Formidable Info About Finance Lease Cash Flow Statement

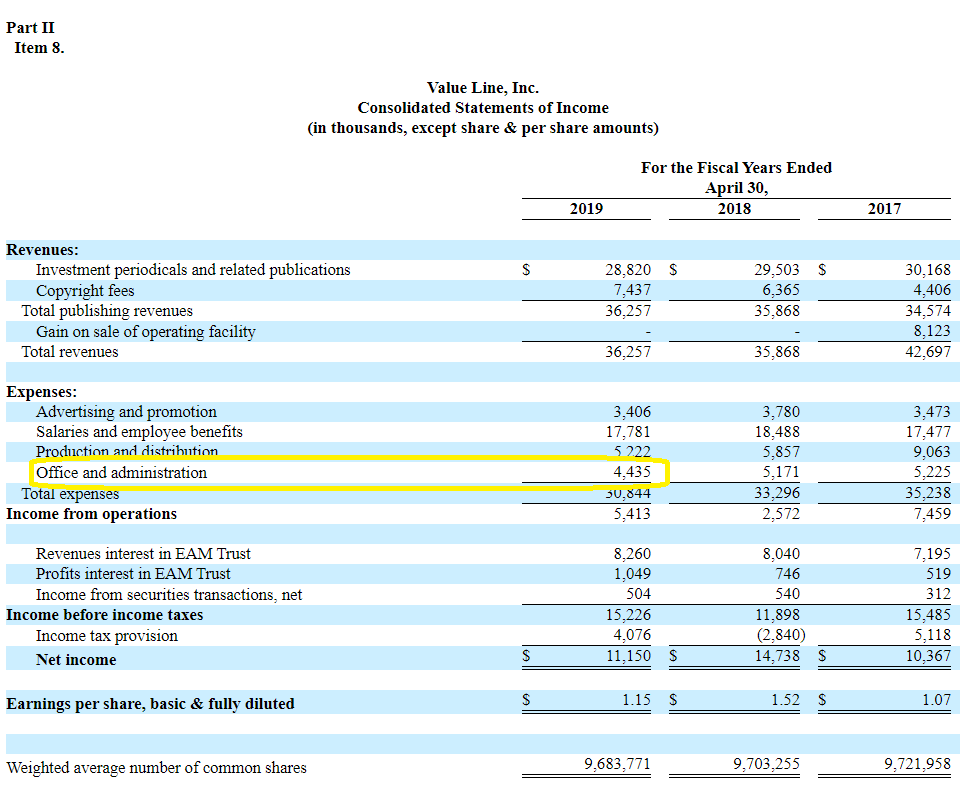

Lessors must classify all cash receipts from leases as operating activities in the statement of cash flows.

