Fine Beautiful Info About Advance Income Tax Paid In Cost Sheet

The new tax slab would be default tax slab.

Advance income tax paid in cost sheet. The resources below provide expert advice on tricky tax topics. In other words, ‘pay as. You c/f the same advance tax in the next year as opening balance.

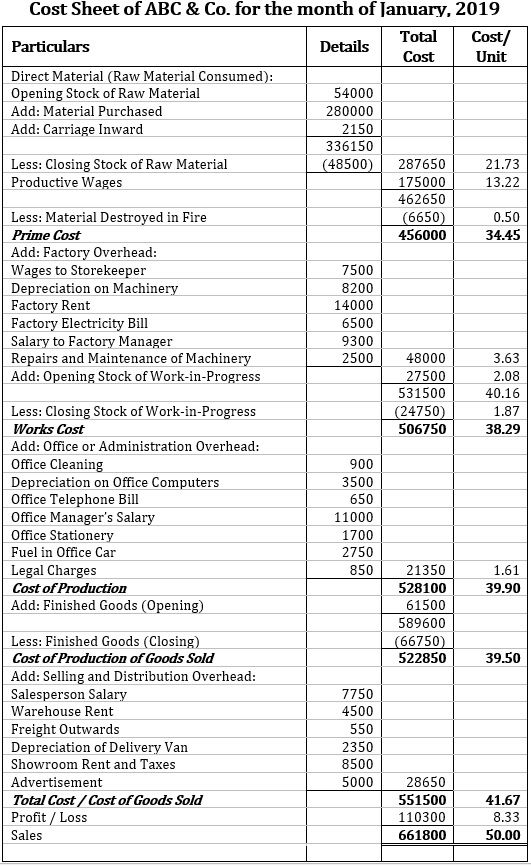

This means that the premium you pay is allotted to the. Information to be included in cost sheet. Is subject to advance tax.

However, the organization may not receive the benefits from these expenses by the end. In the normal course of business, some of the expenses may be paid in advance. Liability side of the balance.

Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. Salary income from which paye is deducted, hmrc will ask. Section 129 of companies act 2013, provides for preparation of financial statements.

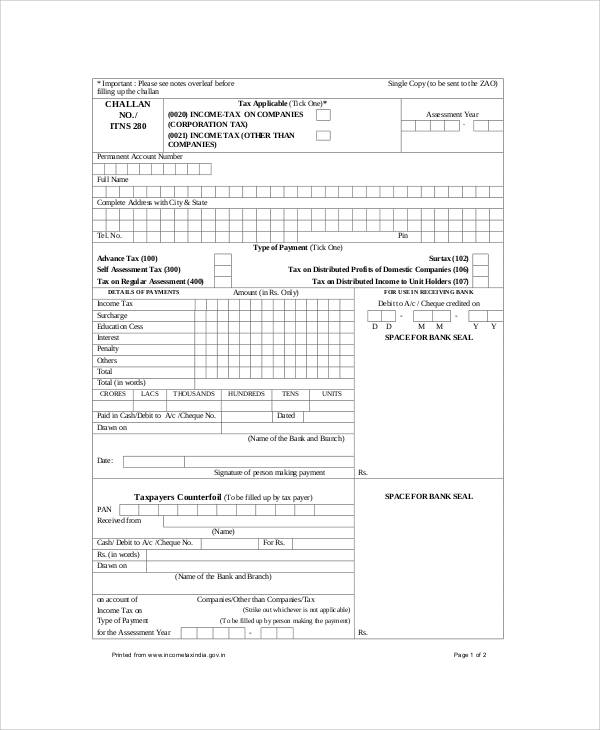

When listing expenses for reimbursement, it is essential to include any advance payments, which should be deducted from the total reimbursement amount. Your assessment and income tax payable is done in the next financial year. Hire purchase installment paid and other such financial expenses.

Following information is required to be included in cost sheet: Preliminary expenses and goodwill written off, iii. However, it is not possible to estimate.

Debit side of profit & loss acount. Income tax expense on its income statement for the revenues and expenses appearing on the accounting period's income statement, and. Interest paid on borrowed capital, iv.

