Perfect Tips About Gross Profit In And Loss Account

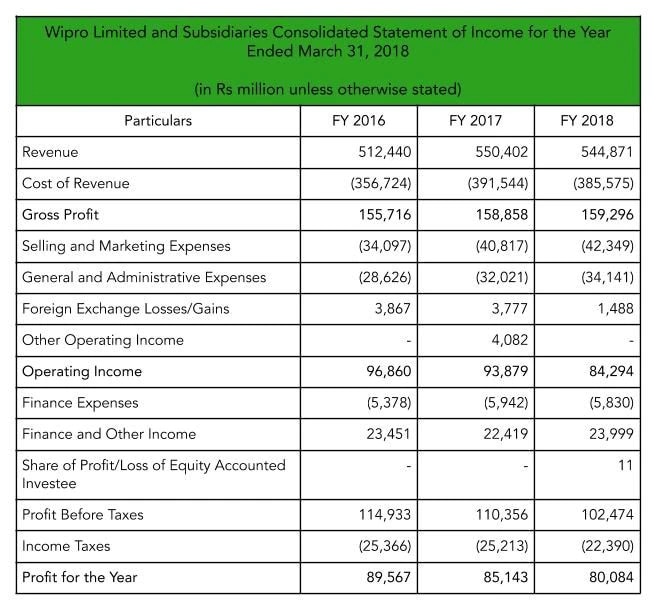

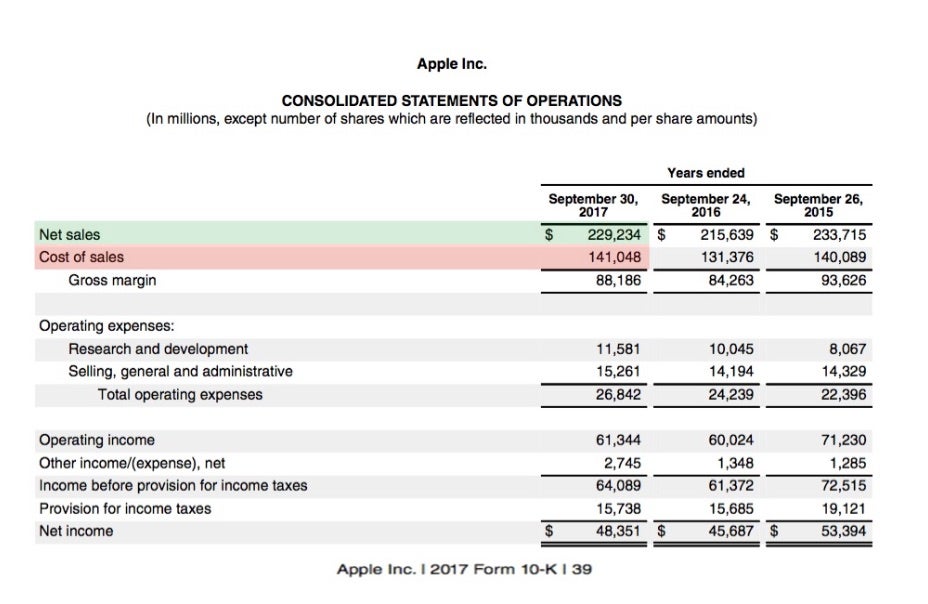

