Recommendation Tips About Cash Flows Falling Under The Operating Activities

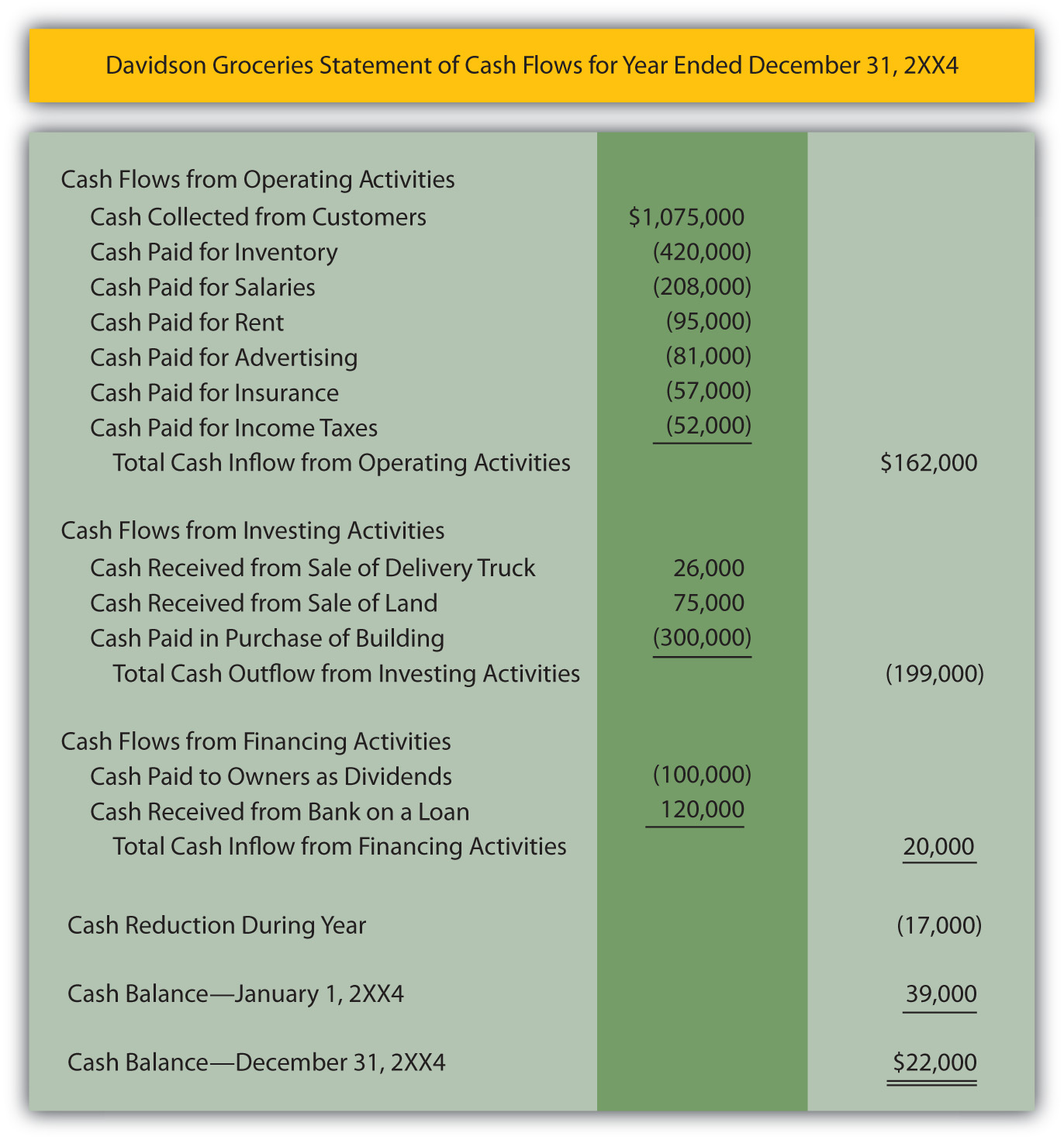

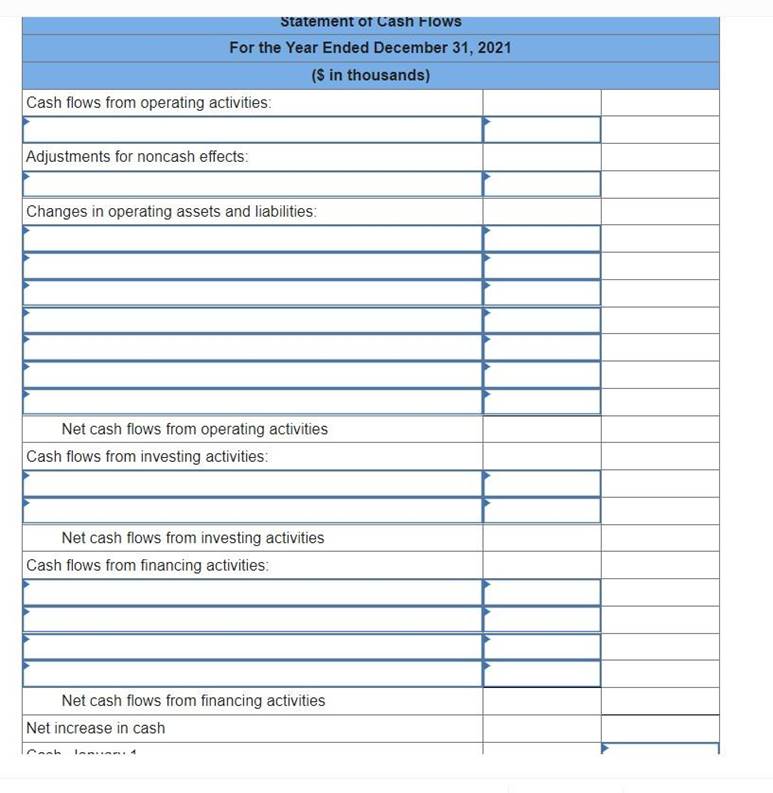

Operating activities investment activities financing activities

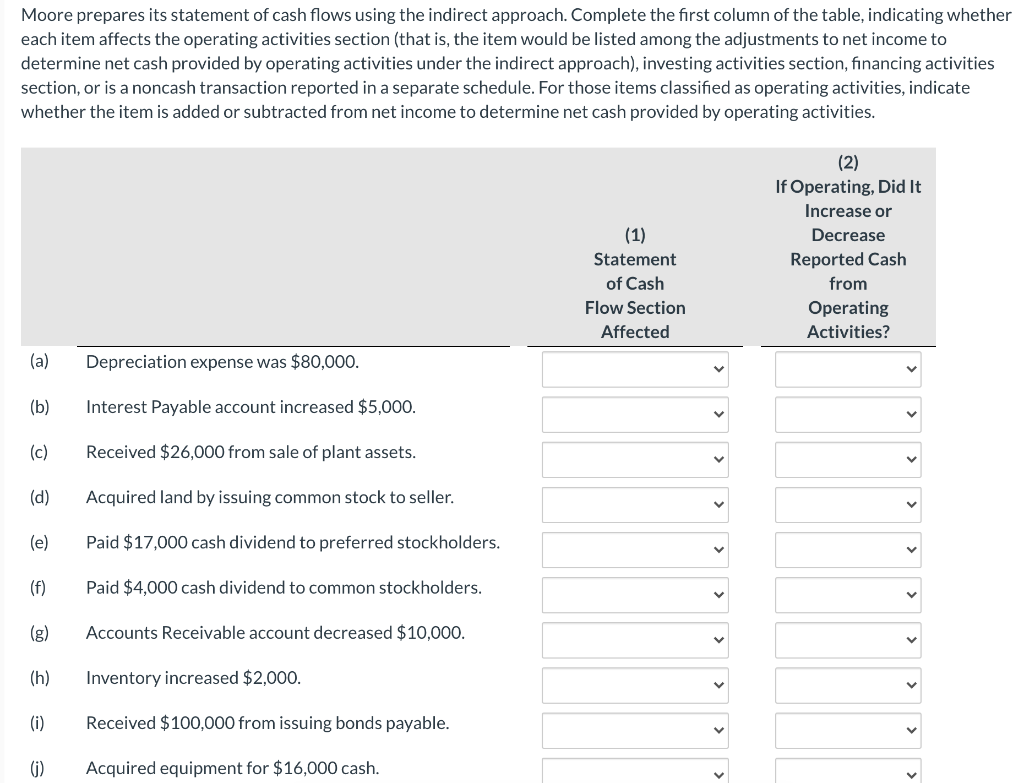

