Top Notch Info About Difference P&l And Income Statement

The main difference between a.

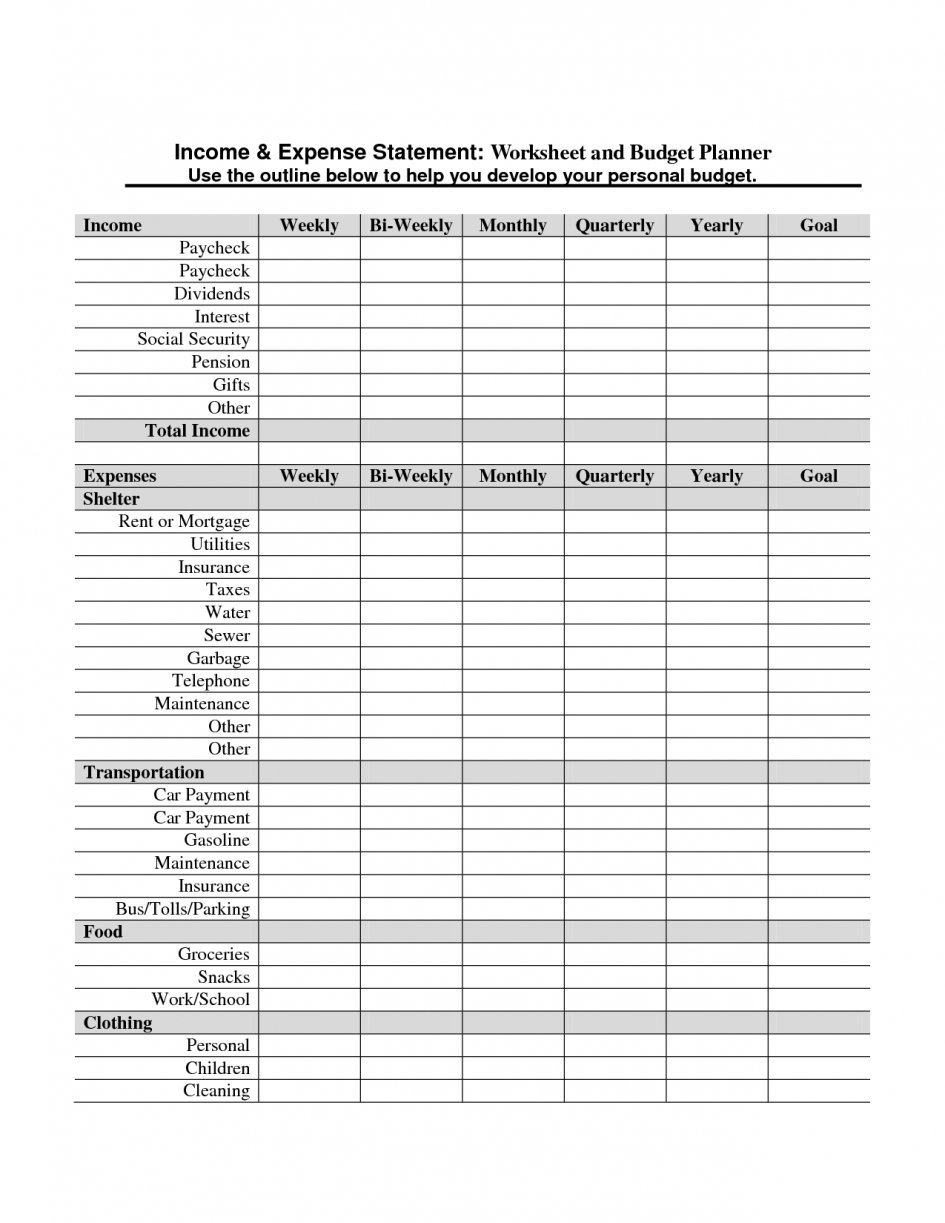

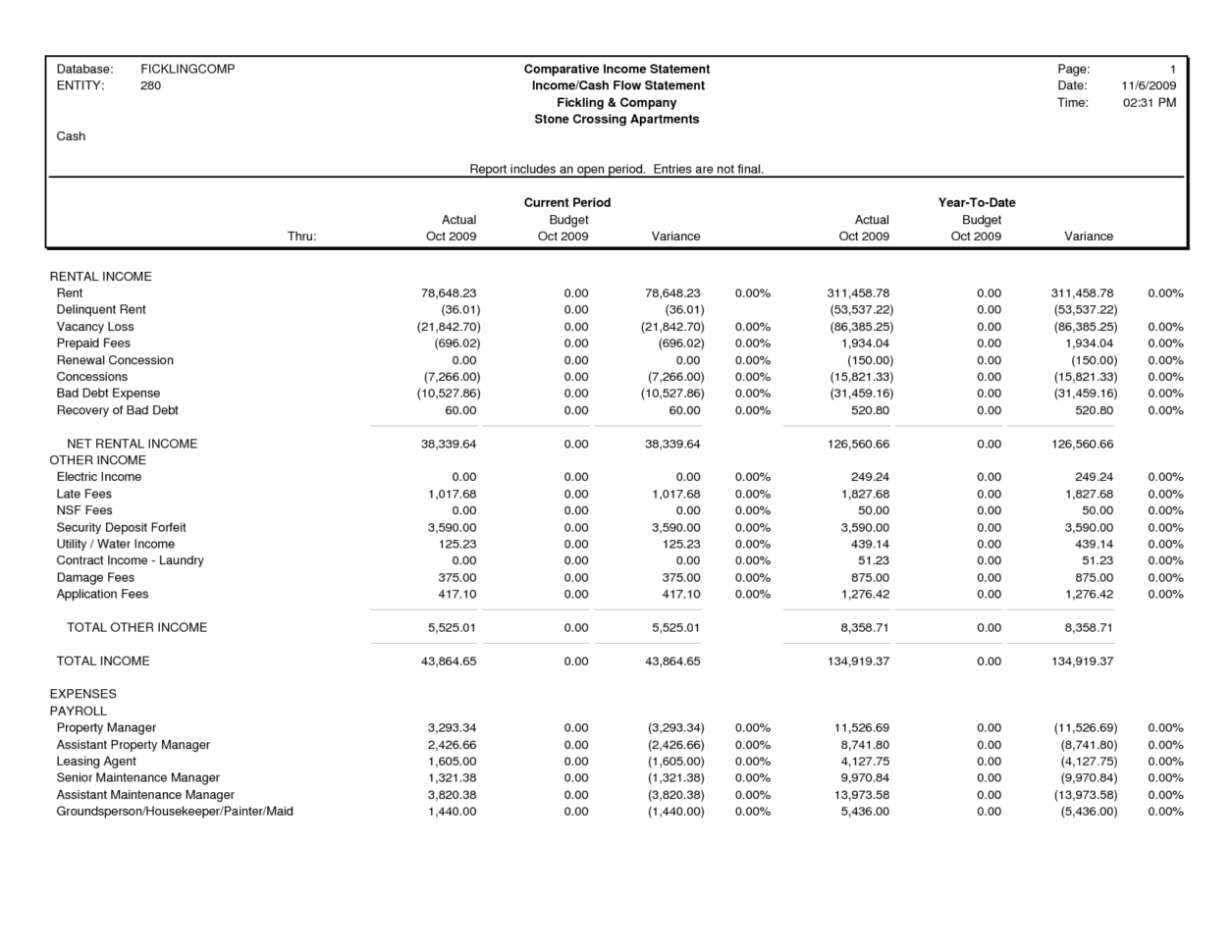

Difference p&l and income statement. Additionally, you can use the data contained in the p&l statement to measure the business’s profitability according to commonly used profitability ratios like profit margin. The statement displays the company’s revenue,. Profit and loss (p&l) statement.

