Out Of This World Tips About Balance Sheet Income Statement Example

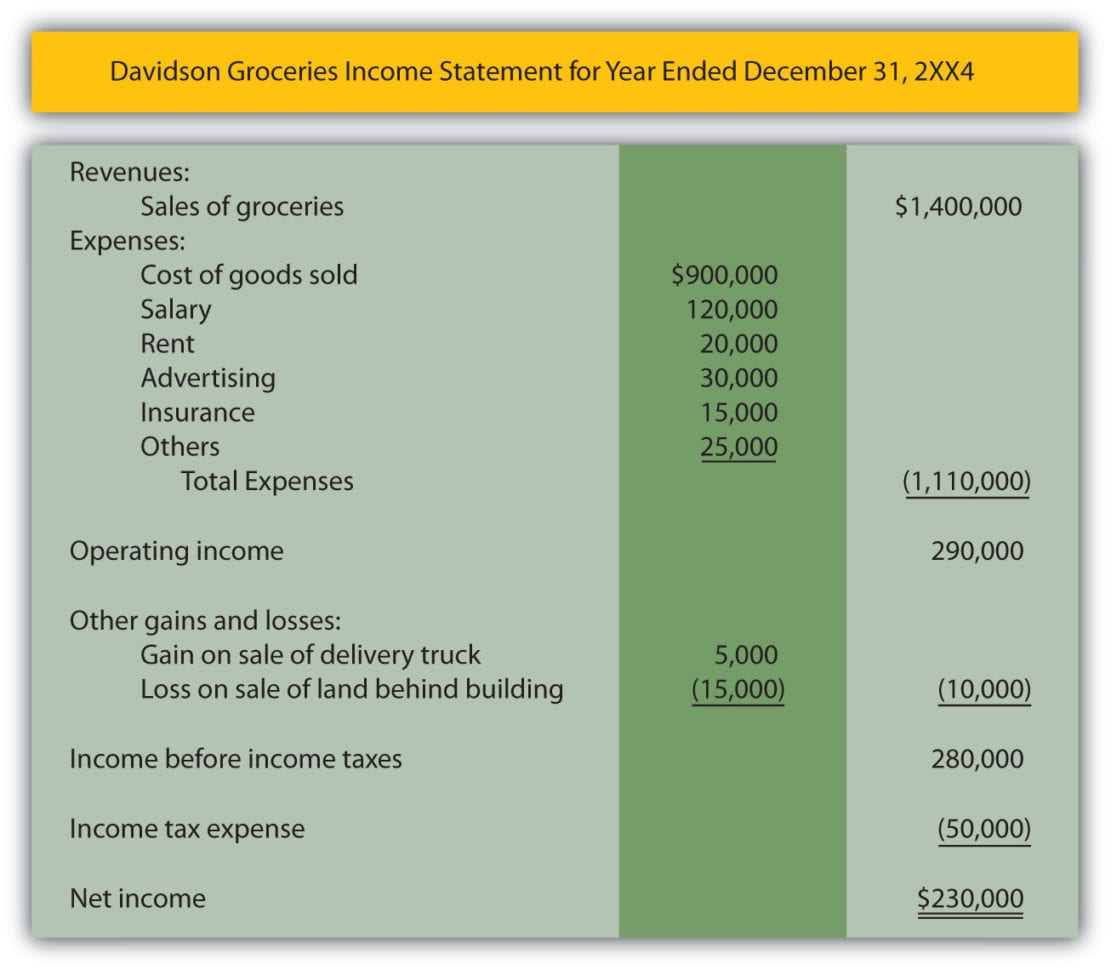

Unlike the balance sheet, the income statement calculates net income or loss over a range of time.