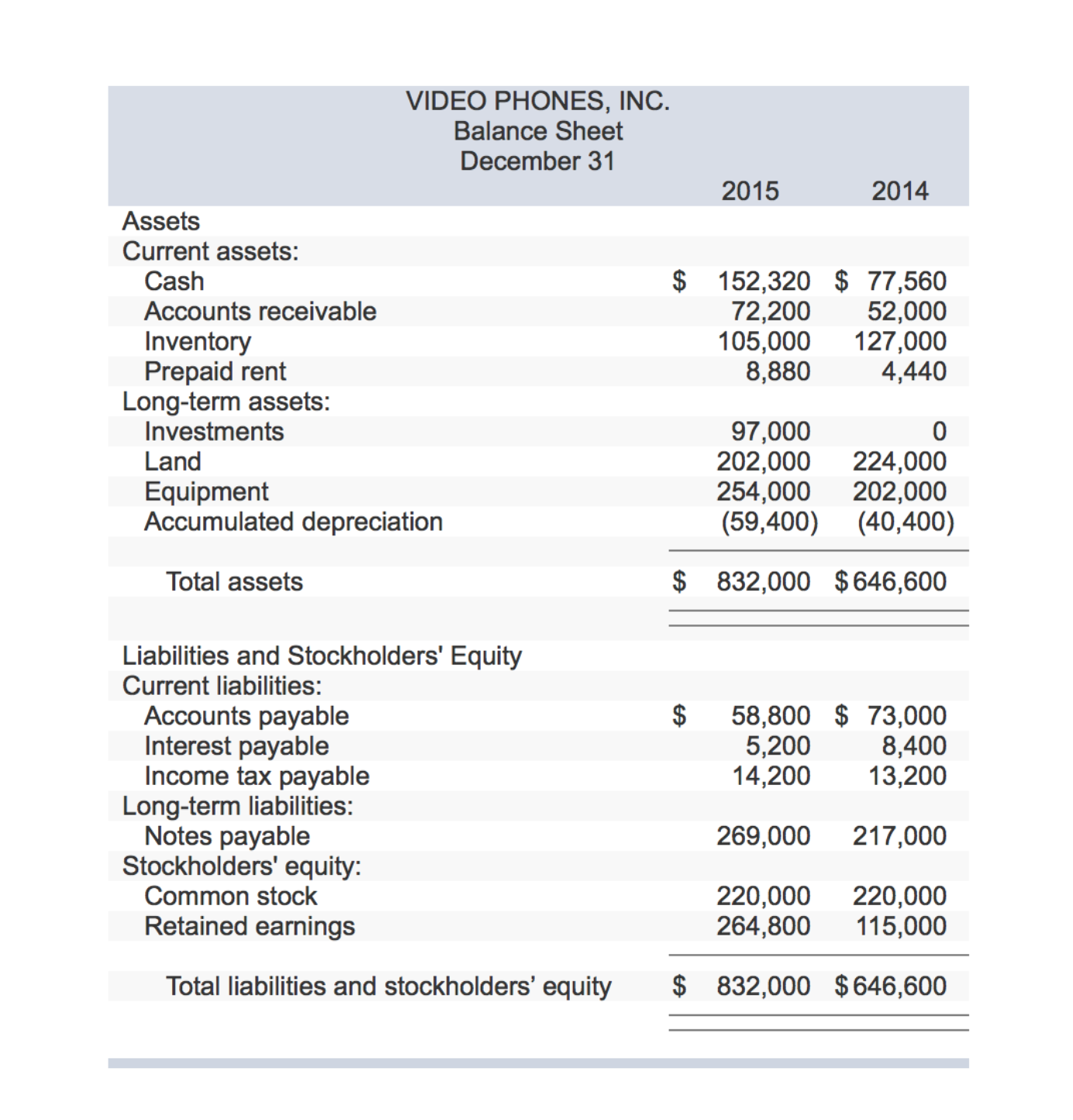

As per income tax act, we have to pay advance income tax and that is showed at “property & assets” side of balance sheet in the. Income taxes payable (a current liability. Income is not liable to pay advance tax.

Income tax paid in advance should be shown on the ________________. Donald trump has been hit with all three in the past nine months, with. One of the more common forms of prepaid expenses is insurance, which is usually paid in advance.

