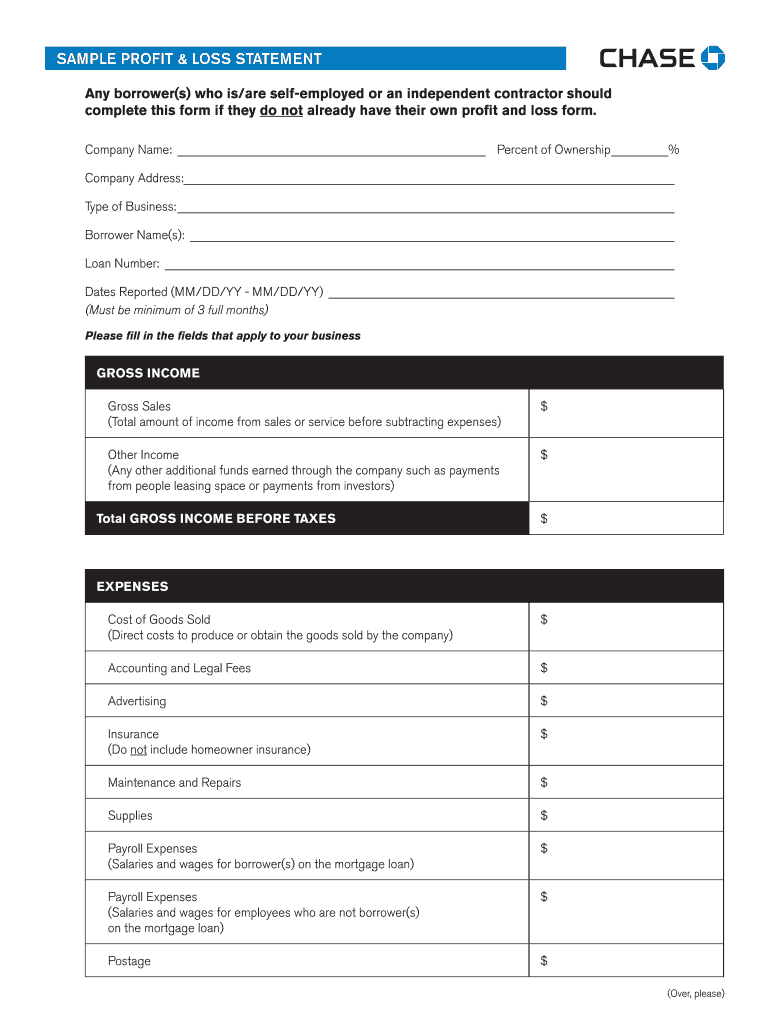

Profit and loss statements look like. An activity qualifies as a business if: The single worksheet in this template (called “independent contractor p&l”) has the typical profit and loss sections (income and expenses) that i mentioned above.

In the case of a. Contractor taxation & uk limited company taxes. You will need to fill out and file the form in a timely manner in order to satisfy irs profit and loss reporting requirements for sole proprietors.

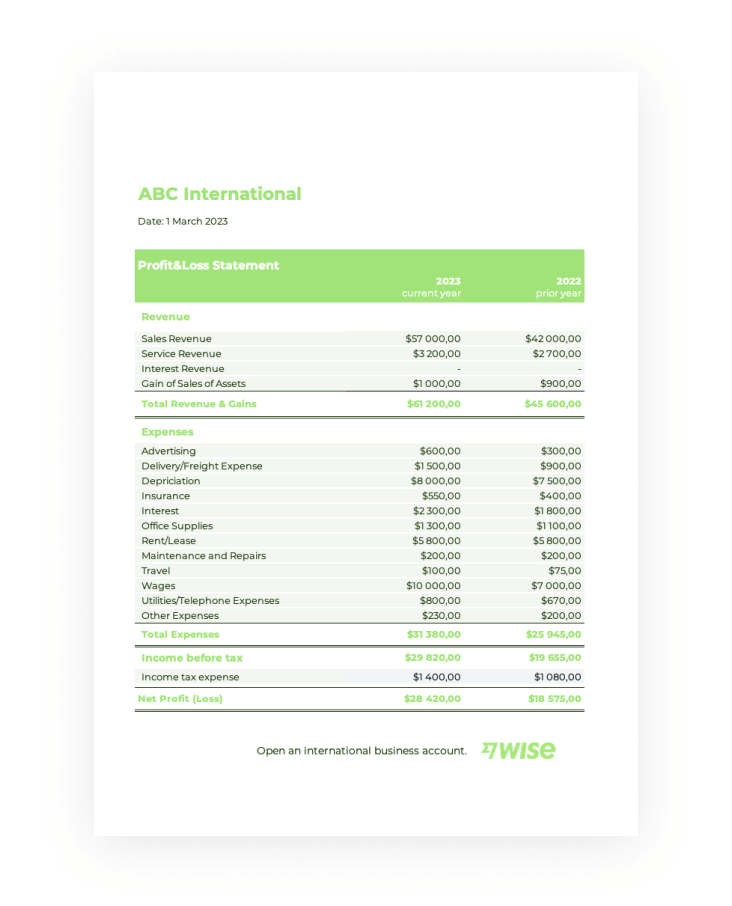

Net income (or net loss) net income is found at the bottom of the income statement, and represents your company’s profit for the period. The main categories that can be found on the p&l include:. Revenue, expenses, and net income.

Take a look at the overviewimage to see a screenshot of the statement (the details of the income and expense sections are hidden to provide a clearer. Common size profit and loss statements can help you compare trends and changes in your business. It is to help you evaluate downloadable independent contractor profit and loss statement template will help you as an independent contractor.

A profit and loss statement summarizes your revenue, costs, and expenses incurred during a specific period, thus providing essential information that demonstrates. A profit and loss statement contains three basic elements: Use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

The single step profit and loss statement formula is: A p&l statement compares company revenue against expenses to. Independent contractors have their own business expenses and need to cover their budget based on what they determined to charge their customers.

The income statement (profit and loss) understanding the income statement (sometimes we refer to this as the profit and loss statement) is the one common theme among. At a minimum, an independent contractor will need a profit and loss statement at tax time to be able to calculate their taxable income. This latest installment in our series on the department of labor’s proposed independent contractor rule under the fair labor standards act.

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-and-Loss-Statement-Overview.jpg)