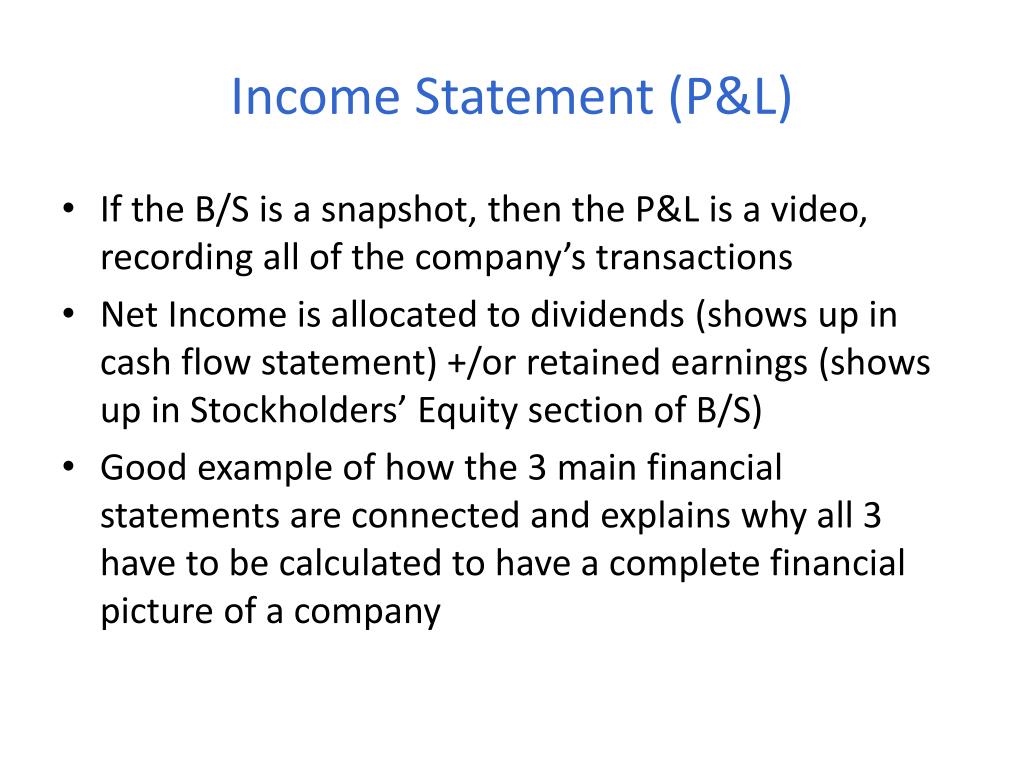

The income statement, also known as the profit and loss statement or p&l for short, is a financial document that summarizes a company’s revenue, expenses, and net income. While the p&l is a financial statement that summarizes a. A profit and loss statement, formally known as an income statement or simply as a p&l, tracks the amount of profit that remains after a business subtracts all of.

Also known as the profit and loss (p&l) statement, the income statement summarizes the financial performance of a business during a specific period, reporting. Single step income statement this simplest form of a p&l statement is typically used by small businesses that have fewer line items to report. Trump was penalized $355 million plus interest and banned for three years from.

The income statement, sometimes referred to as the p&l statement, is a summary of the profits or losses a business generated for a given period of time. It is also known as an income. The cash flow statement and the income statement are integral parts of a corporate balance sheet.

A p&l (profit and loss) statement is a financial report that summarizes the revenues, costs, and expenses incurred during a specific period. The cash flow statement details a company's cash. A p&l statement, often referred to as the income statement, is a financial statement that summarizes the revenues, costs, and.

P&l and income statement may sound like similar terms, but they are different in many ways. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. How are they different?

An income (or p&l) statement shows readers the revenue and total expenses for a certain period of time. The civil fraud ruling on donald trump, annotated. The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a.

The main difference between income tax and tds is that the income tax is deducted from the payer’s overall profit or annual return, on the other hand, tds refers. A business profit and loss statementshows you how much money your business earned and lost. The main difference between the two is that an income statement is more comprehensive than a profit and loss statement.

Within these categories of different documents, each one serves a separate function in analyzing the. An income statement shows all of a. A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364 million in a civil fraud case, handing a win to.

While p&l and income statement may sound interchangeable, they are actually two different financial statements. How are they different? A profit and loss (or p&l) focuses on and displays a firm’s financial performance in the context of its revenues, expenses, and profit.

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)