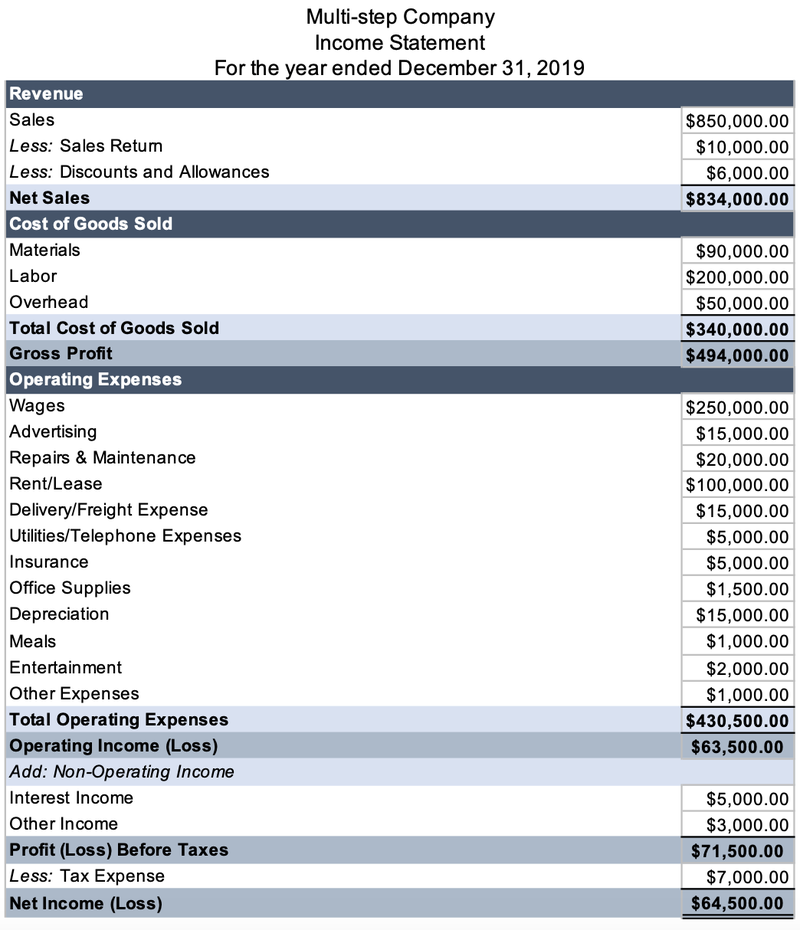

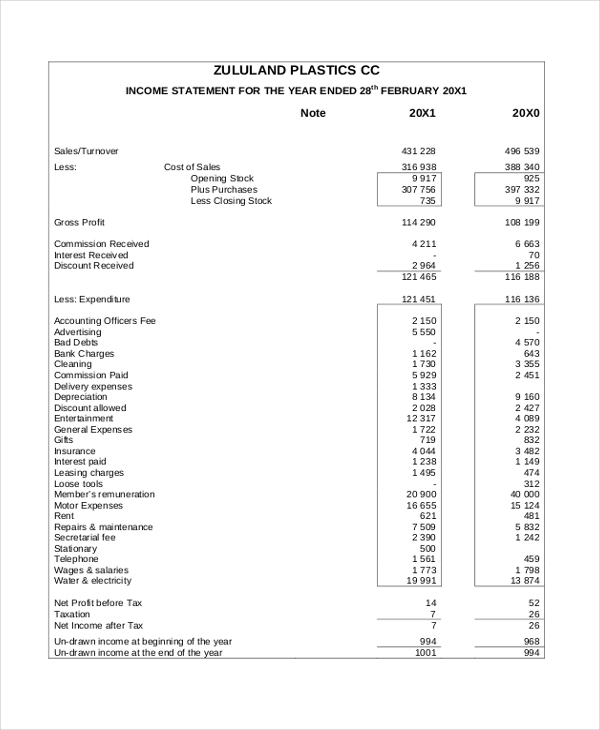

Balance sheet income statement example. An income statement is one of the three major financial statements that report a company’s financial performance over a specific accounting period. Income statement and balance sheet examples by michelle black february 3, 2023 11 min read income statements and balance sheets are reliable ways to measure the financial health of your business. This guide is designed to be useful for both beginners and advanced finance professionals, with the main topics covering:

The income statement is also known. In this free guide, we will break down the most important types and techniques of financial statement analysis. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year.