Cash flows falling under the operating activities. Meanwhile, under us gaap, it is an operating cash flow. The movement of cash & cash equivalents or inflow and outflow of cash is known as cash flow. Operating activities include cash activities related to.

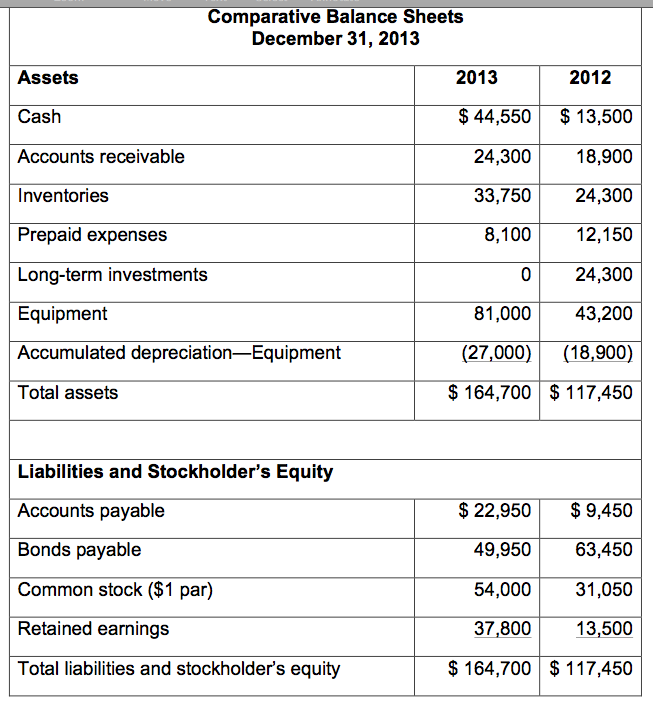

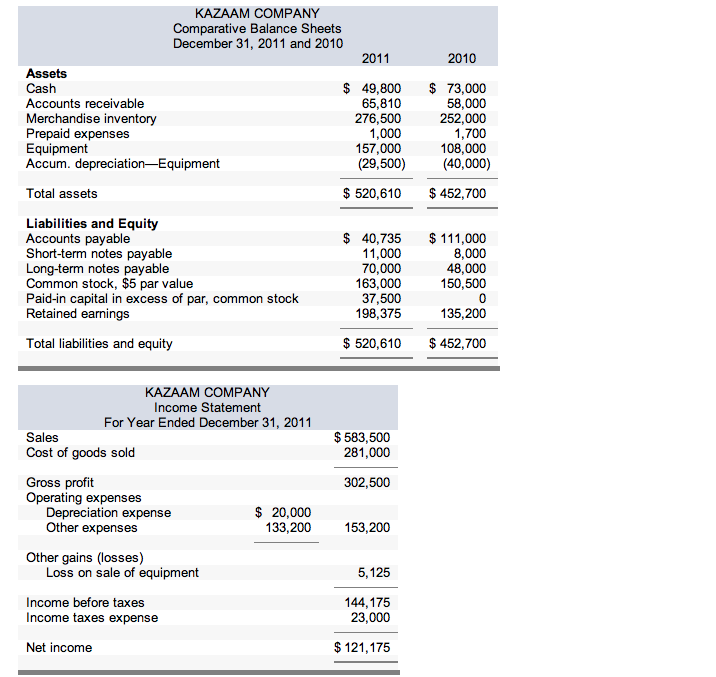

Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a. Adjust for changes in working capital. Operating activities, investment activities, and financing activities.