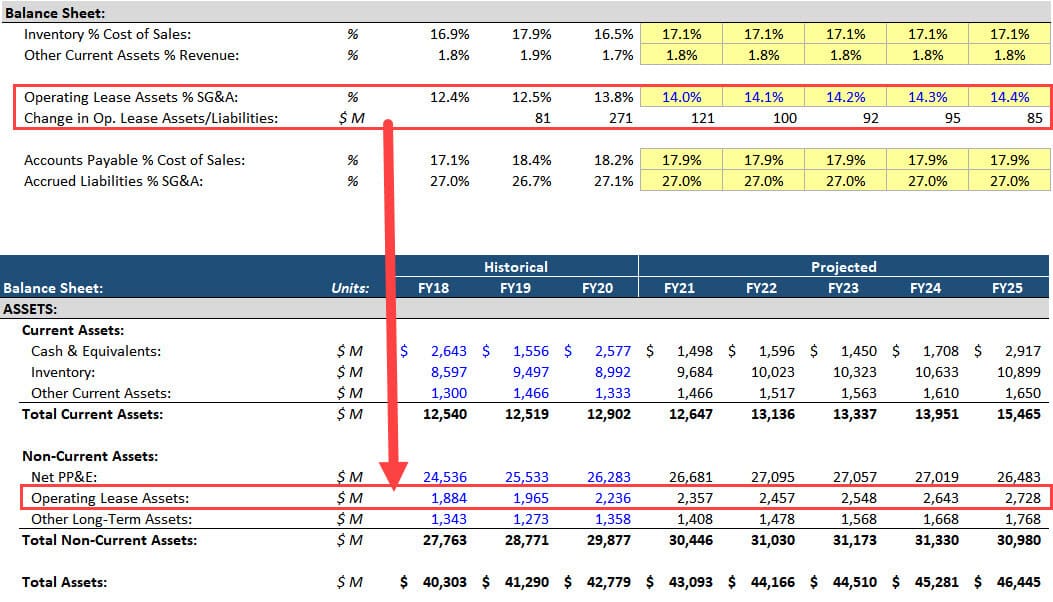

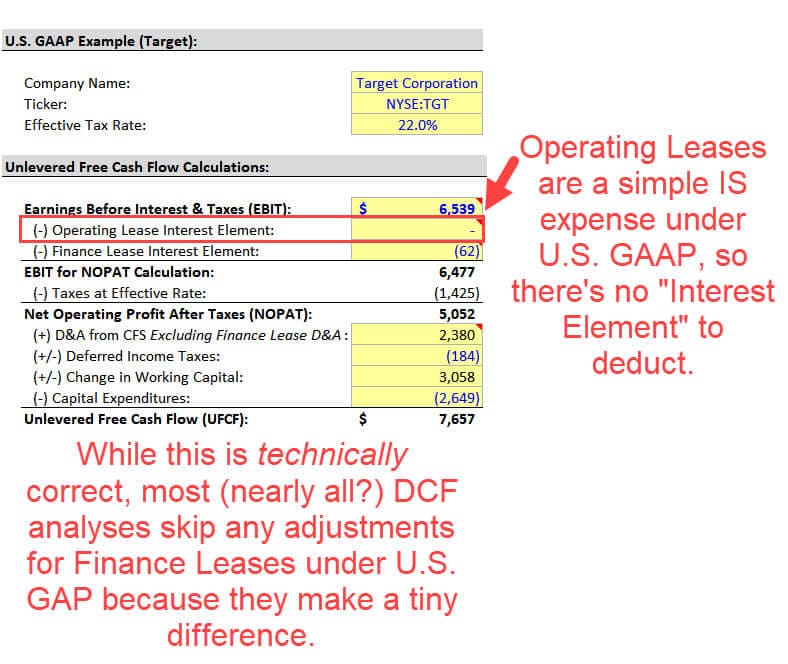

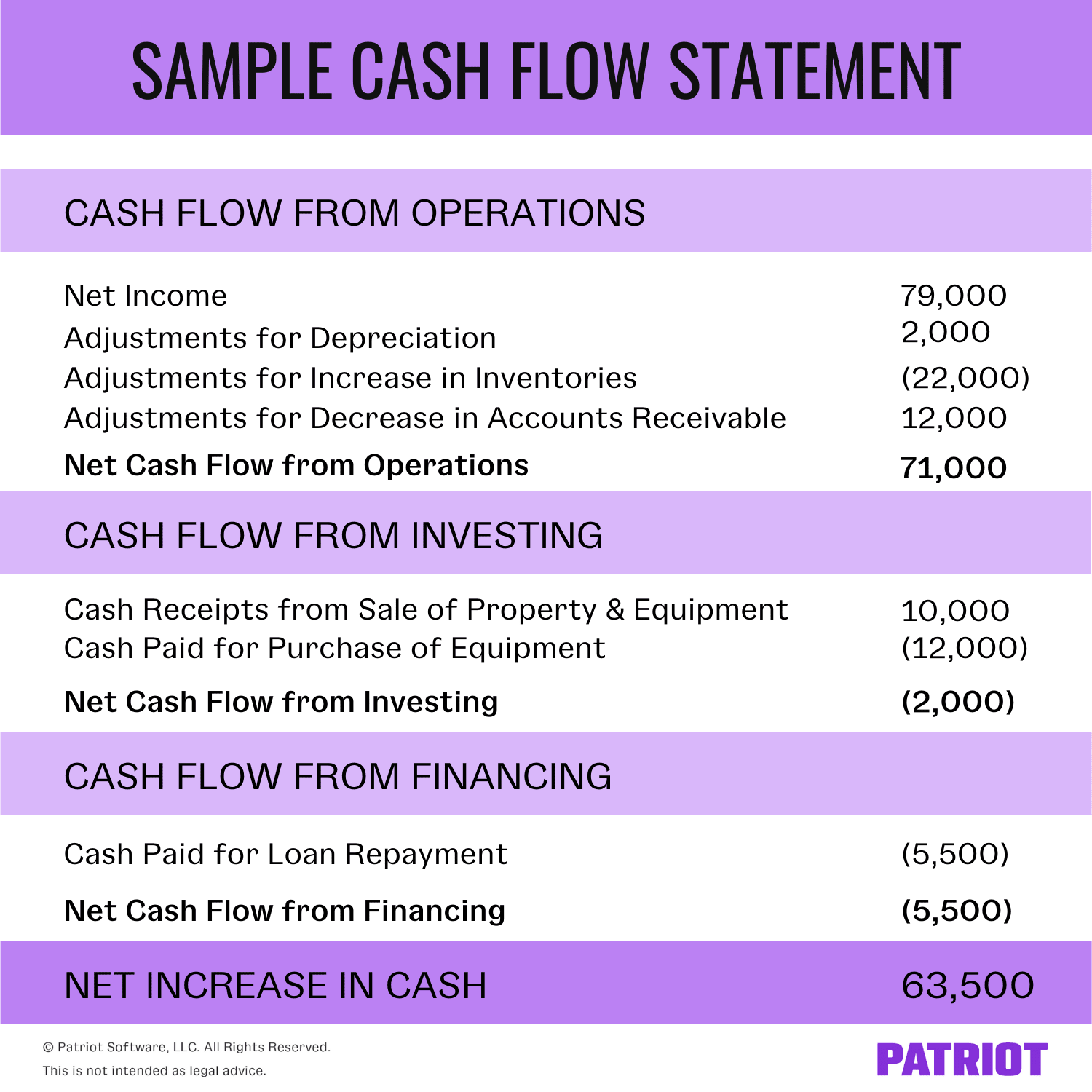

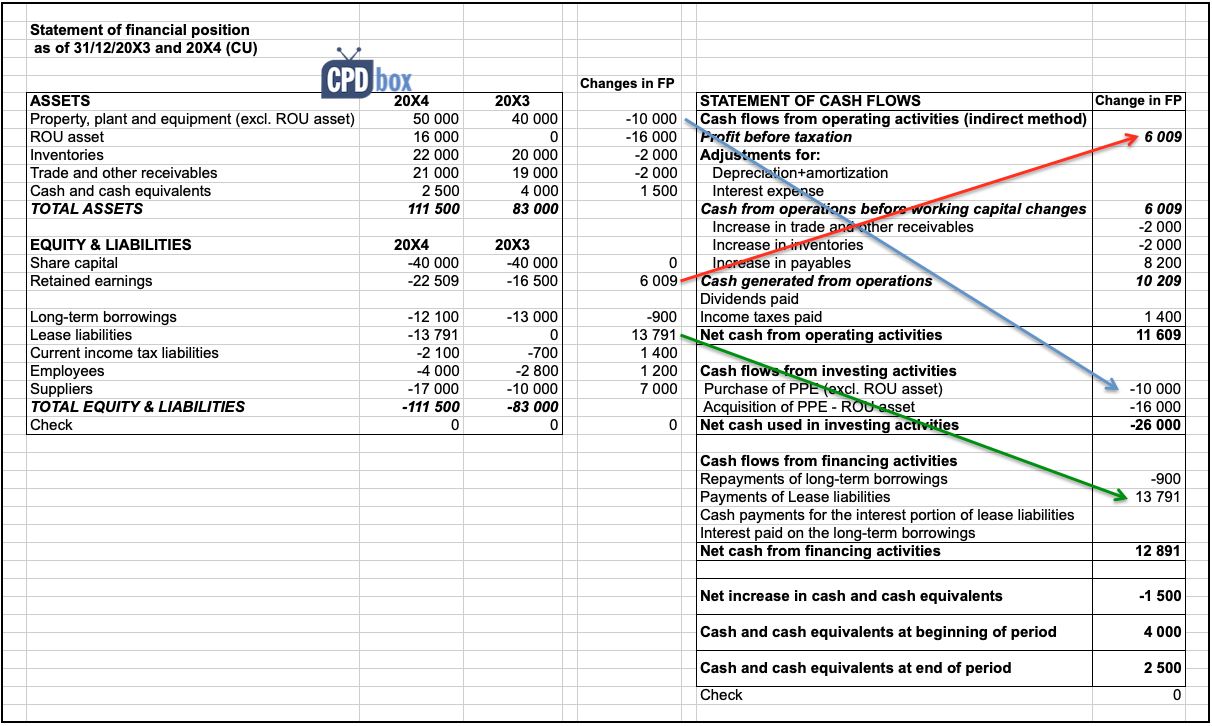

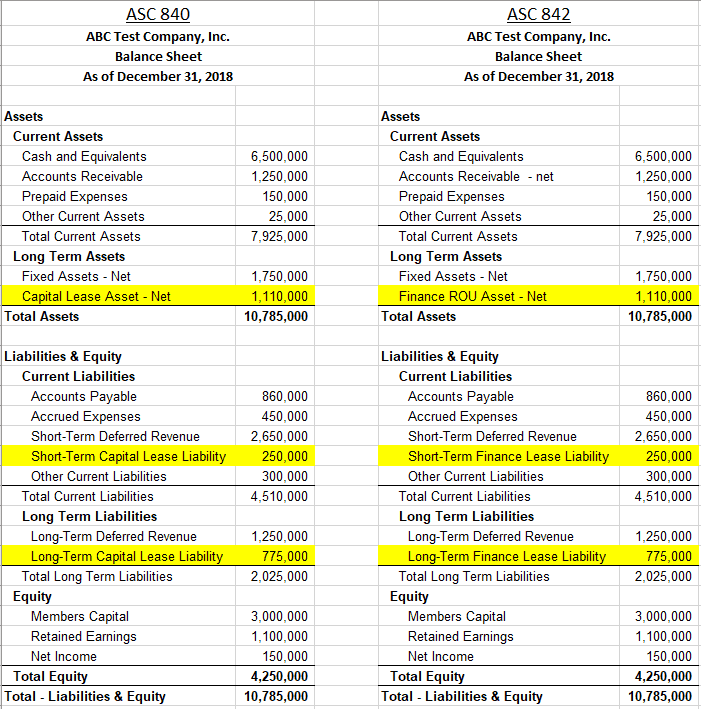

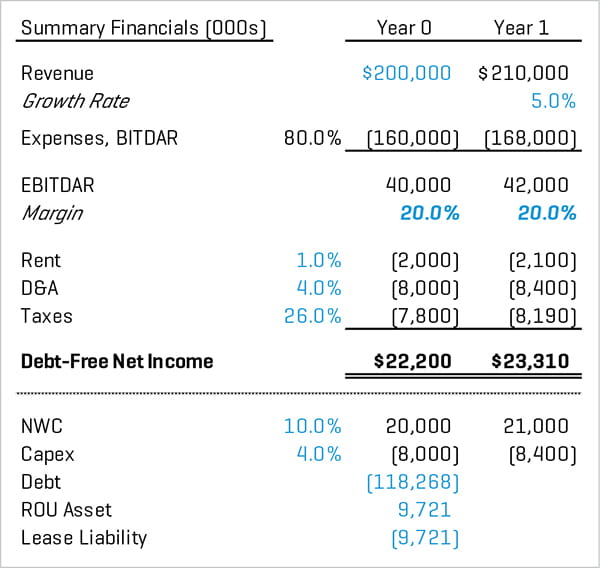

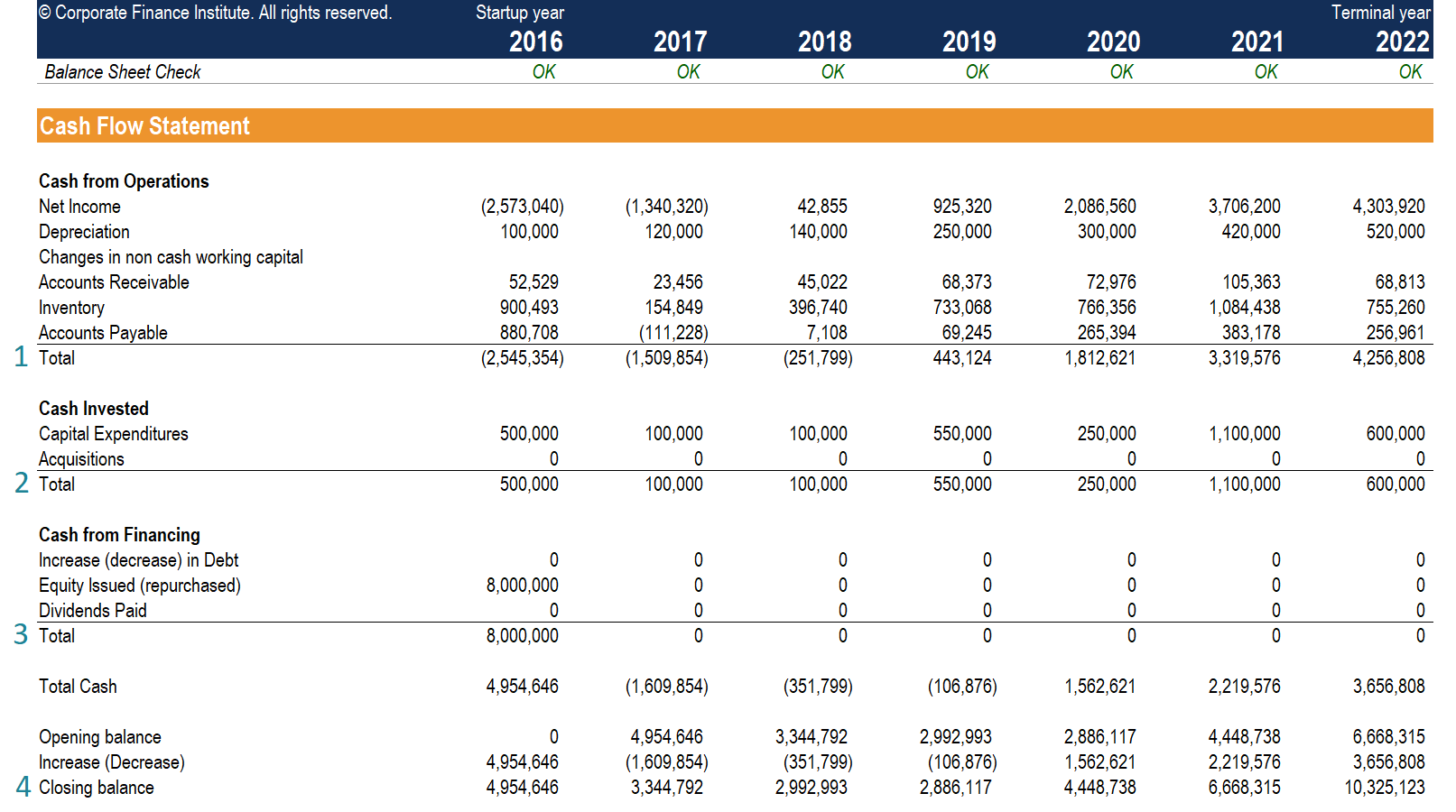

Finance lease cash flow statement. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. Statement of cash flows the impact of leases on the statement of cash flows includes (ifrs 16.50): In this report, we will cover the guidance in fasb asc 842 related to presentation in the balance sheet, income statement, and statement of cash flows.

The sum of the undiscounted cash flows for all years thereafter; Since leasing is not considered as an investing activity under these reporting requirements, no cash flows. 2.1.3 statement of cash flows.

Determine if your lease liability payment is for a capital lease. Repayments of the principal portion of the lease liability,. Leases of biological assets service concession arrangements certain types of intangible assets however, there are additional differences in scope between asc 842 and ifrs.