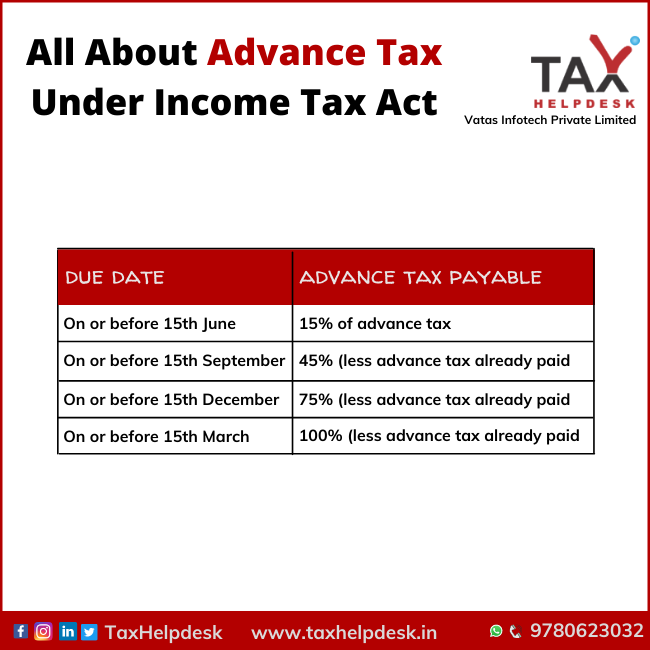

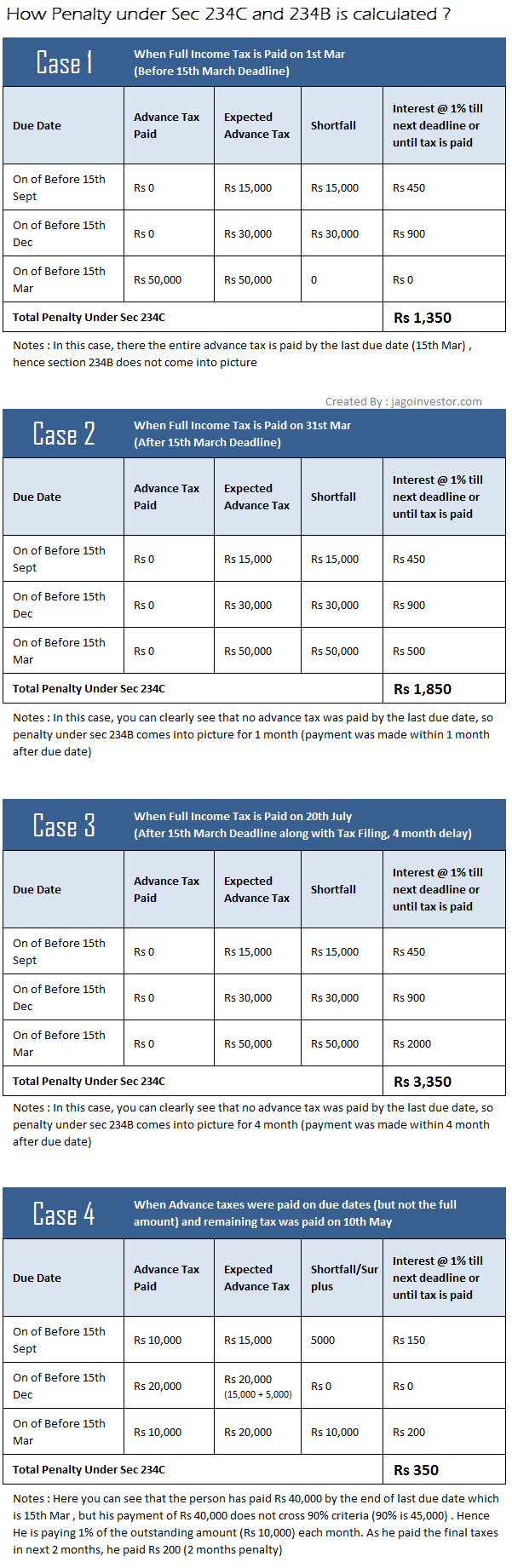

What is advance tax and who should pay advance tax? Advance tax is a ‘pay as you earn’ tax, so it is required to be paid during the financial year in four different instalments in case your taxable liability is more than. [2] advance income tax :

![Advance Tax Provisions, Calculation and Due Dates [ FY 201920 ] Meteorio](https://i.pinimg.com/originals/13/44/a8/1344a822f0d9e34a3c89b438b85a73a6.png)