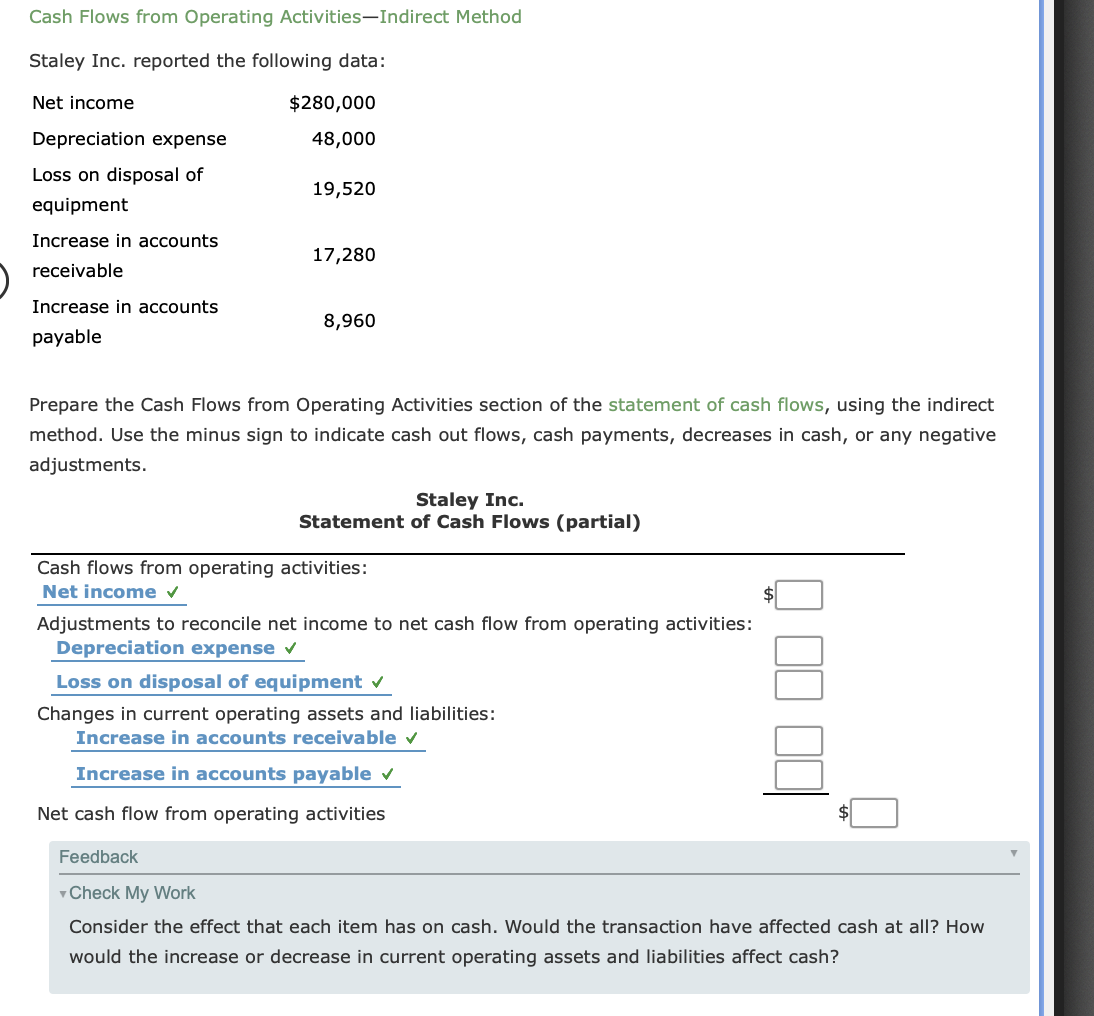

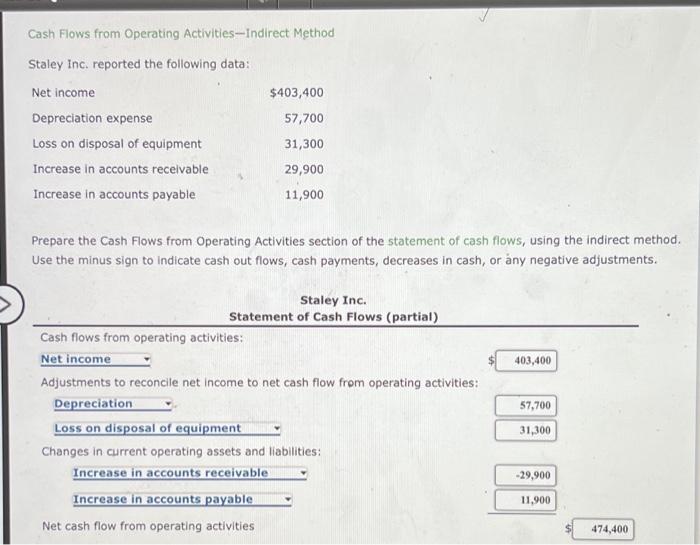

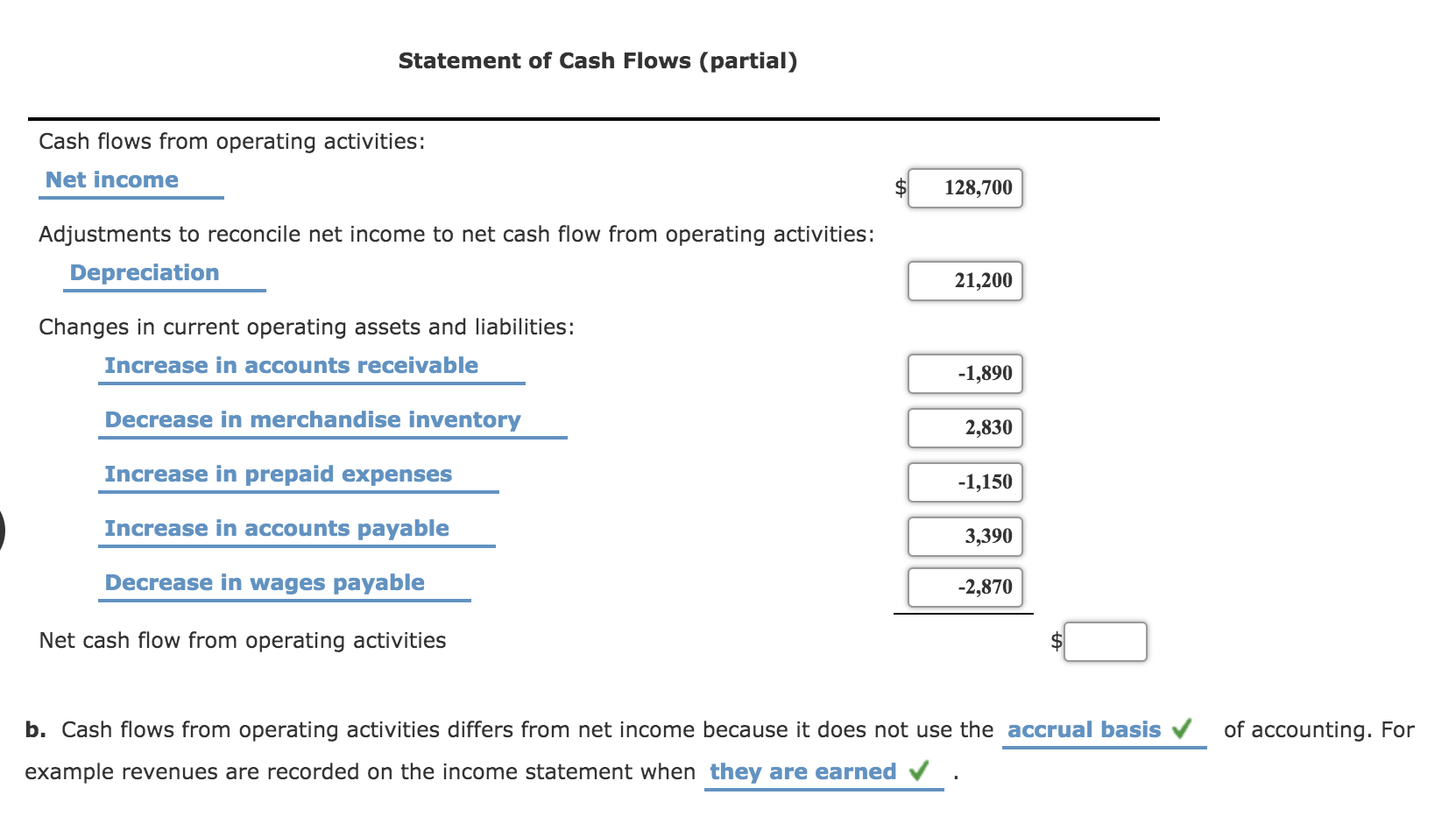

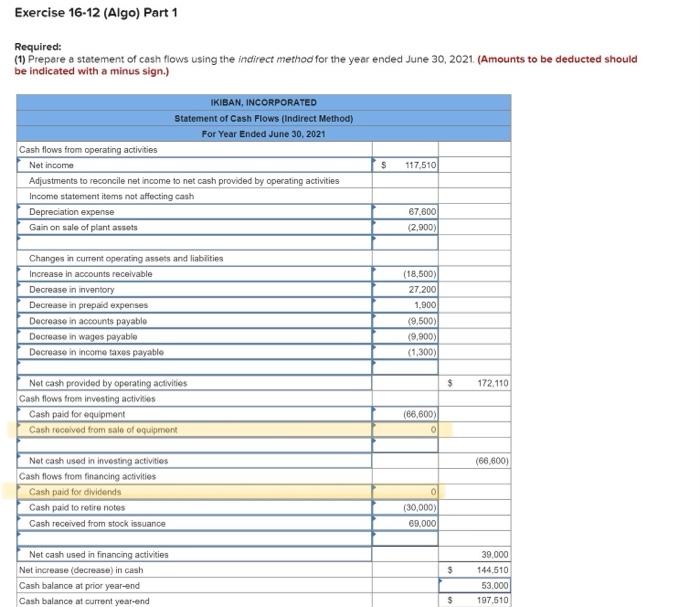

The ocf calculation will always include the following three components: Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.financial statement users are able to assess a company’s strategy and ability to generate a profit and stay in business by assessing how much a. Since the net income was based on the accrual method of accounting, the amount of net income must be adjusted to the cash amount.

Cash flows arising from taxes on income are normally classified as operating, unless they can be specifically identified with financing or investing activities [ias 7.35] for operating cash flows, the direct method of presentation is encouraged, but the indirect method is acceptable [ias 7.18] Cash flows are classified as operating, investing, or financing activities on the statement of cash flows, depending on the nature of the transaction. Such capitalisation is also common in research and development expenses incurred year on year.

Cash flow from operating activities is the first of the three parts of a company's cash flow statement. The cash flow from operating activities section appears at the top of a company's cash flow statement. It is used to explain where a company gets its cash from ongoing regular business.

Cash receipts from fees, royalties, commissions, and other revenue. In this case, depreciation and amortization is the only item. Under the indirect method, the scf section cash flows from operating activities begins with the amount of net income, which is taken from the company's income statement.

Cash receipts from the sale of goods and rendering services. It is an important indicator of a company's financial health, as it shows the company's ability to generate consistent positive cash flow from its core business operations. For example, operating cash flows include cash sources from sales and cash used to purchase inventory and to pay for operating expenses such as salaries and utilities.

These operating activities may include: Some of the cash flows arising from operating activities are as follows: Suggested videos classification of activities for cash flow statement cash flow activities majorly classified into three categories they are:

Money spent on daily supplies for your company to do business is. Operating cash flows concentrate on cash inflows and outflows related to a company's main business activities, such as selling and purchasing inventory, providing services, and paying salaries. Difference between cash flows from operating activities, financing activities, and investing activities.

Cash flows from operating activities arise from the activities a business uses to produce net income. Cash flow from operating activities. The following items would fall under your business operations cash flow:

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)