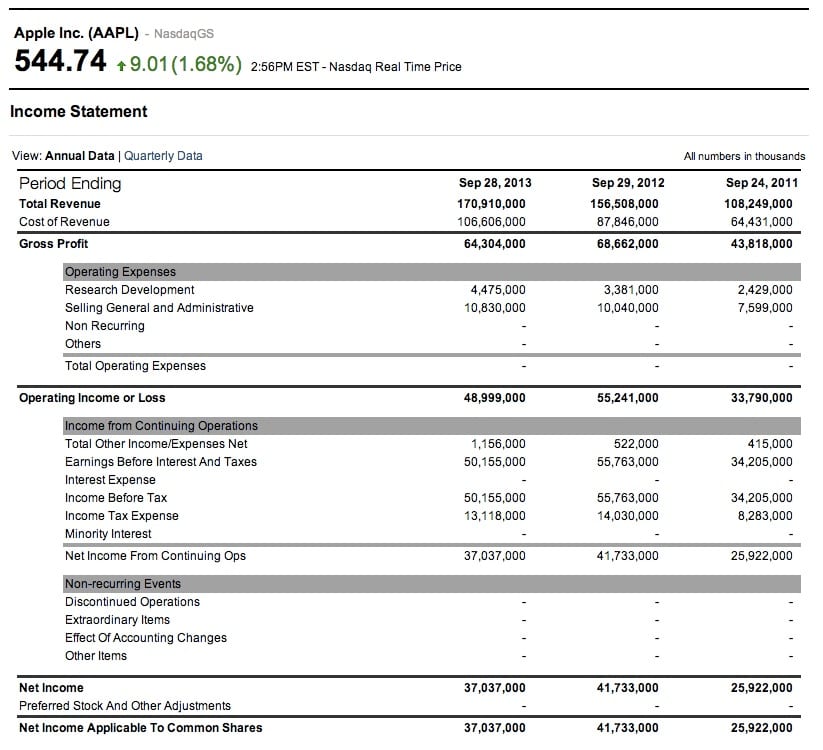

The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business. During the reporting period, the company made approximately $4.4 billion in total sales. The interest expense appears on the income statement, the principal amount of debt owed sits on the balance sheet, and the change in the principal amount owed is reflected on the cash from financing section of the cash flow statement.