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

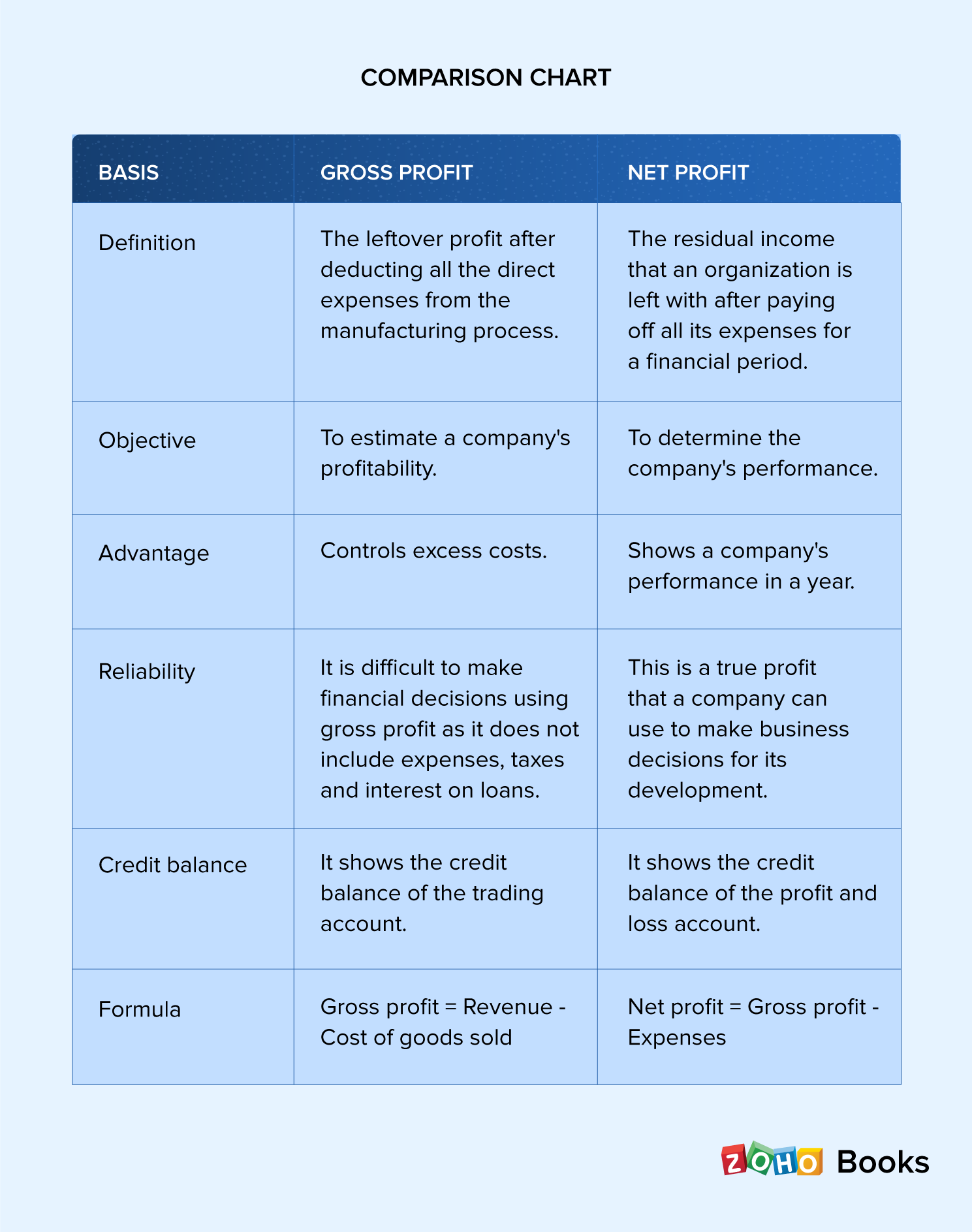

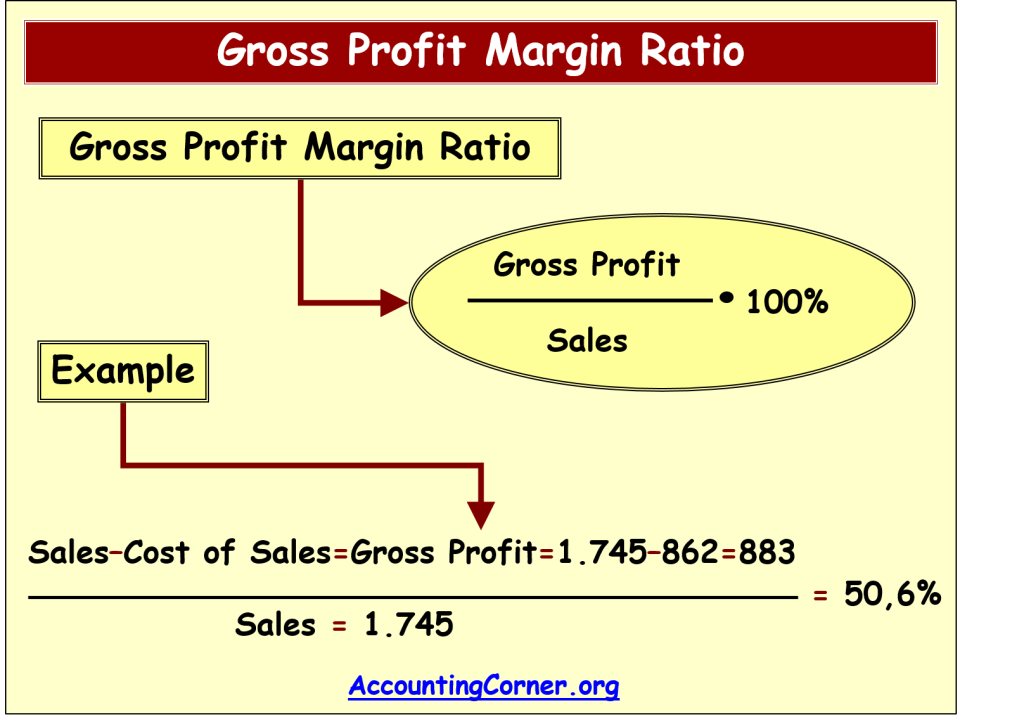

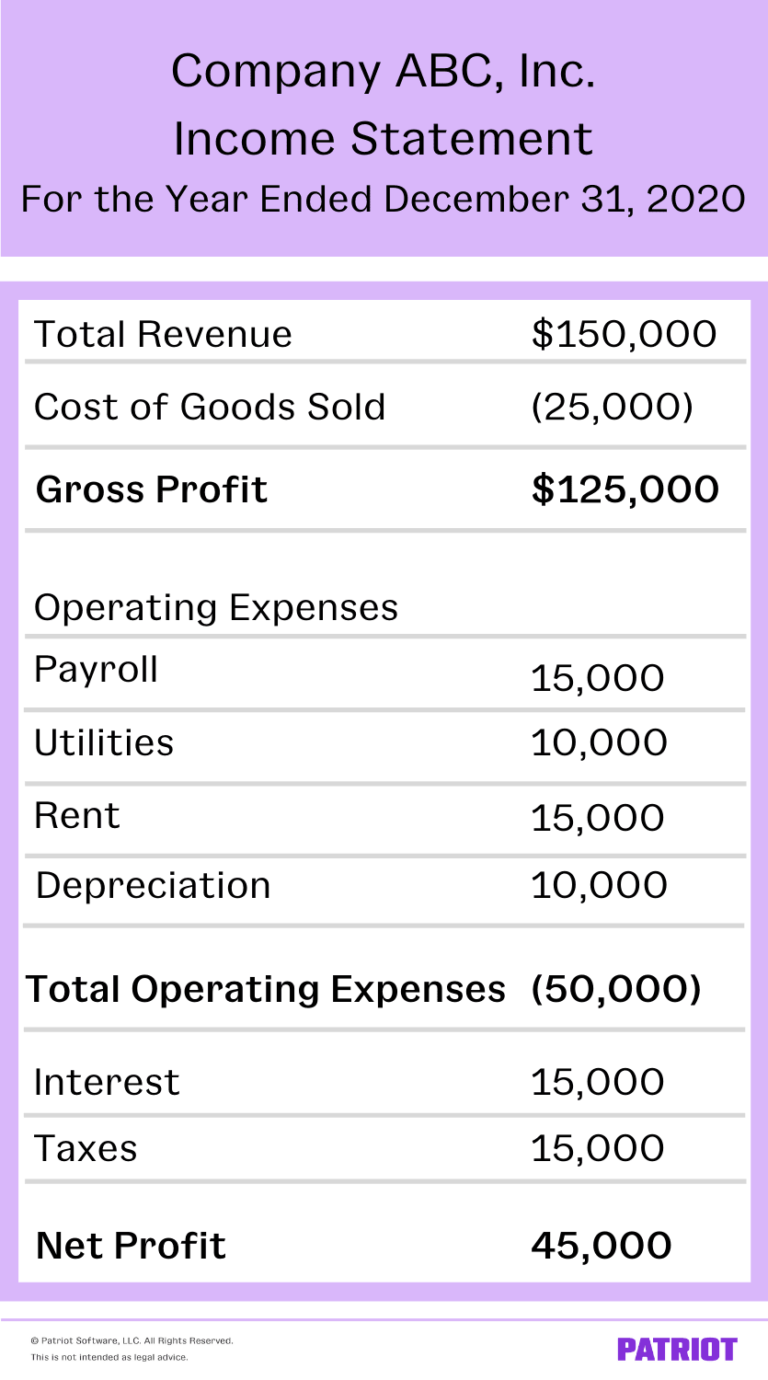