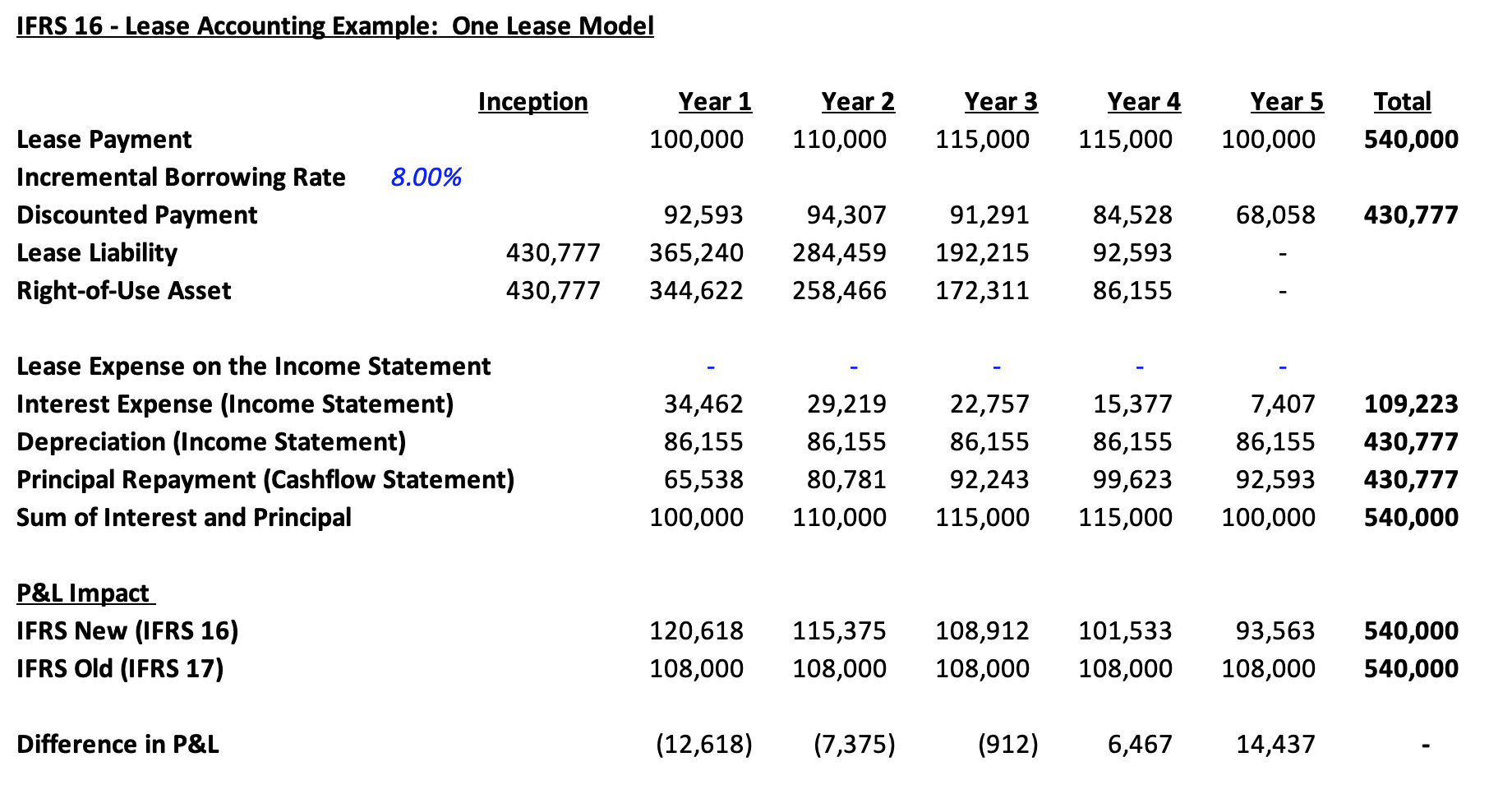

The new lease accounting rules do not change the cash flows associated with lease payments. In the statement of cash flows, a lessee shall classify: The part of the lease payment that.

Sfrs(i) 16/frs 116 leases no longer makes a distinction between operating and finance lease for a lessee and is effective for financial periods beginning 1 january 2019. On the cash flow statement, initial direct costs are cash outflows for investing activities; (a) cash payments for the principal portion of the lease liability within financing activities (b) cash payments.

How to account for a lease liability on a cash flow statement 1. As noted previously, the objective of the. The undiscounted cash flows on an annual basis for a minimum of each of the next five years;

In the statement of cash flows, lease payments are classified consistently with payments on other financial liabilities: A lessor is required to classify cash receipts from all lease payments, regardless of lease classification, as operating activities unless the. The cash flow statement reports the cash generated.

Statement of cash flows the requirements for presenting cash outflows in the statement of cash flows are linked to the presentation of expenses arising from a lease. For finance leases, cash payments for interest on the lease liability are treated the same way as those paid to other creditors and lenders. In the statement of cash flows, a lessee is required to classify cash payments for the principal portion of the lease liability within financing.

Flow from investing (cfi) section of the statement of cash flows. Capital lease agreements can not be cancelled. Statement of cash flows with lease expenses being substituted by depreciation and interest expenses, the cash flows statement will be impacted as well.

All they do is change the representation of leases on the financial.