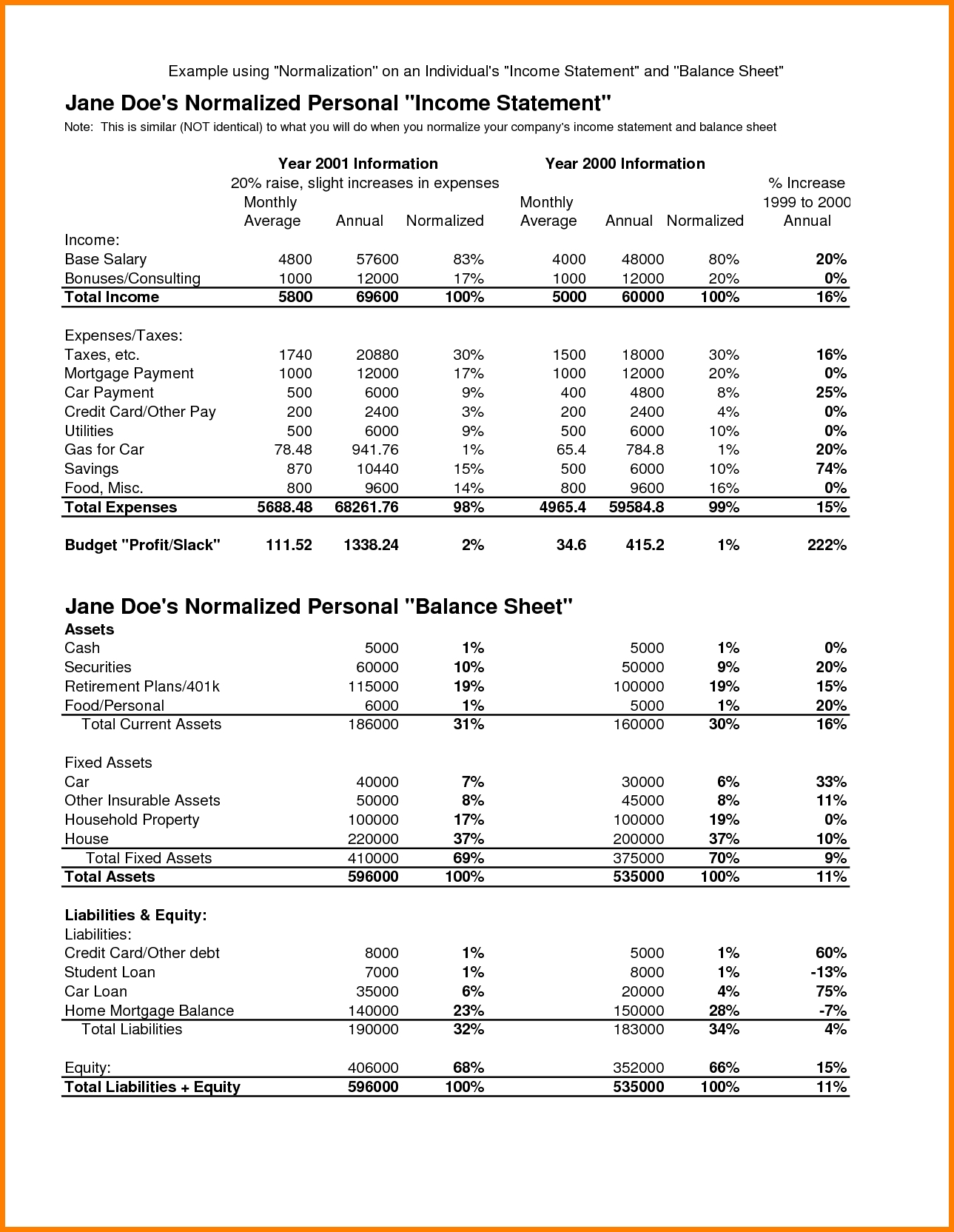

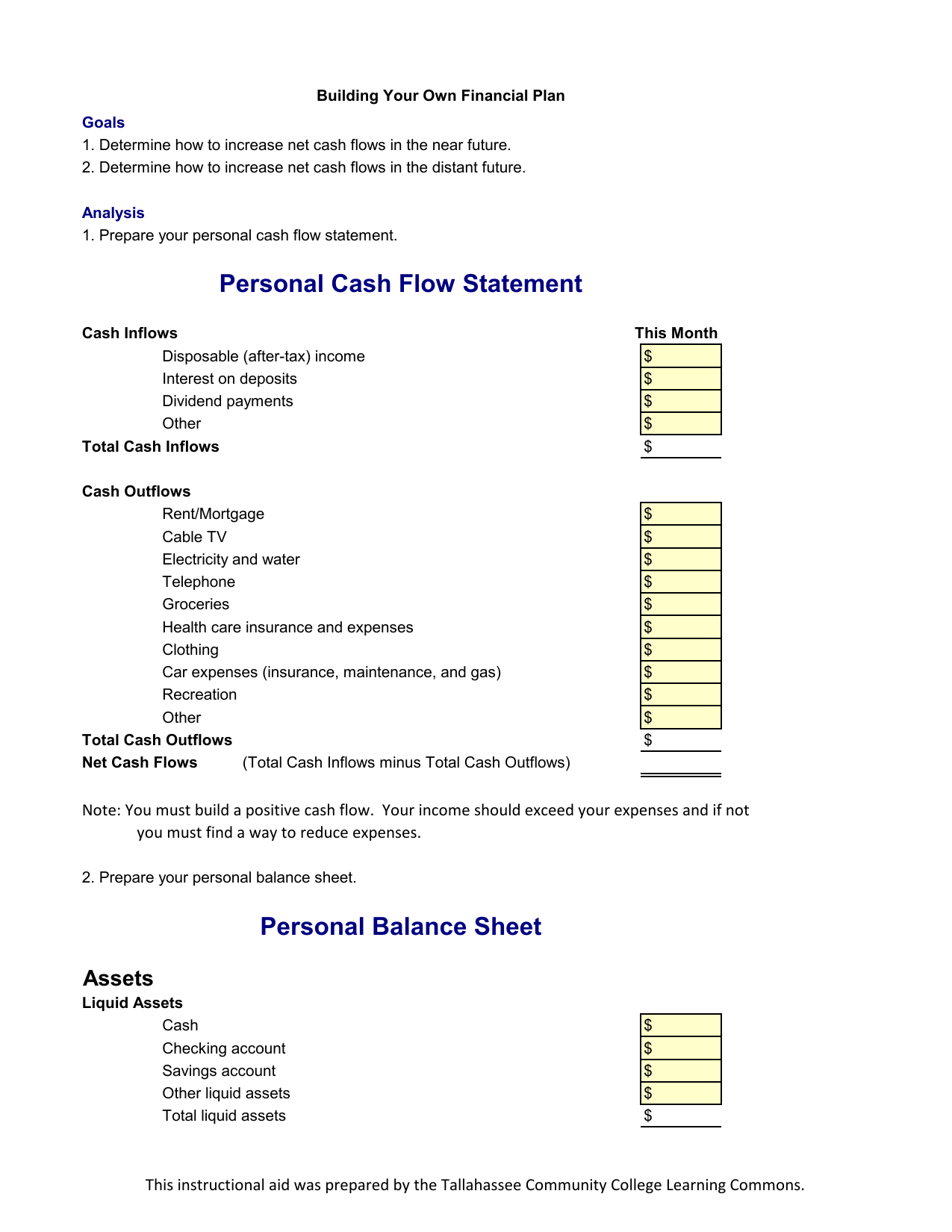

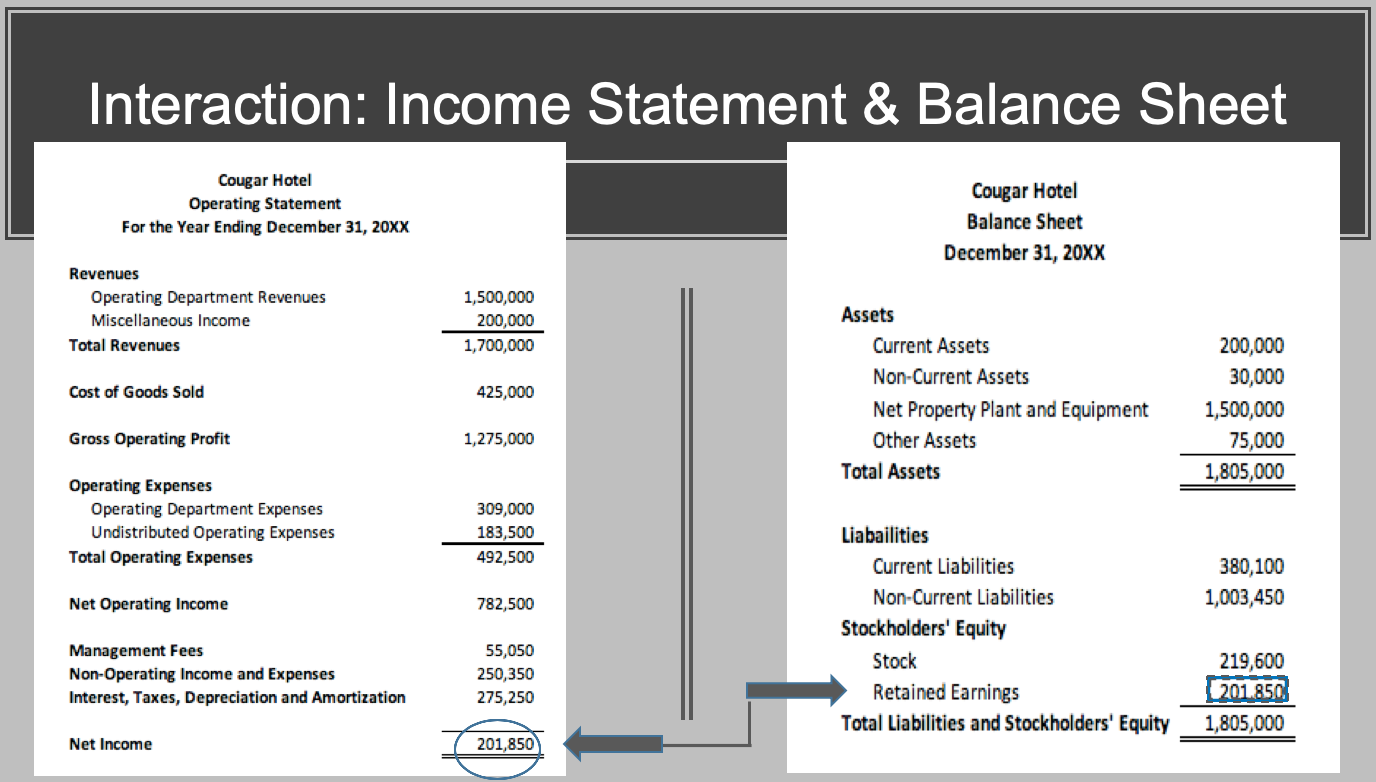

(1) the income statement, (2) the balance sheet, (3) the cash flow statement, and (4) rates of return. Also referred to as a profit and loss (p&l) statement, an income statement is one of three main financial reports a business of any size needs to prepare, alongside the balance sheet and cash flow statement. This is the amount that flows into retained earnings on the balance sheet, after deductions for any dividends.