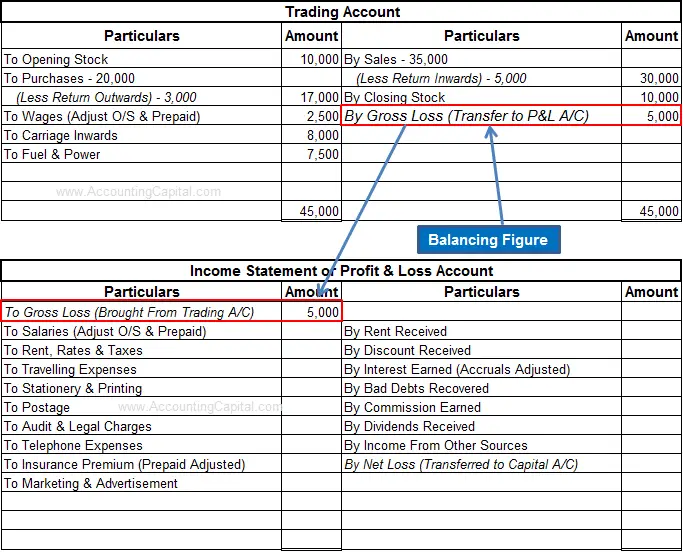

Gross profit in profit and loss account. Gross profit / loss. Revenue equals the total sales, and the cost of goods sold includes all of the costs needed to make the product you’re selling. The resultant figure is either gross profit or gross loss.