Unlike the balance sheet which represents a snapshot of a single moment in time, the income statement is a range that covers the revenue and expenses that took place from year to year. To see more balance sheet samples, head to freshbooks. It also shows whether a company is making profit or loss for a given period.

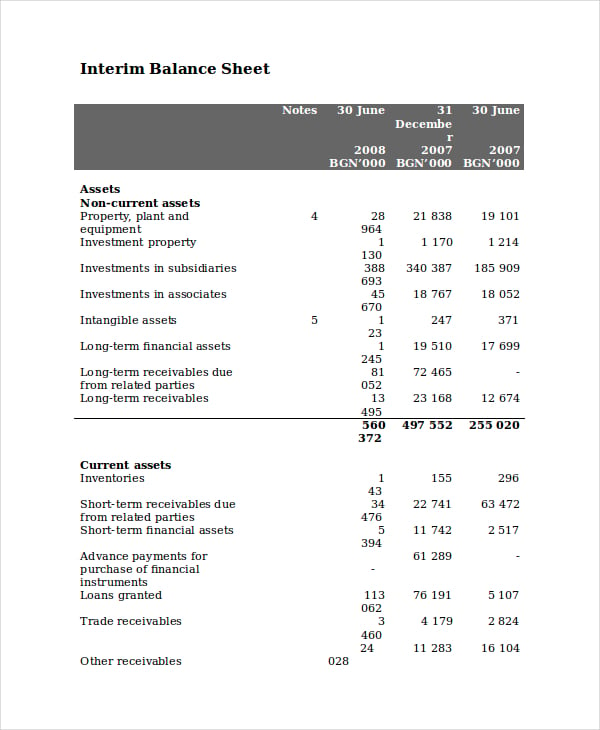

Below is the balance sheet for apple ( aapl) at the end of its 2017 fiscal year. A balance sheet, on the other hand, records assets, liabilities, and equity. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

Prepare an income statement. The income statement vs. Revenues indicate how much your business earned.

As fixed assets age, they begin to lose their value. The image below is an example of a comparative balance sheet of apple, inc. An income statement gives insights into your business’s operations, how efficiently it is being.

Prepare a statement of owner’s equity. Example of a balance sheet. Click below to download a free sample template of each of these important financial statements.

An income statement is a financial statement that shows you the company’s income and expenditures. Now, lets understand this with sample income statement. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.