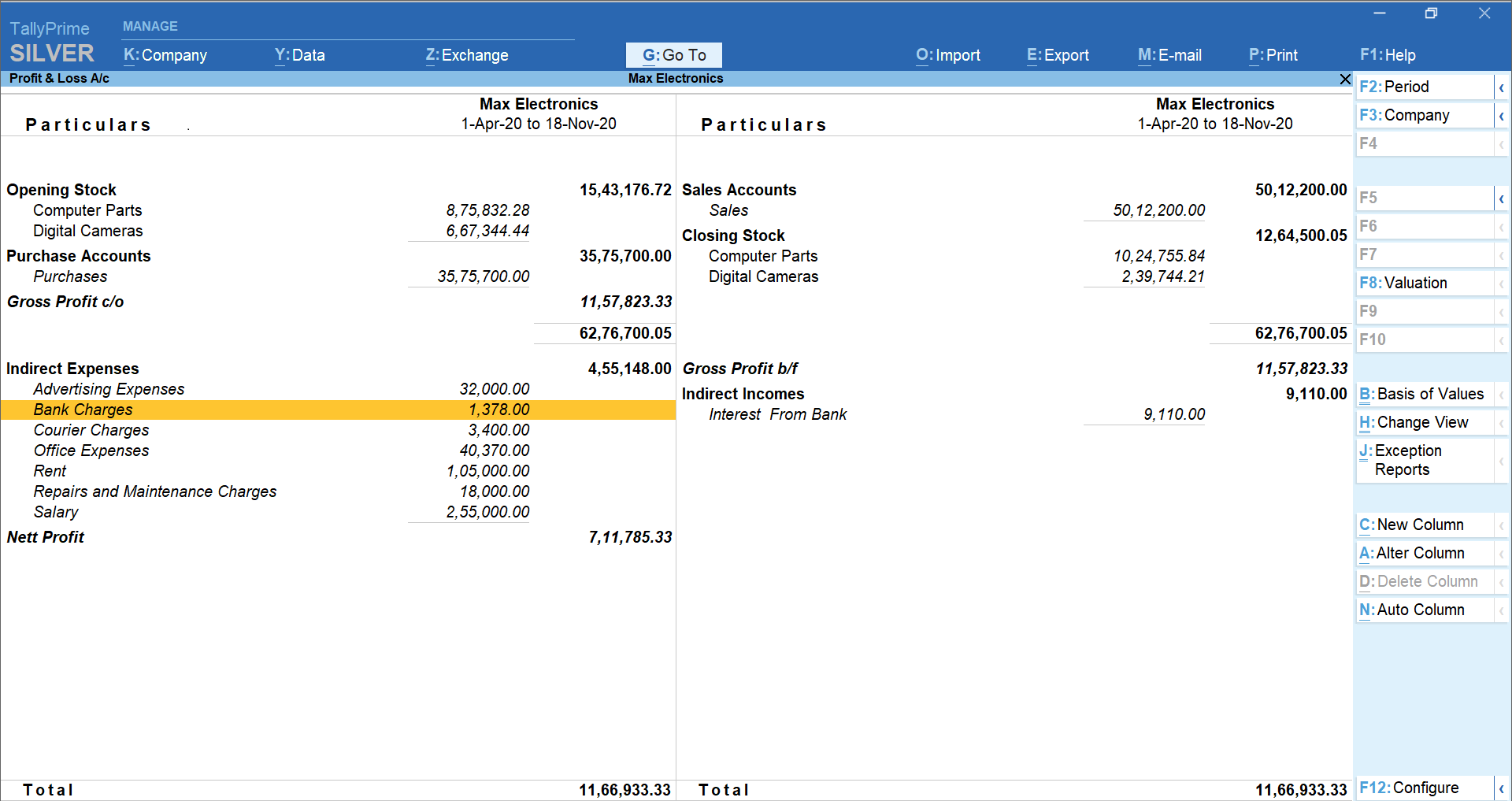

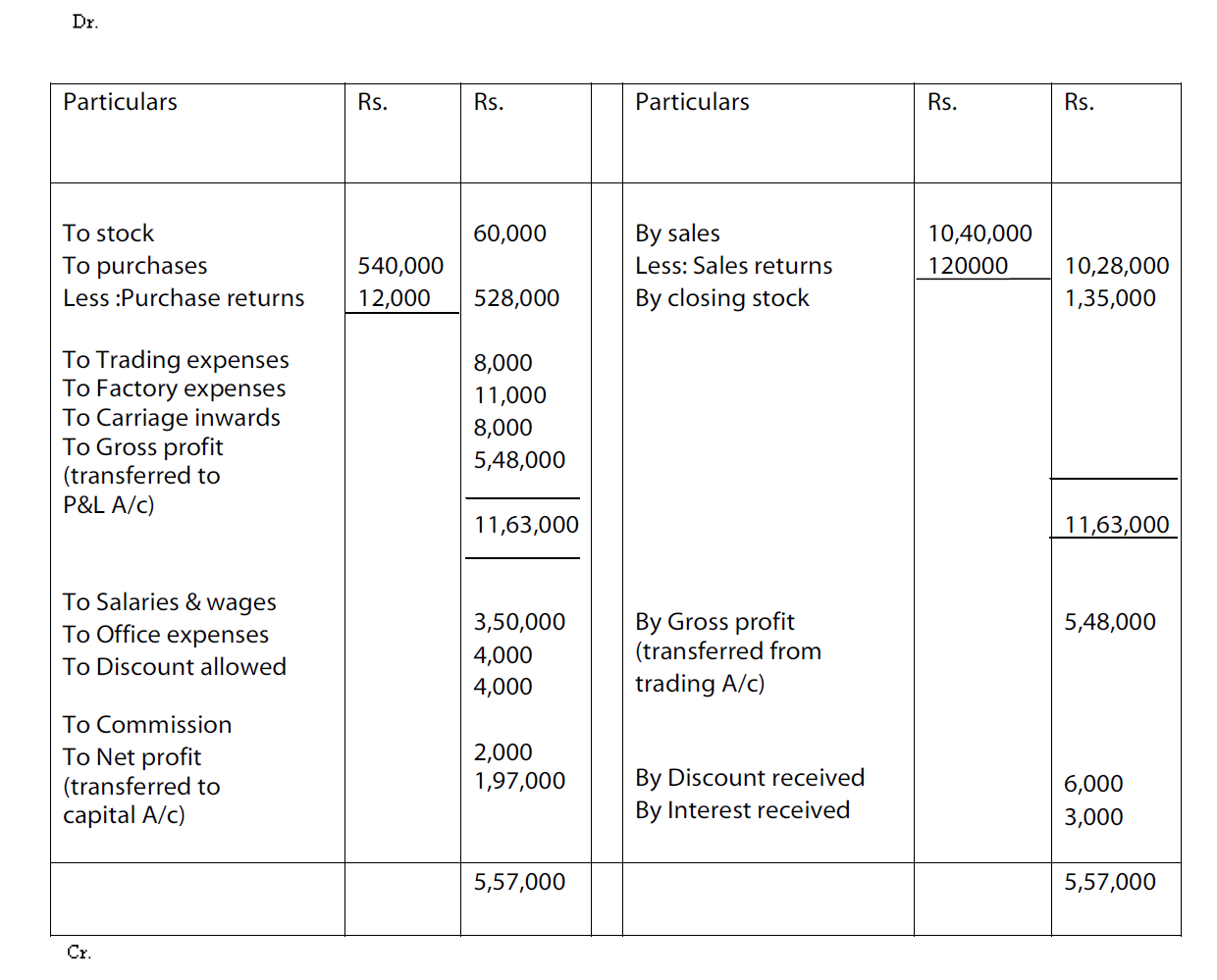

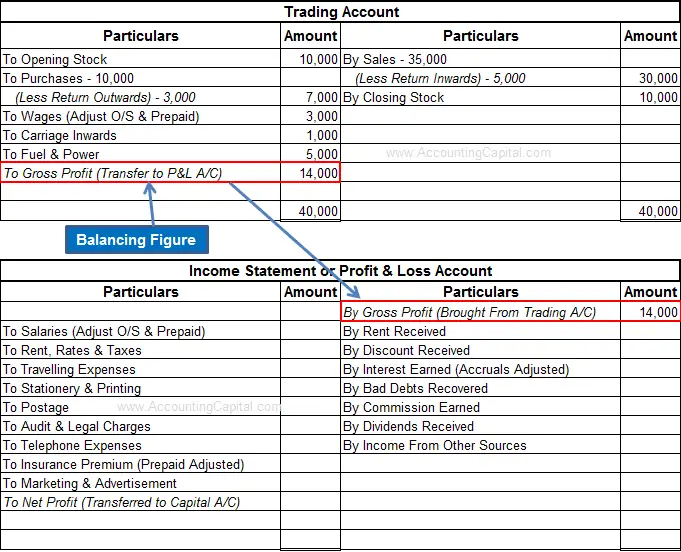

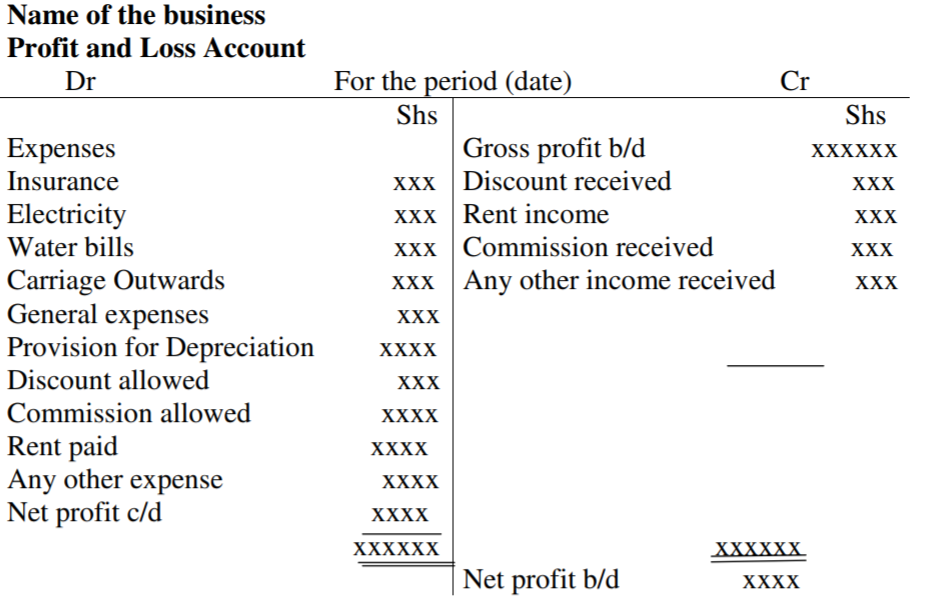

Gross profit (transferred from trading account) all indirect revenues net profit or net loss net profit or net loss is the difference between the total revenue for a certain period and the total expenses for the same period. Sales less direct costs of sales. The trading account reflects the gross profit or loss of the business.

Notes on the items in the profit and loss account: [1] whereas gross profit is a dollar amount, the gross profit margin is a percentage. A company reports net profits when its total revenues exceed its total expenses.

Fy profit attributable 465.8 million baht versus loss 8.03 billion baht. The top section of the profit and loss account, up to and including the gross profit, is referred to as the trading account. Add all revenue earned over the accounting period.

Gross profit is one of the most important measures to determine the profitability and the financial performance of a business. Calculations in the profit & loss account would be as follows: Costs not directly involved in the production process (indirect costs) e.g.

The profit and loss account is compiled to show the income of your business over a given period of time. Profit and loss account get initiated by entering the gross loss on the debit side or. Understand the concept of trading account here in detail.

In other words, it is the profit generated as an outcome of undertaking the basic operational activities of your business. Only the revenue or expenses related to. Gross profit and gross loss meaning and definition the income statement or profit & loss account is a financial statement that provides a summary of a company’s expenses, losses, incomes, and gains over a specific period of time.

Knowing the gross profit margin, net profit margin. Gross margin is expressed as a percentage. It could be for a week, a quarter or a financial year.

A profit and loss account (or statement or sheet) is, on a simple level, used to show you how much your company is making or how much it is losing. The gross profit margin formula is: On that basic level, profit and loss is derived from taking your costs away from your sales.

For example, a company has revenue of $500 million and cost of goods sold of $400 million; It reflects the efficiency of a business in terms of making use of its labor, raw material and other supplies. The trading account is prepared in order to find the gross profit/loss which is further carried to the profit and loss account.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-Loss-Gross-Profit-Net-Operating-Income.jpg)